Finance

Is it cheaper to buy eggs or raise chickens?

Hello! Today, I have a great article to share about raising backyard chickens for eggs, and how much it will cost you to raise chickens. I have several different family members who raise chickens for eggs, so I am familiar with the topic. When Chris approached me with the guest post idea, I had to say yes because I thought it would be interesting to learn more about the money side of it. Enjoy!

Like many, I didn’t decide to start raising chickens with a spreadsheet in front of me.

I had just returned from visiting my parents’ new retirement project, a hobby farm in northern Vermont that was bustling with chickens and ducks and all sorts of wonderful, useful livestock I had never considered keeping for myself until that moment.

After all, I grew up in the suburbs, full of cats, dogs, and the snake the “weird kid” in middle school loved to talk about, and the only “livestock” were the cows that were shipped in every summer to picturesquely dot the fields behind the local ice cream place – carefully kept too far away from customers to smell.

I was thinking about delicious, farm-fresh eggs; endless access to high-quality fertilizer and pest controls; taking control of where my food came from and developing a healthier, organic diet; and of course, just the joys of animal ownership.

Waking up to the delightful chattering of chickens in the yard, getting to hang out with feathery friends on the weekend – spending time with the animals we love can be so intoxicating, you can read more about my story here.

However, starting a chicken coop is an economic venture, even for chicken owners who don’t intend to make a profit off of their eggs.

For a chicken coop to be sustainable, owners have to take into account all of their costs – from starting costs like building a coop and buying chicks, to the regular maintenance costs of feed and supplements, to the unexpected expenses like repairs and vet bills – to figure out how much they’ll need to plan to spend every year on keeping their animals happy and healthy.

Related content: How Elizabeth Reached Financial Independence by 32 And Moved To A Homestead

Here is a picture of my chickens.

Start-Up Costs Of Raising Chickens For Eggs

The costs and logistics of starting your first chicken coop can be daunting, and this is the point where a lot of people who had romantic ideas of homesteading with a few picturesque white chickens beside the red wheelbarrow in the garden give up.

I know I almost quit after I spent more than an hour on the town website, looking for a simple list of the steps I needed to take to keep chickens in my backyard –

- Was there paperwork?

- What about noise regulations?

- Did I need a permit?

-and ended up wading through 100-page food regulations, months’ worth of senior center lunch menus, and Board of Health meeting minutes, only to finally show up to the town hall to ask in person and find out there were no paperwork requirements.

That saved cost on my part, because there were no filing fees in order to get a permit, but every locality is different. And every prospective chicken owner should do their own research on their town or district’s regulations before moving ahead with their planning.

The most obvious start-up cost in chicken keeping is, of course, the cost of the chickens themselves. This can vary, depending on what kind of chickens you get and how old they are.

On paper, the cheapest option might seem to be to buy eggs and hatch them yourself. For common breeds like the Rhode Island Red or Plymouth Rock, hatching eggs can cost less than $5 each. However, you should know that chicken eggs do not have a 100 percent hatch rate – for a shipment of eggs, the hatch rate actually averages around 50 percent.

Additionally, hatching eggs can be difficult, and comes with extra costs, most notably an incubator for the eggs, which usually run about $100, plus all the extra equipment needed to raise chicks, which can be another $100.

On the plus side, as kindergarten classes around the country learn every spring, watching eggs hatch and caring for adorable baby chicks can be one of the most exciting and rewarding experiences in the chicken-keeping world.

In total, starting a flock of five hens from eggs will probably run you about $250.

On the other hand, one of the most common ways to start a flock is to bypass eggs entirely and buy live chicks.

This has several advantages over hatching eggs, including saving incubator costs and having to pay for eggs that ultimately won’t hatch.

As with eggs, chick costs vary depending on the breed, but common breeds average about $5 per chick, unless you want a purebred or particularly exotic bird, in which case each chick can cost up to $100!

However, raising chicks will also require additional costs in purchasing the equipment necessary to replace their mothers – things like a brood box to keep them warm while they grow their feathers and prevent them from running off and a specialized chick feeder, which will need to be replaced with a traditional feeder as they get older.

Most of those expenses will add up to about $100 – although the handier amongst us can try to save costs by building their own brooder box, for example.

There are also still the costs of setting them up to thrive as adults, which we’ll get to in just a minute. Just getting set up for the chicks, though, will come out to about $125.

The other option when starting a flock is to acquire adult chickens – either pullets, young adults around 4-16 weeks old, which run around $25 a bird, or rescue hens, fully grown adults who have been “spent” in the industrial poultry world, but will still produce good eggs regularly enough for backyard purposes.

For folks who really want to bond with their chickens and have them be pets as well as livestock, adults probably aren’t the way to go, as chicks that have bonded with you from the beginning will be much friendlier and more trusting than older birds. The main advantage to starting with pullets is the cost savings, since you’ll only have to outfit them once, with the same coop, feeder, and other supplies that they’ll use their whole lives.

How much does a chicken coop cost?

Coop costs is the big expense many prospective chicken owners worry about the most, and they’re not wrong to do so – it’s going to be your biggest expense!

And it should be, because having a sturdy, healthy place to live is crucial to your birds’ overall health and well-being.

Trying to cut costs on the coop, by going smaller than you need or buying second-hand, will almost always end up costing you more in the long run, either in medical care or replacement costs for sick birds or in finally ponying up for the more expensive coop you should have gotten in the first place.

While local regulations vary, the rule of thumb for coop size is four square feet per bird if they have an attached run or free range, and 10 square feet per bird if they don’t, which is enough space to allow them to be comfortable, exercise, and gives them enough fresh air to prevent respiratory illnesses, assuming the coop is well-ventilated.

