Finance

Will Equal Weighted Index Funds Outperform Their Benchmark Indexes?

We love index funds here at The College Investor, and we’ve recommended several in our Guide to Investing. However, there’s a type of index fund that is gaining in popularity, and one that I think has a lot of merit - equal weighted index funds.

An equal weighted index fund is just like it sounds - everything inside the index fund is equally weighted. This differs from other index funds, in that most are capitalization-based, meaning stocks with higher market capitalization (or value) are held as a higher percentage of the fund.

Let’s see how that really breaks down…

What Is An Equal Weighted Index Fund?

Let’s use the S&P 500 for this example. You know that the S&P 500 is composed of the 500 largest stocks in the United States.

Right now, a standard S&P 500 index fund (let’s use SPY), has the following Top 5 Holdings:

- Microsoft (MSFT) - 5.86%

- Apple (AAPL) - 5.49%

- Amazon (AMZN) - 4.21%

- Facebook (FB) - 2.11%

- Alphabet (GOOG) - 1.72%

So, as you can see, there is a much larger percentage of the fund in several stocks (and if you notice, these are all technology stocks), which can skew returns if these stocks perform well or poorly. In fact, that happened with Apple - many broad index funds were up much higher than the market, simply because of the weighting of Apple and Microsoft in their portfolios.

Let’s look at what equal weighting does. One of the most popular equal-weighted funds is the Invesco S&P 500 Equal Weight ETF (RSP).

If you look at the holdings of RSP, all of the stocks in the fund are at 0.22%, since the fund is equal weighted. This changes the dynamic of the performance of the fund, since no single holding can overtake the others, and performance is equalized.

How Equal Weighted Index Funds Perform

The balance that you get with an equal weighted index fund really comes into play when you chart out performance over time.

