Economy

Betsy DeVos’ Deadly Plan to Reopen SchoolsTrump education…

Betsy DeVos’ Deadly Plan to Reopen Schools

Trump education secretary Betsy DeVos is heading the administration’s effort to force schools to reopen in the fall for in-person instruction. What’s her plan to reopen safely? She doesn’t have one.

Rather than seeking additional federal funds, she’s using this pandemic to further her ploy to privatize education — threatening to withhold federal funds from public schools that don’t reopen.

Repeatedly pressed by journalists during TV appearances, DeVos can’t come up with a single mechanism or guideline for reopening schools safely. She can’t even articulate what authority the federal government has to unilaterally withhold funds from school districts — a decision that’s made at the state and local level, or by Congress. But when has the Constitution stopped the Trump administration from trying to do whatever it wants?

DeVos is following Trump’s lead — prematurely reopening the economy, which he sees as key to his re-election but is causing a resurgence of the virus.

Let’s get something straight: Every single parent, teacher, and student wants to be able to return to in-person instruction in the fall — but only if no one’s life is put at risk.

Districts need more funding, not less, to implement the CDC’s guidelines. Given that state and local governments are already cash-strapped, it’s estimated that K-12 schools need at least $245 billion in additional funding to put safety precautions in place — funding that Republicans in Congress and the Trump administration refuse to give.

One might think an education secretary would be studying what kind of safety precautions would work best, and seeking emergency funding for those safeguards. Not DeVos. Just like her boss in the Oval Office, she’s been hard at work shafting working families to advance her personal agenda.

In late April, she issued rules for how states should use the $13 billion allocated in the CARES Act for schools. Her rules would divert millions of dollars away from low-income schools into the coffers of wealthy private schools. It’s such a blatant violation of federal law that several states are suing her and her department.

DeVos’ entire tenure has centered on shafting low-income students and their families — the very people she’s supposed to protect.

She has repeatedly empowered the predatory for-profit college industry at the expense of the students they prey upon. Why? She has considerable financial stakes that are rife with conflicts of interest. Her financial investments are a web of holdings in for-profit colleges and student loan collectors.

When DeVos took office, she repealed an Obama-era rule imposing stricter regulations and higher standards on for-profit colleges. She also stopped canceling the debts of students defrauded by these institutions — a move that has prompted 23 states to bring a lawsuit against her. In the process, she was even held in contempt of court for violating a federal court order.

Now, in the middle of the worst public health crisis in more than a century, she’s jeopardizing the safety of our students, teachers, parents, bus drivers, and custodians, while rerouting desperately needed public school funds towards the private schools she’s always championed.

Remember, when you vote against Trump this November — you’re voting against her, too. It’s a win-win.

Economy

More on debt

Following my last post on debt I’ve thought a bit more, and received some very useful emails from colleagues.

A central clarifying thought emerges.

The main worry I have about US debt is the possibility of a debt crisis. I outlined that in my last post, and (thanks again to correspondents) I’ll try to draw out the scenario later. The event combines difficulty in rolling over debt, the lack of fiscal space to borrow massively in the next crisis. The bedrock and firehouse of the financial system evaporates when it’s needed most.

To the issue of a debt crisis, the whole debate about r<g, dynamic inefficiency, sustainability, transversality conditions and so forth is largely irrelevant.

We agree that there is some upper limit on the debt to GDP ratio, and that a rollover crisis becomes more likely the larger the debt to GDP ratio. Given that fact, over the next 20-30 years and more, the size of debt to GDP and the likelihood of a debt crisis is going to be far more influenced by fiscal policy than by r-g dynamics.

In equations with D = debt, Y = GDP, r = rate of return on government debt, s = primary surplus, we have* [frac{d}{dt}frac{D}{Y} = (r-g)frac{D}{Y} - frac{s}{Y}.] In words, growth in the debt to GDP ratio equals the difference between rate of return and GDP growth rate, less the ratio of primary surplus (or deficit) to GDP.

Now suppose, the standard number, r>g, say r-g = 1% or so. That means to keep long run average 100% debt/GDP ratio, the government must run a long run average primary surplus of 1% of GDP, or $200 billion dollars. The controversial promise r<g, say r-g = -1%, offers a delicious possibility: the government can keep the debt/GPD ratio at 100% forever, while still running a $200 billion a year primary deficit!

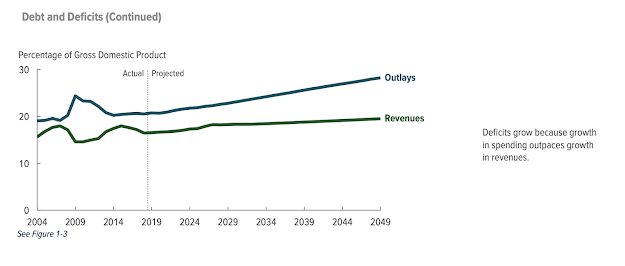

But this is couch change! Here are current deficits from the CBO September 2 budget update

Now that this is clear, I realize I did not emphasize enough that Olivier Blanchard’s AEA Presidential Address acknowledges well the possibility of a debt crisis:

Fourth, I discuss a number of arguments against high public debt, and in particular the existence of multiple equilibria where investors believe debt to be risky and, by requiring a risk premium, increase the fiscal burden and make debt effectively more risky. This is a very relevant argument, but it does not have straightforward implications for the appropriate level of debt.