For our hypothetical five-bird starter flock, that’s a 20 square foot coop, five feet by four, plus a run.

This is another area where you can cut costs by building your own, and there are lots of do-it-yourself chicken coop guides and blueprints available online. Just make sure the material you’re using is chicken-friendly and non-toxic, as well as being sturdy enough to last through years of chicken poop and bad weather.

For those who aren’t thrilled about their next home carpentry project, ready-made coops or some assembly required coop kits are easy to find and easy to build.

Small wooden coops start at about $160, though some will tell you you’ll have to spend more if you want to get a really high-quality one, while a plastic coop will usually run about $700.

Which one will work better for you and your flock will depend on a number of factors, but both materials have their devotees. Plastic coops are easier to clean and dry much faster, which will be a huge boon to anyone raising chickens in an area with harsh winters.

As a New Englander, this was a big consideration for me when choosing my first coop. I ultimately went with wood, though, because wooden coops come in a much wider variety of designs and are much easier to repair – another consideration in a region prone to nasty blizzards.

As for run costs, here again you can build your own – which usually costs about $1 per meter – or buy a kit for about $150.

You might also be able to roll your run costs into your coop costs by buying one of the many coops with a run attachment included. As for size, you’ll want to plan for approximately 15 square feet per chicken, though this can vary by breed. As an example, bantam chickens usually need less space than their larger cousins, so they’re absolutely an option to look into if you’re strapped for space in your backyard.

A 15 square foot requirement, though, means our starter flock of five will need 75 square feet total, maybe 7.5 by 10 feet, which is only about $11 worth of fencing. All of this brings our coop and run costs anywhere from $171 to $850.

Unfortunately, we aren’t done with start-up costs yet, as we also need to outfit our chicken coop, with things like a feeder, a waterer, perches, and nesting boxes. Luckily, our five-hen flock will only need one feeder and one waterer, though costs can vary widely depending on what kind you decide is best for your flock.

Owners planning for bigger flocks should aim to have one feeder and one waterer for every eight birds. Waterers can be plastic or metal, with metal being the more durable but also more expensive option of the two. Depending on material and size, a waterer will usually run between $6-$30.

For feeders, chicken owners have more choices. A wall-mounted feeder can cost as little as $3, and hanging feeders are only slightly more expensive at $7. Trough feeders, which are ideal for chicks and smaller bantam birds, average $15, so whichever one you go with, it’s unlikely your feeder cost will break the bank.

Nesting boxes and perches are also relatively inexpensive; many will often come with the coop. If your coop doesn’t come with nesting boxes, you can get your own for about $10 a pop for the most basic model, which is likely all you need. You’ll want to plan for one nesting box for every three hens. The cost for perches, on the other hand, is essentially just the cost of a 2×4 and a handful of nails at your local hardware store – probably about $5. You’ll want a long enough perch for each of your hens to get about 10 inches of space.

So, when all is said and done, where does that leave the total cost for setting up a flock of five hens?

- $125-250 for chickens and the equipment to raise them to adulthood

- $171-850 for a coop and a run

- $34-70 to outfit the coop

For a grand total of between $330 and $1,170. Ouch.

Maintenance Costs Of Raising Chickens For Eggs

Of course, we’re just getting started on our expenses.

Now that you have your chickens, you still need to buy feed, supplements, bedding, and other crucial supplies for your birds. These are recurring expenses, so what seem like small savings on one bag of feed or bale of hay will add up in the long run.

For feed, there’s no need to get caught up in the many, many different types of feed you might see on the shelves – for the most part, your small backyard flock of layers will only need a basic layer feed once they reach adulthood, which usually runs about $15-25 per 50 pound bag.

A good starter rate is to feed six ounces of feed per chicken per day, which means that 50-pound bag will last our hypothetical five hens a little less than a month. Those raising their flocks from eggs or chicks will have to feed them on starter feed or starter crumbles to make sure they get enough protein and don’t overdose on calcium, transitioning to layer feed at around 18 weeks old.

Chickens also need several supplements in their diets, the most important of these being calcium carbonate and insoluble grit. Calcium carbonate helps laying chickens get the calcium they need to put strong, healthy shells on their eggs; it can be introduced to their diet through ground up oyster shells, which usually cost about $3 for a month’s supply. Insoluble grit helps the birds digest their food, basically serving the same purpose as teeth do for people, and costs about $15 a bag.

Free range chickens will need less grit than their confined counterparts, because they pick it up while foraging, but they should still have grit available to them to supplement that.

Another potential maintenance cost is bedding. Here again, chicken owners have a lot of different options, including some that can be basically free, like wood shavings or shredded newspapers. The classic straw is also an option, as are hemp and sand. All of these beddings have their potential upsides and downsides, and chicken owners may have to experiment a bit before they find an option that makes both their chickens and their bottom lines happy. A good number to expect for your bedding costs would be about $5 a month.

Other chicken maintenance costs are harder to quantify – how much they’ll add to your water and electricity bills, for example, or time and labor costs.

You might also run up against unexpected one-time expenses, like vet bills or repairs to your coop or your run. These things can be difficult to plan for, so make sure to keep a cushion in your chicken budget so you can comfortably cover any surprises that might come up.

Based on these numbers, though, our hypothetical starter flock of five hens will cost about $45 a month in maintenance and upkeep, for a yearly total of about $516.

Are backyard chickens worth it?

Of course, keeping chickens isn’t all about the bottom line.

It’s almost impossible to put a monetary value on most of the benefits we reap from our feathery friends, including the joys of their company and the myriad mental and physical health benefits of keeping a backyard barnyard.

For my part, watching my five-year-old niece absolutely glow when she finally got a hen to hop into her lap after months of trying was worth, conservatively, about $1 million in oyster shells and layer feed.

