Finance

Questions About Retirement Savings Priorities, Gas Grills, Gap Years and More

What’s inside? Here are the questions answered in today’s reader mailbag, boiled down to summaries of five or fewer words. Click on the number to jump straight down to the question.

1. Living on debt

2. Prioritizing saving for retirement

3. Extending life of gas grill

4. What happens in August?

5. More on sanded cast iron

6. Stay-cation idea with kids

7. Prepping for next lockdown

8. Dry beans advice?

9. Handling child’s “gap year”

10. Inexpensive pocket-sized games?

11. Giant ham and turkey suggestion

12. Inexpensive long term isolation ideas

A few months ago, I mentioned Money in Excel, a spreadsheet template that (at the time) was an upcoming release from Microsoft that worked within their Excel spreadsheet program to provide some personal finance management tools.

It released a couple of weeks ago. I’ve spent some time using it and I’m impressed. My only concern is security; I hope to see a thorough security audit of the software from someone who is skilled at that type of analysis (I haven’t seen one yet as of this writing, but there may be one available by the time you read this). If you already have access to Excel through the Office 365 program, I highly encourage you to download it and give it a try.

On with the questions.

Q1: Living on debt

I was working as a 1099 contractor until May when my employer let me go. I was able to still get unemployment, but the total unemployment plus CARES benefit isn’t enough to pay my bills so I have been living on credit cards until I can get a new job. I need to make some real decisions about what to do but I don’t have any idea what to prioritize. Do you have any articles on this?

- Darren

I would go through each of your big expenses and ask yourself what you can do to cut that expense drastically.

Let’s start at the top — housing. Do you own a home or rent an apartment? Have you looked at downsizing those things? Moving to a smaller place will cut your housing bill plus your utility bills significantly.

Do you have a car? Do you need that car? If it’s on a lease, can you end that lease early and just get a junker to drive or rely on public transport?

Look at all of your services. Which ones do you need? Do you need both home internet and cellular service? Do you need any of your entertainment services?

Are you taking smart steps with your day-to-day living expenses? Buying store brands at the store? Eating meals you prep yourself at home rather than takeout or delivery?

Can you renegotiate or shop around for your insurance packages?

You have to tighten up all of your money leaks hard. If you’re living off of credit cards while you’re actively looking for work, that means your spending is well above your income right now, and that’s not sustainable for very long and will leave you with a giant hole to dig out of if/when you stabilize.

Q2: Prioritizing saving for retirement

How big of a priority is retirement savings when you have student loans and credit card debt?

- Damon

It depends on a number of other factors.

If you’re accumulating more credit card debt, you should prioritize getting your spending habits straight above everything else. You have to be spending less than you earn now, even if you think you’ll be earning more in the future. Get that straight before even thinking about retirement savings. This comes before everything else listed below.

If your employer offers matching funds for retirement savings, you should prioritize getting every drop of those matching funds. Matching funds blow away anything else you could do with that money in terms of return on the dollar.

If you don’t have matching options, get rid of all of your high-interest debt as fast as humanly possible, then build a cash emergency fund so that you don’t slip back into debt. High-interest debt is anything over 7%, so that probably includes your credit card debt but not your student loans.

So, your first priority is to make sure you’re spending less than you earn, then contribute to retirement such that you get every dime of matching funds, then pay off high-interest debts, then build a small emergency fund, then contribute more to retirement (up to about 15% of your salary). Check off each one before you move to the next.

Q3: Extending life of gas grill

I received a gas grill and propane tank and cover as an early Father’s Day present (so I could use it on Father’s Day). Manual doesn’t give much maintenance and care advice and couldn’t find much online. What can I do to keep it in good shape besides covering it?

- Brad

The big thing is to clean it regularly, once every month or two. I’m surprised this isn’t in the manual, honestly, but some manuals are better than others. You’ll need a wire brush and a big bucket of soapy water and some rags.

First, disconnect the propane tank from the grill. Then, pull the grates off and scrub them down thoroughly with the wire brush. Take out the burner protectors (the metal pieces that rest over the burner) and wash them in the soapy water by hand, rinse them off with clean water, and leave them out to dry.

After that, get a soapy rag, wring it out well, and wipe down the burners. You’ll get a lot of nasty grime off of them — that’s OK. Just keep rinsing off the rag in the soapy water, wring it out, and wipe some more. After it’s good, wipe it down with non-soapy water.

After that, there are some removable plates underneath the burners. Remove them, get rid of all of the debris that comes with them, and gently clean them like the burner protectors and leave them out to dry.

Beneath those, there should be a removable tray. Brush any debris still on the bottom of the grill into that tray, remove it, and dump the contents.

Then, just reassemble in reverse order. Put the tray back in, put the plates on the bottom of the grill back in, put the burner protectors back in (assuming they’re dry), put the grates back on top, and reconnect the propane. Your grill should look fantastic.

Just do this every month or two and your grill will hold up well. You’ll probably more than double its life by doing this. It’s mostly the grime that builds up and eventually starts damaging and clogging things that cause most grill problems, assuming that you’re also keeping the water out with a grill cover.

Again, I’m surprised this isn’t in your manual, but this basic procedure is great for keeping pretty much any propane grill going.

Q4: What happens in August?

I liked your stuff about the economy but I am still worried about what happens in August when people start falling off of unemployment if their job didn’t come back.

- Barry

First of all, what happens at the end of July is that the extra unemployment benefits provided by the federal CARE Act will run out, so on August 1 benefits fall back to the normal rate in each state (that’s the state of things as I write this). Right now, most states are offering basic unemployment for 39 weeks (a few are offering less, but most seem to be at the 39-week level), so the real problem starts popping up near the end of the year. People will find it harder after August 1, but they shouldn’t fall into complete panic mode until near year’s end.

So what will happen?

One possibility — and this is the one I find most likely — is that unemployment benefits are extended in many states. Some states may have trouble paying unemployment benefits for that long (as the sudden jump in unemployment caught many of their unemployment funds unaware) but I expect the federal government will make sure they won’t fail.

Another possibility is that the CARES Act is extended. I don’t think that will happen unless states start to shut down again due to COVID-19 resurgence.

The other possibility is that the states do nothing and unemployment runs out for lots of people this coming winter. I think this only happens if there has been a complete return to normalcy, with a vaccine or an effective treatment for COVID-19 widely available.

So, I think the first possibility is the most likely one, the second is the “bad” scenario, and the third is the “good” scenario.