See more on p. 1226. Blanchard’s concise summary

there can be multiple equilibria: a good equilibrium where investors believe that debt is safe and the interest rate is low and a bad equilibrium where investors believe that debt is risky and the spread they require on debt increases interest payments to the point that debt becomes effectively risky, leading the worries of investors to become self-fulfilling.

Let me put this observation in simpler terms. Let’s grow the debt / GDP ratio to 200%, $40 trillion relative to today’s GDP. If interest rates are 1%, then debt service is $400 billion. But if investors get worried about the US commitment to repaying its debt without inflation, they might charge 5% interest as a risk premium. That’s $2 trillion in debt service, 2/3 of all federal revenue. Borrowing even more to pay the interest on the outstanding debt may not work. So, 1% interest is sustainable, but fear of a crisis produces 5% interest that produces the crisis.

Brian Riedi at the Manhattan Institute has an excellent exposition of debt fears. On this point,

… there are reasons rates could rise. …

market psychology is always a factor. A sudden, Greece-like debt spike—resulting from the normal budget baseline growth combined with a deep recession—could cause investors to see U.S. debt as a less stable asset, leading to a sell-off and an interest-rate spike. Additionally, rising interest rates would cause the national debt to further increase (due to higher interest costs), which could, in turn, push rates even higher.

***********

So how far can we go? When does the crisis come? There is no firm debt/GDP limit.

Countries can borrow a huge amount when they have a decent plan for paying it back. Countries have had debt crises at quite low debt/GDP ratios when they did not have a decent plan for paying it back. Debt crises come when bond holders want to get out before the other bond holders get out. If they see default, haircuts, default via taxation, or inflation on the horizon, they get out. r<g contributes a bit, but the size of perpetual surplus/deficit is, for the US, the larger issue. Again, r<g of 1% will not help if s/Y is 6%. Sound long-term financial strategy matters.

From the CBO’s 2019 long term budget outlook (latest available) the outlook is not good. And that’s before we add the new habit of massive spending.

Here though, I admit to a big hole in my understanding, echoed in Blanchard and other’s writing on the issue. Just how does a crisis happen? “Multiple equilibria” is not very encouraging. Historical analysis suggests that debt crises are sparked by economic and political crises in the shadow of large debts, not just sunspots. We all need to understand this better.

******

Policy.

As Blanchard points out, small changes do not make much of a difference.

a limited decrease in debt—say, from 100 to 90 percent of GDP, a decrease that requires a strong and sustained fiscal consolidation—does not eliminate the bad equilibrium. …

Now I disagree a bit. Borrowing 10% of GDP wasn’t that hard! And the key to this comment is that a temporary consolidation does not help much. Lowering the permanent structural deficit 2% of GDP would make a big difference! But the general point is right. The debt/GDP ratio is only a poor indicator of the fiscal danger. 5% interest rate times 90% debt/GDP ratio is not much less debt service than 5% interest rate times 100% debt/GDP ratio. Confidence in the country’s fiscal institutions going forward much more important.

At this point the discussion usually devolves to “Reform entitlements” “No, you heartless stooge, raise taxes on the rich.” I emphasize tax reform, more revenue at lower marginal rates. But let’s move on to unusual policy answers.

Borrow long. Debt crises typically involve trouble rolling over short-term debt. When, in addition to crisis borrowing, the government has to find $10 trillion new dollars just to pay off $10 trillion of maturing debt, the crisis comes to its head faster.

As blog readers know, I’ve been pushing the idea for a long time that especially at today’s absurdly low rates, the US government should lock in long-term financing. Then if rates go up either for economic reasons or a “risk premium” in a crisis, government finances are much less affected. I’m delighted to see that Blanchard agrees:

to the extent that the US government can finance itself through inflation-indexed bonds, it can actually lock in a real rate of 1.1 percent over the next 30 years, a rate below even pessimistic forecasts of growth over the same period

contingent increases in primary surpluses when interest rates increase.

I’m not quite sure how that works. Interest rates would increase in a crisis precisely because the government is out of its ability or willingness to tax people to pay off bondholders. Does this mean an explicit contingent spending rule? Social security benefits are cut if interest rates exceed 5%? That’s an interesting concept.

Or it could mean interest rate derivatives. The government can say to Wall Street (and via Wall Street to wealthy investors) “if interest rates exceed 5%, you send us a trillion dollars.” That’s a whole lot more pleasant than an ex-post wealth tax or default, though it accomplishes the same thing. Alas, Wall Street and wealthy bondholders have lately been bailed out by the Fed at the slightest sign of trouble so it’s hard to say if such options would be paid.