And many others have written more eloquently than I about the joys and sorrows of chicken keeping.

Suffice it to say that a single number cannot possibly sum up all the costs and benefits of chicken keeping.

For those obsessed with the numbers, though, we can come up with a rough per-egg cost of keeping hens. Your average hen produces about 200 eggs per year, though, again, this varies widely by breed and also depends on the health and age of your chickens. That means our five-hen flock will produce about 1000 eggs per year, for a first-year cost of between 84 cents and $1.69 per egg.

Every year after that, though, will yield a per egg cost of about 52 cents. I don’t know about you, but I think it’s worth it.

Author bio: Chris Lesley has been Raising Chickens for over 20 years and today keeps 11 chickens. She can remember being a young child when her grandad first taught her how to hold and care for chickens. She also holds a certificate in Animal Behavior and Welfare and are interested in backyard chicken health and care. Her work has been shared on HuffPost, Mother Nature Network, Community Chickens, Mother Earth News and many more outlets. You can find Chris at Chickens and More.

Are you interested in raising backyard chickens for eggs? Have you ever thought about the money side of it all?

The post Is it cheaper to buy eggs or raise chickens? appeared first on Making Sense Of Cents.

Finance

Instant ePAN Card using Aadhaar Card: 5 Things to Know

A PAN Card is a 10-digit alpha-numeric unique code issued by the Income Tax Department of India to file the Income Tax Returns or to make banking transactions exceeding Rs. 50,000. Moreover, a PAN Card is also considered as one of the important identification documents for opening a bank account, purchasing a property, investing in mutual funds, applying for a debit/credit card and more.

According to the Union Government of India, it is now mandatory for all the individuals to link their Aadhaar Card with a PAN Card and failure to do the same will result in an inoperative PAN Card. You will also be fined Rs. 10,000 for using an inoperative PAN Card under the Section 272B of the Income Tax Act. The deadline for linking PAN with Aadhaar has been extended to 31st March 2021.

However, getting a PAN Card has now become quite easy as compared to the offline procedure which was lengthy, paper-heavy and tedious. You can instantly get your PAN Card Application through an Aadhaar Card. It is worth mentioning that in order to avail this facility of getting an instant PAN Card through Aadhaar Card, your mobile number must be registered with Aadhaar to generate One Time Password(OTP) for the verification.

This facility of instant and free PAN Card through Aadhaar based e-KYC has been recently launched by the Finance Minister of India , Nirmala Sitharam on 25th June 2020.

Let us now understand what are those five important things for instant PAN Card Application using Aadhaar Card.

Process of Instant PAN Card through Aadhaar Card

You must know the steps involved for availing Instant PAN through Aadhar Card. The steps are as follows:

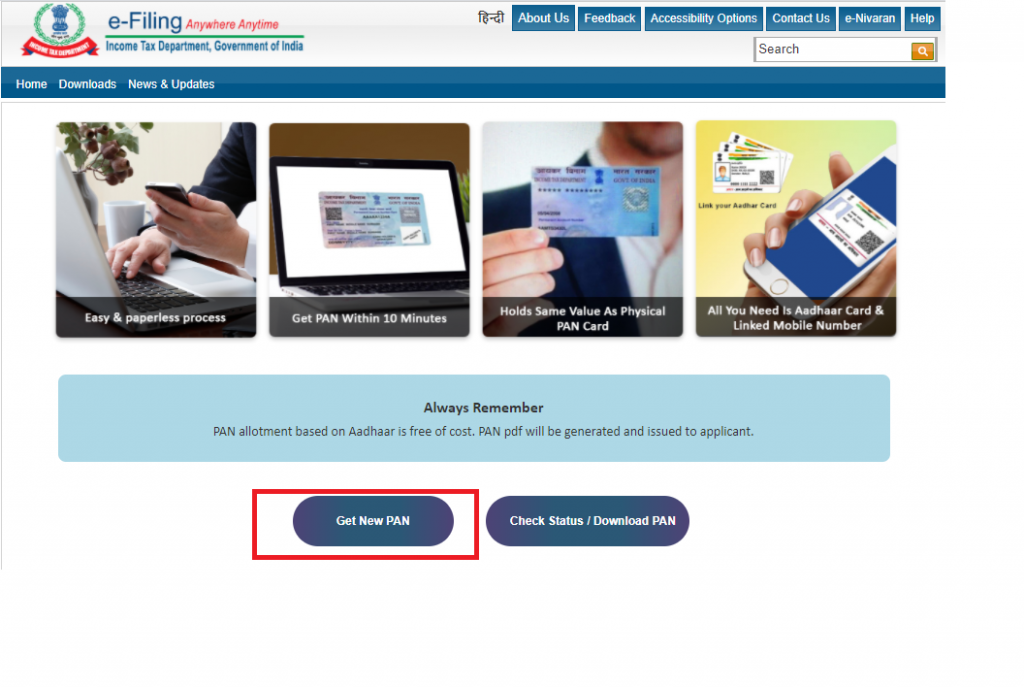

Step 1: You have to visit the official website of the Income Tax Department at https://www.incometaxindiaefiling.gov.in/e-PAN/

