Economy

On woke capitalism

Just because you are an idiot doesn't mean you are always wrong. So it is with James Cleverly's denunciation of Ben & Jerry's "virtue-signalling" after the company spoke out against the government's ill-treatment of migrants.

The thing is, he was right. Ben & Jerry's fine words contrast with the company's reluctance to improve the rights of its own workers until it came under huge pressure to do so - thereby demonstrating the truth of Marx's claim that "capital is reckless of the health or length of life of the labourer, unless under compulsion from society."

But of course, Ben & Jerry's are not alone in their hypocrisy. Amazon (among many other companies) has spoken in support of Black Live Matter despite being a notoriously bad employer. Facebook and Twitter bosses have supported BLM whilst allowing race hate speech on their sites. Starbucks enthusiasm for being "an ally to the lesbian, gay, bisexual, transgender and queer community" is matched by its enthusiasm for avoiding tax. And as Sarah O'Connor points out, several "sustainable" fund managers are better at PR than at actually forcing improvements in working conditions. And so on and so on.

Blackwashing is the new greenwashing. Luke Savage is right. What we're seeing here is "the commodification of social justice" - using virtue-signalling to shift more product. Sometimes, the twin goals of capitalism - raising profits and trying to legitimate the system - happen to coincide.

All of which poses the question: is "woke capitalism" feasible or even desirable?

Certainly, capitalism has historically been associated with patriarchy, racism and slavery - although the contribution of the latter to capitalism is still a matter of debate. But of course, so too have been other modes of production.

The question is: are racism and sexism inherent features of capitalism?

There are two reasons to suspect so. One is that racism fulfils a useful function by dividing the working class and promoting national identity at the expense of class consciousness: Tory and media attempts to stir up anti-migrant feeling whilst employment is collapsing is just the latest example of this.

The other is that in capitalism those with little bargaining power lose out relative to others - which means that women and migrant workers often get a raw deal. In this context, the idea that sexism and racism could be eliminated if only capitalists were more woke is a mistake. Some injustices arise from emergent processes independent of intentions. As Marx wrote:

[The fate of the worker] does not, indeed, depend on the good or ill will of the individual capitalist. Free competition brings out the inherent laws of capitalist production, in the shape of external coercive laws having power over every individual capitalist.

Granted, some have been more optimistic about these external coercive laws. Gary Becker, for example, thought that competition could eliminate discrimination - although it seems it is yet to actually do so.

Let's assume, however, that all this is wrong and that capitalism could be woke, in the sense that there were no gender or ethnic pay gaps, that women and minorities were as likely to achieve prominent positions as white men, and that there was no racism or sexism in the workplace. What then?

Well, every criticism Marx made of capitalism would still be on the table. Marx did not criticise capitalism because of its racism and sexism* - a fact that has historically led some Marxists to understate the importance of these. Instead, his complaints were that it was alienating, oppressive, a force for inequalities in wealth and power, and prone to crises and stagnation. The fact that capitalism currently works to the disproportionate benefit of mediocre white men is but one of its flaws.

Of course, you can deny the force of these criticisms. But the point is that Marx's critique of capitalism is independent of racism and sexism. Even if we had the most perfectly woke capitalism, Marxists would find huge problems with the system. (I think rightly, but that's by the by.)

All of which is to endorse Helen Lewis's point, that there's a big difference between social and economic radicalism. Some - maybe many - capitalists might be the former, perhaps sincerely. But they are not the latter.

* With the caveat that the process of primitive accumulation was often accompanied by racism.

Economy

Blaming the voters

In the Times, Matthew Parris wrote: "this Prime Minister is ultimately our [the electorate's] fault." I tweeted that this was absolutely right, but got a little pushback. I should therefore elaborate.

What I and Matthew meant was that Johnson is not doing anything unexpected. He is merely living down to what everybody knew about him. As Matthew wrote:

There was never any reason for confidence in Boris Johnson’s diligence, his honesty, his directness, his mastery of debate, his people-skills with colleagues, his executive ability or his policy grip. We’d seen no early demonstration of any of these qualities but we just blanked that out.