Growth. Really, the best option in my view is to work on the g part of r-g. Policies that raise economic growth over the next decades raise the Y in D/Y, lowering the debt to GDP ratio; they raise tax revenue at the same tax rates; and they lower expenditures. It’s a trifecta. In my view, long-term growth comes from the supply side, deregulation, tax reform, etc. Why don’t we do it? Because it’s painful and upsets entrenched interests. For today’s tour of logical possibilities if you think demand side stimulus raises long term growth, or if you think that infrastructure can be constructed without wasting it all on boondoggles, logically, those help to raise g as well.

********

*Start with (frac{dD}{dt} = rD - s.) Then ( frac{d}{dt}frac{D}{Y} = frac{1}{Y}frac{dD}{dt}-frac{D}{Y^2}frac{dY}{dt}.)

***

Update: David Andolfatto writes, among other things,

“Should we be worried about hyperinflation? Evidently not, as John does not mention it”

For these purposes, hyperinflation is equivalent to default. In fact, a large inflation is my main worry, as I think the US will likely choose default via inflation to explicit default. This series of posts is all about inflation. Sorry if that was not clear.

also

Is there a danger of “bond vigilantes” sending the yields on USTs skyward? Not if the Fed stands ready to keep yields low.

All the Fed can do is offer overnight interest-paying government debt in exchange for longer-term government debt. If treasury markets don’t want to roll over 1 year bonds at less, than, say, 10%, why would they want to hold Fed reserves at less than 10%? If the Fed buys all the treasurys in exchange for reserves that do not pay interest, that is exactly how we get inflation. And mind the size. The US rolls over close to $10 trillion of debt a year. Is the Fed going to buy $10 trillion of debt? Who is going to hold $10 trillion of reserves, who did not want to hold $10 trillion of debt.

In a crisis, even the Fed loses control of interest rates.

Economy

Briefly Noted for 2020-09-17

George Orwell was very insightful. He focused on the fact that at the core of fascism, in both its right-wing and its left-wing versions and in whatever future versions may emerge, is the ability to tell public lies with impunity—and for supporters to then glory in the facts of the leaders were clever enough to tell them: Hannah Arendt: The Origins of Totalitarianism https://twitter.com/WindsorMann/status/1265793327884046336: ‘Instead of deserting the leaders… they would protest that they had known all along that the statement was a lie and would admire the leaders for their superior tactical cleverness…’ Media Matters: : ‘Rush Limbaugh praises the president for being “clever” in sharing conspiracy theories: “Trump is just throwing gasoline on a fire here, and he’s having fun watching the flames…

I think the very sharp Angus Deaton is wrong here. America’s federalism has not been an insuperable obstacle to united national action in the past. Of course, that required presidential leadership and an opposition party willing to buy in and except a share of credit for national action, rather than regarding its primary mission as making the president of the other party appear to be a failure. Perhaps that America that could have reacted properly to coronavirus even with its federalism is long gone: Angus Deaton: America’s Compromised State https://www.project-syndicate.org/commentary/us-connecticut-compromise-1987-and-failed-covid-response-by-angus-deaton-2020-07: ‘A malevolent, incompetent Trump administration bears much of the blame for America’s failure to control COVID-19. But there is an additional, less noticed cause: the Connecticut Compromise of 1787…. Each state follows its own instincts and perceived interests, usually myopically…

Looking greatly forward to this: Pierre-Olivier Gourinchas & Barry Eichengreen: New Thinking in a Pandemic https://www.youtube.com/watch?v=EcHBD-D5CRQ&feature=youtu.be: ‘What will be the political legacy of the Coronavirus pandemic? Will COVID-19 renew or diminish public trust in science? How will the crisis shape “Gen Z”—those who are coming of age during the pandemic?…

I remember that after 2003 I waited for years for the New York Times deep dive: “how Judy Miller fooled herself and us on Saddam Hussein’s nuclear weapons”. It never came. Instead, they went all in on the access journalism of which Judy Miller had been a master. And the problem with access journalism is that, in order to preserve your access, you have to work hard to mislead and misinform your readers. Duncan Black looks at yet another piece of the resulting flaming wreckage: Duncan Black: Scoop of a Lifetime https://www.eschatonblog.com/2020/08/scoop-of-lifetime.html: ‘Maggie Haberman…. “Treating the coronavirus as a blue state problem was a fairly widespread approach in the West Wing…”. Wow! If only you’d been a reporter at a prominent American news outlet so you could have informed the public!… Maggie isn’t even saying she missed it, just that it wasn’t worth being in the paper of record…. Not infrequently reporters… say, “oh, yes, we knew all that.” Cool. Why didn’t you tell us?…

And I found this greatly troubling as well: Here we have David Brooks saying: “American democracy is in trouble. Why? Because my journamalistic colleagues and I do not expect to do our jobs competently and truthfully to contextualize and interpret the world to our readers and viewers on the forthcoming November 3”: Steve M.: Just Do Your Damn Jobs https://nomoremister.blogspot.com/2020/09/just-do-your-damn-jobs.html: ‘David Brooks writes: “On the evening of Nov. 3… Donald Trump seems to be having an excellent night…” Why? Why should what’s happening be a gut punch? Why should it be perceived that Donald Trump is having an excellent night?…

