Marketing Strategies

Where to Find Public and Private Small Business Funding in 2020

With the recent passing of a $2 trillion U.S. stimulus package, small business owners impacted by COVID-19 have been given options for low-interest loans, financial assistance, and other aid that can help them in this uncertain economic time.

Aside from this stimulus package, a number of private, state and local institutions have also stepped up to provide aid, assistance, and loans to small business owners suddenly facing unforeseen challenges.

With a number of different options emerging, small business owners might be asking themselves, “Which options am I eligible for?” and “Which funding option is right for my particular business?”

To help business owners and entrepreneurs looking for financing options, we’ve compiled a list of public and private opportunities for small businesses.

National Funding Resources for Small Businesses

Small Business Administration

The Small Business Administration is a federally funded organization that provides loans, debt relief, and other financial aid to small businesses with 500 employees or less.

Currently, the Small Business Administration oversees small business loans from SBA-approved lenders, such as banks. While SBA doesn’t lend money directly to small business owners, it sets guidelines for loans made by its partnering lenders, community development organizations, and micro-lending institutions. This process reduces the risk for lenders, which — in turn — enables more small businesses to receive loans.

Here are a few examples of loans that the Small Business Administration coordinates:

Paycheck Protection Program

This program provides low-interest loans of up to $10 million funded by the recently passed CARES Act. These loans aim to prevent the financial downturn of small businesses impacted by COVID-19. The program assists business owners in paying employee payroll, mortgage payments, or other vital business expenses.

According to the SBA’s site, up to 100% of the loan is forgivable and partial forgiveness will be granted if all employees stay on the payroll for eight weeks or more after a business receives the loan.

Economic Injury Loan Assistance

As part of another emergency preparedness act, small businesses impacted by COVID-19 can apply on the SBA site for a low-interest disaster loan of up to $2 million. Applicants will receive a decision about their loan within three days of applying.

These low-interest loans will have a payback period of up to 30 years, determined by lenders on a case-by-case basis. Each loan’s interest rate will be 2.75% for non-profits and 3.75% for other small businesses.

Standard 7(a) Small Business Loans

The 7(a) loan program is the SBA’s primary program for small businesses. The terms and conditions, like the guarantee percentage and loan amount, vary by the type of loan. These small business loans are often used for smaller startup business costs and are not related to emergencies or disasters.

The 7(a) loan size is usually between $350,000 and $5 million. Lenders are not required to take collateral for loans up to $25,000. For loans over $350,000, the SBA requires a lender to accept as much collateral as possible. This collateral could include a business’ fixed assets, trading assets, or real estate.

Express Small Business Loans

Express loans are similar to 7(a) Small Business Loans in that they max at $350,000 and will require lender collateral. The key difference is that applicants will get a decision and disbursement within 36 hours of applying for the loan. Like other SBA loans, the lender determines the eligibility and the loan’s terms.

For more urgent loans, exporters can apply for an Export Express loan. Applications for these loans, which cap at $500,000, will get a response from lenders within 24 hours.

Aside from the loans mentioned above, SBA also offers assistance for veterans, businesses that require short-term seasonal loans, and small businesses that need loans for international trading purposes.

You can find more about SBA’s standard loan programs here. On the SBA website, you can also find information about SBA lenders.

While SBA primarily provides loans, the administration also works with organizations to provide grants to businesses in certain fields, such as scientific research and development and exporting. Information about these specific grant opportunities can be found on the SBA’s grant page.

Grants.gov

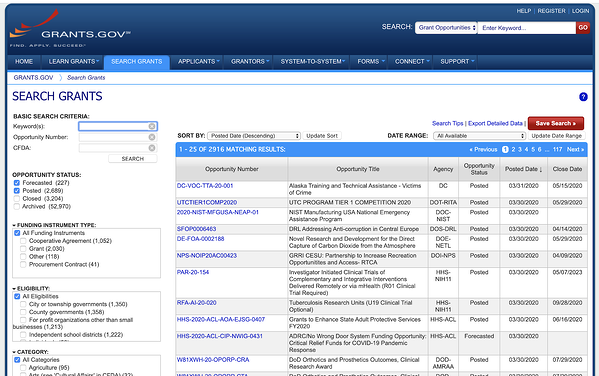

Grants.gov is a comprehensive site that educates grant applicants about funding opportunities and allows them to search a huge catalog of federal, state, and local grants from a variety of different organizations.