Voters, then, are getting what they voted for. Those who voted Labour in 2001 could say of the Iraq war “I never voted for that”. Those who voted Lib Dem in 2010 could say of the tripling of tuition fees “I never voted for that.” Those who voted Tory last year, however, cannot say the same. They got what they wanted. They should own it.

There are some objections to this, most of which I find inadequate.

The first is that voters were deceived by our dishonest grifter media. There’s some truth in this. The media does have some influence, if less than its critics claim.

But people have agency. They are responsible for believing the media’s lies: the victims of conmen are not always wholly deserving of our sympathy. And voters are quite capable of being wrong without the media’s help. They are systematically mistaken about many social facts, such as how many immigrants there are. They don’t understand economics (or, I suspect, the social sciences generally). Some of their preferences – for benefit cuts and a hostile environment for immigrants - are plain vicious. And they have cognitive biases which support inequality. The media amplify these failings. But to believe they are the sole cause of them is to regard voters as childlike noble savages who are corrupted by a few billionaires. That’s just romantic twaddle.

You don’t need to believe in Marxian ideas of false consciousness (a phrase Marx never used) to accept this. Bryan Caplan and Jason Brennan have said similar things from a non-Marxian point of view.

Another objection to Parris’s claim is that the Tories got only a minority of the vote and so it is our electoral system to blame rather than the voters.

Let’s leave aside the fact that the electorate support this system: they rejected mild reform in the 2011 referendum. And let’s also leave aside the fact that it’s not just Tory voters to blame. Those who abstained or voted Lib Dem thereby allowing a Tory candidate to win in their constituency are also guilty.

And let’s also leave aside the fact those using this argument must be careful – because it will undoubtedly be weaponized by the right to delegitimize even a mildly social democratic government.

Instead, there’s another problem. If voters do have vicious, biased and ill-informed preferences – whether caused by the media or anything else – then the last thing we should want is for parliament to better reflect these. (Of course, some Labour supporters might have such bad preferences too.)

Our problem is not how to get a more representative parliament but rather how to filter voters’ preferences so they reflect the wisdom rather than stupidity of crowds.

Traditionally, small-c conservatives have been alive to this question. It is why Edmund Burke thought that MPs’ judgment should over-ride the “hasty opinion” of their constituents. And it’s why they have prized an independent civil service and judiciary, as these too restrain hasty, silly and nasty preferences: it is no accident that populists everywhere attack such institutions.

But there is a more radical alternative – to use devices of deliberative (pdf) democracy such as citizens juries to increase our chances of getting the best rather than worst of public opinion. It is these we need more than electoral reform.

You might object here that it is futile to complain about the electorate as we must work with the world as it is, not as we’d like it.

Public opinion, however, is malleable – a fact our most successful recent Prime Ministers have recognised. Thatcher sought to change it not just by persuasion but by introducing a property-owning democracy to incentivize people to vote Tory. And Blair’s expansion of higher education has (inadvertently?) created a large cohort of liberal-minded youngsters: there’s a reason why Tories are attacking universities.

There’s a further objection to Parris’s claim. Some of us (not enough!) voted Labour. Surely we’re not to blame?

There’s an irony here. Many people using this to exculpate themselves also believe in the idea of collective guilt – that, for example, Britons collectively were responsible for the slave trade and imperialism. But if our ancestors, many of whom never owned slaves or participated in imperialism, were collectively guilty of these crimes, mightn’t we too be collectively responsible for the Tory government?

Mightn’t even we Labour supporters be partly to blame by for example not campaigning sufficiently or sufficiently well or for making bad political choices ourselves – be they choosing a Labour leader who didn’t appeal sufficiently to voters or not accepting the Brexit referendum result?

Which brings me to another irony. Part of Johnson’s appeal is like Trump’s: it’s a backlash against metropolitan elites who think they know better than “the people”. And yet those of us who claim that (some) voters are ill-informed and vicious are making the same mistake Hillary Clinton made when she called Trump supporters “deplorables”: we’re inviting a backlash against us arrogant know-alls.