And here is evidence on the strong positive effect of the 10% opportunity program in Texas: Sandra E. Black, Jeffrey T. Denning, & Jesse Rothstein: Winners and Losers?: The Effect of Gaining and Losing Access to Selective Colleges on Education and Labor Market Outcomes https://economics.yale.edu/sites/default/files/rothstein_-_winners_and_loosers_abstract_10_2019.pdf: ‘Students who gain access to the University of Texas at Austin see increases in college enrollment and graduation with some evidence of positive earnings gains 7-9 years after college. In contrast, students who lose access do not see declines in overall college enrollment, graduation, or earnings…

I would put this point considerably differently. The stock market is relevant only to how the upper class is doing, yes. But there is more. A high stock market can mean that the present and the future are bright for the upper class. But it can also mean that the future is crap—hence it is worth paying a fortune for anything, anything, that promises to give you even some income in the future. Yes, current stock market values are high. But expected cash flows as a proportion of capital invested—are those high? Really?: Heather Boushey: The Stock Market Is Detached From Economic Reality https://t.co/57ZOJhRJOt?amp=1: ‘Wealthy investors and the Fed have been propping up large companies. It can’t last.… If the stock market doesn’t reflect the health of our economy, what does it reflect? Most directly, it reflects the financial health of the richest among us…

Andrés Velasco: Are We All Keynesians Again? https://www.project-syndicate.org/commentary/states-must-be-insurer-of-last-resort-against-aggregate-risks-by-andres-velasco-2020-08: ‘Rich-country governments can comfortably borrow far more than fiscal prudes once thought possible… and markets have yet to bat an eyelash…. When the nominal interest rate is at or near zero… savers are happy to hold the dollars, pounds, and euros central banks are printing with abandon. Inflation is nowhere on the horizon…

Steven J. Davis & Till von Wachter: Recessions and the Costs of Job Loss http://www.econ.ucla.edu/tvwachter/papers/BPEA_JobDisplacement_Davis_vonWachter.pdf: ‘Men lose an average of 1.4 years of predisplacement earnings if displaced in mass-layoff events that occur when the national unemployment rate is below 6 percent. They lose a staggering 2.8 years of predisplacement earnings if displaced when the unemployment rate exceeds 8 percent. These results reflect discounting at a 5 percent annual rate over 20 years after displacement

Steve Randy Waldmann: Social democracy & Freedom https://www.interfluidity.com/v2/7557.html: ‘We should return to the wisdom of Milton Friedman, that political freedom is a structural matter, inextricable from economic arrangements…. What is required is some system in which the economic stakes of unpopular speech are unlikely to be so horrible, because the distance between lives of the conformist elite and unwashed others is not so great…

Duncan Black: Medicaid Expansion https://www.eschatonblog.com/2020/08/medicaid-expansion.html: ‘The way the press covers this stuff is that Dems can’t support crazy lefty economic policies in swing states because those old white guys in diners can’t handle the communism…. That isn’t actually how it works. As a now former senator explained… “the Chamber would go after me.” He didn’t mean “the Chamber” would run a bunch of ads about his support for increasing the minimum wage. That would have been a favor! It was popular! It passed overwhelmingly! He meant they would have dumped a bunch of money in the race nuking him on other issues. Any issue at all. Staying out of it was one way to just keep their money out of the race…

Sean Gallagher: Ars Readers on the Present & Future of Work https://arstechnica.com/features/2020/08/ars-readers-take-on-the-present-and-future-of-work/: ‘“It will suck, until it suddenly stops sucking.”… I’ve curated some of the thoughts of the Ars community on the topics of working better from home and what our shared experiences have taught us about the future of collaboration technology and the future nature of the corporate office…

Ben Smith: I’m Still Reading Andrew Sullivan. But I Can’t Defend Him https://www.nytimes.com/2020/08/30/business/media/im-still-reading-andrew-sullivan-but-i-cant-defend-him.html: ‘Sullivan… finds himself now on the outside, most of all, because he cannot be talked out of views on race that most of his peers find abhorrent. I know, because I tried…

Anne Booth and Kent Deng: Japanese Colonialism in Comparative Perspective https://delong.typepad.com/japanese-colonialism-2017.pdf…

Atul Kohli: “Where Do High Growth Political Economies Come From? The Japanese Lineage of Korea’s ‘Developmental State'” https://delong.typepad.com/highgrowth09_1994.pdf…

Chez Panisse Restaurant: Café Menu https://www.chezpanisse.com/menus/cafe-menu…

Plus

Paul Romer (2016): The Trouble with Macroeconomics https://github.com/braddelong/public-files/blob/master/readings/article-romer-2016-trouble-macro.pdf: ‘For more than three decades, macroeconomics has gone backwards. The treatment of identification now is no more credible than in the early 1970s but escapes challenge because it is so much more opaque. Macroeconomic theorists dismiss mere facts by feigning an obtuse ignorance about such simple assertions as “tight monetary policy can cause a recession.” Their models attribute fluctuations in aggregate variables to imaginary causal forces that are not influenced by the action that any person takes. A parallel with string theory from physics hints at a general failure mode of science that is triggered when respect for highly regarded leaders evolves into a deference to authority that displaces objective fact from its position as the ultimate determinant of scientific truth…

