Share Market

How to Start a Business Using Retail Arbitrage

If you’ve ever shopped for items at TJMaxx or on eBay, you’ve encountered retail arbitrage. It’s a prolific practice, and nearly impossible to avoid. One of the reasons retail arbitrage is so common is because there is consumer demand and - for sellers - it’s profitable. When it comes to leveraging retail arbitrage for selling, many people do it to supplement their income, while others turn it into a business. But what does retail arbitrage mean? Is it really that profitable? And, how do you start a business using retail arbitrage?

What is Retail Arbitrage?

Retail arbitrage, as a concept, is actually very simple; which is likely why it’s so common. At its core, retail arbitrage is simply purchasing products from a retailer at a lower price and reselling it for profit. If done right, buyers-turned-merchants can sell the products at a much higher profit margin than the original discounted price.

For example, say Target has a sale on board games. The original MSRP is $30, but on sale, the price is $15. You purchase all the board games they have in stock at the discounted rate and resell them for $29 a piece. You make a $14 profit on every board game you sell (excluding taxes and shipping). This is retail arbitrage. You can apply this method to absolutely any consumer good. The most common items that resell for strong profits include: Toys, appliances, electronics, and clothing.

It sounds like a brilliant strategy, right? Especially if you’re looking at it as a method for starting a small business. And, if you’re looking to do this on a larger scale, there are ways to secure discounted products in bulk (versus buying single items off the shelves at Target). Large retailers liquidate their products while the demand is still high which provides an efficient way to purchase large quantities of popular goods to resell back to consumers—but is there a catch? Let’s look at some of the challenges and best practices when it comes to retail arbitrage.

Challenges of Retail Arbitrage

The first thing you need to know about retail arbitration is that it’s a perfectly legit way to make money. In fact, there was a Supreme Court ruling on the topic. The Court determined product resales are not prohibited if they were legally acquired. In other words, if you bought the merchandise, you can resell it.

There aren’t many limits on retail arbitration, except customers buying power. For instance, some sellers drastically mark up their prices over the original retail price. While this may work for some items and some customers, it’s not always ideal. It also doesn’t necessarily guarantee the greatest profit. Sellers should always assume their customers are smart; they typically do their research, especially when purchasing online. Often, they know the in-store price and went online to search for a better value. Simply put, if you mark your prices too high it’s almost guaranteed people will notice. On the flipside, if you mark them too low and you risk not turning a profit, especially after factoring in shipping and taxes.

Another challenge of retail arbitrage you may face is from the retailers themselves. Some sellers receive harassment from retailers that don’t want their products resold. While they legally can’t take action, this can be stressful for some. Additionally, if you’re reselling on Amazon, brand gating may occur. Brand gating is part of an application process in which third party sellers reselling a brand name product must fulfill certain guidelines. These guidelines are in place to protect buyers against counterfeiters and unauthorized sellers across the site. Amazon protects legitimate resellers because they help generate profits for the site. But they also protect big retailers: If a brand has brand gating in place, you need its permission to resell the items. If the retailer doesn’t grant permission, resellers will be forced to list that product on another site.

And, finally, the biggest challenge of retail arbitrage is the obvious one: You risk losing money on your investment. Especially if a product was on sale due to a default or recall. In order to make money, you must have a good product at a good price. You also have to consider that others take a cut of your profit. You’ll pay tax, shipping, and fees to the site you’re using, plus your original purchase price. Always remember there are middlemen in reselling. Choose your products wisely and understand your margins.

Retail Arbitrage for Beginners

Don’t let the challenges discourage you, there are still huge benefits to retail arbitrage. One, of course, is the potential for profit. But it’s also important to remember that retail arbitration is incredibly easy to start. You can begin with as little as $200 and a few products from your local Walmart.

Here are the four steps you need to take to get started:

Market Research

Though you can resell anything online, you may consider doing some market research. Visit sites like Amazon and search through the bestseller categories.