This is a dilemma. The solution to it – if there is one – is to try to separate talk about outcomes from talk about process. We must ask: what sort of processes and institutions are likely to best deliver policies that are both good (by whatever lights you want) and democratic? Few people, however, want such a debate.

Economy

More on debt

Following my last post on debt I’ve thought a bit more, and received some very useful emails from colleagues.

A central clarifying thought emerges.

The main worry I have about US debt is the possibility of a debt crisis. I outlined that in my last post, and (thanks again to correspondents) I’ll try to draw out the scenario later. The event combines difficulty in rolling over debt, the lack of fiscal space to borrow massively in the next crisis. The bedrock and firehouse of the financial system evaporates when it’s needed most.

To the issue of a debt crisis, the whole debate about r<g, dynamic inefficiency, sustainability, transversality conditions and so forth is largely irrelevant.

We agree that there is some upper limit on the debt to GDP ratio, and that a rollover crisis becomes more likely the larger the debt to GDP ratio. Given that fact, over the next 20-30 years and more, the size of debt to GDP and the likelihood of a debt crisis is going to be far more influenced by fiscal policy than by r-g dynamics.

In equations with D = debt, Y = GDP, r = rate of return on government debt, s = primary surplus, we have* [frac{d}{dt}frac{D}{Y} = (r-g)frac{D}{Y} - frac{s}{Y}.] In words, growth in the debt to GDP ratio equals the difference between rate of return and GDP growth rate, less the ratio of primary surplus (or deficit) to GDP.

Now suppose, the standard number, r>g, say r-g = 1% or so. That means to keep long run average 100% debt/GDP ratio, the government must run a long run average primary surplus of 1% of GDP, or $200 billion dollars. The controversial promise r<g, say r-g = -1%, offers a delicious possibility: the government can keep the debt/GPD ratio at 100% forever, while still running a $200 billion a year primary deficit!

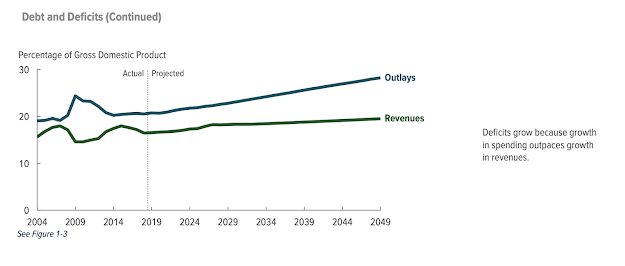

But this is couch change! Here are current deficits from the CBO September 2 budget update

Now that this is clear, I realize I did not emphasize enough that Olivier Blanchard’s AEA Presidential Address acknowledges well the possibility of a debt crisis:

Fourth, I discuss a number of arguments against high public debt, and in particular the existence of multiple equilibria where investors believe debt to be risky and, by requiring a risk premium, increase the fiscal burden and make debt effectively more risky. This is a very relevant argument, but it does not have straightforward implications for the appropriate level of debt.

See more on p. 1226. Blanchard’s concise summary

there can be multiple equilibria: a good equilibrium where investors believe that debt is safe and the interest rate is low and a bad equilibrium where investors believe that debt is risky and the spread they require on debt increases interest payments to the point that debt becomes effectively risky, leading the worries of investors to become self-fulfilling.

Let me put this observation in simpler terms. Let’s grow the debt / GDP ratio to 200%, $40 trillion relative to today’s GDP. If interest rates are 1%, then debt service is $400 billion. But if investors get worried about the US commitment to repaying its debt without inflation, they might charge 5% interest as a risk premium. That’s $2 trillion in debt service, 2/3 of all federal revenue. Borrowing even more to pay the interest on the outstanding debt may not work. So, 1% interest is sustainable, but fear of a crisis produces 5% interest that produces the crisis.