Financial Times: Keeping þe Torch of Global Democracy Alight https://www.ft.com/content/4f10a2d7-d380-4b53-a864-35f40aaef298: ‘In Belarus this week, protests over rigged elections have been met by mass arrests and a hail of rubber bullets…. In Hong Kong, China has stepped up its crackdown on democracy and press freedom…. Yet it is not necessarily authoritarians who should be taking heart…. The autocrats may force the democratic impulse underground, but it will not die…. Black Lives Matter rallies in the US and elsewhere demonstrate the urge even in richer countries to oppose injustice…. This year’s US election will be a test. If, as some Americans fear, Mr Trump adopts tactics verging on the authoritarian, the damage to the global democratic cause will be hard to repair…

.#brieflynoted #noted #2020-09-17

Economy

Statistics, lies and the virus: five lessons from a pandemic

My new book, “How To Make The World Add Up“, is published today in the UK and around the world (except US/Canada).

Will this year be 1954 all over again? Forgive me, I have become obsessed with 1954, not because it offers another example of a pandemic (that was 1957) or an economic disaster (there was a mild US downturn in 1953), but for more parochial reasons. Nineteen fifty-four saw the appearance of two contrasting visions for the world of statistics — visions that have shaped our politics, our media and our health. This year confronts us with a similar choice.

The first of these visions was presented in How to Lie with Statistics, a book by a US journalist named Darrell Huff. Brisk, intelligent and witty, it is a little marvel of numerical communication. The book received rave reviews at the time, has been praised by many statisticians over the years and is said to be the best-selling work on the subject ever published. It is also an exercise in scorn: read it and you may be disinclined to believe a number-based claim ever again.

There are good reasons for scepticism today. David Spiegelhalter, author of last year’s The Art of Statistics, laments some of the UK government’s coronavirus graphs and testing targets as “number theatre”, with “dreadful, awful” deployment of numbers as a political performance.

“There is great damage done to the integrity and trustworthiness of statistics when they’re under the control of the spin doctors,” Spiegelhalter says. He is right. But we geeks must be careful — because the damage can come from our own side, too.

For Huff and his followers, the reason to learn statistics is to catch the liars at their tricks. That sceptical mindset took Huff to a very unpleasant place, as we shall see. Once the cynicism sets in, it becomes hard to imagine that statistics could ever serve a useful purpose.

But they can — and back in 1954, the alternative perspective was embodied in the publication of an academic paper by the British epidemiologists Richard Doll and Austin Bradford Hill. They marshalled some of the first compelling evidence that smoking cigarettes dramatically increases the risk of lung cancer. The data they assembled persuaded both men to quit smoking and helped save tens of millions of lives by prompting others to do likewise. This was no statistical trickery, but a contribution to public health that is almost impossible to exaggerate.

You can appreciate, I hope, my obsession with these two contrasting accounts of statistics: one as a trick, one as a tool. Doll and Hill’s painstaking approach illuminates the world and saves lives into the bargain. Huff’s alternative seems clever but is the easy path: seductive, addictive and corrosive. Scepticism has its place, but easily curdles into cynicism and can be weaponised into something even more poisonous than that.

The two worldviews soon began to collide. Huff’s How to Lie with Statistics seemed to be the perfect illustration of why ordinary, honest folk shouldn’t pay too much attention to the slippery experts and their dubious data. Such ideas were quickly picked up by the tobacco industry, with its darkly brilliant strategy of manufacturing doubt in the face of evidence such as that provided by Doll and Hill.

As described in books such as Merchants of Doubt by Erik Conway and Naomi Oreskes, this industry perfected the tactics of spreading uncertainty: calling for more research, emphasising doubt and the need to avoid drastic steps, highlighting disagreements between experts and funding alternative lines of inquiry. The same tactics, and sometimes even the same personnel, were later deployed to cast doubt on climate science. These tactics are powerful in part because they echo the ideals of science. It is a short step from the Royal Society’s motto, “nullius in verba” (take nobody’s word for it), to the corrosive nihilism of “nobody knows anything”.

So will 2020 be another 1954? From the point of view of statistics, we seem to be standing at another fork in the road. The disinformation is still out there, as the public understanding of Covid-19 has been muddied by conspiracy theorists, trolls and government spin doctors. Yet the information is out there too. The value of gathering and rigorously analysing data has rarely been more evident. Faced with a complete mystery at the start of the year, statisticians, scientists and epidemiologists have been working miracles. I hope that we choose the right fork, because the pandemic has lessons to teach us about statistics — and vice versa — if we are willing to learn.