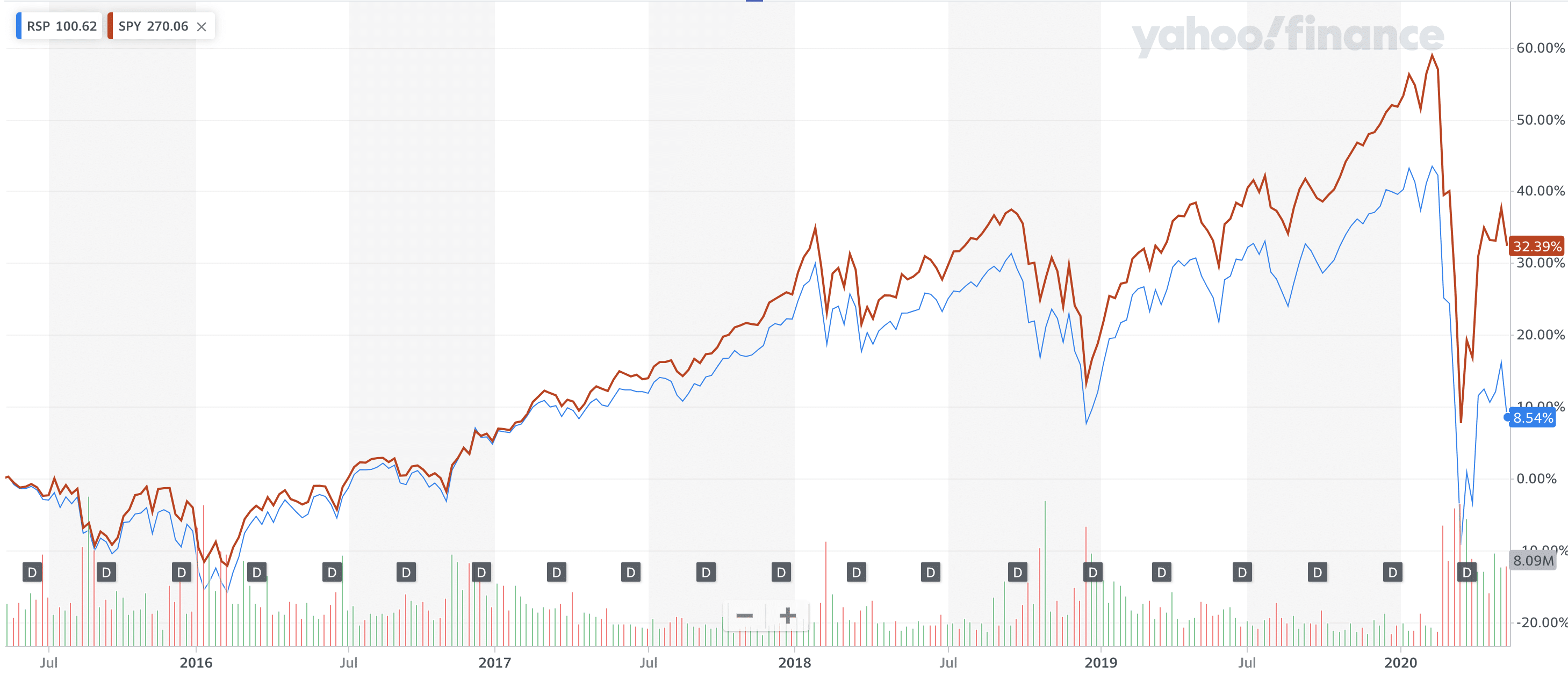

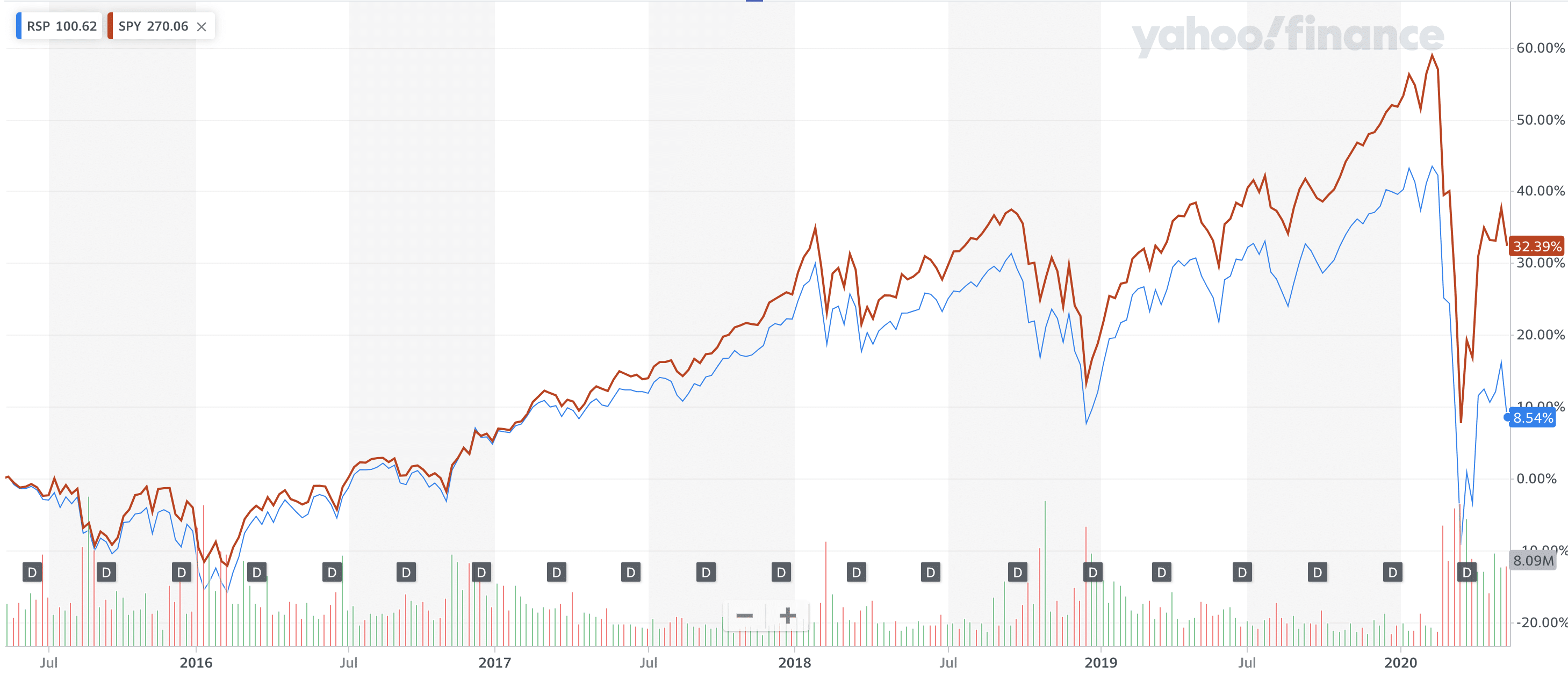

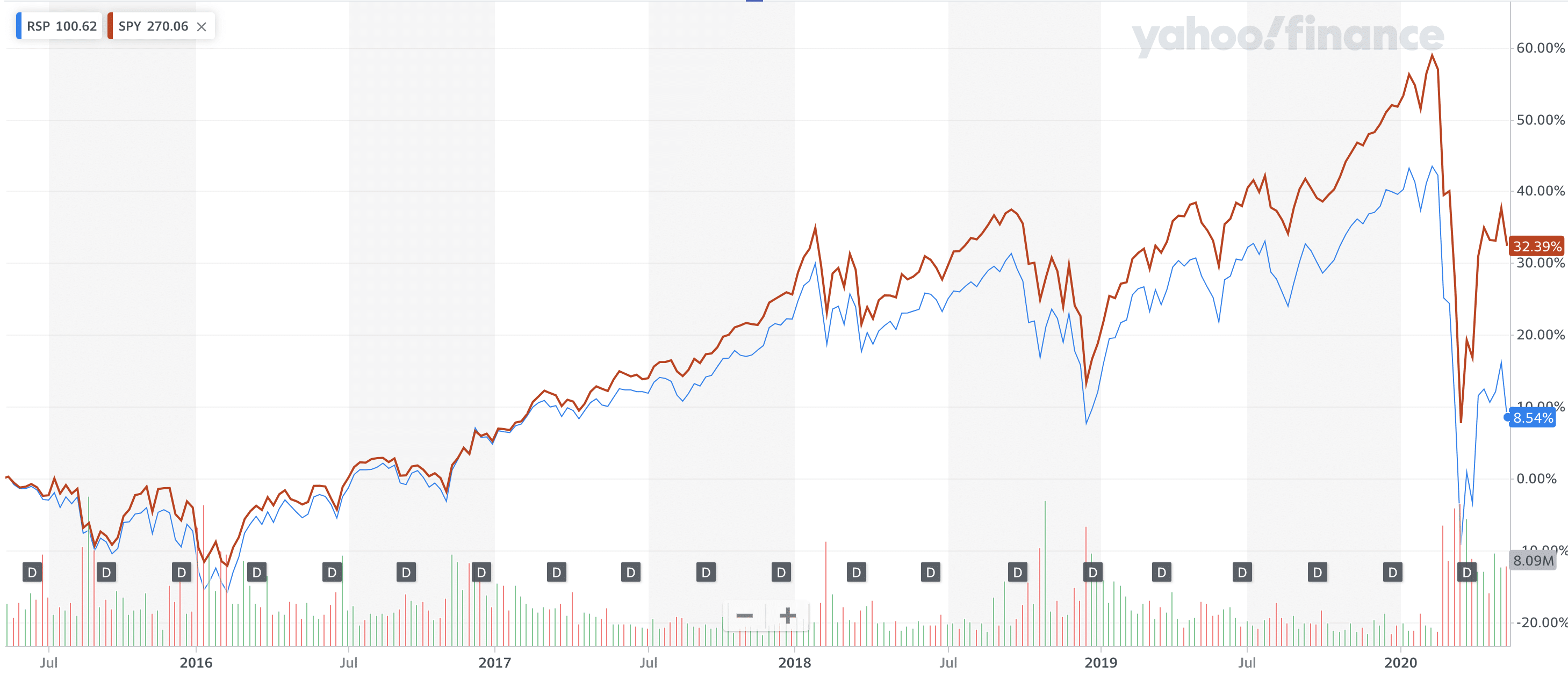

Here is a side-by-side comparison of SPY and RSP from 2005 to 2015.

The red line is RSP, the equal weighted portfolio, and the blue line is SPY, the standard capitalization weighted portfolio.

Over the this decade, RSP has returned 82.49% vs. 64.41% for SPY over the same period.