Sourcing

Before you even register for a seller account on any site, you have to source products. Scour your local retailers for discounted items that are likely to resell well online. For the best results, select items that are in higher demand. Keep in mind you’ll get just a little inventory to begin with and it requires keeping an eye out for big sales. As mentioned earlier in the article, you could also check out online liquidation sites and buy pallets of inventory in bulk from top retailers. Again, you can sell anything, but items with higher demand will sell faster and easier.

Register for a Seller Account

Amazon is the most popular selling platform. It’s also one of the easiest platforms to work with. With the seller app, you can scan sale items in-store to see comparison prices on Amazon. The app also shows fees, shipping costs, and other details. This helps you determine whether or not you’ll make a profit from the scanned items. However, do your research as each site has its own rules, fees, and features. Some sites are better suited to furniture reselling due to included shipping costs. Others only charge per item sold. Take time to find the best sites for retail arbitrage and choosing your products for the best chance at success.

List Items

Setting your prices is relatively easy. In most cases, you can set the price at or just below market value. You may also check comparison prices on the site you’re using. Plus, don’t forget to factor in your shipping costs, taxes, and seller fees. You should maintain a profit minimum of at least $3.

If you’re a high volume reseller, you may consider shipping your products to FBA warehouses. FBA warehouses are Fulfillment by Amazon warehouses, which handle shipping for you. This way you can ship items in bulk for the same price, and let Amazon handle individual shipping.

Retail arbitrage has the ability to create big business, and it’s simple to get started. The first step is to source products. As mentioned above, you can search your local retailers for discounted or clearance products, but there is a better way. Retailers, especially those in e-commerce, see product returns at a rate of about 30%. These companies often sell returns by the pallet through auction marketplaces. Many of these products are resold directly from the retailer at 30 cents on the dollar. This leaves a lot of room for profit and it’s completely open to certified resellers. Potential resellers should know that certification isn’t difficult to acquire so don’t be intimidated.

Learn more about buying return pallets, or get your business started by visiting B-Stock. We’re the source for dozens of retailer marketplaces across the country. So if you’re ready to start your retail arbitrage business, start buying heavily discounted products at B-Stock.

The post How to Start a Business Using Retail Arbitrage appeared first on B-Stock Solutions.

Share Market

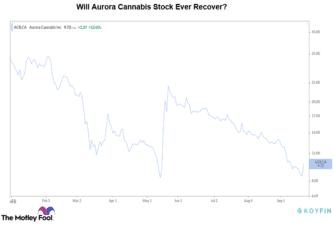

No Respite for Aurora Cannabis (TSX:ACB) Investors

The shares of the top pot producer Aurora Cannabis (TSX:ACB)(NYSE:ACB) soared more than 15% on Tuesday on higher expectations of its quarterly earnings. However, it was again the same, old story from Aurora. It reported a weaker-than-expected revenues and posted one of the biggest losses in history.

Aurora Cannabis: Yet another disappointing quarter

For fiscal Q4 2020, Aurora Cannabis reported $72 million in revenues, a decline of more than 5% from the previous quarter. Its net loss jumped to $1.8 billion driven by goodwill writedowns and asset impairment charges. The company reported $2.9 billion in impairment charges in the entire fiscal year 2020.

The recent gains of the top pot stock might evaporate, given Aurora’s disappointing results. Once investors’ favourite, Aurora Cannabis stock has lost almost 70% so far this year.

The company management expects $62 million in revenues for Q1 2021, lower compared to the recently reported quarter. According to management guidance, Aurora Cannabis was expected to turn EBITDA positive by Q1 2021. However, now the target has been pushed back by a quarter. On the net income front, Aurora has reported a loss for the last seven straight quarters.

Aurora announced the closure of several production facilities in June in order to increase efficiency. It currently operates an annual production capacity of 142,000 kg per year.

Aurora Cannabis was successful in lowering its production costs during the fiscal fourth quarter. It spent around $0.89 to produce a gram of cannabis, lower from $1.22 per gram in the earlier quarter.

Concern for investors

Too many players amid lower-than-expected demand have dominated the marijuana industry in the last few years. The industry once looked promising due to its steep growth prospects, but the industry as a whole has been on a decline lately.