Q5: More on sanded cast iron

As an engineer sitting here with two similar Lodge cast iron skillets, I still couldn’t help myself from running the experiment for myself. So here’s what I did. I took one skillet that was up for reseasoning anyway due to misuse, some carbonized food residue spots that were really baked on at this point and took it back to bare iron with that one lye-containing oven cleaner. Once it was pristine bare iron, I took some heavy grit sanding to it with the orbital sander. This took a LONG time, I want to say an hour or more, but when finished I had a beautifully smooth surface as you can see in the pic below. I then reseasoned with 4x bakes with flax oil and got to cooking. The result: After a few weeks of cooking with this thing twice a day it is a dream, honestly. Scrambled eggs, in particular, just slip right off, provided I let it get hot first. And since the side walls were not sanded, I get a real side-by-side of how much better the release is on the sanded surface. I’ve been surprised at how well the initial seasoning has held up and seemingly only gotten better with use. So yeah, interesting and unexpected results. Below are pics of the freshly sanded skillet and the same skilled today, seasoned and two weeks into its new life. Do with that what you will, but my takeaway is that a sanded cast iron can still hold on to polymerized oil like a champ.

- David

This is a follow-up to a question a few weeks ago in which a reader wanted to know whether sanding down a cast-iron skillet before use was a good idea, and I advised him not to do so. The big reason for not doing it is that the somewhat rough surface of cast iron is full of pores that grab onto the things you cook on cast iron and gradually form a wonderful natural non-stick surface. If you sand it down, you lose the pores.

From this reader’s experience, it sounds like sanding down the surface to make it easier to cook on initially is still enabling it to start to form that natural non-stick surface.

I’d really like to know (for my own curiosity) how this surface holds up over time. Will it peel in a year or two when that surface gradually thickens? I honestly don’t know. All I know is that the cast iron I’ve used in the past started with a very rough surface, took quite a lot of cooking to develop a nice smooth non-stick surface, and has never peeled.

Q6: Stay-cation idea with kids

Our plan this summer was to go to Disney World in late July but there’s no way we’re doing that now even if the place is open. We held out hope for a while but canceled recently. So now we are planning a “stay-cation” that week but we are struggling for cool ideas. We do have some budget but we mostly want to roll our savings forward to next year for a nice vacation. I’m interested in ideas that aren’t camping.

- Amber

Honestly, I’d talk to your kids about it. What kinds of things have they always wanted to do at home or near home (with social distancing in mind) that there’s never been time to do? Any big projects? Anything they’ve ever wanted to try? Perhaps you could all agree to pick a few things and then you all participate in them.

Here’s a good thing to do. Each of you should come up with a list of, say, ten things you might want to do on a staycation. They should all be things that take a day or less and fit within your social distancing restrictions.

Then, sit down together and share your lists. Everyone should pick out their favorite three things from each other person’s list — so your partner and each kid would each pick out their three favorite things from your list, and you and each kid would pick out your three favorite things from your partner’s list, and so on. The items that get picked multiple times (meaning at least three out of four of you really like the idea) are things you include in the stay-cation.

So, my list might look like this:

1. Play a strategy board game.

2. Build a blanket fort.

3. Make a big batch of homemade root beer.

4. Play a role-playing game.

5. Find ten geocaches nearby.

6. Make a big batch of sauerkraut.

7. Have a croquet match in the back yard.

8. Make tie-dyed t-shirts.

9. Make an enormous sidewalk chalk mural on our whole driveway and front walk.

10. Make a big pot of “stone soup” over a fire in the backyard.

I have a wife and three kids. So, my wife might pick 1, 5, and 10. My oldest son would probably pick 4, 5, and 7. My daughter would probably pick 2, 8, and 9. My youngest would probably pick 1, 2, and 8. So, 1, 2, 5, and 8 were picked by at least two people, so they’d make it on the final “staycation” list. Likely, each person would have 3–4 things picked, and you could fudge in the end to make things even.

There’s a decent chance that we do this for a week in August, actually, before the school year — in whatever form that takes — gets started.

Q7: Prepping for next lockdown

My wife and I believe that another coronavirus lockdown is inevitable and are looking for steps to prepare for it. We think this one will be in the fall and much more strongly enforced. How should we prepare for this financially without our moves going to waste if it doesn’t happen?

- David

Obviously, having liquid cash is a good idea. You’re likely most safe having that money in a local branch of a larger bank so you could get it locally if needed. Get money into savings so that if there is job loss for anyone, you can still stay put for a long while. If there’s not another lockdown, you can move that money back into other things.

Another good move is to do a lot of bulk buying now, but buy things you will eventually use up no matter what. Buy basic toiletries, household supplies, and nonperishable goods — things like dry rice, dry beans, canned tomatoes, and so on. Focus on things you know you will use and eat, and buy enough to sustain you for months. Those supplies can be used up over time even if there isn’t a lockdown.

The advantage of both of these moves is that there’s no real financial cost to them. With the savings account money, at worst you might miss out on some investment gains for a few months, but you may also avoid losses. With the nonperishable goods, as long as you focus on things you will actually use regardless of lockdown, it’ll probably save you money.

Here’s some more specific advice probably related to your efforts.

Q8: Dry beans advice?

I bought a lot of dry beans but I’m having a hard time actually using them. Seems like a lot of extra work. Can you explain very carefully your workflow for dry beans?

- Stan

Every few days, I’ll look ahead at our meal plan and see if there’s anything that uses beans. Usually, I’ve planned such that there are two (or even more) meals that use the same kind of beans so I can do a larger batch.

When I know there’s a meal coming up, I fill up a big pot of water one evening and put the beans in to soak overnight. I just dump in enough so that I know the recipes I intend to make will be well covered. The exact amount of beans depends a lot on the type of bean - some dry beans will double in weight and size with soaking, while others will grow even more. You’ll want to look up the specifics for the type of bean you’re using.

The next day, I drain the water from those beans, rinse them, and put them in the slow cooker with more water. I then cook them on low for a length of time depending on the bean. In general, the smaller the bean, the less cooking time it needs. I look up the type of bean using Google to find out how long to cook it on low. Sometimes, I’ll add seasonings while they’re cooking.

When the beans are done cooking, I remove them from the heat entirely, pour off any excess liquid (I keep the thicker sauce-like liquid; I just want to get rid of the really watery stuff), move them to a resealable container of some kind, and let that cool to room temperature (maybe an hour), then close the container and put it in the fridge. That container will then have all of the cool cooked beans I need for my recipes in the coming days.

Then, when I actually go to cook something, I just pull out my bean container and add them at the appropriate time.

Most of this is completely hands-off. I do other things while the beans soak and when they’re cooking in the slow cooker. For the slow cooker, I usually set a loud timer to tell me when they’re done.

Q9: Handling a child’s “gap year”

My daughter was intending to go to a large state university in the fall but after reviewing their plans for the fall in dealing with coronavirus she decided to take a gap year instead. The university has agreed to postpone her admission to next fall. She plans to spend the year working locally and living with us. However I am concerned that she simply won’t go to school next fall. I am not sure how to handle this. We have money put aside for her in a 529, and we don’t want her to live here as a freeloader if she’s just doing hourly work and not trying to do anything to improve her situation. What advice do you have?