Step 2: Click on the ‘ Get New PAN’ option

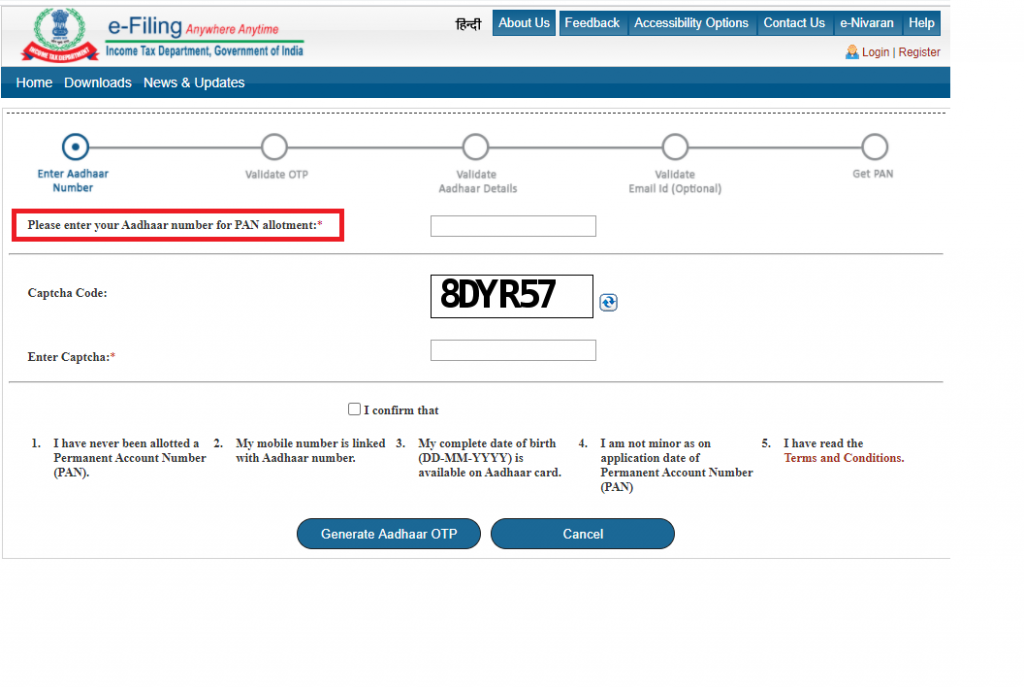

Step 3: You will be redirected to a new page. Enter your 12-digit Aadhaar Number for PAN allotment

Step 4: Enter the ‘Captcha Code’ for verification

Step 5: Now, you need to confirm the following details:

-

- I have never been allotted a PAN Card

- My mobile number is linked with Aadhaar number

- My complete date of birth is available on the Aadhaar Card (DD/MM/YY)

- I am not minor as on application date of Permanent Account Number (PAN)

- I have read the Terms and Conditions

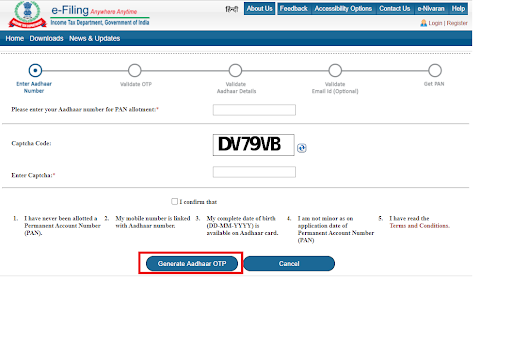

Step 6: Once done, click on the ‘Generate Aadhaar OTP’ button

Step 7: You have to enter the OTP be sent on your registered mobile number

Step 7: You have to enter the OTP be sent on your registered mobile number

Step 8: You have to validate your Aadhaar details, your email address (optional)

Step 9: Once all the details will be validated from the database UIDAI, your e-PAN will also be sent if the email ID of the applicant is registered with Aadhaar

Note: You will receive a 15-digit acknowledgement number for further tracking of PAN Card Status

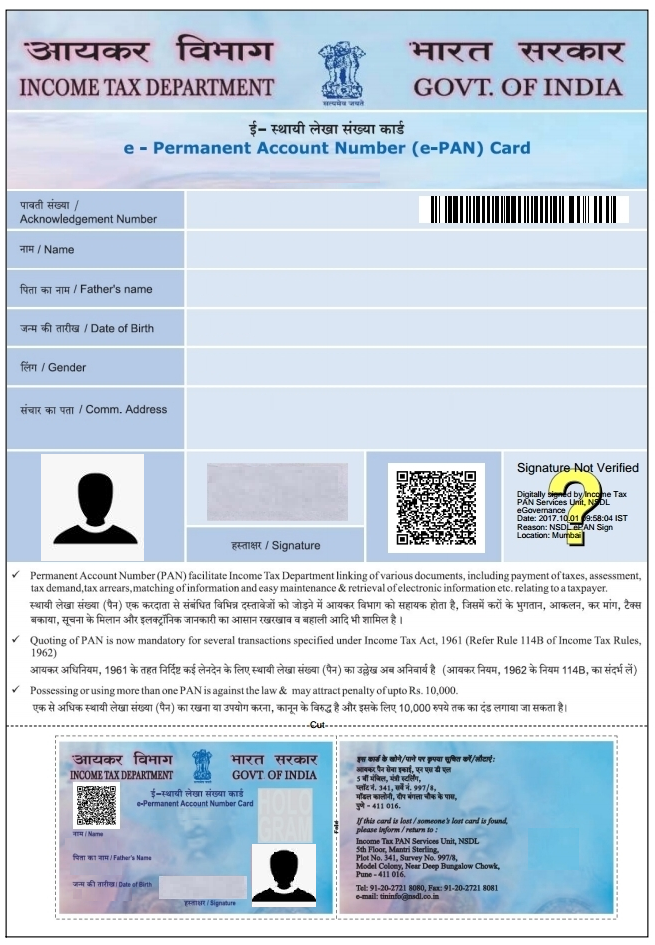

Format of of Instant PAN Card facility through Aadhaar based e-KYC

The issued instant PAN Card is in the format of pdf which also has a QR code containing all the demographic information such as your name, date of birth, gender and the photograph too. Morerver, this instant e-PAN can be downloaded through the 15-digit acknowledgement number sent to you once the process of PAN Card application is completed on your registered mobile number and email address. Moreover, you will also be sent a soft copy of your PAN Card on your email address (if registered with Aadhaar Card).