While anyone can use the website to find grants for many different purposes, small business owners can filter searches to grants that directly pertain to their company or industry.

Although there are thousands of searchable grants on this database, it’s important to note that many of them focus on non-profits, health, education, or public service. Additionally, many of the grants offered are from federal or state-funded organizations. This means that some for-profit small businesses might have difficulty finding grants related to their field.

Private Assistance and Lenders

In the coming months, many private banks will be offering assistance or special funding opportunities for individuals or small businesses. Here’s a quick rundown of companies with temporary assistance or ongoing small business loan programs:

JPMorgan Chase’s Small Business Pledge

In light of COVID-19, JPMorgan Chase has pledged $2 million to its nonprofit partners around the world and $8 million to “assist small businesses vulnerable to significant economic hardships in the U.S., China, and Europe.”

The banking company says they will be working with community development financial institutions around the world that will provide low or zero-interest loans and interest rate buydowns to owners. JPMorgan Chase will also aim to financially help those who’ve benefited from its Ascend and Entrepreneurs of Color funds.

Along with the aid noted above, Chase and JPMorgan are SBA-approved lenders, meaning they offer many of SBA’s low-interest loan options. They also offer real-estate, equipment, and business trade financing to small businesses.

Small business owners can also apply for short-term loans of up to $5,000. These loans have fixed or adjustable rates and can be paid back between one and seven years.

TD Bank Loans and Lines of Credit

TD Bank offers credit lines, loans, mortgages, and equipment leasing to small businesses.

According to TD, credit lines are best for borrowing $25,000 to $500,000. However, larger lines are available for commercial-sized businesses. Interest rates vary based on the credit line. When paying the money back, credit line recipients have the option to pay towards the overall credit line, or just pay interest-only.

When it comes to loans, mortgages, and equipment leasing, TD Bank says it can lend up to $1 million to small business owners. Similarly to credit lines, larger loans are available for commercial companies.

Like many other financial institutions on this list, TD Bank is an SBA lender and also claims to offer competitive interest rates.

Capital One

Capital One is also an approved SBA lender. Aside from SBA lending, Capital One also offers business installment loans. These loans are fixed-term loans of $10,000 or more.

According to Capital One’s website, the loans require monthly payments with a max payback period of five years. The company also aids small businesses in consolidating debt, so they only have to pay one lender each month.

Wells Fargo’s Small Business Initiative

According to a recent press release from Wells Fargo, the banking chain will soon be offering resources to meet the urgent needs of small businesses impacted by COVID-19.

As part of Wells Fargo’s initiative, the institution will dedicate $2 million “to the deployment of flexible capital in collaboration with Opportunity Fund and will also provide immediate cash boosts and financial coaching support of entrepreneurs and their low-wage workers in coordination with SaverLife.”

Aside from the initiative noted above, Wells Fargo offers three types of loans: unsecured business loans, Equipment Express Loans, and an Advancing Term loan. The first two loans are aimed at one time projects or purchases.

The loans can be for an amount between $10,000 and $100,000 and have payback periods of one to five years or two to six years respectively. The Advancing term loan is a $100,000 to $500,000 working capital loan which requires business assets as collateral.

The banking institution also offers credit lines between $5,000 to $100,000. Interest rates vary depending on the line. No collateral is required for these lines and all businesses that use them are automatically enrolled in Wells Fargo’s rewards program. For larger businesses, which make $2-to-$5-million annually, Wells Fargo also offers a Prime Line valued between $100,000 and $500,000

BlueVine

BlueVine is an organization that provides small businesses with loans between $5,000 and $5 million. Interest rates for loans and credit lines start at 4.8% and vary based on the type and size of loan selected. The company offers three specific types of lending: Credit lines of up to $250,000 with no repayment penalties. term loans of up to $250,000, and Invoice factoring — a credit line specifically for invoices — of up to $5 million.

