Economy

UI claims and GDP growth are historically bad: Now is not the time to cut benefits that are supporting jobs

Last week 2 million workers applied for unemployment insurance (UI) benefits. Breaking that down: 1.2 million applied for regular state unemployment insurance (not seasonally adjusted), and 830,000 applied for Pandemic Unemployment Assistance (PUA). Many headlines this morning are saying there were 1.4 million UI claims last week, but that’s not the right number to use. For one, it ignores PUA, the federal program that is serving millions of workers who are not eligible for regular UI, like the self-employed. It also uses seasonally adjusted data, which is distorted right now because of the way Department of Labor (DOL) does seasonal adjustments.

Last week was the 19th week in a row that unemployment claims have been more than twice the worst week of the Great Recession. If you restrict this comparison just to regular state claims—because we didn’t have PUA in the Great Recession—this is the 19th week in a row that claims are more than 1.25 times the worst week of the Great Recession.

Republicans in the Senate just allowed the across-the-board $600 increase in weekly UI benefits to expire. They are proposing to (essentially) replace it with a $200 weekly payment. That $400 cut in benefits is not just cruel, it’s terrible economics. These benefits are supporting a huge amount of spending by people who would otherwise have to cut back dramatically. The spending made possible by the $400 that the Senate wants to cut is supporting 3.4 million jobs. If you cut the $400, you cut those jobs. This map shows the number of jobs that will be lost in each state if the extra $600 unemployment benefit is cut to $200.

Today’s release of GDP data underscores how wrong it is to cut those benefits. Second-quarter GDP collapsed at the fastest rate on record—and the second quarter includes the employment bounce-back of May and June. And because we did not put the public health measure in place necessary to successfully reopen, the coronavirus has spiked, and the economic improvement we saw in May and June has stalled, if not reversed. Now is not the time to cut benefits that are supporting jobs.

But what about the potential work disincentive of the extra $600? After all, the additional payment means many people have higher income on unemployment insurance than they did from their prior job. It turns out that the concern about the disincentive effect has been massively overblown. In fact, rigorous empirical studies show that any theoretical disincentive effect has been so minor that it cannot even be detected. For example, a new study by Yale economists found no evidence that recipients of more generous benefits were less likely to return to work. A case in point: in May and June—with the $600 in place—7.5 million people went back to work. And, about 70% of likely UI recipients who returned to work were making more on UI than their prior wage. Further, there are 14 million more unemployed workers than job openings, meaning millions will remain jobless no matter what they do. Slashing the $600 cannot incentivize people to get jobs that are not there. Even further, many people are simply unable to take a job right now because it’s not safe for them or their family, or because they have care responsibilities as a result of the virus. Slashing the $600 cannot incentivize them to get jobs, it will just cause hardship.

Slashing the $600 will also exacerbate racial inequality. Due to the impact of historic and current systemic racism, Black and brown communities are suffering more from this pandemic, and have less wealth to fall back on. They will take a much bigger hit if the $600 is cut. This is particularly true for Black and brown women and their families, because in this recession, these women have seen the largest job losses of all.

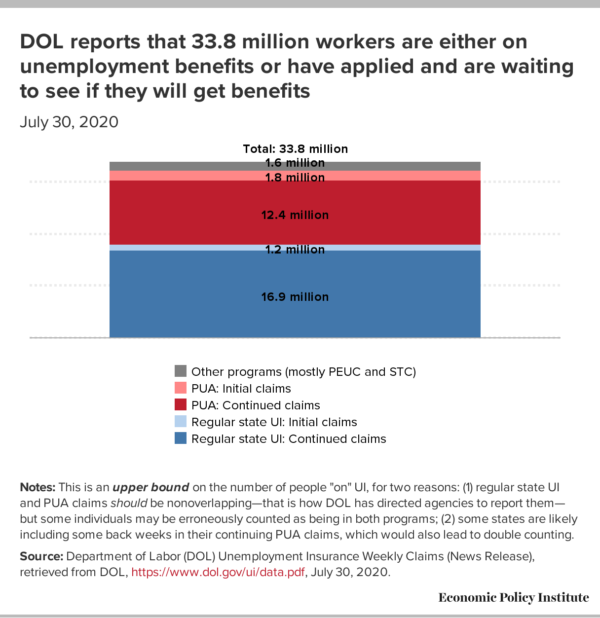

Figure B combines the most recent data on both continuing claims and initial claims to get a measure of the total number of people “on” unemployment benefits as of July 25. DOL numbers indicate that right now, 33.8 million workers are either on unemployment benefits, have been approved and are waiting for benefits, or have applied recently and are waiting to get approved. But importantly, Figure B provides an upper bound on the number of people “on” UI, for two reasons: (1) Some individuals may be being counted twice. Regular state UI and PUA claims should be non-overlapping—that is how DOL has directed state agencies to report them— but some individuals may be erroneously counted as being in both programs; (2) Some states are likely including some back weeks in their continuing PUA claims, which would also lead to double counting (the discussion around Figure 3 in this paper covers this issue well).