However, if you look at 2015 to 2020, this was arguably driven by technology stocks, and as such, the equal weighted fund underperformed the S&P 500:

The key to this success is balance. At the top, no single holding that may underperform can drag the portfolio down, while at the bottom, faster growing stocks get more weight than in a capitalization-based index - which worked out well for the last five years.

The key is that smaller stocks provide as much growth as bigger stocks - which can work well during some periods, and work against you in other periods.

Drawbacks to Equal Weighted Index Funds

The biggest drawback to equal weighted index funds are higher expense ratios. These funds have higher expenses because they have daily costs of maintaining balance in their portfolio. For example, the EWMC ETF has an expense ratio of 0.538% versus IWR, which has an expense ratio of 0.19%.

While an ETF like SPY will only trade when major changes happen, equal weighted funds have to continually trim overweighted holdings to maintain the balance. Think of it like a daily portfolio rebalancing act.

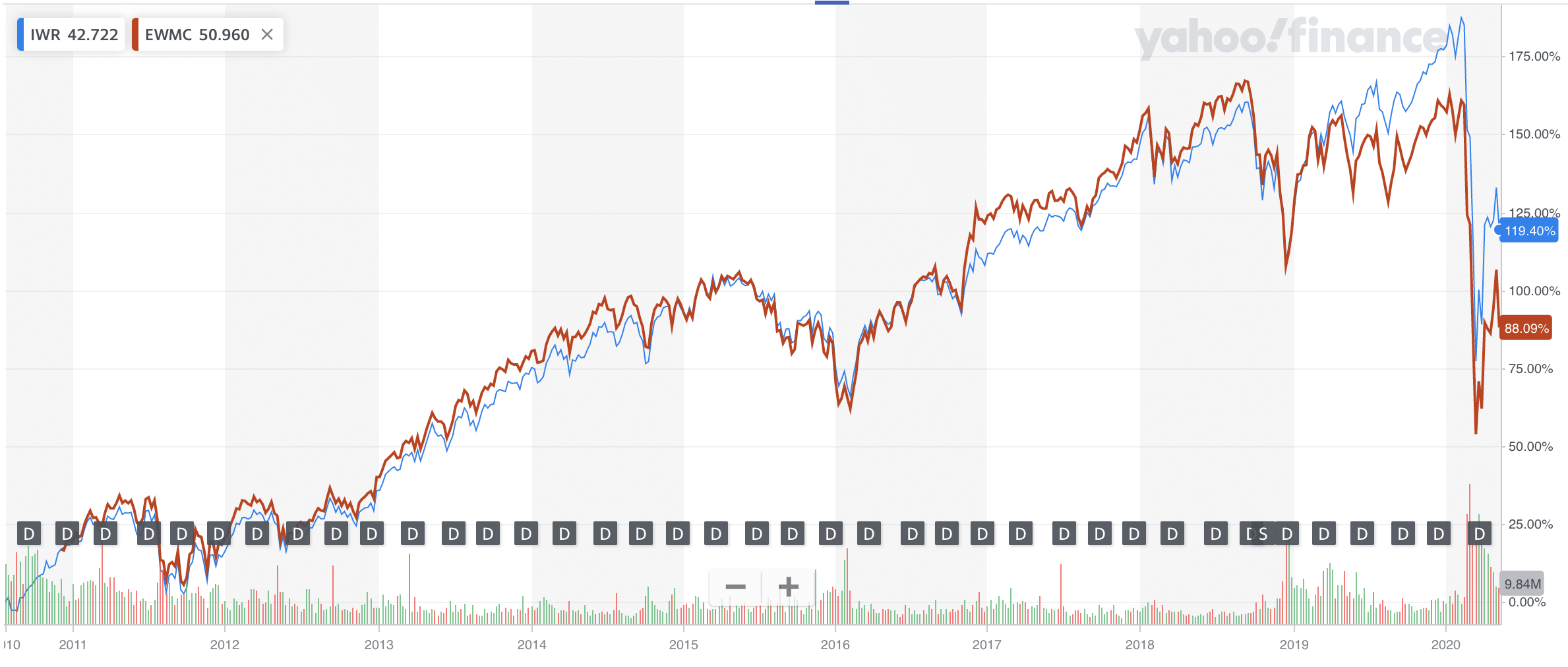

The second big drawback to equal-weighted funds is that the gap in performance vanishes as you move from large cap funds to mid and small cap funds. In fact, the equal-weighted index funds are basically even at the mid cap and underperform at the small cap level.