To apply for a BlueVine credit line or loan, you must have $10,000 in revenue and have been in business for more than six months. The business owner must also have higher than a 600 FICO score. Eligibility information is not noted online for BlueVine’s invoice factoring service.

Once an application is submitted to BlueVine, the lender could respond within five minutes or 24 hours.

Funding Circle

Funding Circle offers small business loans between $25,000 and $500,000. Loans are fixed term and can have a payback period between six months and five years. Interest and origination fees might vary based on the type and size of the loan.

The company says that loan applicants will receive a decision within 24 hours of applying. According to its website, Funding Circle also provides loans for female entrepreneurs, minorities, and small business acquisitions.

Funding Circle is also an SBA-approved lender. According to its website, it will soon be offering loans funded by the Paycheck Protection Program, noted in the CARES Act.

Small businesses that are interested in working with this company to receive Paycheck Protection Program loans can sign up to receive email notifications when applications are launched specifically for it.

It’s important to note that certain Funding Circle loans require a one-time fee before they’re dispersed. When an applicant is approved for a loan, they’ll receive the fee and interest information before being required to commit to the loan.

To receive a loan from Funding Circle, business owners must have an Experian credit score of 660. Additionally, businesses in some industries are ineligible for term loans. These industries include speculative real estate, nonprofit organizations, weapons manufacturers, gambling businesses, and marijuana dispensaries. They also cannot provide loans to businesses in Nevada due to the state’s lending regulations.

PayPal Business Loans

PayPal offers small business loans between $5,000 and $500,000 to companies that have been in business for nine months or more and have a free PayPal Business profile.

According to PayPal’s site, no interest is due on the loan if it is paid back within the first six months. The amount of interest and payback period varies based on the type of loan businesses apply for.

To receive a PayPal loan, businesses must be more than nine months old, earn $42,000 annual revenue, and not have any active bankruptcies. Any business owner in the United States can apply for a PayPal loan, but they must have a FICO score of at least 550. Like Funding Circle, PayPal notes that some industries are ineligible for business loans.

Citi Fee Waivers

For retail customers and small business customers, Citi has waived fees on certificate of deposit withdrawals until May 2020. For small businesses, Citi will also provide waivers for monthly service fees and remote deposit capture.

Additionally, those with a Citi credit card might qualify for a forbearance program which would delay them from needing to pay back their full balance.

State and Local Funding Resources for Small Businesses

State-Funded Programs

Each state offers different benefits, tax exemptions, loans, or grant opportunities for businesses. To learn more about state-based assistance and funding, visit your state department’s website.

For example, small business owners in Massachusetts can visit mass.gov to find information about state-mandated COVID-19 relief. On this page, you’ll find information about Massachusetts’ own relief funding, as well as federal loan options.

Additionally, you can also check out the grants.gov database or this interactive map that allows you to see assistance opportunities by state.

Local Banks and Credit Unions

While many big banks are currently offering loans related to the financial climate, your local bank or smaller chains might also be allowing small business owners to take out loan amounts with interest rates and payback periods that work for them.

Tips for Picking the Right Funding

While the CARES Act and private business initiatives have opened the door to a number of financial opportunities for businesses, there are still a few things small business owners should keep in mind.

First, it’s important to note that some of the loans above might come with fees. For example, you might have to pay a small fee to disburse the loan in the first place.

Secondly, some of these loans do not disperse all at once. For instance, loans of up to $10 million designated by the CARES Act will offer small businesses a cash advance of up to $10,000 before the rest of the funds are dispersed.

Before committing to a loan, small businesses might need to look at their timeline for paying bills and other expenses and make sure that a loan’s disbursement works for them.

Lastly, and most importantly, when accepting a loan, a small business owner agrees to pay it back.

While some loan programs are currently offering deferment or partial forgiveness programs, most will expect all the funds plus interest to be paid back. As business owners research these loans, they should fully understand the payback and interest rate terms before committing. They should also have a financial plan and backup plan for how they will pay off the loans and interest in the future, regardless of whether their business is or is not running.