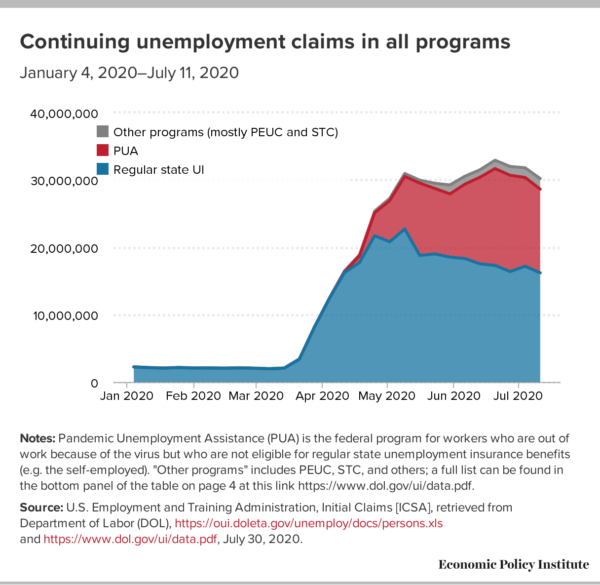

Figure C shows continuing claims in all programs over time (the latest data are for July 11). Continuing claims are more than 28 million above where they were a year ago. However, the above caveat about potential double counting applies here too, which means the trends over time should be interpreted with caution.

Economy

Newsletter Special Report: Millions of Jobs Added, Millions More to Go

This is the web version of the WSJ’s newsletter on the economy. You can sign up for daily delivery here.

Employers added 1.8 million jobs in July and the unemployment rate fell to 10.2%, marking only partial progress toward recouping massive losses tied to the coronavirus pandemic. Jeff Sparshott and Greg Ip here to take you through the key numbers.

Maybe Not a V, but Not a U Either

July’s payroll growth, at 1.8 million, still leaves total payrolls 12.9 million lower than in February. And yet if job gains continued at July’s pace, that deficit will be erased by March, 2021. If payrolls reclaim their last peak in 13 months, that would be remarkably fast. It took more than six years after the last recession. So can they maintain that pace? In July, job gains were blunted by a resurgence of the virus in the South and West which put the brakes on economic reopening. With cases slowly trending down now, economic activity should pick up, though that hasn’t shown up yet in private data such as credit card spending. Spending could also take a hit from the recent expiration of enhanced unemployment insurance benefits; Congress is struggling with an extension. And it’s unlikely that the pandemic is going to completely disappear by next year, so neither will the damage to many industries such as tourism and retailing. —Greg Ip

KEY THEMES

Labor-Market Churn

The unemployment rate fell for mostly the right reasons. Some people dropped out of the labor force but not nearly as many as found a job. Measures across the board improved, including the share of workers who wanted full-time work but were stuck in a part-time job.

The number of workers on temporary layoff fell and the number of permanent job losses was little changed last month, suggesting that many workers are getting recalled to old jobs or are able to switch into new ones. “The rate of churn in the labor market remains incredibly high, but a notable positive detail in this month’s report was the downtick in the rate of new permanent layoffs,” economists at Morgan Stanley wrote.

One potentially worrisome sign: The number of long-term unemployed is on the rise. That suggests that some people are at risk of getting locked out of the labor market—and ultimately exhausting unemployment benefits.

Job losses and gains haven’t been evenly distributed. Initially Blacks were less hard-hit than some other racial groups in the early stages of the recession, but the drop in their unemployment rate in July was the smallest among racial groups. —Greg Ip

Some of that was due to growing labor force participation; the Black employment-to-population ratio rose more than for Hispanics and whites. —Greg Ip

Who’s Hiring?

Some of the industries hit hardest by March and April lockdown orders experienced some of the biggest gains last month. Bars and restaurants, retailers, healthcare, laundry services and gambling halls posted big gains from June to July, reflecting efforts to reopen the economy by relaxing social distancing requirements.

While positive, July’s gains only begin to retrace earlier losses. And it’s not clear that the Labor Department data fully captured rising Covid-19 caseloads toward the end of July, which caused state and local governments to halt or roll back reopening plans and consumers to show renewed caution.

Not everything may be as it seems with the monthly figures. Government jobs, mainly in public schools, rose by a seasonally adjusted 300,000 in July. That’s welcome relief for a sector that typically stabilizes the economy in downturns, but which has been hard hit by the pandemic. However, it may be a mirage. On an unadjusted basis public-school jobs continued to decline in July, but the decrease was smaller than seasonal factors expected—because so many jobs have already been cut. Bottom line: If large school districts holding class online this fall don’t rehire staff, job losses will resume in the public sector soon. —Eric Morath

Can We Fix It?