Mid Cap Equal Weighted Funds

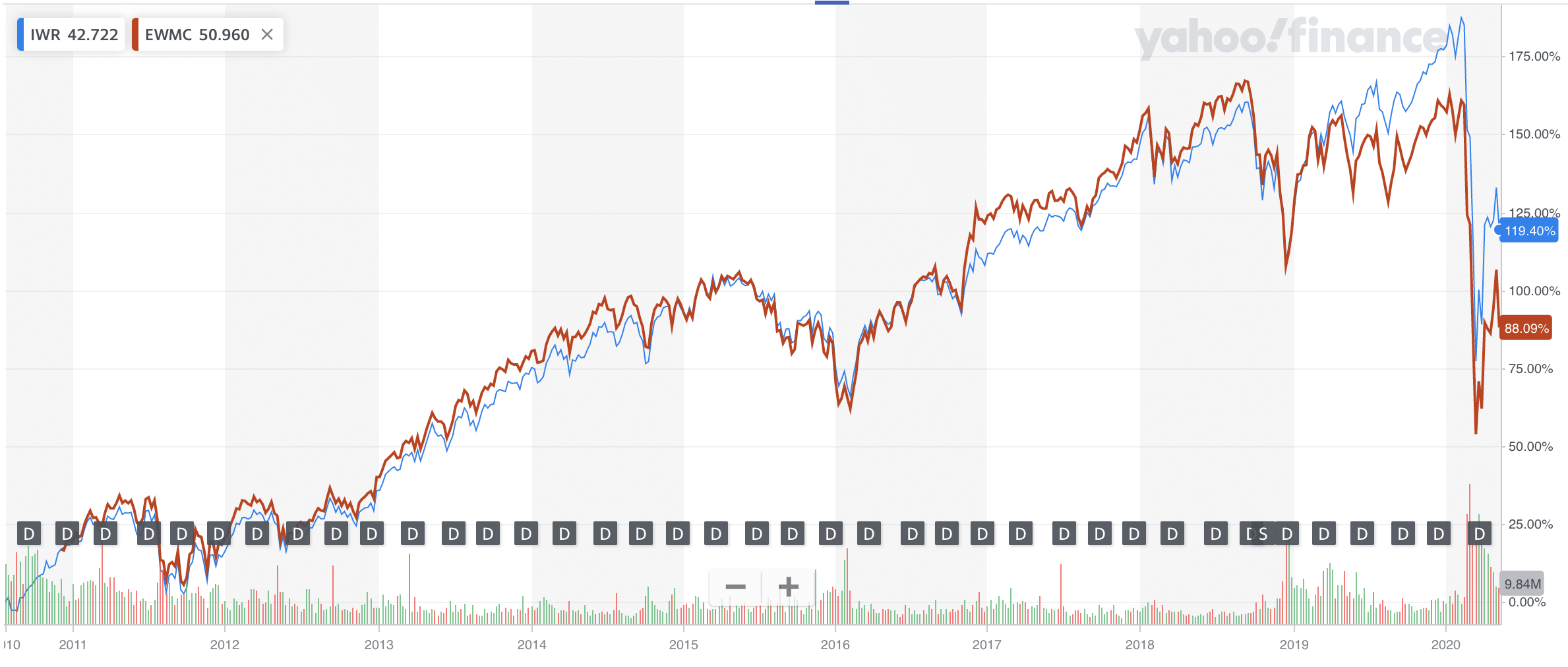

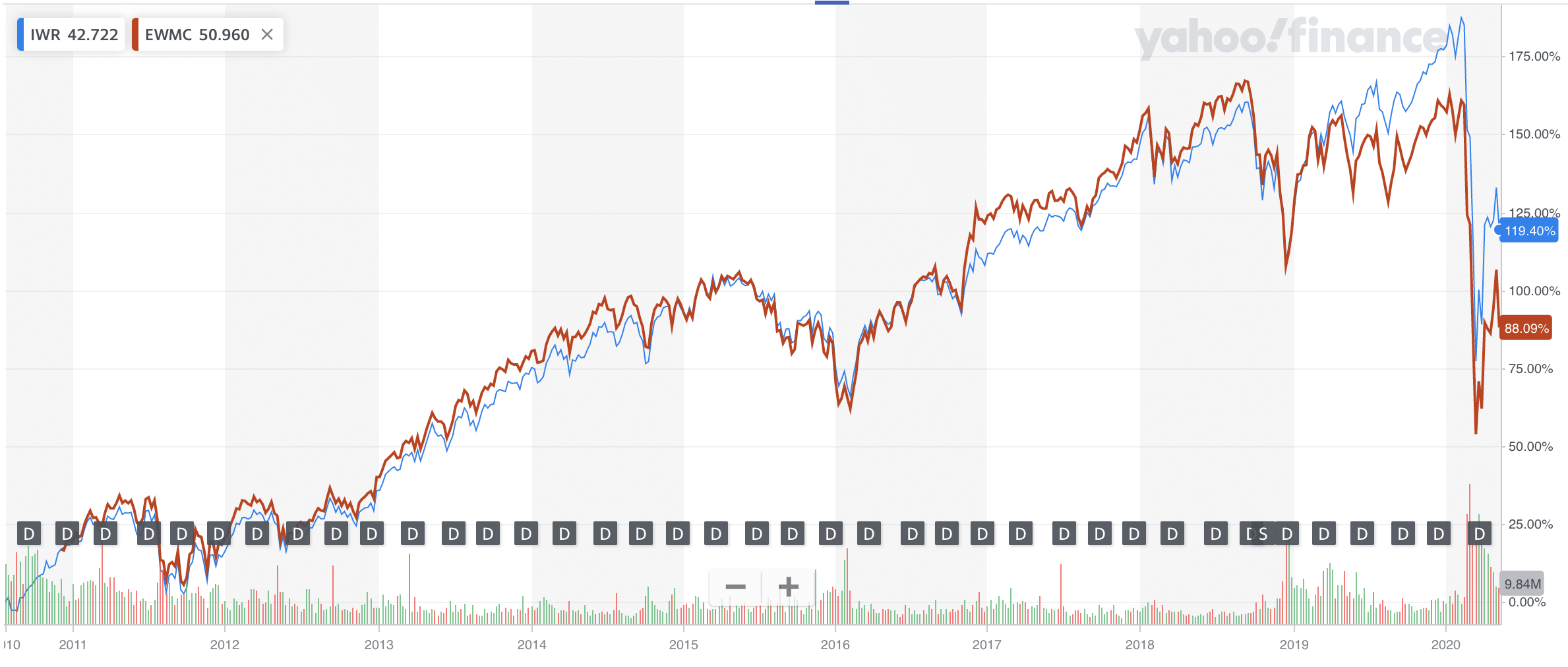

Here, we look at the Invesco S&P MidCap 400® Equal Weight ETF (EWMC) vs. the iShares Russell MidCap ETF (IWR). You can see over the last 10 years (total time of fund’s existence), performance of the two funds has basically been even, with a slight underperformance of the equal-weighted fund - which was magnified in the current crisis.

Over the period, EWMC returned 88.09% vs. 119.40% for IWR.