- Erica

If I were in your shoes, I would lay all of this out with her. Make it clear that you’re supportive of her if this is a “gap year,” but that the “gap year” needs to entail at least some effort in getting prepared for some sort of postsecondary education next fall, whether it’s college or trade school or something else. What is she planning to do over the course of this year to help her figure out what she wants to study or, if she’s figured that out, to prepare herself for that field?

If she’s uninterested in doing that, and especially if she doesn’t want to pursue any education after this “gap year,” you should plan on having her move out at the end of that year. It is hard to do, particularly when she may financially struggle at first.

All of this should be made clear in a conversation with her. It’s really hard to tell from this where exactly your daughter is intending to go. She may feel like it’s genuinely not safe to go to college with COVID-19 ongoing, or that the experience and education will be far worse if she goes right now. She may be second-guessing the entire idea of continuing her education or considering a completely different path. I encourage you to be supportive of her if she’s on a path that leads to a meaningful career or entrepreneurship, but if her goals are to work an hourly job and not work toward anything more, having her move out is probably the best option.

As for her 529, there’s no reason to tap it for anything other than education. If she goes to college next fall, use it then; if she chooses not to, it can wait until later in her life or eventually be transferred to her children.

Q10: Inexpensive pocket-sized games?

Do you have any suggestions for inexpensive pocket-sized games? Ideally, ones to play solo and with one other person? Don’t like just staring at screens all the time but don’t want to carry around big board games.

- Brenda

The most cost-effective solution here is a deck of playing cards. There are almost infinite games you can play with a deck of playing cards and you can pick up one for a dollar or two that will sustain many plays. The Bicycle website is a wonderful repository of rules for games you can play with an ordinary deck of cards.

Another solution, one that I used for many years and still do on occasion, is a pocket chess set, like this one. They’re about the size of a cell phone, give or take a little. I carried one of these with me for years, doing chess puzzles (when I was alone) and playing with friends.

There are lots of small card games that fit nicely in a pocket out there. I particularly like Sprawlopolis (1–4 players), Hanabi (2–4 players), Mottainai (2–5 players, best at 2–3, requires some table space), Pentaquark (solo only), Tussie Mussie (2–4 players), and Innovation (2–5 players, best at 2–3, requires some table space). I could actually list a lot of these, as many of them are “camping trip” games for us. I fill up a little box with a lot of games like these and we play them in a shelter when we’re camping and it’s raining.

Q11: Giant ham and turkey suggestion

I was just getting some of our ham out of the freezer and wanted to tell you about it. During holidays when hams or turkeys are on sale like Thanksgiving or Christmas or Easter we buy an enormous one because it’s so cheap. We make it for ourselves and then save many pounds of extra meat frozen. We cut it up and store it in freezer bags with enough for a meal for the two of us. Then we just thaw it and heat it up. We are still eating bags of the ham from Christmas. Also saved the big ham bone and we will use it for soup at some point.

- Ellen

This is a really good idea if you enjoy eating ham or turkey. Rather than getting a ham or turkey that’s just right for your family for a holiday, get a giant one. Cook it, then cut up all the extras and store them for later.

During the holidays, ham and turkey is often on sale at a rate that’s super cheap per pound. A friend of mine gets a free turkey at work each Thanksgiving and a free ham each Christmas, but he doesn’t host holiday meals, so he just cooks them for himself and stores the meat, much as you describe.

Also, my parents used to do this with hams. Whenever there was a ham on sale, they’d buy it and then cut it up into cubes and put those cubes into bags with roughly a pound of ham cubes in each one. This would end up being used for lots of soups in the coming months. We often had ham and bean soup, which was basically great northern beans cooked with cubed ham and a few flavorful vegetables like onions.

Q12: Inexpensive long term isolation ideas

I have lupus. My doctor advised me to minimize my contact with others and basically act like I’m under a shelter-in-place order until there’s a vaccine or a very reliable treatment for COVID-19 which I estimate will take a year or two. Other than going on some walks in areas where I’m sure people won’t be near, I am staying at home. My job allows me to work remotely 100% now so employment isn’t a worry. I am trying to find inexpensive at-home hobbies I can get involved with that don’t have me staring at a screen all the time. I live in a small apartment so I don’t have a ton of space. Hoping you have some ideas!

- Fergie

I spent a few days thinking this one over, trying to make a list of inexpensive hobby ideas that you can take up without leaving your house and without spending time on a screen. Here are the better ones I came up with.

Reading (get books from the library delivered, if possible). Knitting or crocheting. Cooking. Yoga. Other bodyweight exercises. Journaling. Solving spatial puzzles (like a Rubik’s Cube or a Megaminx - trust me, learning how to solve those quickly takes time). Doing jigsaw puzzles. Solving paper puzzles (like sudoku). Studying a subject. Learning a musical instrument (this will require some screen time, but a lot of time without one, too). Painting or drawing. Letter writing. Learning really good card or party tricks, like how to memorize a full deck of shuffled playing cards.

There are fourteen ideas. I had a lot more, but I cut out a lot of them because they were either repetitive or weren’t very good unless you were really into a very narrow thing.

Got any questions? The best way to ask is to follow me on Facebook and ask questions directly there. I’ll attempt to answer them in a future mailbag (which, by way of full disclosure, may also get re-posted on other websites that pick up my blog). However, I do receive many, many questions per week, so I may not necessarily be able to answer yours.

We welcome your feedback on this article. Contact us at [email protected] with comments or questions.

The post Questions About Retirement Savings Priorities, Gas Grills, Gap Years and More appeared first on The Simple Dollar.

Finance

The 10 Best Short Term Investments

Right now, the market is at all time highs, and at some point in the future, it will inevitably pull back. While investing is long term, you might have short-er term goals that require short term investments.

If you’re a young investor and don’t want to see an immediate decline in your portfolio, now’s a good time to consider short term investment options. Short term investments typically don’t see the growth of longer term investments, but that’s because they are designed with safety and a short amount of time in mind.

However, millennials honestly haven’t experienced a prolonged bear or flat market. While the Great Recession was tough, millennials have seen their net worth’s grow. However, in periods of uncertainty, it can make sense to invest in short term investments.

Also, for millennials who may be looking at life events in the near future (such as buying a house or having a baby), having short term investments that are much less likely to lose value could make a lot of sense.

If you’re a young investor looking for a place to stash some cash for the short term, here are ten of the best ways to do it.