Brian Riedi at the Manhattan Institute has an excellent exposition of debt fears. On this point,

… there are reasons rates could rise. …

market psychology is always a factor. A sudden, Greece-like debt spike—resulting from the normal budget baseline growth combined with a deep recession—could cause investors to see U.S. debt as a less stable asset, leading to a sell-off and an interest-rate spike. Additionally, rising interest rates would cause the national debt to further increase (due to higher interest costs), which could, in turn, push rates even higher.

***********

So how far can we go? When does the crisis come? There is no firm debt/GDP limit.

Countries can borrow a huge amount when they have a decent plan for paying it back. Countries have had debt crises at quite low debt/GDP ratios when they did not have a decent plan for paying it back. Debt crises come when bond holders want to get out before the other bond holders get out. If they see default, haircuts, default via taxation, or inflation on the horizon, they get out. r<g contributes a bit, but the size of perpetual surplus/deficit is, for the US, the larger issue. Again, r<g of 1% will not help if s/Y is 6%. Sound long-term financial strategy matters.

From the CBO’s 2019 long term budget outlook (latest available) the outlook is not good. And that’s before we add the new habit of massive spending.

Here though, I admit to a big hole in my understanding, echoed in Blanchard and other’s writing on the issue. Just how does a crisis happen? “Multiple equilibria” is not very encouraging. Historical analysis suggests that debt crises are sparked by economic and political crises in the shadow of large debts, not just sunspots. We all need to understand this better.

******

Policy.

As Blanchard points out, small changes do not make much of a difference.

a limited decrease in debt—say, from 100 to 90 percent of GDP, a decrease that requires a strong and sustained fiscal consolidation—does not eliminate the bad equilibrium. …

Now I disagree a bit. Borrowing 10% of GDP wasn’t that hard! And the key to this comment is that a temporary consolidation does not help much. Lowering the permanent structural deficit 2% of GDP would make a big difference! But the general point is right. The debt/GDP ratio is only a poor indicator of the fiscal danger. 5% interest rate times 90% debt/GDP ratio is not much less debt service than 5% interest rate times 100% debt/GDP ratio. Confidence in the country’s fiscal institutions going forward much more important.

At this point the discussion usually devolves to “Reform entitlements” “No, you heartless stooge, raise taxes on the rich.” I emphasize tax reform, more revenue at lower marginal rates. But let’s move on to unusual policy answers.

Borrow long. Debt crises typically involve trouble rolling over short-term debt. When, in addition to crisis borrowing, the government has to find $10 trillion new dollars just to pay off $10 trillion of maturing debt, the crisis comes to its head faster.

As blog readers know, I’ve been pushing the idea for a long time that especially at today’s absurdly low rates, the US government should lock in long-term financing. Then if rates go up either for economic reasons or a “risk premium” in a crisis, government finances are much less affected. I’m delighted to see that Blanchard agrees:

to the extent that the US government can finance itself through inflation-indexed bonds, it can actually lock in a real rate of 1.1 percent over the next 30 years, a rate below even pessimistic forecasts of growth over the same period

contingent increases in primary surpluses when interest rates increase.

I’m not quite sure how that works. Interest rates would increase in a crisis precisely because the government is out of its ability or willingness to tax people to pay off bondholders. Does this mean an explicit contingent spending rule? Social security benefits are cut if interest rates exceed 5%? That’s an interesting concept.

Or it could mean interest rate derivatives. The government can say to Wall Street (and via Wall Street to wealthy investors) “if interest rates exceed 5%, you send us a trillion dollars.” That’s a whole lot more pleasant than an ex-post wealth tax or default, though it accomplishes the same thing. Alas, Wall Street and wealthy bondholders have lately been bailed out by the Fed at the slightest sign of trouble so it’s hard to say if such options would be paid.