Note: Sometimes, the applicants get confused whether the e-PAN is considered equally valid or not, but as per the recent rules of the Income Tax Department of India, the e-PAN is equivalent to a laminated PAN Card.

Charges for Instant PAN Card through Aadhaar Card

You can also get your PAN Card through the official website of NSDL and UTIITSL, but both these PAN Card issuing authorities charge for the PAN Card application whereas the issuing of a 10-digit alphanumeric number is free of cost at the Income Tax Department’s portal.

Read more at: PAN Card Fees and Charges

Documents Required for Instant PAN Application

There is no documentation required for the Instant PAN Application facility through Aadhaar Card as the data will be automatically fetched from the database of the Unique Identification Authority of India (UIDAI) once you enter your Aadhaar number.

The income tax department says the turnaround time for issuing an instant PAN is just about 10 minutes. So far more than 6.7 lakh such instant PAN cards have been issued.

How to Check Status of Instant PAN Application

You can also check the status of your Instant PAN Application by following the steps mentioned below:

Step 1: Go to the official e-filing home page of the Income Tax Department (https://www.incometaxindiaefiling.gov.in/home)

Step 2: Click on the ‘Instant PAN through Aadhaar’ option under the ‘Quick Links’ section on the homepage which will redirect you to the instant PAN allotment webpage

Step 3: Now, you need to select the ‘Check Status/Download PAN’ option

Step 4: Enter your Aadhar number and captcha code

Step 5: Click on the ‘Submit’ button

Step 6: You have to validate the OTP which will be sent to your registered mobile number. Once again click on the ‘Submit’ button

Step 7: A new page will appear on your screen to check the status of your Instant PAN Card Application

Step 8: Upon successful approval of your PAN Application, you will receive a PDF link within ten minutes to download the PAN

Note: The PDF which will be generated will be password protected and you need to use your date of birth in the format ‘DDMMYYYY’ as the password to open the PDF file.

The post Instant ePAN Card using Aadhaar Card: 5 Things to Know appeared first on Compare & Apply Loans & Credit Cards in India- Paisabazaar.com.

Finance

How To Stick To A Budget (10 Budgeting Tips & Tricks)

(The following is a transcription from a video Linda and I recorded. Please excuse any typos or errors.)

All right. Today, we’re talking about 10 incredibly useful hacks to stick with your budgets. And, I’m really excited to share them with you.

We have really honed in on what it takes to have a budget that you can enjoy, that makes you feel good about life.

We’ve done it wrong so much that we’ve just learned how to do it right, and how to have fun in the process.

If you haven’t gotten Our Free Budgeting Worksheet, I’ve spent a lot of time making this thing and I think it’s awesome.

It’s a good first step to see how your income and expenses stack up. It’s just a good way to get started with your budget.

You can just pick that up by clicking here, and you’ll be on your way to starting your budget!

Now let’s get to these 10 amazing hacks to help you stick with your budget…

10. Make Savings Automatic

Bob: One of the biggest mistakes that most people make is they spend their money and then they try to save or give afterwards. You have to do it the opposite way, the things that are most important to you: giving money, savings, whatever those are, that needs to come first. If you don’t do it that way, if you don’t have some automatic thing in place, the reality is, we all know this.

Linda: It’s not going to happen.

Bob: We all know this, it’s probably not going to happen. You’re going to get to the end of the month, there’s not anything there. And so, that’s why making it automatic is incredibly important.

9. Reward Yourself

Bob: Or if you’re a Parks and Recreation fan, we could call it, treat yo self.

Linda: Treat yo self. This comes across though, as like, “I’m just going to treat myself all the time,” which is something I would do, but we’re not talking about that. Right?

Bob: Yeah. But the key in terms of sticking to your budget, you need rewards. You need incentives to stay the course. And so, yeah, when we were paying off our debt, this was a big part of that. Our budget was a big piece of us being able to pay off our debt. But in order to reach that goal, we had to have milestones. It was too big of a thing, it was too much, it was too long of a road for us to walk without some rewards. And so, we made sure to keep them in there and because we did, we were able to stick with it. Right?

Linda: Yeah. And I think this was especially key for me because he was watching the numbers of our debt go down, down, down. And he was really, really involved. But for me, I was more on the sidelines. And if I wouldn’t have had this incentive, it would have been really difficult for me to keep going. I think I would have just gotten discouraged and given up. So, I think this was extremely key for me since I was not as involved.

Bob: Yeah. Definitely.

8. Budget With Accountability

Bob: I’ve had the unique advantage of being able to try out and test out a whole bunch of different budgeting methods, budgeting softwares and tools and spreadsheets, and all this stuff over the years. I’ve been a financial blogger for almost 13 years, and I have reviewed almost everything out there, and I’ve tried out so much of the stuff. Because we’ve actually tried it ourselves.

The thing that I’ve come to realize is that most budgeting methods don’t actually hold you accountable. There’s this false sense of accountability. And so, the only tool that I’m aware of that ever actually hold you accountable are cash envelopes, if you do that and put cash in envelopes and do that type of budgeting.

Linda: Yeah. And that wasn’t going to work for us because we use plastic sometimes because we online shop or whatever.

Bob: Yeah. Then the other option is The Real Money Method. And this is kind of our hack to do that, to have a budgeting method that actually holds you accountable. So, we have an entire course teaching this method in which you’re welcome to check out if you’re interested. But the bottom line is that for most of us to stick with a budget, we need accountability. We need a budget that’ll hold us accountable. And so, if you’ve ever failed with budgeting, this might be the reason why. So, just find something that will hold you accountable.