1. Online Checking and Savings Accounts

Online checking and savings accounts are one of the best short term investments for several reasons:

- They have higher interest rates than traditional accounts

- They are completely safe: your accounts are FDIC insured up to $250,000

- You can access your money any time and don’t have to worry about losing interest as a result

However, to get the very best rates from online checking and savings account, you typically have to do one of the following:

- Contribute a certain amount to the account (say $10,000 minimum)

- Sign up for direct deposit into the account

- Use your debit card for a certain number of transactions each month

If you’re going to be doing those types of transactions anyway, signing up for one of these accounts can make a lot of sense. And to make these accounts even more attractive, interest rates have been rising the last few months making yields go higher.

Our favorite online savings account right now is CIT Bank. They offer 0.60% APY online savings accounts with just a $100 minimum deposit! Check out CIT Bank here.

Check out the other best high yield savings accounts here.

2. Money Market Accounts

Money market accounts are very similar to online savings accounts, with one exception. Money market accounts typically aren’t FDIC insured. As a result, you actually can earn a little higher interest rate on the account versus a typical savings account.

Money market accounts typically have account minimums that you have to consider as well, especially if you want to earn the best rate.

Our favorite money market account right now is CIT Bank. They offer 0.60% APY money market accounts with just a $100 minimum deposit! Check out CIT Bank here.

Check out our list of the best online bank accounts for your money.

3. Certificates Of Deposit (CDs)

Certificate of deposits (CDs) are the next best place that you can stash money as a short term investment. CDs are bank products that require you to keep the money in the account for the term listed - anywhere from 90 days to 5 years. In exchange for locking your money up for that time, the bank will pay you a higher interest rate than you would normally receive in a savings account.

The great thing about CDs is that they are also FDIC insured to the current limit of $250,000. If you want to get fancy and you have more than $250,000, you can also sign up for CDARS, which allows you to save millions in CDs and have them insured.

Our favorite CD of the moment is the CIT Bank 11-Month Penalty Free CD! Yes, penalty free! Check it out.

We maintain a list of the best CD rates daily if you want to explore other options.

4. Short Term Bond Funds

Moving away from banking products and into investment products, another area that you may consider is investing in short term bonds. These are bonds that have maturities of less than one year, which makes them less susceptible to interest rate hikes and stock market events. It doesn’t mean they won’t lose value, but they typically move less in price than longer maturity bonds.

There are three key categories for bonds:

- U.S. Government Issued Bonds

- Corporate Bonds

- Municipal Bonds

With government bonds, your repayment is backed by the U.S. government, so your risk is minimal. However, with corporate bonds and municipal bonds, the bonds are backed by local cities and companies, which increased the risk significantly.

However, it’s important to note that investing in a bond fund is different than investing in a single bond, and if you invest in a bond fund, your principal can go up or down significantly. Here’s a detailed breakdown of why this happens: Buying a Bond Fund vs. Buying A Single Bond.

If you do want to invest in bonds, you have to do this through a brokerage. The best brokerage I’ve found for both buying individual bonds and bond funds is TD Ameritrade. TD Ameritrade has a bond screener built into it’s platform that makes it really easy to search for individual bonds to buy, and gives you a breakdown of all aspects of the bond.

Also, TD Ameritrade offers a $0 minimum IRA and hundreds of commission-free ETFs.

5. Treasury Inflation Protected Securities (TIPS)

Treasury Inflation Protected Securities (TIPS) are a type of government bond that merits their own section. These are specially designed bonds that adjust for inflation, which makes them suitable for short term investments as well as long term investments. TIPS automatically increase what they pay out in interest based on the current rate of inflation, so if it rises, so does the payout.

What this does for bondholders is protect the price of the bond. In a traditional bond, if interest rates rise, the price of the bond drops, because new investors can buy new bonds at a higher interest rate. But since TIPS adjust for inflation, the price of the bond will not drop as much - giving investors more safety in the short term.

You can invest in TIPS at a discount brokerage like TD Ameritrade. Some of the most common ETFs that invest in TIPs (and are commission-free at TD Ameritrade):

- STPZ - PIMCO 1-5 Year U.S. TIPS Index

- TIP - iShares TIPS Bond ETF

6. Floating Rate Funds

Floating rate funds are a very interesting investment that don’t get discussed very often - but they are a really good (albeit risky) short term investment. Floating rate funds are mutual funds and ETFs that invest in bonds and other debt that have variable interest rates. Most of these funds are invested in short term debt - usually 60 to 90 days - and most of the debt is issued by banks and corporations.

In times when interest rates are rising, floating rate funds are poised to take advantage of it since they are consistently rolling over bonds in their portfolio every 2-3 months. These funds also tend to pay out good dividends as a result of the underlying bonds in their portfolios.

However, these funds are risky, because many invest via leverage, which means they take on debt to invest in other debt. And most funds also invest in higher risk bonds, seeking higher returns.

If you want to invest in a floating rate fund, you have to do this at a brokerage as well. TD Ameritrade is a great choice for this as well. The most common floating rate funds are:

- FLOT - iShares Floating Rate Bond ETF

- FLRN - Barclay’s Capital Investment Grade Floating Rate ETF

- FLTR - VanEck Vectors Floating Rate ETF

- FLRT - Pacific Asset Enhanced Floating Rate ETF

7. Selling Covered Calls

The last “true” investment strategy that you can use in the short term is to sell covered calls on stocks that you already own. When you sell a call on a stock you own, another investor pays you a premium for the right to buy your stock at a given price. If the stock never reaches that price by expiration, you simply keep the premium and move on. However, if the stock does reach that price, you’re forced to sell your shares at that price.

In flat or declining markets, selling covered calls can make sense because you can potentially earn extra cash, while having little risk that you’ll have to sell your shares. Even if you do sell, you may be happy with the price received anyway.

To invest in options, you need a discount brokerage that supports this. TD Ameritrade has some of the best options trading tools available through their ThinkorSwim platform.

Related: Best Options Trading Platforms

8. Pay Off Student Loan Debt

Do you want a guaranteed return on your money over the short run? Well, the best guaranteed return you can get is paying off your student loan debt. Typical student loan debt interest rates vary from 4-8%, with many Federal loans at 6.8%. If you simply pay off your debt, you can see an instant return on your money of 6.8% or more, depending on your interest rate.

Maybe you can’t afford to pay it all off right now. Well, you could still look at refinancing your student loan debt to get a lower interest rate and save some money.

We recommend Credible to refinance your student loan debt. You can get up to a $750 bonus when you refinance by using our special link: Credible >>

9. Pay Off Credit Card Debt

Similar to getting out of student loan debt, if you pay off your credit card debt you can see an instant return on your money. This is a great way to use some cash to help yourself in the short term.

There are very few investments that can equal the return of paying off credit card debt. With the average interest rate on credit card debt over 12%, you’ll be lucky to match that in the stock market once in your life. So, if you have the cash to spare, pay down your credit card debt as quickly as possible.

If you’re struggling to figure out a way out of credit card debt, we recommend first deciding on an approach, and then using the right tool to get out of debt.