Small Cap Equal Weighted Funds

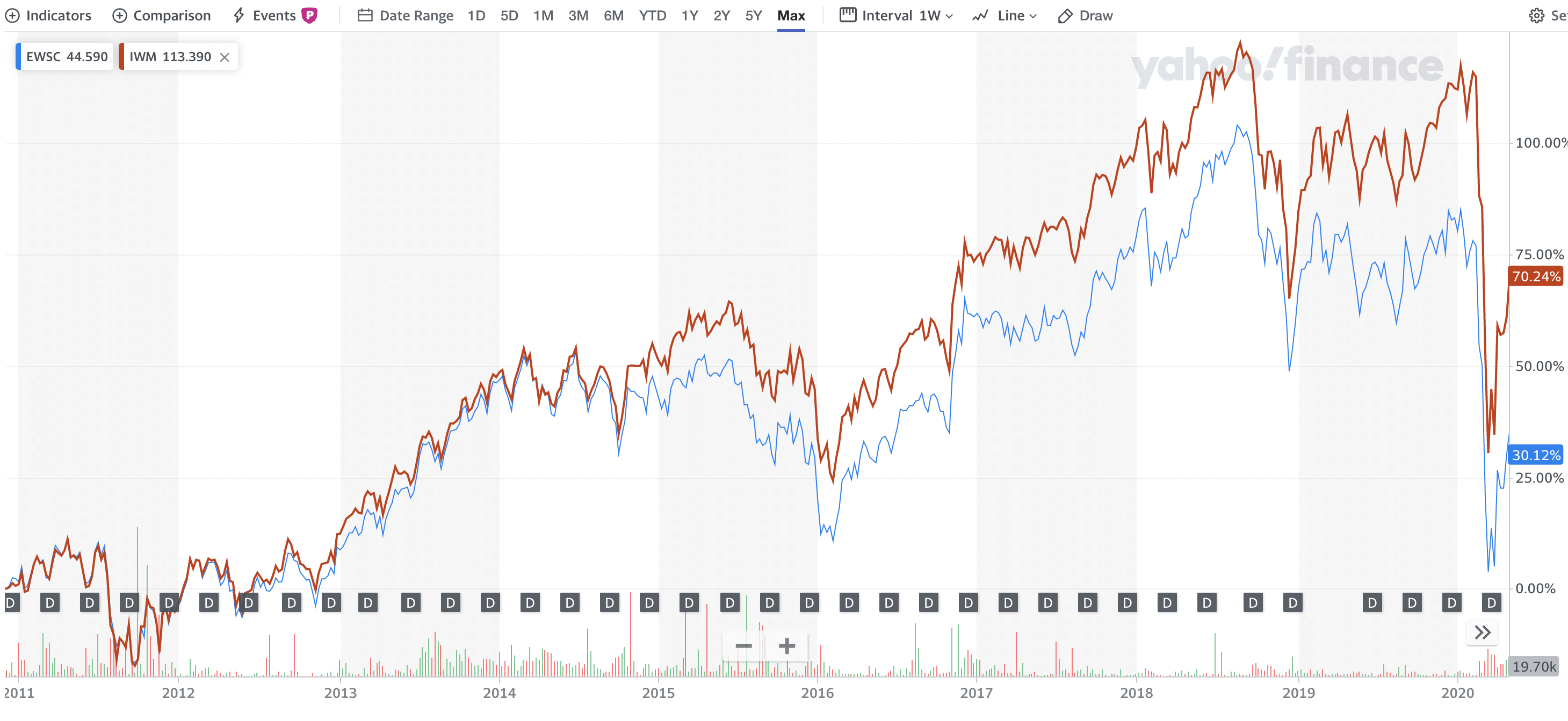

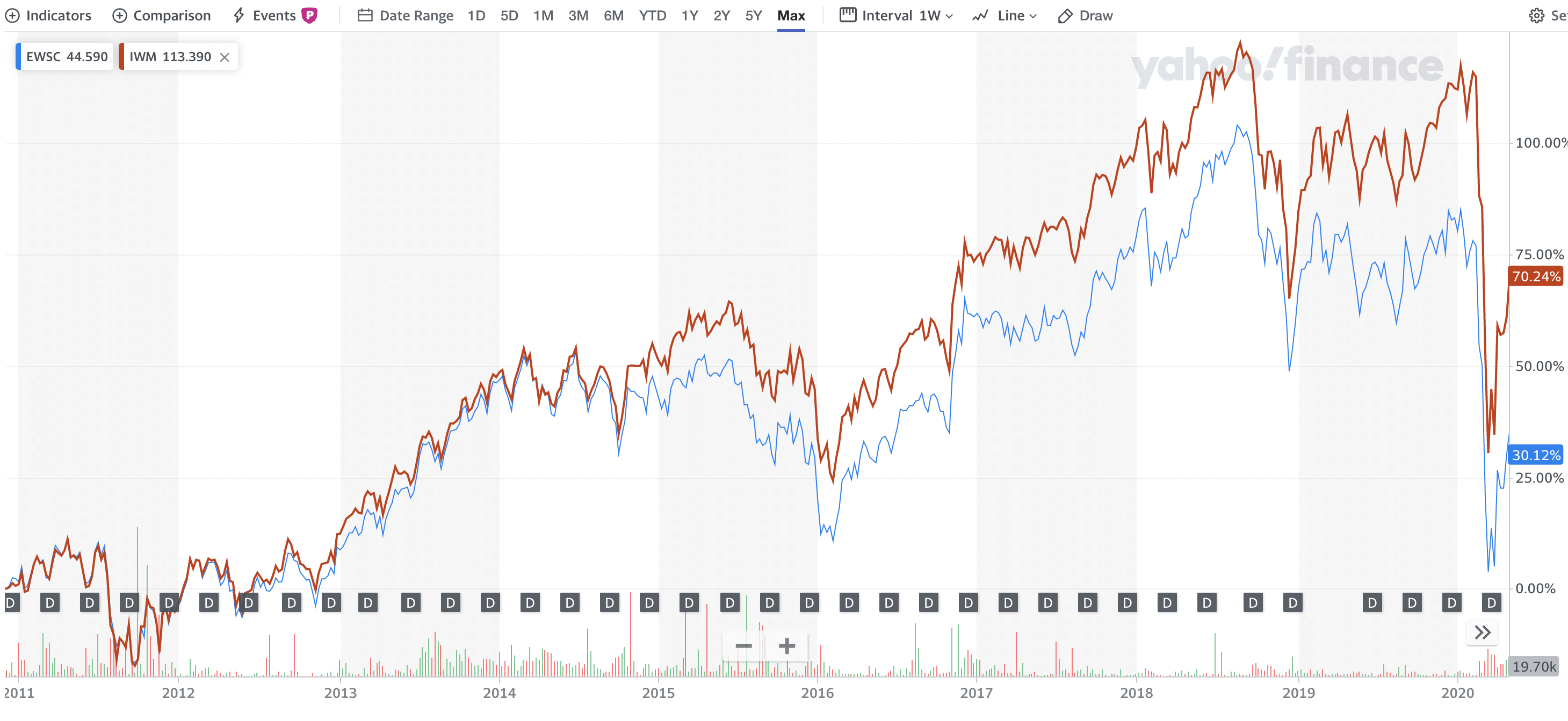

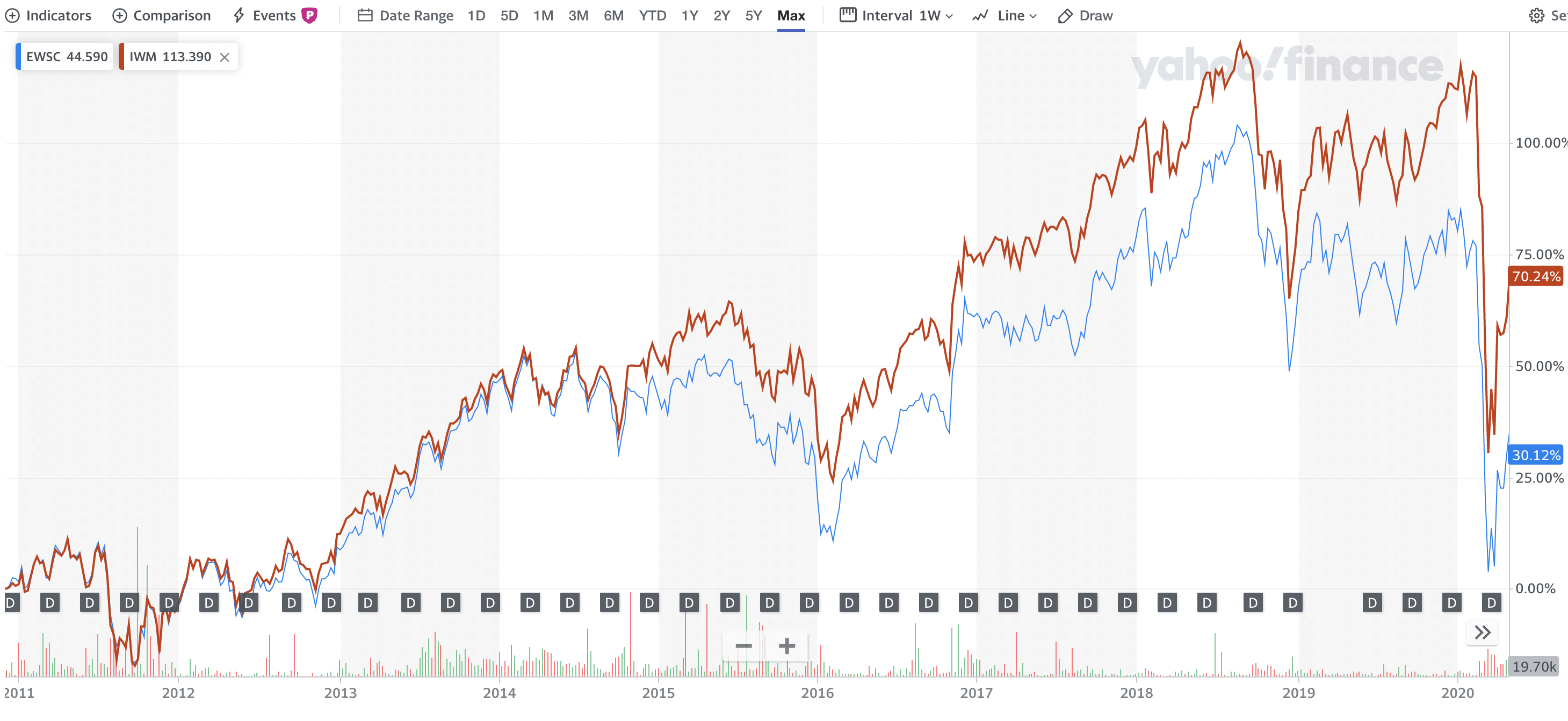

Here, we look at S&P 600 Small Cap Equal Weight ETF (EWSC) vs. the iShares Russell 2000 ETF (IWM). You can see that the equal weighted fund actually underperformed the benchmark index in this case.

Over this period, ERWS returned 30.12% vs. 70.24%% for IWM. That is over 40% underperformance, not including the higher expense ratio.

Lessons on Equal Weighted Index Funds

The biggest lesson learned is that, if you’re looking for a large cap index fund, you should consider an equal weighted fund - especially if you’re concerned about technology performance. These funds are great for large cap investors because:

- It dampens underperformance of top holdings

- It increases performance of “smaller cap” holdings

- It has a bias towards growth stocks because of the equal weighted

Second, we learned that these rules don’t apply to mid cap and small cap index funds for the same reasons. Equal weighted funds are not good investments at the small cap level because:

- Small caps have a tendency towards extreme growth, and you lose that with equal weighting

- Larger holdings in small cap funds are the ones you want to hold, but you lose exposure to

Finally, it’s important to keep in mind the higher expenses when investing in equal weighted index funds.

Popular Equal Weighted Index Funds