Aurora Cannabis has some of the geographically diversified operations across the globe. However, its international sales have failed to pick up and continued to burn cash. Along with falling stock price, Aurora’s continued losses and declining revenue growth might bother investors. Additionally, a prolonged equity dilution will also be one of the major concerns for them.

A higher number of retail shops, along with an innovative recreational product range, should boost Aurora Cannabis’s sales. Product differentiation will be vital here, as many pot players are working on launching similar goods. Notably, top-line growth and consistent efforts on pruning operating costs will help the company reach breakeven.

Declining stock price

Aurora Cannabis still seems far from turning profitable. The top pot stock has dug a deep hole in investors’ pockets in the last few years. While Aurora stock has lost around 90%, cannabis stocks at large have lost approximately 55% in the last 12 months.

Aurora Cannabis is currently trading at a forward price-to-sales valuation multiple of four. This looks expensive against its average historical valuation as well as compared to peers. The stock will likely continue to trade volatile and could be a risky bet for conservative investors.

Where should you invest $1,000 today?

The 10 Best Stocks to Buy This Month

Renowned Canadian investor Iain Butler just named 10 stocks for Canadians to buy TODAY. So if you’re tired of reading about other people getting rich in the stock market, this might be a good day for you.

Because Motley Fool Canada is offering a full 65% off the list price of their top stock-picking service, plus a complete membership fee back guarantee on what you pay for the service. Simply click here to discover how you can take advantage of this.

More reading

- Aurora Cannabis Q4 Earnings: Where Did Things Go Wrong?

- Aurora Cannabis (TSX:ACB): The Perfect 5-Year Contrarian Bet?

- Why Aurora Cannabis (TSX:ACB) Stock Gained 15% Yesterday

- TSX NEWS: Why These 2 Stocks Rose by Over 5% On Tuesday

- Is Aurora Cannabis (TSX:ACB) Stock a Buy Before Tuesday Earnings?

Fool contributor Vineet Kulkarni has no position in any of the stocks mentioned.

The post No Respite for Aurora Cannabis (TSX:ACB) Investors appeared first on The Motley Fool Canada.

Share Market

Which Way Wednesday – Fed Edition

And once again the Futures are up.

As you can see from the S&P chart, we have had some massive gaps up in the thinly traded open and then drifted down during real trading at the end of the day. This is like someone who works for the auction house shouting "100 Million Dollars" on the first bid for a painting to make sure the other suckers in the audience start bidding higher.

In the case of the markets, the Banksters buy up the Futures on thin trading (so it's very cheap to do) and cause the Retail Suckers to pour in and chase the momentum so the Banksters can dump their stocks all day long during real volume trading. This is how rich people exit the market - they create a buying atmosphere and they take their profits while poor people follow their advice - which doesn't actually apply to their own actions. You see the big brokerage houses doing that all the time, exiting positions while their analysts are pumping the Tesla stock.

We had a good day yesterday shorting the Dow (/YM) Futures from our trade idea in the Morning Report and congratulations to all who played along. Our morning call for our Members was:

We had a good day yesterday shorting the Dow (/YM) Futures from our trade idea in the Morning Report and congratulations to all who played along. Our morning call for our Members was:

So we're sticking with our strategy of shorting the indexes (which didn't work yesterday) as we're likely to be rejected here (Dow (/YM) 28,100, S&P (/ES) 3,405, Nasdaq (/NQ) 11,475 and Russell (/RTY) 1,550) and, as usual, we can just short the laggards, which would be /ES crossing below 3,400 and /YM confirming below 28,000 - we should catch a quick ride down but the Fed goes tomorrow and that should give the marketsupport until they are disappointed by that so tight stops above!

As you can see, this wasn't rocket science, the pivot points on the Dow were 28,014 and 27,795 and we simply allowed for the pre-market BS pump job and took a stab at shorting early but once we confirmed the move below 28,000, it was a no-brained to jump in for the 200-point drop on the Dow (at $5 per point, per contract!). This morning we're back to 28,000 again but we have a Fed Meeting at 2pm so it's not a good day to play the futures - too volatile.