One final note: The Labor Department appears to have largely solved misclassification problems that had artificially suppressed the unemployment rate. In March, April and May the agency counted millions of workers as absent—something that usually applies to vacation or sick leave—when they probably should have been classified as unemployed. That subtracted as many as 5 percentage points from the headline rate. The issue now accounts for less than 1 percentage point, Labor said Friday.

TWEET OF THE DAY

[wsj-responsive-sandbox id = “0” ]

WHAT ECONOMISTS ARE SAYING

“This is not a V-shaped recovery. Adding 1.8 million jobs is not sufficient for any sort of speedy recovery after the astronomical job losses of early spring.” —Nick Bunker, Indeed

“The pace of job growth slowed in July, but the gains over the past three months represent an impressive rebound during the ongoing economic challenges brought forth by the pandemic.” —Mike Fratantoni, Mortgage Bankers Association

“Recovery in jobs to pre-pandemic levels will likely be slow and prolonged, one that will restrain the pace of recovery.” —Rubeela Farooqi, High Frequency Economics

“These numbers suggest that the surge in virus cases since late June has so far not prevented the continued re-opening of the economy at the national level.” —Brian Coulton, Fitch Ratings

“The slowdown we’re seeing is a reminder that a return to economic stability is ultimately hinged on addressing the public health crisis.” —Daniel Zhao, Glassdoor

“The economy is expanding, but the pace of improvement has slowed.” —Jim Baird, Plante Moran Financial Advisors

“The huge remaining level gap in employment—still 12.9m lower than in February before the Covid shock hit—will keep the Fed firmly focused on supporting the recovery.” —Krishna Guha, Evercore ISI

“The payroll count still reveals a slowing in the pace of the labor market recovery. In the absence of additional fiscal aid, the broad economy risks losing momentum as it shifts into the second phase of its rehabilitation.” —Kathy Bostjancic, Oxford Economics

SIGN UP FOR OUR CALENDAR

Real Time Economics has launched a downloadable calendar with concise previews forecasts and analysis of major U.S. data releases. To add to your calendar please click here.

Economy

On woke capitalism

Just because you are an idiot doesn't mean you are always wrong. So it is with James Cleverly's denunciation of Ben & Jerry's "virtue-signalling" after the company spoke out against the government's ill-treatment of migrants.

The thing is, he was right. Ben & Jerry's fine words contrast with the company's reluctance to improve the rights of its own workers until it came under huge pressure to do so - thereby demonstrating the truth of Marx's claim that "capital is reckless of the health or length of life of the labourer, unless under compulsion from society."

But of course, Ben & Jerry's are not alone in their hypocrisy. Amazon (among many other companies) has spoken in support of Black Live Matter despite being a notoriously bad employer. Facebook and Twitter bosses have supported BLM whilst allowing race hate speech on their sites. Starbucks enthusiasm for being "an ally to the lesbian, gay, bisexual, transgender and queer community" is matched by its enthusiasm for avoiding tax. And as Sarah O'Connor points out, several "sustainable" fund managers are better at PR than at actually forcing improvements in working conditions. And so on and so on.

Blackwashing is the new greenwashing. Luke Savage is right. What we're seeing here is "the commodification of social justice" - using virtue-signalling to shift more product. Sometimes, the twin goals of capitalism - raising profits and trying to legitimate the system - happen to coincide.

All of which poses the question: is "woke capitalism" feasible or even desirable?

Certainly, capitalism has historically been associated with patriarchy, racism and slavery - although the contribution of the latter to capitalism is still a matter of debate. But of course, so too have been other modes of production.

The question is: are racism and sexism inherent features of capitalism?

There are two reasons to suspect so. One is that racism fulfils a useful function by dividing the working class and promoting national identity at the expense of class consciousness: Tory and media attempts to stir up anti-migrant feeling whilst employment is collapsing is just the latest example of this.

The other is that in capitalism those with little bargaining power lose out relative to others - which means that women and migrant workers often get a raw deal. In this context, the idea that sexism and racism could be eliminated if only capitalists were more woke is a mistake. Some injustices arise from emergent processes independent of intentions. As Marx wrote:

[The fate of the worker] does not, indeed, depend on the good or ill will of the individual capitalist. Free competition brings out the inherent laws of capitalist production, in the shape of external coercive laws having power over every individual capitalist.

Granted, some have been more optimistic about these external coercive laws. Gary Becker, for example, thought that competition could eliminate discrimination - although it seems it is yet to actually do so.