For the approach, you can choose between the debt snowball and debt avalanche. Once you have a method, you can look at tools.

First, you need to get financially organized. Use a free tool like Personal Capital to get started. You can link all your accounts and see where you stand financially.

Next, consider either:

- Balance Transfer: If you can qualify for a balance transfer credit card, you have the potential to save money. Many cards offer a promotional 0% balance transfer for a set period of time, so this can save you interest on your credit card debt while you work to pay it off.

- Personal Loan: This may sound counter-intuitive, but most personal loans are actually used to consolidate and manage credit card debt. By getting a new personal loan at a low rate, you can use that money to pay off all your other cards. Now you have just one payment to make. Compare personal loans at Credible here.

10. Peer To Peer Lending

Finally, you could invest in peer to peer loans through companies like LendingClub and Prosper. These aren’t completely short term investments - many loans are for 1-3 years, with some longer loans now available. However, that is shorter than what you’d traditionally want to invest for in the stock market.

With peer to peer lending, you get a higher return on your investment, but there is the risk that the borrower won’t pay back the loan, causing you to lose money. Many smart peer to peer lenders spread out their money across a large amount of loans. Instead of investing $1,000 in just one loan, they many invest $50 per loan across 20 different loans. That way, if one loan fails, they still have 19 other loans to make up the difference.

One of the great aspects of peer to peer lending is that you get paid monthly on these loans, and the payments are a combination of principal and interest. So, after several months, you’ll typically have enough to invest in more loans immediately, thereby increasing your potential return.

We are huge fans of LendingClub as a CD alternative, and you can sign up for LendingClub here.

Frequently Asked Questions

Here are some common questions about short term investments.

What makes a short term investment?

A short term investment is one that has a time frame of less than 5 years. Typically, short term investments are done to be more stable - but at the end of the day, it’s all about time frame.

Are short term investments risky?

They can be. The duration of the investment does not imply less risk. While some short term investments are risk-free (like savings accounts), others are extremely risky (like peer to peer lending).

Who should consider short term investments?

Anyone who is looking for an investment duration of less than 5 years. While it’s common to think people nearing retirement may need a short term investment, any age - including young adults - can benefit.

Is debt payoff an investment?

We think so! Paying off debt is a guaranteed return, especially in the short term.

{"@context":"https://schema.org","@type":"FAQPage","mainEntity":[{"@type":"Question","name":"What makes a short term investment?","acceptedAnswer":{"@type":"Answer","text":"A short term investment is one that has a time frame of less than 5 years. Typically, short term investments are done to be more stable - but at the end of the day, it's all about time frame."}},{"@type":"Question","name":"Are short term investments risky?","acceptedAnswer":{"@type":"Answer","text":"They can be. The duration of the investment does not imply less risk. While some short term investments are risk-free (like savings accounts), others are extremely risky (like peer to peer lending)."}},{"@type":"Question","name":"Who should consider short term investments?","acceptedAnswer":{"@type":"Answer","text":"Anyone who is looking for an investment duration of less than 5 years. While it's common to think people nearing retirement may need a short term investment, any age - including young adults - can benefit."}},{"@type":"Question","name":"Is debt payoff an investment?","acceptedAnswer":{"@type":"Answer","text":"We think so! Paying off debt is a guaranteed return, especially in the short term."}}]}Final Thoughts

Finding short term investments can be tough. It’s a bit counter intuitive to invest, but only for a short period of time. As a result, you’ll typically see investments with lower returns, but also have lower risk of loss.

What are your favorite short term investments?

The post The 10 Best Short Term Investments appeared first on The College Investor.

Finance

Socially Responsible Investing: Is It Also More Profitable?

Since the Dawn of Mustachianism in 2011, the same question has come up over and over again:

I see your point that index fund investing is the best option. But when you buy the index, you’re getting oil companies, factory farm slaughterhouses and a million other dirty stories.

How can I get the benefits of investing for early retirement without contributing to the decline of humanity?”

And in these nine years since then, the movement towards socially responsible investing has only grown. Public pension funds have started to “divest” from oil company stocks, and various social issues like human rights, child labor, climate change or corporate corruption have bubbled to the surface at different times.

And all of this has led to the exploding new field of Socially Responsible Investing (SRI), and a growing array of new ways to do it.

So it seems that this is not just a passing trend - people just might be starting to care a bit more. And since capitalism is just an expression of human behavior, the nature of capitalism itself may be starting to change.

This leads us naturally to the question:

What can I do with my money to help fix the world? And even better, is there a way I can make money in the process of fixing it?

The answer is a good, solid “Probably.”

As long as you don’t get too hung up on getting every last detail perfect, because just like real life, investing is a haphazard and approximate and unpredictable thing. But by understanding the big picture, you can make slightly better decisions on average, which lead to slightly better results. And slightly better results, stacked up consistently over time, can lead to a much better life, or even a much better world.

This is true in all of the main areas we care about - personal wealth, fitness and health, even relationships and happiness. And while your money and investments are certainly not the most important thing in life, they are still worthy of a bit of easy and effective optimization.

So anyway, the first thing to understand with SRI is, “what problem am I trying to solve?”

The answer is, “You are trying to make your investing (especially index fund investing) have a better impact on the world.”

On its own, index fund investing is ridiculously simple. You just get an account at any brokerage like Vanguard, Etrade, Schwab or whatever, and dump all your money into one exchange-traded fund: VTI.

When you do this, you are buying a stake in 3500 companies at once(!), which is both impressive and overwhelming. How do you even know what you are holding?