Speaking of volatile,

IN PROGRESS

Share Market

The IPOX® Week, September 21th, 2020

- Futures and Options expiration week delivers pain for most global equity investors, strong gains for investors in IPOX Strategies. IPOX SPAC Index (SPAC) extends big run-up.

- IPOX 100 U.S. (ETF: FPX) adds +1.73% to +15.32% YTD. IPOX International (ETF: FPXI) rises +1.98% to +43.52% YTD. IPOX Europe (ETF: FPXE) adds +2.00% to +16.07% YTD.

- More U.S. deals lined up as IPO window open in Europe

Track the performance of U.S. SPACs live with the IPOX® SPAC Index (BBG: SPAC, Reuters: .SPAC): The liquid IPOX SPAC (SPAC) added +3.81% last week, to +19.31% since its 07/30 live launch, outperforming the S&P 500 (SPX) and Russell 2000 (RTY) anew. SPAC news include: 1) fleet electrification solution provider XL Fleet to merge with Pivotal Investment Corp II; 2) 9 SPACs launched last week and at least 12 new SPACs filings include Apollo sponsored Apollo Strategic Growth Capital; 3) Playboy Enterprises explores “going public” via SPAC merger.

Expiration week delivers pain for most global equity investors, strong gains for investors in IPOX. U.S. Futures and Options expiration left investors in the IPOX Strategies (ETFs: FPX, FPXI, FPXE) towards

the top of the weekly performance rankings, as U.S. equity risk declined (VIX: -3.87%), rates steadied, and large-cap U.S. technology stocks drifted anew (NDX: -1.36%). In the U.S., e.g., the broad-based IPOX 100 U.S. (ETF: FPX), benchmark for U.S. IPO and Spin-off performance, added +1.73% to +15.32% YTD, extending the YTD/YY lead vs. the S&P 500 (SPX) to +1257 (857) bps. Strength extended to markets abroad, with the IPOX International (ETF: FPXI) and IPOX Europe (ETF: FPXE) all rising. Strength in IPOX-tracked specialty exposure often untracked in the conventional portfolios drove the good showing, including Michael Jordan-backed SPAC IPOX 100 U.S. member (ETF: FPX) online entertainment services provider DraftKings (DKNG US: +33.60%), online collaborations platform operator Zoom Video (ZM US: +14.55%), Dutch Payment processor Adyen (ADYEN NA: +10.76%) and key Saudi Arabia’s health care services provider Dr. Sulaiman Al-Habib (SULAIMAN AB: +6.86%). Corporate Actions and seasonality pressured select names including security services firm ADT (ADT US: -20.07%) and outdoor products/services providers vehicle maker Camping World (CWH US: -12.72%) and cooler maker Yeti (YETI US: -8.68%).

| Select IPOX® Indexes Price Returns (%) | Last Week | 2019 | 2020 YTD |

| IPOX® Indexes: Global/International | |||

| IPOX® Global (IPGL50) (USD) | 1.87 | 27.93 | 37.88 |

| IPOX® International (IPXI)* (USD) (ETF: FPXI) | 1.98 | 31.37 | 43.52 |

| IPOX® Indexes: United States | |||

| IPOX® 100 U.S. (IPXO)* (USD) (ETF: FPX) | 1.73 | 29.60 | 15.32 |

| IPOX® ESG (IPXT) (USD) | 3.05 | - | - |

| IPOX® SPAC (SPAC) (USD) | 3.81 | - | - |

| IPOX® Indexes: Europe/Nordic | |||

| IPOX® 30 Europe (IXTE) (EUR) | 2.11 | 34.55 | 21.70 |

| IPOX® Nordic (IPND) | 2.54 | 38.52 | 36.02 |

| IPOX® 100 Europe (IPOE)* (USD) | 2.00 | 30.97 | 16.07 |

| IPOX® Indexes: Asia-Pacific/China | |||

| IPOX® Asia-Pacific (IPTA) (USD) | 3.34 | 4.41 | 32.49 |

| IPOX® China (CNI) (USD) | 2.25 | 26.31 | 51.61 |

| IPOX® Japan (IPJP)** (JPY) | 3.05 | 37.91 | 12.82 |

* Basis for ETFs: FPX US, FPX LN, FPXE US, FPXU FP, FPXI US, TCIP110 IT and CME-traded e-mini IPOX® 100 U.S. Futures (IPOM0). Source: Bloomberg L.P. & Refinitiv/Thomson Reuters. For IPOX Alternative Strategies Returns, please contact [email protected]