Growth. Really, the best option in my view is to work on the g part of r-g. Policies that raise economic growth over the next decades raise the Y in D/Y, lowering the debt to GDP ratio; they raise tax revenue at the same tax rates; and they lower expenditures. It’s a trifecta. In my view, long-term growth comes from the supply side, deregulation, tax reform, etc. Why don’t we do it? Because it’s painful and upsets entrenched interests. For today’s tour of logical possibilities if you think demand side stimulus raises long term growth, or if you think that infrastructure can be constructed without wasting it all on boondoggles, logically, those help to raise g as well.

********

*Start with (frac{dD}{dt} = rD - s.) Then ( frac{d}{dt}frac{D}{Y} = frac{1}{Y}frac{dD}{dt}-frac{D}{Y^2}frac{dY}{dt}.)

***

Update: David Andolfatto writes, among other things,

“Should we be worried about hyperinflation? Evidently not, as John does not mention it”

For these purposes, hyperinflation is equivalent to default. In fact, a large inflation is my main worry, as I think the US will likely choose default via inflation to explicit default. This series of posts is all about inflation. Sorry if that was not clear.

also

Is there a danger of “bond vigilantes” sending the yields on USTs skyward? Not if the Fed stands ready to keep yields low.

All the Fed can do is offer overnight interest-paying government debt in exchange for longer-term government debt. If treasury markets don’t want to roll over 1 year bonds at less, than, say, 10%, why would they want to hold Fed reserves at less than 10%? If the Fed buys all the treasurys in exchange for reserves that do not pay interest, that is exactly how we get inflation. And mind the size. The US rolls over close to $10 trillion of debt a year. Is the Fed going to buy $10 trillion of debt? Who is going to hold $10 trillion of reserves, who did not want to hold $10 trillion of debt.

In a crisis, even the Fed loses control of interest rates.

Economy

Briefly Noted for 2020-09-17

George Orwell was very insightful. He focused on the fact that at the core of fascism, in both its right-wing and its left-wing versions and in whatever future versions may emerge, is the ability to tell public lies with impunity—and for supporters to then glory in the facts of the leaders were clever enough to tell them: Hannah Arendt: The Origins of Totalitarianism https://twitter.com/WindsorMann/status/1265793327884046336: ‘Instead of deserting the leaders… they would protest that they had known all along that the statement was a lie and would admire the leaders for their superior tactical cleverness…’ Media Matters: : ‘Rush Limbaugh praises the president for being “clever” in sharing conspiracy theories: “Trump is just throwing gasoline on a fire here, and he’s having fun watching the flames…

I think the very sharp Angus Deaton is wrong here. America’s federalism has not been an insuperable obstacle to united national action in the past. Of course, that required presidential leadership and an opposition party willing to buy in and except a share of credit for national action, rather than regarding its primary mission as making the president of the other party appear to be a failure. Perhaps that America that could have reacted properly to coronavirus even with its federalism is long gone: Angus Deaton: America’s Compromised State https://www.project-syndicate.org/commentary/us-connecticut-compromise-1987-and-failed-covid-response-by-angus-deaton-2020-07: ‘A malevolent, incompetent Trump administration bears much of the blame for America’s failure to control COVID-19. But there is an additional, less noticed cause: the Connecticut Compromise of 1787…. Each state follows its own instincts and perceived interests, usually myopically…

Looking greatly forward to this: Pierre-Olivier Gourinchas & Barry Eichengreen: New Thinking in a Pandemic https://www.youtube.com/watch?v=EcHBD-D5CRQ&feature=youtu.be: ‘What will be the political legacy of the Coronavirus pandemic? Will COVID-19 renew or diminish public trust in science? How will the crisis shape “Gen Z”—those who are coming of age during the pandemic?…

I remember that after 2003 I waited for years for the New York Times deep dive: “how Judy Miller fooled herself and us on Saddam Hussein’s nuclear weapons”. It never came. Instead, they went all in on the access journalism of which Judy Miller had been a master. And the problem with access journalism is that, in order to preserve your access, you have to work hard to mislead and misinform your readers. Duncan Black looks at yet another piece of the resulting flaming wreckage: Duncan Black: Scoop of a Lifetime https://www.eschatonblog.com/2020/08/scoop-of-lifetime.html: ‘Maggie Haberman…. “Treating the coronavirus as a blue state problem was a fairly widespread approach in the West Wing…”. Wow! If only you’d been a reporter at a prominent American news outlet so you could have informed the public!… Maggie isn’t even saying she missed it, just that it wasn’t worth being in the paper of record…. Not infrequently reporters… say, “oh, yes, we knew all that.” Cool. Why didn’t you tell us?…