Here are the most popular equal weighted index funds, in case you’re interested in investing.

Large Cap

- RSP - Invesco S&P 500 Equal Weight ETF

- QQEW - First Trust NASDAQ 100 Equal Weight Index ETF

Mid Cap

- EWMC - Invesco S&P MidCap 400 Equal Weight ETF

Small Cap

- EWSC - Invesco SmallCap 600 Equal Weight ETF

Sector ETFs

- Basic Materials - RTM - Invesco S&P 500 Equal Weight Materials ETF

- Consumer Discretionary - RCD - Invesco S&P 500 Equal Weight Consumer Discretionary ETF

- Consumer Staples - RHS - Invesco S&P 500 Equal Weight Consumer Staples ETF

- Energy - RYE - Invesco S&P 500 Equal Weight Energy ETF

- Financial Services - RYF - Invesco S&P 500 Equal Weight Financial Services ETF

- Health Care - RYH - Invesco S&P 500 Equal Weight Health Care ETF

- Industrials - RGI - Invesco S&P 500 Equal Weight Industrials ETF

- Technology - RYT - Invesco S&P 500 Equal Weight Technology ETF

- Utilities - RYU - Invesco S&P 500 Equal Weight Utilities ETF

What are your thoughts on equal weighted index funds? Do you invest in these in your portfolio?

The post Will Equal Weighted Index Funds Outperform Their Benchmark Indexes? appeared first on The College Investor.

Finance

How to Be More Creative

Those of us who weren’t fortunate enough to be born the next Picasso may think there’s no way we can learn to be more creative. But is that really true? According to some of the most creative people in the business, it’s not.