7. Don’t Save Your Credit Card Info On Any Site Where You Shop

Bob: This is a good hack. This, yeah, because adding that friction, I think that would definitely, yeah. It just doesn’t seem like much, but having to spend the extra minute or two to go through with the purchase to type all that in, it just slows you down.

Linda: All right. So, I think you’ve told me about this before, where there’s something almost physical that happens in your body when you pay for something and you have to hand over cash.

Bob: Because it’s just real money and you get to feel it.

Linda: Yeah. And you’re like, “There’s my money and it’s leaving.”

Bob: It’s disappearing, yeah.

Linda: But when you write a check, you told me it’s less, but it’s still more of a process that you still feel like…

Bob: A little bit less real, yeah.

Linda: And then, less when you are swiping your credit card.

Bob: Yeah.

Linda: I think you told me this years ago, really before online shopping was as big as it is now. And I can only imagine how little you feel that when it’s like click, click, and it’s, “I bought it.”

Bob: Yeah.

Linda: It’s done.

Bob: I mean, that’s what Amazon has done. It’s like literally-

Linda: Oh, my gosh.

Bob: Add To Cart, boom. Done.

Linda: Well, and you can even hit Buy It Now. And it’s like click, you’re done.

Bob: Yeah. You’re right. It’s one click. So, it’s brilliant on their part. But the point is, is that adding that friction will overall reduce the spending that we make. So yeah, it’s an important move to make.

6. Only Use Gift Cards To Shop On Amazon

Linda: Number six ties right into what we were just talking about. Only use gift cards to shop on Amazon.

Bob: This is an interesting idea that the author had to basically go to the grocery store, buy an Amazon gift card for $100 or whatever, and then load that on your account and then make purchases with that. And so, this kind of takes that friction to a whole new level in that you need to go to the store and buy an Amazon gift card. But at the same time, it kind of undoes the previous thing we were just talking about because the gift card is loaded in there and it’s still pretty easy to buy. So, it’s kind of like, yeah, I don’t know. It might work for some people, but something to consider.

5. Never Buy Anything That You Put In An Online Shopping Cart Until The Next Day

Linda: Number five, never buy anything that you put in an online shopping cart until the next day.

Bob: This is a good idea. I can’t tell you how many times I’m struggling with some annoying problem around the house and I need to go buy this. I’m like, “I need to go buy this thing to fix it,” whatever it is. And I’ll put the thing in a cart and just because I forget to go buy it and I’ll come back a couple of days later, I’m like, I actually solved that problem already. Or it’s not even that big of a problem. It seemed like a big problem in the moment, but it really isn’t that big of a problem. And it is amazing. We’ve all heard this, just sit on a purchase for a little bit and then, half the time, you don’t want to make it later on. But I like this idea of throwing it in the cart. That way, you won’t forget about it. And you can check in a couple of days.

Linda: Yeah.

Bob: And see.

Linda: Well, and I think this is really key for stuff that you just want.

Bob: Yeah, especially.

Linda: Because I mean, so many times, you’re just trying to numb yourself. You’re like, “I’ve had a bad day, so I’m going to go online shop.” And I know that’s what I do. So, just sitting on that, having it in your cart kind of gives you a little bit of satisfaction, and then being able to sit on it for a little bit, I think really helps. And then you can make a decision when you’re a little bit more clearheaded.

Bob: Yeah.

4. Read The One-Star Reviews For The Products Before You Buy Them

Linda: Okay, I really like this one. Read the one-star reviews for the products before you buy them.

Bob: This is a great idea. Because it definitely gives you a whole different perspective on the product.

Linda: Yeah.

Bob: And yeah, and you just might not be as interested when you see all the negative things about it.

Linda: Right.

Bob: Now, I do this for really, most products I buy, because I want to see what people are saying the bad is.

Linda: Yeah. You don’t want to buy a product that’s going to be terrible and it’s not what you want.

Bob: Well, yeah, if you have 20 people in a row saying that whatever, “it stopped working after three months,” it’s like, all right, there might be a trend here. So, just from a smart shopping perspective, I think this is good, but it also will help you. Yeah, I think it will deter you from buying more things if you’re looking at the bad.

3. Don’t Go To The Grocery Store Hungry

Linda: All right. Number three, this one is classic.

Bob: But it works. It works.

Linda: Don’t go to the grocery store hungry.

Bob: Yeah. It just really, really works. It’s such a big difference when you, yeah, when you’re…

Linda: When you’re full and you’re not hungry.

Bob: Yeah.

Linda: You should go to the grocery store only full. It’s where you’re just like, “None of this sounds good.”

Bob: No, this is what you should do. You should go to the grocery store after a Thanksgiving meal, when you’re so bloated and just be like, “I don’t want any food.” You’re tired. That’s when you go to the grocery store.

Linda: You won’t be buying much. But then, you’ll regret it later because you’ll be like, “Why is there no food in the house?”

2. Only Make Major Purchases In The Morning

Linda: Number two, only make major purchases in the morning.

Bob: Yeah. I think this is really interesting. I remember, I think Tim Ferriss was talking about decision fatigue, and this idea that we only have a limited number of decisions that we can make any given day. And after that point, we’re just tapped out and we can’t actually make any more decisions.

Linda: Yeah.

Bob: And so, what happens is, so many of us in busy lives, we get to the end of the day and we’re just worn down and we don’t have good decision-making abilities. Whereas at the beginning of the day, we’re fresher. And we have, if you think of it in terms of a bank account, we have a lot more decisions sitting there that we can tap into. So, making these purchases, especially big purchases in the morning when we’re stronger, it’s just a better approach.