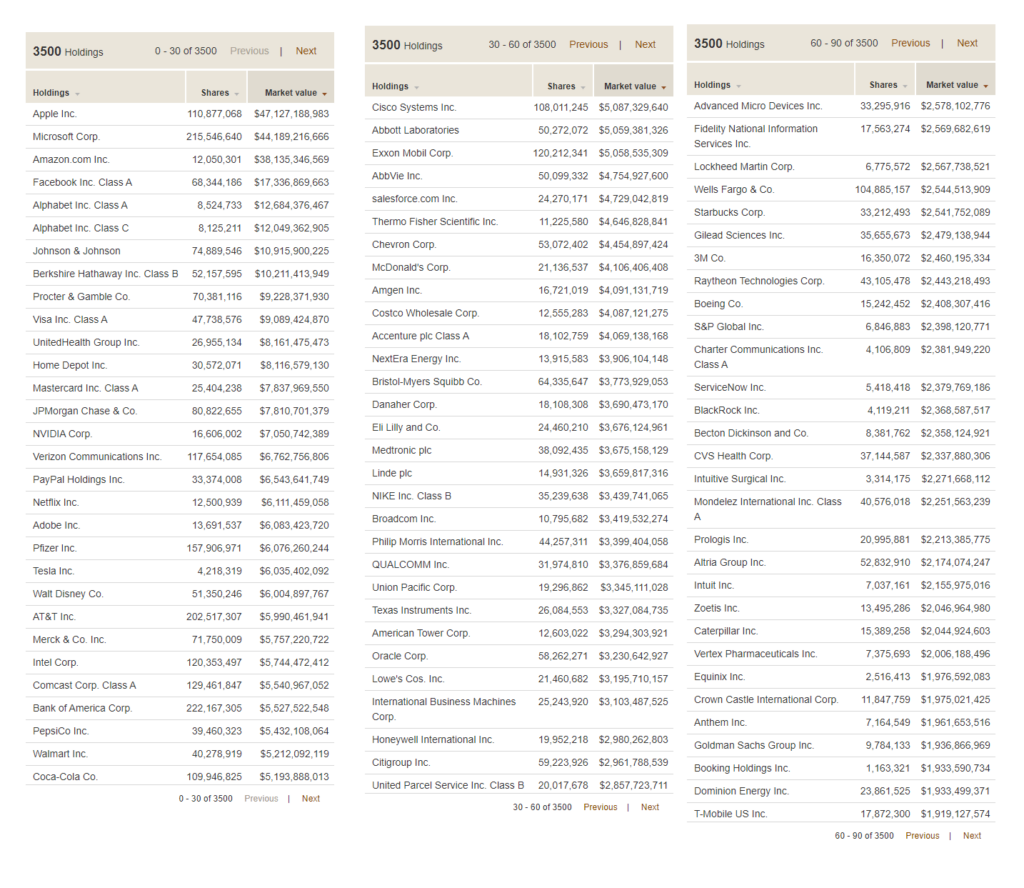

Well, this is all public information, and easily available with a quick Google search. For example, here’s a list of the top 90 holdings in VTI (click for larger):

As you can see, the biggest chunk of money is allocated to today’s tech darlings, because this index fund is weighted according to market value, and these are the most valuable companies in the US today.

Through a convenient coincidence, the total value of the VTI fund happens to be just under $1 trillion dollars, which means you can just throw a decimal point after the ten billions digit of market value to get a percentage. In other words, about 4.7% of your money will go towards Apple stock, 4.4 towards Microsoft, and so on. Together, these top 90 companies are worth more than the remaining 3,410 companies combined, so these are what really drive your retirement account.

And within this list, you will see some of the usual suspects: Exxon and Chevron (oil), Philip Morris (tobacco), Raytheon and Lockheed (bombs), and so on.

But what about the less-usual suspects? For example, I happen to think that sugar, and especially sugar-packed beverages like Coke, is the biggest killer in the developed world - a major contributor to 2 million of the 2.8 million deaths each year in the US alone. Should I exclude that from my portfolio too?

And what about drug and insurance companies - aren’t they behind the political stalemate and high costs of the US healthcare system? Comcast funded some election disinformation campaigns here in my home town in the early 2010s, should I exclude them too? And if you’re part of a religion that is against charging interest on loans, or in favor of pasta and Pirate costumes, or against a spherical Earth, or any number of additional ornate rules, you may have still more preferences.

The higher your desire for perfection, the more difficult this exercise will become. However, if you are like me and you just want to get most of the desired result with minimal effort, you might simply have a look at the Vanguard fund called ESGV.

ESG stands for “Environmental, Social and Governance”, and in practice it just means “We have tried to avoid some of the shittier companies according to some fairly simple rules.”

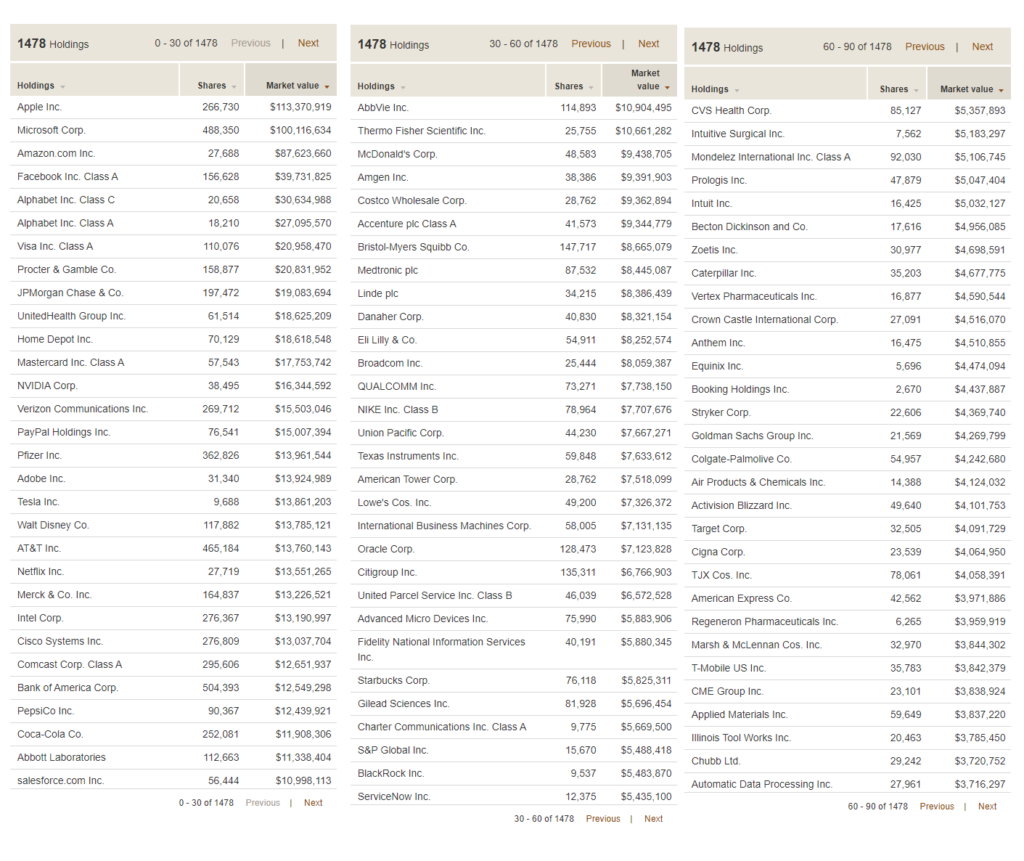

And the result is this:

The first thing you’ll notice is that it’s almost the same. In fact, the top five holdings - Apple, Microsoft, Amazon, Facebook, Alphabet (Google) and Netflix not far behind, collectively referred to as the FAANG stocks - are completely unchanged - and this means that there will be plenty of correlation between these funds.

It’s also the reason that the stock market as a whole has recovered so quickly from this COVID-era recession: small businesses like restaurants and hair salons have been destroyed by the shutdowns, but big companies that benefit from people staying at home and using computers and phones are making more money than ever. The stock market isn’t the whole economy, it’s just the publicly traded companies, which are the big ones.