And I found this greatly troubling as well: Here we have David Brooks saying: “American democracy is in trouble. Why? Because my journamalistic colleagues and I do not expect to do our jobs competently and truthfully to contextualize and interpret the world to our readers and viewers on the forthcoming November 3”: Steve M.: Just Do Your Damn Jobs https://nomoremister.blogspot.com/2020/09/just-do-your-damn-jobs.html: ‘David Brooks writes: “On the evening of Nov. 3… Donald Trump seems to be having an excellent night…” Why? Why should what’s happening be a gut punch? Why should it be perceived that Donald Trump is having an excellent night?…

And here is evidence on the strong positive effect of the 10% opportunity program in Texas: Sandra E. Black, Jeffrey T. Denning, & Jesse Rothstein: Winners and Losers?: The Effect of Gaining and Losing Access to Selective Colleges on Education and Labor Market Outcomes https://economics.yale.edu/sites/default/files/rothstein_-_winners_and_loosers_abstract_10_2019.pdf: ‘Students who gain access to the University of Texas at Austin see increases in college enrollment and graduation with some evidence of positive earnings gains 7-9 years after college. In contrast, students who lose access do not see declines in overall college enrollment, graduation, or earnings…

I would put this point considerably differently. The stock market is relevant only to how the upper class is doing, yes. But there is more. A high stock market can mean that the present and the future are bright for the upper class. But it can also mean that the future is crap—hence it is worth paying a fortune for anything, anything, that promises to give you even some income in the future. Yes, current stock market values are high. But expected cash flows as a proportion of capital invested—are those high? Really?: Heather Boushey: The Stock Market Is Detached From Economic Reality https://t.co/57ZOJhRJOt?amp=1: ‘Wealthy investors and the Fed have been propping up large companies. It can’t last.… If the stock market doesn’t reflect the health of our economy, what does it reflect? Most directly, it reflects the financial health of the richest among us…

Andrés Velasco: Are We All Keynesians Again? https://www.project-syndicate.org/commentary/states-must-be-insurer-of-last-resort-against-aggregate-risks-by-andres-velasco-2020-08: ‘Rich-country governments can comfortably borrow far more than fiscal prudes once thought possible… and markets have yet to bat an eyelash…. When the nominal interest rate is at or near zero… savers are happy to hold the dollars, pounds, and euros central banks are printing with abandon. Inflation is nowhere on the horizon…

Steven J. Davis & Till von Wachter: Recessions and the Costs of Job Loss http://www.econ.ucla.edu/tvwachter/papers/BPEA_JobDisplacement_Davis_vonWachter.pdf: ‘Men lose an average of 1.4 years of predisplacement earnings if displaced in mass-layoff events that occur when the national unemployment rate is below 6 percent. They lose a staggering 2.8 years of predisplacement earnings if displaced when the unemployment rate exceeds 8 percent. These results reflect discounting at a 5 percent annual rate over 20 years after displacement

Steve Randy Waldmann: Social democracy & Freedom https://www.interfluidity.com/v2/7557.html: ‘We should return to the wisdom of Milton Friedman, that political freedom is a structural matter, inextricable from economic arrangements…. What is required is some system in which the economic stakes of unpopular speech are unlikely to be so horrible, because the distance between lives of the conformist elite and unwashed others is not so great…