1: The numbers matter

“One lesson this pandemic has driven home to me is the unbelievable importance of the statistics,” says Spiegelhalter. Without statistical information, we haven’t a hope of grasping what it means to face a new, mysterious, invisible and rapidly spreading virus. Once upon a time, we would have held posies to our noses and prayed to be spared; now, while we hope for advances from medical science, we can also coolly evaluate the risks.

Without good data, for example, we would have no idea that this infection is 10,000 times deadlier for a 90-year-old than it is for a nine-year-old — even though we are far more likely to read about the deaths of young people than the elderly, simply because those deaths are surprising. It takes a statistical perspective to make it clear who is at risk and who is not.

Good statistics, too, can tell us about the prevalence of the virus — and identify hotspots for further activity. Huff may have viewed statistics as a vector for the dark arts of persuasion, but when it comes to understanding an epidemic, they are one of the few tools we possess.

2: Don’t take the numbers for granted

But while we can use statistics to calculate risks and highlight dangers, it is all too easy to fail to ask the question “Where do these numbers come from?” By that, I don’t mean the now-standard request to cite sources, I mean the deeper origin of the data.

For all his faults, Huff did not fail to ask the question. He retells a cautionary tale that has become known as “Stamp’s Law” after the economist Josiah Stamp — warning that no matter how much a government may enjoy amassing statistics, “raise them to the nth power, take the cube root and prepare wonderful diagrams”, it was all too easy to forget that the underlying numbers would always come from a local official, “who just puts down what he damn pleases”.

The cynicism is palpable, but there is insight here too. Statistics are not simply downloaded from an internet database or pasted from a scientific report. Ultimately, they came from somewhere: somebody counted or measured something, ideally systematically and with care. These efforts at systematic counting and measurement require money and expertise — they are not to be taken for granted.

In my new book, How to Make the World Add Up, I introduce the idea of “statistical bedrock” — data sources such as the census and the national income accounts that are the results of painstaking data collection and analysis, often by official statisticians who get little thanks for their pains and are all too frequently the target of threats, smears or persecution.

In Argentina, for example, long-serving statistician Graciela Bevacqua was ordered to “round down” inflation figures, then demoted in 2007 for producing a number that was too high. She was later fined $250,000 for false advertising — her crime being to have helped produce an independent estimate of inflation.

In 2011, Andreas Georgiou was brought in to head Greece’s statistical agency at a time when it was regarded as being about as trustworthy as the country’s giant wooden horses. When he started producing estimates of Greece’s deficit that international observers finally found credible, he was prosecuted for his “crimes” and threatened with life imprisonment. Honest statisticians are braver — and more invaluable — than we know.

In the UK, we don’t habitually threaten our statisticians — but we do underrate them.

“The Office for National Statistics is doing enormously valuable work that frankly nobody has ever taken notice of,” says Spiegelhalter, pointing to weekly death figures as an example. “Now we deeply appreciate it.”

Quite so. This statistical bedrock is essential, and when it is missing, we find ourselves sinking into a quagmire of confusion.

The foundations of our statistical understanding of the world are often gathered in response to a crisis. For example, nowadays we take it for granted that there is such a thing as an “unemployment rate”, but a hundred years ago nobody could have told you how many people were searching for work. Severe recessions made the question politically pertinent, so governments began to collect the data. More recently, the financial crisis hit. We discovered that our data about the banking system was patchy and slow, and regulators took steps to improve it.

So it is with the Sars-Cov-2 virus. At first, we had little more than a few data points from Wuhan, showing an alarmingly high death rate of 15 per cent — six deaths in 41 cases. Quickly, epidemiologists started sorting through the data, trying to establish how exaggerated that case fatality rate was by the fact that the confirmed cases were mostly people in intensive care.

Quirks of circumstance — such as the Diamond Princess cruise ship, in which almost everyone was tested — provided more insight. Johns Hopkins University in the US launched a dashboard of data resources, as did the Covid Tracking Project, an initiative from the Atlantic magazine. An elusive and mysterious threat became legible through the power of this data. That is not to say that all is well.

Nature recently reported on “a coronavirus data crisis” in the US, in which “political meddling, disorganization and years of neglect of public-health data management mean the country is flying blind”. Nor is the US alone. Spain simply stopped reporting certain Covid deaths in early June, making its figures unusable. And while the UK now has an impressively large capacity for viral testing, it was fatally slow to accelerate this in the critical early weeks of the pandemic. Ministers repeatedly deceived the public about the number of tests being carried out by using misleading definitions of what was happening. For weeks during lockdown, the government was unable to say how many people were being tested each day.

Huge improvements have been made since then. The UK’s Office for National Statistics has been impressively flexible during the crisis, for example in organising systematic weekly testing of a representative sample of the population. This allows us to estimate the true prevalence of the virus. Several countries, particularly in east Asia, provide accessible, usable data about recent infections to allow people to avoid hotspots.

These things do not happen by accident: they require us to invest in the infrastructure to collect and analyse the data. On the evidence of this pandemic, such investment is overdue, in the US, the UK and many other places.