But let’s look at the biggest differences between the normal index fund versus the social version.

The following large companies listed on the left are missing in the ESGV fund, in order of size. And to make up the difference, the stake in the companies on the right have been boosted up to take their place in your portfolio.

The omission of Berkshire Hathaway was a bit of a shocker, as it is run with solid ethical principles by Warren Buffett, one of the worlds most generous philanthropists. And in fact the modern day nerd-saint Bill Gates is on the Berkshire board of directors, another person whose work I follow and respect greatly.

(side note: Apparently the company fails on the “independent governance” category. And Buffett disputes this category, but in his characteristic way has decided to say, “Fuck it, I’ma just keep doing my own thing with my half-trillion dollar empire over here and you can have fun with your little committee” - I’m paraphrasing a bit but he totally did say that.)

Furthermore, both funds hold the factory meat king Tyson foods, while neither holds Roundup-happy Monsanto, because it was bought by the German conglomerate Bayer AG a while back. Nextera is a giant electric utility in the Southeastern US that claims to be the world’s largest generator of renewable energy. Some do-gooders are against nuclear power, while others (including me) think it’s the Bee’s Knees and we should keep advancing it. And all this just goes to show how nobody will agree 100% on what makes a good socially responsible fund.

But What About The Performance?

In the past, some investors were nervous about giving up oil companies in their portfolio, because while it was a dirty substance, it was also what made the world go round - which meant it was a cash cow.

Now, however, oil is on its way out as renewable energy and battery storage have crossed the cost parity threshold - meaning it’s cheaper to make power (and vehicles) that don’t use oil. In its place, technology is the new cash cow, and tech is heavily represented in the ESG funds. The result:

As you can see, the performance has been similar but the ESG fund has done significantly better in the (admittedly short) time since it was introduced at Vanguard.

Of course, we have no idea if this will continue, but the point is that at least our thesis is not a ridiculous one - environmentally sustainable companies do have an advantage, if the world gradually starts to care more about these things. And if you look at the share price of Tesla and other companies that surround it in electric transportation and energy storage, you will see that there are many trillions of dollars already lining up to benefit from this transition. And the very presence of so much investment money creates a self-fulfilling prophecy, as Tesla is now building or expanding five of the world’s largest factories on three continents simultaneously.

So What Should You Do? (and what I do myself)

First of all, it helps to remember a fundamental piece of economics: your spending dollars will probably have a much bigger impact than your investment dollars. This is because you are sending a direct message to the world rather than an indirect one:

When you buy a new gasoline-powered Subaru (or a tank of gas for your existing guzzler) or a steak at the grocery store, or a plane ticket, you are telling those companies directly that consumers want more of these products, so they will produce more of them immediately.

When you buy shares in Exxon, you are only subtly raising the demand for those shares, which raises the average price, making it ever-so-slightly easier for Exxon to maybe issue more shares in the future. In other words, you are making it easier for them to access capital. But capital is only useful if there is demand for their products. And with oil there is a nearly constant surplus, which is why OPEC and other cartels need to work together to artificially restrict supply, just to keep prices up.

Plus, as a shareholder you are theoretically eligible to place votes and influence the future direction of companies - even companies that you don’t like. If you look up the field of “shareholder activism”, you’ll see this is a tradition that goes way back.

So I have tried to take a few simple steps on the consumer side myself, and I find it quite satisfying: Insulating the shit out of all of my properties, building a DIY solar electric array on one of them, and buying one electric car so far to eliminate local gas burning. And a few electric bikes including a super fast one I made myself.

Each one of these steps has provided a very high economic return, percentage-wise, but that still leaves a lot of money to account for, which brings us back to stock investing.

As someone who loves simplicity, I have done this:

- Bought almost entirely VTI (or similar Vanguard funds) from 2000-2015

- Started experimenting with Betterment in 2015, liked it, and have been adding a percentage of my ongoing savings to that account to that since then. (Note that Betterment now also offers a socially responsible portfolio option.)

- Switched the dividend re-investing of my old Vanguard VTI over to Vanguard ESGV, to avoid “wash sales” in making the most of Betterment’s tax loss harvesting feature.

- Bought some shares of Berkshire Hathaway separately, and also make a few sentimental investments in local businesses, including the MMM HQ Coworking space.

But you could choose to be more hardcore in your ESG/SRI investing:

- Buy your own basket of stocks based on the index, but with different weighting based on your own values

- Spend more money on other things that generate or save money (a bigger solar array on your house, better insulation, electric car, an ebike to reduce car trips, etc.)

- Invest in local businesses of your choice, rental real estate, community solar projects, or other things which generate passive income - publicly traded stocks are just one of many ways to fund an early retirement!

Like most areas of life, investing is not something you have to do perfectly in order to succeed - even socially responsible investing. If you apply the 80/20 rule to get the big picture right, you have probably found the Sweet Spot and you can move on to the next area of life to optimize.

In the Comments:

What is your own investment strategy? Have you thought at all about this ESG / SRI stuff? Did this article bring anything new to the table?

Finance

A second wave is looming over stock markets and investors should be wary

Given what we have seen in broad North American stock market indexes over the past six months, you could make the statement that COVID-19 doesn’t affect markets.

From the bottom in late March until recently, markets have risen steadily despite a backdrop of increasing global COVID cases. The explanation offered repeatedly along the way has been that the economy and the stock market are two different things. Besides, with lower interest rates investors would be foolish to bet against the Federal Reserve. On top of that, all of the significant government financial intervention would protect us from the worst impacts.

All of these comments are and have been true. I have said them myself and believe them. The question is can stock markets continue to rise when COVID-19 isn’t slowing down and may very well be getting worse? The answer is that it is increasingly unlikely.

Back in July, we hosted a webinar with an epidemiologist. At the time, they said it was “almost inevitable” that there would be a second wave of COVID-19. The rationale was threefold:

First, COVID-19 is an active virus with no vaccine or significant treatment, so it is unlikely to just “go away.”

Second, while a first wave saw new cases slow meaningfully, it wasn’t eliminated. Reopening happened while there were still new cases every day. This almost guarantees a second wave, as behaviours returned that increase the spread of COVID-19.

Third, the history of past pandemics shows that a second wave is almost always the case.