I recently interviewed Brian Koppelman, a renowned filmmaker, producer, and writer. He has worked on some of my favorite movies, like Rounders, Ocean’s Thirteen, and The Illusionist. He also created the popular T.V. show Billions, which has won many prestigious awards. Brian’s creativity has resulted in massive career success, and he’s spent years perfecting his creative process. We sat down together and he gave me his best advice on how anyone can be more creative.

Quick Tips on How to Be More Creative:

- Tip #1: Don’t be afraid to fail

- Tip #2: Don’t try to get it right on the first try

- Tip #3: Accept that creating can be uncomfortable

- Tip #4: Limit your time

- Tip #5: Reduce your anxiety

- Tip #6: Use rejection as a tool

You can watch my full interview with Brian below.

Tip #1: Don’t be afraid to fail

Brian says, “Whatever your favorite movie is, at some point during the writing of it the screenwriter felt completely lost”. When you’re working on a big creative project, you run the risk that it will be a complete failure. People often forget this, because they only see the finished successful product. But we know that for every movie that gets made, there are thousands of movies that don’t. If you’re afraid to fail, you’ll never be able to get to that amazing finished product. Even if it takes a few tries to get it right, it’s worth it to create something brilliant in the end.

Tip #2: Don’t try to get it right on the first try

There are two steps to creating something new: the first step is making the first draft, or coming up with something from scratch. The second step is editing that draft into a beautiful finished product. If you want to be more creative, you need to be careful not to combine these two steps (most people do). When you’re creating something from scratch, you need to silence your inner critic and just create with as much freedom and passion as possible. THEN once you have a first draft, you can go back over it with a critical eye and make it better.

If you try to edit it while you create, you’re limiting your creativity in a big way. You have to be able to try something new, and edit it out later if it doesn’t work. If you edit it out before you try it, you’ll never know if that would have ended up being the perfect addition.

Tip #3: Accept that the process of creating can be uncomfortable

We all have times where we’re working on something and we think it’s terrible. Brian explains that when he was working on his ESPN documentary on Jimmy Conners, he would come home feeling like he made it worse rather than better. But you have to get up the next day and attack it again. Once you realize that this discomfort is part of the process of making something great, you can learn to work through this tough part of the process and become even more creative.

Tip #4: Limit the amount of time you have

You don’t need a lot of time to make something great. It’s actually a huge advantage If you only have an hour a day to work on your creativity, because it forces you to focus and work with intensity. If you give yourself too much time, it’s too tempting for your mind to wander. By limiting your time, you’ll produce more creative work at a faster pace. Brian also advises to “Leave yourself ‘a wet edge’, or a little roadmap for tomorrow, at the end of your creative practice”. This way your subconscious will keep working on it, and when you come back the next day, you’ll be able to hit the ground running.

Tip #5: Eliminate sources of anxiety

When Brian and his partner David Levien were writing their first screenplay, they were both working full time. Brian advises aspiring creators not to quit their jobs, because it creates too much pressure. If there is a lot of pressure on you to create something magnificent, it can actually thwart your creative abilities. Instead, focus on eliminating anxiety wherever you can so you can truly focus on your creativity.

Tip #6: Use rejection as a tool

A lot of times when we hear “No”, it’s crushing, and it feels like a huge judgement on our work and our character. But Brian points out that you never know what’s going on behind closed doors, “Maybe that morning the head of the agency said ‘hey guys, don’t tell anybody but we can’t afford to take on any new clients. So for the next month you need to pass on everything’”. Your work could get passed up because of something internal you don’t know about, but if you take it personally and give up, you might miss your chance.

Rejection can actually be a useful tool to help you look objectively at your work.

Take your Creativity to the next level

Overall, creativity is a skill that you can improve over time. If you follow the tips Brian laid out above, you’ll be well on your way to being more creative.

Once you’ve honed your creative process, you may want to take it to the next level. Many great creators have started businesses from their work, and you could too.

If you want even more inspiration on how improving your creativity could transform your life, take my earnings potential quiz below.

How to Be More Creative is a post from: I Will Teach You To Be Rich.

Finance

YOUR GUIDE FOR SAVING MONEY ON PET FOOD

If you are like most people, your dog is not simply a pet. He or she is a member of your family.

You want to provide them the best of everything. From toys to treats, you love to spoil them rotten

But the costs. Oh, how they can quickly get out of control!

WHY CHEAP IS NOT BETTER

Your first thought may be to buy the cheap dog food.

Please, don’t.

The problem is that the lower quality food can lead to health problems for your pet, which could end up costing you more. It is not the answer.

Instead, focus on ways you can save while still getting your favorite canine the food and treats that are best for them.

STOCK UP WHEN ON SALE

When you find a great deal on the dog food you need, buy extra! There is no reason to pick up one bag when you can get a couple and save.

BUY IN BULK

Oftentimes, the larger bags result in greater savings. Compare the price per ounce of the smaller items to the bigger bags to find the lowest cost.

TRY THE STORE BRAND

Just as with the store brands you buy, sometimes the store brand of pet foods is the same – simply in different packaging.

Carefully review the ingredients before making the switch. After all, if they are the same, why are you paying for the label?

SIGN UP FOR THE STORE REWARDS PROGRAM

Loyalty has its perks. Many stores offer loyalty programs to members. You can get exclusive offers, discounts and coupons that are only offered to those who have signed up.

Some programs also reward for your purchase in the form of points. Once you accumulate the points you can cash them in towards savings or freebies.

GET ON THE LIST

Even if you are a member of their program, make sure you are also on the list! You will get alerts for sales and may even find some awesome coupons to make their way into your inbox as well.

Tip: Make a secondary email address to use so your inbox is not cluttered with these types of emails.

USE ONLINE SERVICES

There are online pet product providers, such as Chewy, who sell pet food and other items, often at a discount. The added perk here is that they deliver it directly to you – so no lugging home huge bags of dog food from the store.

You can use apps such as Honey or Wikibuy to compare online prices to ensure you also find the lowest possible price for the items you need.

SET UP AUTOMATED DELIVERIES

Some sites, such as Amazon, offer discounts if you sign up for automated delivery of select products. Not only will it be delivered, but you also won’t have to worry about running out.

CHECK FOR REBATE OFFERS

Sometimes, manufacturers offer product rebates. If you can find these, you’ll get money back on your purchase.

PRAISE (OR COMPLAIN)

If you have a food your pet loves, send an email letting them know. They may send you coupons or vouchers for products as a thank you.