Let's assume, however, that all this is wrong and that capitalism could be woke, in the sense that there were no gender or ethnic pay gaps, that women and minorities were as likely to achieve prominent positions as white men, and that there was no racism or sexism in the workplace. What then?

Well, every criticism Marx made of capitalism would still be on the table. Marx did not criticise capitalism because of its racism and sexism* - a fact that has historically led some Marxists to understate the importance of these. Instead, his complaints were that it was alienating, oppressive, a force for inequalities in wealth and power, and prone to crises and stagnation. The fact that capitalism currently works to the disproportionate benefit of mediocre white men is but one of its flaws.

Of course, you can deny the force of these criticisms. But the point is that Marx's critique of capitalism is independent of racism and sexism. Even if we had the most perfectly woke capitalism, Marxists would find huge problems with the system. (I think rightly, but that's by the by.)

All of which is to endorse Helen Lewis's point, that there's a big difference between social and economic radicalism. Some - maybe many - capitalists might be the former, perhaps sincerely. But they are not the latter.

* With the caveat that the process of primitive accumulation was often accompanied by racism.

Economy

TikTok dust up

This week’s Goodfellows conversation was a bit more contentious than usual. The most interesting part, I think, is our little dust-up over TikTok, following Niall’s Bloomberg commentary.

As in the rest of this series I am the skeptic of jumping in to Cold War II — or at least against lashing out against all things China without an overall strategy. So I pushed hard on my colleagues — Be specific. Just exactly what is the danger you fear about allowing a Chinese social media company to operate in the U.S?

Let us remember TikTok is a private company, not a direct arm of the Chinese Communist Party. It loudly says it keeps data private and locates that data outside China. Certainly, one could and should ask for long lists of assurances on data privacy to be allowed to operate in the US. Yes, under Chinese law, the Chinese government can demand data. And then we’ll see what happens. But let us not confuse the facts on the ground as they are.

But admitting all that, be specific. Exactly what is the danger to US national security if the Chinese Communist Party gets TikToks data that finds Suzie Derkins really likes fluffy cat videos? What is special about Chinese ownership that makes TikTok super-dangerous?

Judge for yourself, as it is unfair for me to post too many late hits at my colleagues’ responses, but I remain unconvinced. Sure, 40 years from now Suzie might be a Supreme Court nominee and China might release an embarrassing video from her teenage years. But China can archive Reels or twitter or YouTube just as easily.

Many other answers seemed to me to veer off to other issues. Niall thinks TikTok is like crack cocaine, addictive to young and feeble minds, because it has AI algorithms that feed what you want to read. OK, but that has nothing to do with China and national security. Reels will be just as bad. HR is back to countering China’s quest for “economic dominance.” But I guess that means cutting off all Chinese companies, and we’ve had the argument before whether strategic mercantilism or innovation is the right answer there.

The argument broadened to one of general freedom of speech and regulation of the internet. Niall is still worried about all the fake news, and thinks that by regulating internet platforms as publishers all will be well. I notice current publishers are full of fake news too, and that the internet allows much more freedom to respond, and provide a counter-narrative. There is a bottom line, I think, whether one trusts people with freedom of speech and counter-speech, or some hope that some regulatory system, either top-down (which Niall disavows) or through the legal system, being able to sue publishers for wrong stories, will stem fake news and protect people from their feeble-mindedness. It’s a second-best world — I notice all the gatekeepers are just as feeble minded, and trust caveat emptor a lot more, I think, than my colleagues. Facebook’s idea that all postings on covid-19 must conform to current CDC or WHO guidelines, for example, is laughable. The robust and acrimonious debate over policy in the current crisis has been enormously beneficial.

I do think traditional limitations on free speech are allowable, of course. Posting on Facebook “the cops are busy tonight, everybody meet at the Nike store on N. Michigan avenue,” as apparently happened in Chicago last weekend, falls under the crying fire in a crowded theater exemption to free speech.

I won’t prejudice the conversation further. We will surely return to these issues.

Source link

-

Business4 weeks ago

Business4 weeks agoBernice King, Ava DuVernay reflect on the legacy of John Lewis

-

World News3 weeks ago

Heavy rain threatens flood-weary Japan, Korean Peninsula

-

Technology3 weeks ago

Technology3 weeks agoEverything New On Netflix This Weekend: July 25, 2020

-

Finance3 months ago

Will Equal Weighted Index Funds Outperform Their Benchmark Indexes?

-

Marketing Strategies7 months ago

Top 20 Workers’ Compensation Law Blogs & Websites To Follow in 2020

-

World News7 months ago

World News7 months agoThe West Blames the Wuhan Coronavirus on China’s Love of Eating Wild Animals. The Truth Is More Complex

-

Economy10 months ago

Newsletter: Jobs, Consumers and Wages

-

Finance8 months ago

Finance8 months ago$95 Grocery Budget + Weekly Menu Plan for 8