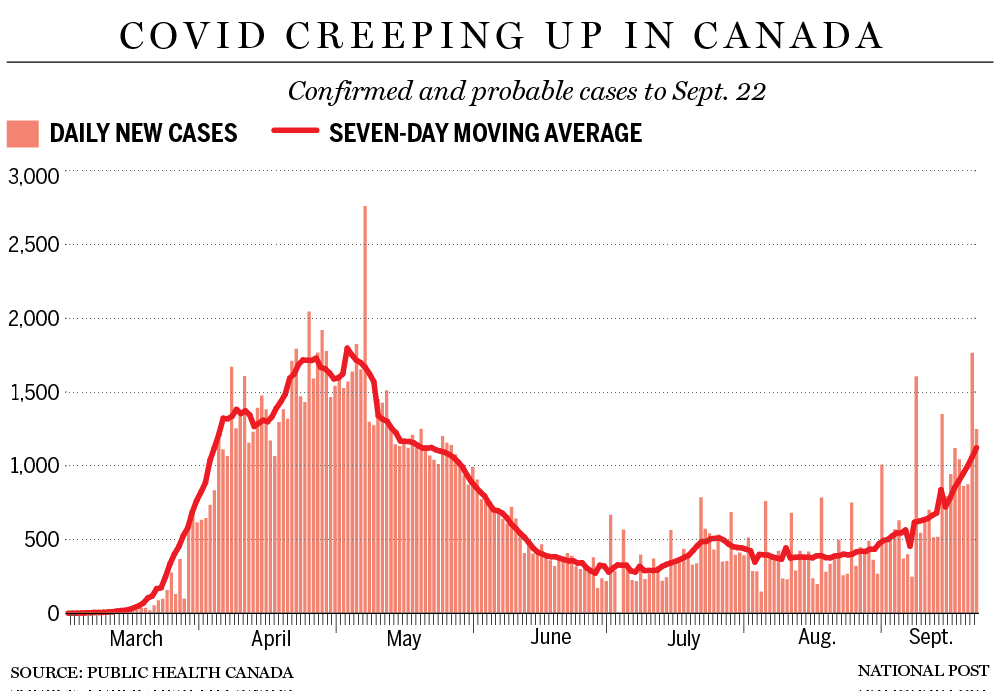

If we look globally, the number of new cases has continued to grow, with daily new cases regularly in the 250,000 to 300,000 range. Globally, there isn’t a second wave because the first wave never ended. Having said this, on a regional basis we are definitely seeing examples of second waves.

To get some sense of what we might face in Canada, it can be instructive to look at Europe, where numbers have meaningfully increased in the past month. If you look at Spain, they went from 10,000 new cases a day in March, to 400 new cases a day in June. Earlier this month they were back at 10,000 new cases a day. There can be no better definition of a second wave than those numbers. The good news is that the death rates have been much lower in this second wave (so far), with numbers 10 per cent to 20 per cent of what they were during the very dark days of March.

The policy response in Spain has been much more muted than the first time around. There is definitely a strong reluctance to shutting down the economy again. There is also a strong reluctance from some citizens and local governments to follow tough rules after going through such a hard time earlier in the year.

In Canada, the number of new COVID-19 cases has grown meaningfully this month. The chart is looking more and more like Spain, although we never had as many cases at the top. Hopefully death rates in Canada will remain much lower than at their peak. How will Canada react to this second wave? Time will tell, but based on our culture and reaction to date, there will probably be a little more willingness to accept tough measures from the government, and to shut some parts of the economy down if deemed necessary.

So what does this all mean for stock markets?

We still have exceptionally low interest rates, which have been a significant driver of strong stock markets. We still have major government spending (which seems to have no end in sight) to help backstop individuals and many companies as they deal with economic challenges. The one thing that we have today that is of concern is that stock markets are currently trading at very high historic valuations. This doesn’t leave you with a lot of room for error. A second wave of COVID-19 in major economic markets could certainly be cause for error. Global trade fights could be cause for error. U.S. political and social battles could be a cause for error. This all makes us cautious even after a dip in markets, like the one we saw on Monday.

When we talk about expensive or cheap stock market valuations, it is usually a form of price-earnings ratio. Essentially, this means that a company’s overall value is a multiple of its earnings or profitability. A more refined version called the Shiller P/E Ratio was developed by economist Robert Shiller.

Historically, a Shiller P/E ratio of 30 or higher has been a very expensive number. In times with very low interest rates, it would make sense that these numbers would get higher, but even over the past three years, this ratio has ranged between 25 and 33. It exceeded 32 at the beginning of September. At the same time, there is concern that corporate earnings growth cannot be maintained if we have more slowdowns caused by COVID-19 around the world. The Shiller P/E ratio is now back just under 30, but in this overall environment, we believe there is room for it to fall a little further.

After Monday’s sell-off, the U.S. tech-heavy Nasdaq was down 13.8 per cent from its level on Sept. 2. The broader-based S&P500 is down 10.6 per cent. The Dow Jones Industrial Average is down 8.2 per cent and the TSX is down 5.3 per cent.

We do not believe the declines are over. For markets to get back to where they were on June 1, the TSX would have to pull back another four per cent, while the Nasdaq would have to tumble another 11 per cent.

It is certainly possible that the declines don’t go that far, but we think there is a decent possibility that they will in the coming weeks. Indices are now back very close to the mid-July levels that we believed were expensive at that time.

As a firm, we do have some cash to invest at the moment, but we are now only dipping our toe in the pool in certain sectors. We are buying a little in utilities and consumer discretionary that we believe are cheap at these prices, but mostly staying on hold. Overall, we will likely be spending a meaningful amount of this cash between now and the end of the year, but mostly as we see some further declines.

We do see some good homes for cash in private credit investments that can take advantage of the high borrowing costs for corporations. Our focus for these investments is through the TriDelta Alternative Performance Fund, where we are aiming for returns in the eight per cent to 10 per cent range. Private credit investments have been quite solid throughout 2020.

We also see some opportunities in fixed-rate preferred shares, with Canadian dividend yields over five per cent and some price stability, and in gold as an alternative asset class given that cash is paying almost nothing and there are increasing concerns about the valuations and even stability of many major currencies.

As for stocks, we are getting a little closer, but mostly still keeping our powder dry.

Ted Rechtshaffen, MBA, CFP, CIM, is president and wealth adviser at TriDelta Financial, a boutique wealth management firm focusing on investment counselling and estate planning. You can contact Ted directly at

.

-

Business2 months ago

Business2 months agoBernice King, Ava DuVernay reflect on the legacy of John Lewis

-

World News2 months ago

Heavy rain threatens flood-weary Japan, Korean Peninsula

-

Technology2 months ago

Technology2 months agoEverything New On Netflix This Weekend: July 25, 2020

-

Finance4 months ago

Will Equal Weighted Index Funds Outperform Their Benchmark Indexes?

-

Marketing Strategies9 months ago

Top 20 Workers’ Compensation Law Blogs & Websites To Follow in 2020

-

World News8 months ago

World News8 months agoThe West Blames the Wuhan Coronavirus on China’s Love of Eating Wild Animals. The Truth Is More Complex

-

Economy11 months ago

Newsletter: Jobs, Consumers and Wages

-

Finance9 months ago

Finance9 months ago$95 Grocery Budget + Weekly Menu Plan for 8