1. Choose A Major Category Each Month To Attack

Linda: Okay. Number one, choose a major category each month to attack.

Bob: I think this is a good idea. I think too many people try to solve 10 problems at once. And I think focusing your energy on just one, find one category in your budget that you’re struggling with, even though you might be struggling with four or five of them, find one, focus your energy on solving that particular one, whatever that is. If it’s groceries, if it’s household goods, whatever that category is, try to solve that one.

Linda: Yeah. And we’ve talked about this before, where you should not base your budget around what your personal goals are. You need to base it around where you actually are in your life. So, if you were going to Starbucks every day and you want to change that, do that one month. And then, once you’ve got that down, work on the next habit. Don’t try and do it all at once, because you’re going to blow your budget. It’s not going to work. And you’re just going to be mad.

What Budgeting Tip Would You Add To This List?

Yeah. So, those are our top 10. I’d love to hear yours in the comments.

Don’t Forget The Free Budgeting Worksheet!

Like I mentioned at the beginning, if you are new to budgeting, or if you just need a little help, be sure to get our free budgeting worksheet.

Source article that inspired this video/article: 13 incredibly useful budgeting hacks to help you stick to your budget.

Finance

Should I Take Money Out of My 401(k) Now?

Is taking money from your 401(k) plan a good idea? Generally speaking, the common advice for raiding your 401(k) is to only take this step if you absolutely have to. After all, your retirement funds are meant to grow and flourish until you reach retirement age and actually need them. If you take money from your 401(k) and don’t replace it, you could be putting your future self at a financial disadvantage.

Still, we all know that times are hard right now, and that there are situations where removing money from a 401(k) plan seems inevitable. In that case, you should know all your options when it comes to withdrawing from a 401(k) plan early or taking out a 401(k) loan.

If you take money from your 401(k) and don’t replace it, you could be putting your future self at a financial disadvantage.

401(k) Withdrawal Options if You’ve Been Impacted by COVID-19

First off, you should know that you have some new options when it comes to taking money from your 401(k) if you have been negatively impacted by coronavirus. Generally speaking, these new options that arose from the CARES Act include the chance to withdraw money from your 401(k) without the normal 10% penalty, but you also get the chance to take out a 401(k) loan in a larger amount than usual.

Here are the specifics:

401(k) Withdrawal

The CARES Act will allow you to withdraw money from your 401(k) plan before the age of 59 ½ without the normal 10% penalty for doing so. Note that these same rules apply to other tax-deferred accounts like a traditional IRA or a 403(b).

To qualify for this early penalty-free withdrawal, you do have to meet some specific criteria. For example, you, a spouse, or a dependent must have been diagnosed with a CDC-approved COVID-19 test. As an alternative, you can qualify if you have “experienced adverse financial consequences as a result of certain COVID-19-related conditions, such as a delayed start date for a job, rescinded job offer, quarantine, lay off, furlough, reduction in pay or hours or self-employment income, the closing or reduction of your business, an inability to work due to lack of childcare, or other factors identified by the Department of Treasury,” notes the Consumer Financial Protection Bureau (CFPB).

Due to this temporary change, you can withdraw up to $100,000 from your 401(k) plan regardless of your age and without the normal 10% penalty. Also be aware that the CARES Act also removed the 20 percent automatic withholding that is normally set aside to pay taxes on this money. With that in mind, you should save some of your withdrawal since you will owe income taxes on the money you remove from your 401(k).

401(k) Loan

The Cares Act also made it possible for consumers to take out a 401(k) loan for twice the amount as usual, or $100,000 instead of $50,000. According to Fidelity, you may be able to take out as much as 50% of the amount you have saved for retirement. However, not all employers offer 401(k) loan options through their plans and they may not have adopted the new CARES Act provisions at all, so you should check with your current employer to find out.

A 401(k) loan is unique from a 401(k) withdrawal since you’ll be required to pay the money back (plus interest) over the course of 5 years in most cases. However, the interest you pay actually goes back into your retirement account. Further, you won’t owe income taxes on money you take out in the form of a 401(k) loan.

Taking Money out of Your 401(k): What You Should Know

Only you can decide whether taking money from your 401(k) is a good idea, but you should know all the pros and cons ahead of time. You should also be aware that the advantages and disadvantages can vary based on whether you borrow from your 401(k) or take a withdrawal without the intention of paying it back.

If You Qualify Through the CARES Act

With a 401(k) withdrawal of up to $100,000 and no 10% penalty thanks to the CARES Act, the major disadvantage is the fact that you’re removing money from retirement that you will most certainly need later on. Not only that, but you are stunting the growth of your retirement account and limiting the potential benefits of compound interest. After all, money you have in your 401(k) account is normally left to grow over the decades you have until retirement. When you remove a big chunk, your account balance will grow at a slower pace.

As an example, let’s say you have $300,000 in a 401(k) plan and you leave it alone to grow for 20 years. If you achieved a return of 7 percent and never added another dime, you would have $1,160,905.34 after that time. If you removed $100,00 from your account and left the remaining $200,000 to grow for 20 years, on the other hand, you would only have $773,936.89.

Also be aware that, while you don’t have to pay the 10% penalty for an early 401(k) withdrawal if you qualify through the CARES Act, you do have to pay income taxes on amounts you take out.

When you borrow money with a 401(k) loan using new rules from the CARES Act, on the other hand, the pros and cons can be slightly different. One major disadvantage is the fact that you’ll need to repay the money you borrow, usually over a five-year span. You will pay interest back into your retirement account during this time, but this amount may be less than what you would have earned through compound growth if you left the money alone.