3: Even the experts see what they expect to see

Jonas Olofsson, a psychologist who studies our perceptions of smell, once told me of a classic experiment in the field. Researchers gave people a whiff of scent and asked them for their reactions to it. In some cases, the experimental subjects were told: “This is the aroma of a gourmet cheese.” Others were told: “This is the smell of armpits.” In truth, the scent was both: an aromatic molecule present both in runny cheese and in bodily crevices. But the reactions of delight or disgust were shaped dramatically by what people expected.

Statistics should, one would hope, deliver a more objective view of the world than an ambiguous aroma. But while solid data offers us insights we cannot gain in any other way, the numbers never speak for themselves. They, too, are shaped by our emotions, our politics and, perhaps above all, our preconceptions. There is great damage done to the integrity and trustworthiness of statistics when they’re under the control of the spin doctors

A striking example is the decision, on March 23 this year, to introduce a lockdown in the UK. In hindsight, that was too late. “Locking down a week earlier would have saved thousands of lives,” says Kit Yates, author of The Maths of Life and Death — a view now shared by influential epidemiologist Neil Ferguson and by David King, chair of the “Independent Sage” group of scientists.

The logic is straightforward enough: at the time, cases were doubling every three to four days. If a lockdown had stopped that process in its tracks a week earlier, it would have prevented two doublings and saved three-quarters of the 65,000 people who died in the first wave of the epidemic, as measured by the excess death toll.

That might be an overestimate of the effect, since people were already voluntarily pulling back from social interactions. Yet there is little doubt that if a lockdown was to happen at all, an earlier one would have been more effective. And, says Yates, since the infection rate took just days to double before lockdown but long weeks to halve once it started, “We would have got out of lockdown so much sooner . . . Every week before lockdown cost us five to eight weeks at the back end of the lockdown.”

Why, then, was the lockdown so late? No doubt there were political dimensions to that decision, but senior scientific advisers to the government seemed to believe that the UK still had plenty of time. On March 12, prime minister Boris Johnson was flanked by Chris Whitty, the government’s chief medical adviser, and Patrick Vallance, chief scientific adviser, in the first big set-piece press conference.

Italy had just suffered its 1,000th Covid death and Vallance noted that the UK was about four weeks behind Italy on the epidemic curve. With hindsight, this was wrong: now that late-registered deaths have been tallied, we know that the UK passed the same landmark on lockdown day, March 23, just 11 days later. It seems that in early March the government did not realise how little time it had.

As late as March 16, Johnson declared that infections were doubling every five to six days. The trouble, says Yates, is that UK data on cases and deaths suggested that things were moving much faster than that, doubling every three or four days — a huge difference. What exactly went wrong is unclear — but my bet is that it was a cheese-or-armpit problem. Some influential epidemiologists had produced sophisticated models suggesting that a doubling time of five to six days seemed the best estimate, based on data from the early weeks of the epidemic in China.

These models seemed persuasive to the government’s scientific advisers, says Yates: “If anything, they did too good a job.” Yates argues that the epidemiological models that influenced the government’s thinking about doubling times were sufficiently detailed and convincing that when the patchy, ambiguous, early UK data contradicted them, it was hard to readjust. We all see what we expect to see.

The result, in this case, was a delay to lockdown: that led to a much longer lockdown, many thousands of preventable deaths and needless extra damage to people’s livelihoods. The data is invaluable but, unless we can overcome our own cognitive filters, the data is not enough.

4: The best insights come from combining statistics with personal experience

The expert who made the biggest impression on me during this crisis was not the one with the biggest name or the biggest ego. It was Nathalie MacDermott, an infectious-disease specialist at King’s College London, who in mid-February calmly debunked the more lurid public fears about how deadly the new coronavirus was. Then, with equal calm, she explained to me that the virus was very likely to become a pandemic, that barring extraordinary measures we could expect it to infect more than half the world’s population, and that the true fatality rate was uncertain but seemed to be something between 0.5 and 1 per cent. In hindsight, she was broadly right about everything that mattered.

MacDermott’s educated guesses pierced through the fog of complex modelling and data-poor speculation. I was curious as to how she did it, so I asked her.

“People who have spent a lot of their time really closely studying the data sometimes struggle to pull their head out and look at what’s happening around them,” she said. “I trust data as well, but sometimes when we don’t have the data, we need to look around and interpret what’s happening.”

MacDermott worked in Liberia in 2014 on the front line of an Ebola outbreak that killed more than 11,000 people. At the time, international organisations were sanguine about the risks, while the local authorities were in crisis. When she arrived in Liberia, the treatment centres were overwhelmed, with patients lying on the floor, bleeding freely from multiple areas and dying by the hour.

The horrendous experience has shaped her assessment of subsequent risks: on the one hand, Sars-Cov-2 is far less deadly than Ebola; on the other, she has seen the experts move too slowly while waiting for definitive proof of a risk.

“From my background working with Ebola, I’d rather be overprepared than underprepared because I’m in a position of denial,” she said.

There is a broader lesson here. We can try to understand the world through statistics, which at their best provide a broad and representative overview that encompasses far more than we could personally perceive. Or we can try to understand the world up close, through individual experience. Both perspectives have their advantages and disadvantages.