Alternatively, if you have a problem with a product, make sure to reach out. The company may offer a refund or alternative product for your trouble.

SHOP THE WAREHOUSE

Skip the big box stores and head to your local warehouse. You may find larger bags at a lower cost sold there – saving you time and money.

BECOME A TRACKER

All stores run sales in cycles. They do this on food, clothes, and more – including pet food! Keep track of the offers at your favorite stores.

You will start to learn their cycle and can then stock up when items are on sale.

SKIP THE STORE AND MAKE HOMEMADE DOG FOOD

You can even bypass the store and make your own dog food right at home. There are countless recipes on Pinterest that you can try.

But, before you rush to start a cooking frenzy, make sure to carefully research each ingredient to make sure it is safe for your pet to consume.

PUT COUPONS TO WORK

Before you head to the store, head online, and search for coupons for your pet’s food. You may find them on the manufacturer’s website or on coupon printing sites.

Make sure to also check the product packaging as you may find them stuck to the front of that big bag of dog food.

GET FREE SAMPLES FROM YOUR VET

Vets get free samples of the products they sell – so ask for one! The freebies do not cost them anything, so they should be more than happy to give you one if you inquire.

The post YOUR GUIDE FOR SAVING MONEY ON PET FOOD appeared first on Penny Pinchin' Mom.

Finance

A Peek Into the Last Few Weeks (and our family vacation!)

How to get a shower and get ready for the day when you’re taking care of two babies! 🙂

People ask me all the time how I’m doing with having two babies and I think this early morning picture says it all. Life is full, my hands are full, and my heart is so full! (By the way, I’m actually putting this post together while trying to bounce Kierstyn to sleep in the Baby K’tan… it’s rare that I don’t have at least one baby in my arms these days!)

How could my heart not be full when this is an almost daily site at our house!

Silas had another weekend baseball tournament at a town about an hour away (Murfreesboro). We had fans set up with a generator, tents, lots of cold drinks in coolers, and these cold wraps to keep everyone cooled down

Champ has been learning how to hold his head up and roll over!

The babies have started to love having books read to them. Goodnight Moon was Silas’ favorite book when he was little, so it’s been so fun to introduce the babies to this book!

We packed for our family trip in tubs — each person got a tub for the week. This saved so much space in our vehicle and made things much more organized!

Our one out of state trip this summer was to go meet up with my family at Bull Shoals Lake in Arkansas. We weren’t sure if the trip was going to happen due to COVID-19, but because of a number of safety measures we put into place, DCS gave us special permission to be able to go and take Champ with us.

Every afternoon during our annual extended family lake vacation, my mom has “Grandma Time” with her grandkids. She teaches them a Bible lesson, they do a craft, have a snack, and do a game together.

Over the past two years, the older grand kids have started helping out. This year, each of the older ones signed up to help out with a craft and/or a snack and then Kathrynne is in charge of games (complete with an elaborate ticketing system and prizes they can turn their tickets in for at the end of the week ala Chuckie Cheese style!)

As many of you know, my mom had some serious health issues last year, including multiple extensive surgeries and skin grafts for skin cancer. She also got really sick with pneumonia in the middle of all that.

She almost didn’t get to come on the annual lake vacation last year. She did come, but she was so weak and sickly that I wondered if she’d make it another year.

This year, at 66 years old, she’s stronger than ever — not only leading Grandma Time, but also skiing and helping with the babies and cooking and looking for ways to reach out and serve all day long.

I know many of you prayed for her last year and I just wanted to tell you thank you, again! I look at this photo I snapped earlier this week and it just reminds me to be grateful for the many gifts it represents.

Her first time in a pool!

They had this sign at the pool! 😉

For details on how we all pitch in on meals and clean up, check out this post.

One of my favorite parts of our extended family vacations: the daily salad bars we have.

On our way home, we stopped by Ozark, MO so the girls and I could go in to the discount store there. (More details on what we bought coming this weekend!)

Jesse’s parents and his sister, Lisa, drove from Kansas to meet up with us so they could meet the babies, too.

I’m so grateful we got to spend time with extended family. This year certainly has made us so much more grateful for this!

A year ago, we were in the middle of our foster care home study and praying for who God would bring into our home for us to love on.

We were at peace about pursuing this path, but we were still apprehensive and wondering what it might mean for our future. There were so many unknowns, so many what if’s, and so many things outside our control.

I look back on this last year and the 5 children we’ve had the privilege to have in our home — 4 for just a very short-term stint and sweet little Champ who has been with us for almost 4 months.

There are still just as many unknowns, what if’s, and things outside our comfort zone. My heart has been broken in a hundred little pieces over the things we’ve seen and witnessed firsthand and the many kids and their stories whom we weren’t able to say yes to. I’ve cried more tears in the last 10 months than I’ve cried in the last 10 years (okay, pregnancy and postpartum probably played a part in that!).

And yet, my heart is fuller and happier than I can ever remember. The opportunity to love, pour into, and nurture has filled me up in the deepest of places. Seeing my husband and kids sacrifice and serve and love so well has been one of the most amazing experiences.

I don’t know what the future holds. I can imagine it will be full of heartbreak and beauty, tears and love, a roller coaster of emotions, and many things I can’t even imagine.

There are many unknowns, but this one thing I know: I don’t regret for one second saying “yes” to foster care. I look at these pictures and think, “We could have missed this.”

-

Business3 weeks ago

Business3 weeks agoBernice King, Ava DuVernay reflect on the legacy of John Lewis

-

World News2 weeks ago

Heavy rain threatens flood-weary Japan, Korean Peninsula

-

Technology2 weeks ago

Technology2 weeks agoEverything New On Netflix This Weekend: July 25, 2020

-

Marketing Strategies7 months ago

Top 20 Workers’ Compensation Law Blogs & Websites To Follow in 2020

-

World News7 months ago

World News7 months agoThe West Blames the Wuhan Coronavirus on China’s Love of Eating Wild Animals. The Truth Is More Complex

-

Economy9 months ago

Newsletter: Jobs, Consumers and Wages

-

Finance8 months ago

Finance8 months ago$95 Grocery Budget + Weekly Menu Plan for 8

-

Technology8 months ago

Walmart’s ‘Daily Deal Drop’ sale is just as good as Black Friday – here are today’s 10 best deals