Duncan Black: Medicaid Expansion https://www.eschatonblog.com/2020/08/medicaid-expansion.html: ‘The way the press covers this stuff is that Dems can’t support crazy lefty economic policies in swing states because those old white guys in diners can’t handle the communism…. That isn’t actually how it works. As a now former senator explained… “the Chamber would go after me.” He didn’t mean “the Chamber” would run a bunch of ads about his support for increasing the minimum wage. That would have been a favor! It was popular! It passed overwhelmingly! He meant they would have dumped a bunch of money in the race nuking him on other issues. Any issue at all. Staying out of it was one way to just keep their money out of the race…

Sean Gallagher: Ars Readers on the Present & Future of Work https://arstechnica.com/features/2020/08/ars-readers-take-on-the-present-and-future-of-work/: ‘“It will suck, until it suddenly stops sucking.”… I’ve curated some of the thoughts of the Ars community on the topics of working better from home and what our shared experiences have taught us about the future of collaboration technology and the future nature of the corporate office…

Ben Smith: I’m Still Reading Andrew Sullivan. But I Can’t Defend Him https://www.nytimes.com/2020/08/30/business/media/im-still-reading-andrew-sullivan-but-i-cant-defend-him.html: ‘Sullivan… finds himself now on the outside, most of all, because he cannot be talked out of views on race that most of his peers find abhorrent. I know, because I tried…

Anne Booth and Kent Deng: Japanese Colonialism in Comparative Perspective https://delong.typepad.com/japanese-colonialism-2017.pdf…

Atul Kohli: “Where Do High Growth Political Economies Come From? The Japanese Lineage of Korea’s ‘Developmental State'” https://delong.typepad.com/highgrowth09_1994.pdf…

Chez Panisse Restaurant: Café Menu https://www.chezpanisse.com/menus/cafe-menu…

Plus

Paul Romer (2016): The Trouble with Macroeconomics https://github.com/braddelong/public-files/blob/master/readings/article-romer-2016-trouble-macro.pdf: ‘For more than three decades, macroeconomics has gone backwards. The treatment of identification now is no more credible than in the early 1970s but escapes challenge because it is so much more opaque. Macroeconomic theorists dismiss mere facts by feigning an obtuse ignorance about such simple assertions as “tight monetary policy can cause a recession.” Their models attribute fluctuations in aggregate variables to imaginary causal forces that are not influenced by the action that any person takes. A parallel with string theory from physics hints at a general failure mode of science that is triggered when respect for highly regarded leaders evolves into a deference to authority that displaces objective fact from its position as the ultimate determinant of scientific truth…

Financial Times: Keeping þe Torch of Global Democracy Alight https://www.ft.com/content/4f10a2d7-d380-4b53-a864-35f40aaef298: ‘In Belarus this week, protests over rigged elections have been met by mass arrests and a hail of rubber bullets…. In Hong Kong, China has stepped up its crackdown on democracy and press freedom…. Yet it is not necessarily authoritarians who should be taking heart…. The autocrats may force the democratic impulse underground, but it will not die…. Black Lives Matter rallies in the US and elsewhere demonstrate the urge even in richer countries to oppose injustice…. This year’s US election will be a test. If, as some Americans fear, Mr Trump adopts tactics verging on the authoritarian, the damage to the global democratic cause will be hard to repair…

.#brieflynoted #noted #2020-09-17

-

Business2 months ago

Business2 months agoBernice King, Ava DuVernay reflect on the legacy of John Lewis

-

World News2 months ago

Heavy rain threatens flood-weary Japan, Korean Peninsula

-

Technology2 months ago

Technology2 months agoEverything New On Netflix This Weekend: July 25, 2020

-

Finance4 months ago

Will Equal Weighted Index Funds Outperform Their Benchmark Indexes?

-

Marketing Strategies9 months ago

Top 20 Workers’ Compensation Law Blogs & Websites To Follow in 2020

-

World News8 months ago

World News8 months agoThe West Blames the Wuhan Coronavirus on China’s Love of Eating Wild Animals. The Truth Is More Complex

-

Economy11 months ago

Newsletter: Jobs, Consumers and Wages

-

Finance9 months ago

Finance9 months ago$95 Grocery Budget + Weekly Menu Plan for 8