Also be aware that, if you leave your current job, you may be required to pay back your 401(k) loan in a short amount of time. If you can’t repay your loan because you are still experiencing hardship, then you could wind up owing income taxes on the amounts you borrow as well as a 10% penalty.

Note: The same rules will generally apply if you quit your job and move out of the United States as well, so don’t think that moving away can get you off the hook from repaying your 401(k) loan. If you’re planning to leave the U.S. and you’re unsure how to handle your 401(k) or 401(k) loan, speaking with a tax expert is your best move.

Keep in mind that, with both explanations of a 401(k) loan and a 401(k) early withdrawal above, these pros and cons are predicated on the idea you can qualify for the special benefits included in the CARES Act. While the IRS rules for qualifying for a coronavirus withdrawal are fairly broad, you do have to be facing financial hardship or lack of childcare due to coronavirus. You can read all the potential qualification categories on this PDF from the Internal Revenue Service (IRS).

If You Don’t Qualify Through the CARES Act

If you don’t qualify for special accommodation through the CARES Act, then you will have to pay a 10% penalty on withdrawals from your 401(k) as well as income taxes on amounts you take out. With a traditional 401(k) loan, on the other hand, you may be limited to borrowing just 50% of your vested funds or $50,000, whichever is less.

However, you should note that the IRS extends other hardship distribution categories you may qualify for if you’re struggling financially . You can read about all applicable hardship distribution requirements on the IRS website.

Taking Money Out of Your 401(k): Main Pros and Cons

The situations where you might take money out of your 401(k) can be complicated, but there are some general advantages and disadvantages to be aware of. Before you take money from your 401(k), consider the following:

Pros of taking money out of your 401(k):

- You are able to access your money, which could be important if you’re suffering from financial hardship.

- If you qualify for special accommodations through the CARES Act, you can avoid the 10% penalty for taking money from your 401(k) before retirement age.

- You can take out more money (up to $100,000) than usual from your 401(k) with a 401(k) withdrawal or a 401(k) loan thanks to CARES Act rules.

Cons of taking money out of your 401(k):

- If you take money out of your 401(k), you’ll have to pay income taxes on those funds.

- Removing money from your 401(k) means you are reducing your current retirement savings.

- Not only are you removing retirement savings from your account, but you’re limiting the growth on the money you take out.

- If you take out a 401(k) loan, you’ll have to pay the money back.

Alternatives to Taking Money from your 401(k)

There may be some situations where taking money out of your 401(k) makes sense, including instances where you have no other option but to access this money to keep the lights on and food on the table. If you cash out your 401(k) and the market tanks afterward, you could even wind up feeling like a genius. Then again, the chances of optimally timing your 401(k) withdrawal are extremely slim.

With that being said, if you don’t have to take money out of your 401(k) plan or a similar retirement plan, you shouldn’t do it. You will absolutely want to retire one day, so leaving the money you’ve already saved to grow and compound is always going to leave you ahead in the long run.

With that in mind, you should consider some of the alternatives of taking money from a 401(k) plan:

- See if you qualify for unemployment benefits. If you were laid off or furloughed from your job, you may qualify for unemployment benefits you don’t even know about. To find out, you should contact your state’s unemployment insurance program.

- Apply for temporary cash assistance. If you are facing a complete loss in income, consider applying for Temporary Assistance for Needy Families (TANF), which lets you receive cash payments. To see if you qualify, call your state TANF office.

- Take out a short-term personal loan. You can also consider a personal loan that does not use funding from your 401(k). Personal loans tend to come with competitive interest rates for consumers with good or excellent credit, and you can typically choose your repayment term.

- Tap into your home equity. If you have more than 20% equity in your home, consider borrowing against that equity with a home equity loan or home equity line of credit (HELOC). Both options let you use the value of your home as collateral, and they tend to offer low interest rates as a result.

- Consider a 0% APR credit card. Also look into 0% APR credit cards that allow you to make purchases without any interest charged for up to 15 months or potentially longer. Just remember that you’ll have to repay all the purchases you charge to your card, and that your interest rate will reset to a much higher variable rate after the introductory offer ends.

The Bottom Line

In times of financial turmoil, it may be tempting to pull money out of your 401(k). After all, it is your money. But the ramifications to your future financial wellbeing may be substantial. The CARES Act has introduced new options to leverage your 401(k), without the normal penalties. Find out if you qualify and take time to understand the details behind the options. We recommend speaking to a tax expert if you have any questions or concerns regarding possible tax penalties.

The traditional wisdom is to leave your retirement untouched, and we agree with that. If you’re in a financial bind, consider other options to get you through the rough patch. Tapping into your 401(k) should really be your last resort.

The post Should I Take Money Out of My 401(k) Now? appeared first on Good Financial Cents®.

-

Business4 weeks ago

Business4 weeks agoBernice King, Ava DuVernay reflect on the legacy of John Lewis

-

World News3 weeks ago

Heavy rain threatens flood-weary Japan, Korean Peninsula

-

Technology3 weeks ago

Technology3 weeks agoEverything New On Netflix This Weekend: July 25, 2020

-

Finance3 months ago

Will Equal Weighted Index Funds Outperform Their Benchmark Indexes?

-

Marketing Strategies7 months ago

Top 20 Workers’ Compensation Law Blogs & Websites To Follow in 2020

-

World News7 months ago

World News7 months agoThe West Blames the Wuhan Coronavirus on China’s Love of Eating Wild Animals. The Truth Is More Complex

-

Economy10 months ago

Newsletter: Jobs, Consumers and Wages

-

Finance8 months ago

Finance8 months ago$95 Grocery Budget + Weekly Menu Plan for 8