Muhammad Yunus, a microfinance pioneer and Nobel laureate, has praised the “worm’s eye view” over the “bird’s eye view”, which is a clever sound bite. But birds see a lot too. Ideally, we want both the rich detail of personal experience and the broader, low-resolution view that comes from the spreadsheet. Insight comes when we can combine the two — which is what MacDermott did.

5: Everything can be polarised

Reporting on the numbers behind the Brexit referendum, the vote on Scottish independence, several general elections and the rise of Donald Trump, there was poison in the air: many claims were made in bad faith, indifferent to the truth or even embracing the most palpable lies in an effort to divert attention from the issues. Fact-checking in an environment where people didn’t care about the facts, only whether their side was winning, was a thankless experience.

For a while, one of the consolations of doing data-driven journalism during the pandemic was that it felt blessedly free of such political tribalism. People were eager to hear the facts after all; the truth mattered; data and expertise were seen to be helpful. The virus, after all, could not be distracted by a lie on a bus.

That did not last. America polarised quickly, with mask-wearing becoming a badge of political identity — and more generally the Democrats seeking to underline the threat posed by the virus, with Republicans following President Trump in dismissing it as overblown. The prominent infectious-disease expert Anthony Fauci does not strike me as a partisan figure — but the US electorate thinks otherwise. He is trusted by 32 per cent of Republicans and 78 per cent of Democrats.

The strangest illustration comes from the Twitter account of the Republican politician Herman Cain, which late in August tweeted: “It looks like the virus is not as deadly as the mainstream media first made it out to be.” Cain, sadly, died of Covid-19 in July — but it seems that political polarisation is a force stronger than death.

Not every issue is politically polarised, but when something is dragged into the political arena, partisans often prioritise tribal belonging over considerations of truth. One can see this clearly, for example, in the way that highly educated Republicans and Democrats are further apart on the risks of climate change than less-educated Republicans and Democrats. Rather than bringing some kind of consensus, more years of education simply seem to provide people with the cognitive tools they require to reach the politically convenient conclusion. From climate change to gun control to certain vaccines, there are questions for which the answer is not a matter of evidence but a matter of group identity.

In this context, the strategy that the tobacco industry pioneered in the 1950s is especially powerful. Emphasise uncertainty, expert disagreement and doubt and you will find a willing audience. If nobody really knows the truth, then people can believe whatever they want.

All of which brings us back to Darrell Huff, statistical sceptic and author of How to Lie with Statistics. While his incisive criticism of statistical trickery has made him a hero to many of my fellow nerds, his career took a darker turn, with scepticism providing the mask for disinformation. Huff worked on a tobacco-funded sequel, How to Lie with Smoking Statistics, casting doubt on the scientific evidence that cigarettes were dangerous. (Mercifully, it was not published.)

Huff also appeared in front of a US Senate committee that was pondering mandating health warnings on cigarette packaging. He explained to the lawmakers that there was a statistical correlation between babies and storks (which, it turns out, there is) even though the true origin of babies is rather different. The connection between smoking and cancer, he argued, was similarly tenuous.

Huff’s statistical scepticism turned him into the ancestor of today’s contrarian trolls, spouting bullshit while claiming to be the straight-talking voice of common sense. It should be a warning to us all.

There is a place in anyone’s cognitive toolkit for healthy scepticism, but that scepticism can all too easily turn into a refusal to look at any evidence at all.

This crisis has reminded us of the lure of partisanship, cynicism and manufactured doubt. But surely it has also demonstrated the power of honest statistics. Statisticians, epidemiologists and other scientists have been producing inspiring work in the footsteps of Doll and Hill. I suggest we set aside How to Lie with Statistics and pay attention.

Carefully gathering the data we need, analysing it openly and truthfully, sharing knowledge and unlocking the puzzles that nature throws at us — this is the only chance we have to defeat the virus and, more broadly, an essential tool for understanding a complex and fascinating world.

Written for and published by the FT Magazine on 10 September 2020.

My new book, “How To Make The World Add Up“, is published today in the UK and around the world (except US/Canada).

-

Business2 months ago

Business2 months agoBernice King, Ava DuVernay reflect on the legacy of John Lewis

-

World News2 months ago

Heavy rain threatens flood-weary Japan, Korean Peninsula

-

Technology2 months ago

Technology2 months agoEverything New On Netflix This Weekend: July 25, 2020

-

Finance4 months ago

Will Equal Weighted Index Funds Outperform Their Benchmark Indexes?

-

Marketing Strategies9 months ago

Top 20 Workers’ Compensation Law Blogs & Websites To Follow in 2020

-

World News8 months ago

World News8 months agoThe West Blames the Wuhan Coronavirus on China’s Love of Eating Wild Animals. The Truth Is More Complex

-

Economy11 months ago

Newsletter: Jobs, Consumers and Wages

-

Finance9 months ago

Finance9 months ago$95 Grocery Budget + Weekly Menu Plan for 8