| DRAFTKINGS | 33.60 | NETWORK INTERN’TL | -32.69 |

| STILLFRONT GROUP | 19.53 | GOOSEHEAD INSUR. | -20.50 |

| TESLA | 18.63 | ADT INC | -20.07 |

| MYOKARDIA | 18.23 | CAMPING WORLD | -12.72 |

| ADC THERAPEUTICS | 17.63 | INARI MEDICAL | -11.01 |

| ZEALAND PHARMA | 15.43 | YETI HOLDINGS | -8.68 |

| ADAPTIVE BIOTECH | 15.21 | SOFTWAREONE | -8.07 |

| SHOP APOTHEKE EUROPE | 15.05 | PINDUODUO | -5.82 |

| ZOOM VIDEO | 14.55 | FARFETCH | -5.75 |

| ARGENX SE | 13.89 | REYNOLDS CONSUMER | -5.47 |

IPO Deal-flow Review and Outlook: At least 26 firms IPO’d across the eligible global markets last week, with the average (median) equally-weighted deal adding +57.67% (+11.81%) based on the difference between the final offer price and respective Friday’s close. U.S. cloud data warehouse Snowflake (SNOW US: +100.00%), DevOps software developer JFrog (FROG US: +47.23%), game software company Unity (U US: +31.44%) and portable dialysis firm Outset Medical (OM: +122.26%) all surged on debut. Abroad, Canadian payment firm Nuvei (NVEI CN: +77.50%) and British e-commerce unicorn The Hut Group (THG LN: +18.40%) also recorded strong gains, while Kuwait stock exchange operator Boursa Kuwait (BOURSA KK: +939.00%) rose more than tenfold. While high-profile data analytics unicorn Palantir (PLTR US) pushed its Direct Listing to month-end, select key deals lined up include Silver Lake-backed telemedicine firm GoodRx (GDRX US), PE-backed motorhome maker Knaus Tabbert (KTA GR) and German defense supplier Hensoldt (5UH GR). Other IPO news include: 1) Macquarie prepares IPO for its data analytic company Nuix; 2) mortgage lender LoanDepot to revive IPO plan; 3) TikTok weighs U.S. IPO upon U.S. ban whereas its rival Kuaishou mulls $5B Hong Kong IPO; 4) more homecoming secondary offerings from U.S.-listed Chinese companies include Zai Lab, ZTO Express, Baozun, and Huazhu.

Track global deal flow live on: https://bit.ly/32zolmG

The post The IPOX® Week, September 21th, 2020 appeared first on Low Cost Stock & Options Trading | Advanced Online Stock Trading | Lightspeed |.

-

Business2 months ago

Business2 months agoBernice King, Ava DuVernay reflect on the legacy of John Lewis

-

World News2 months ago

Heavy rain threatens flood-weary Japan, Korean Peninsula

-

Technology2 months ago

Technology2 months agoEverything New On Netflix This Weekend: July 25, 2020

-

Finance4 months ago

Will Equal Weighted Index Funds Outperform Their Benchmark Indexes?

-

Marketing Strategies9 months ago

Top 20 Workers’ Compensation Law Blogs & Websites To Follow in 2020

-

World News8 months ago

World News8 months agoThe West Blames the Wuhan Coronavirus on China’s Love of Eating Wild Animals. The Truth Is More Complex

-

Economy11 months ago

Newsletter: Jobs, Consumers and Wages

-

Finance9 months ago

Finance9 months ago$95 Grocery Budget + Weekly Menu Plan for 8