Disclaimer: This blog post is meant as a basic resource and not a comprehensive guide. We will regularly update it to add more information as funding opportunities become available or change.

Marketing Strategies

Marketing and Selling Procurement Software Products and Services

Procurement software is the automation of the procurement process across a web-based system which allows buyers and sellers to locate each other quickly and submit relevant bids for products and services.

By implementing reliable procurement software or services, it enables a company to stabilize the process of obtaining necessary materials and services at quite affordable rates. Of course, besides the obvious financial advantages, procurement software/service also helps a company to have sustainable economic growth.

Today, we’re going to talk about the ways you can effectively sell your procurement software/services.

To start it off, let’s look at the key benefits of having good procurement.

Improved Spend Visibility

All transaction details are stored and monitored regularly. It gives complete details about the passage of the money regarding the cost, suppliers, and quality and time of delivery of the products, etc.

Cost Savings

A procurement system analyzes the areas where high and low costs are required in acquiring things, which services are purchased regularly, places where the company can save costs, and suppliers who provide the best quality products at lower costs.

Minimizes time and errors

Procurement software works in an automated or semi-automated way thus eliminating the errors and time consumption by manual labor.

Improved Supplier relationships

The suppliers are highly competitive. That puts the company at the liberty of choosing the best suppliers and negotiating the terms based on the company’s demands, concerns, and constraints.

The main reason why we kicked off with the key benefits of procurement software/service is that you need to be able to make your customers understand why it’s important and how it can specifically help their business when you do your sales pitch.

Before you market your software/service, make sure that you know exactly who your key target is going to be. In this case, your key target would be the CFO as his or her imperatives such as margin, risk/controllership, cash flow are directly linked to the CPO and procurement organization of their company.

The typical resistance you will face especially when selling your procurement services is the concern of taking over people’s jobs. So to shed light on this concern, you have to let your customers know that procurement isn’t about eliminating jobs, rather it’s about creating bandwidth for the procurement organization so they can focus on more specific activities all while you, their partner, can focus on driving value on the transactional or fragmented activities.

Another key element of selling this service is to develop a compelling commercial model that shares the risk of the endeavor.

When you finally arrange a meeting with the decision-makers, plan your key points the same way you plan your discussions with marketing directors. Think through the procurement executive’s role and mindset, and make sure that your compensation discussions recognize procurement’s needs and hot buttons.

It may be tricky and it definitely has its hurdles when selling your procurement software/services, but just remember to not over complicate things. Be straightforward but coherent and most importantly, offer solutions rather than just trying to sell your product/service.

This article originally posted at The Savy Marketer.

Marketing Strategies

Dancing with belief

All of us believe things that might be inconsistent, not based on how the real world actually works or not shared by others. That’s what makes us human.

There are some questions we can ask ourselves about our beliefs that might help us create the change we seek:

Is it working?

If your belief is working for you, if it’s helping you navigate a crazy world and find solace, and if it’s not hurting anyone else, it’s doing what it’s supposed to do. Often, beliefs are about finding human connection and a way to tell ourselves about our place in the world, not as an accurate predictive insight as to what’s actually happening. And beliefs are almost always about community, about being part of something.

Is it helpful?

Air traffic controllers and meteorologists rarely believe that the earth is flat. It’s a belief that would get in the way of being competent at their work. If your beliefs are getting in the way of your work, of your health or the health of those around you, or of your ability to be a contributing citizen, it might be worth examining why you have them and how they got there. Did you decide to have these beliefs or did someone with an agenda that doesn’t match yours promote them?

Is it true?

True in the sense that it’s falsifiable, verifiable, testable and predictive. Falsifiable means that the belief is specific enough that something contrary to the belief could be discovered (“there are no orange swans” is a falsifiable belief, because all we need to do is find one orange swan). It’s not necessary for a belief to be scientifically true, in fact, it undermines the very nature of belief to require evidence. Once there’s evidence, then whatever is true is true, whether or not you believe it.

Do you need it to be true?

Which means that much of what we do to somehow prove our beliefs are true is wasted time and effort. If a belief is helping you make your way through the world, if it acts as a placebo and a balm and a rubric, then that’s sufficient. The problems occur when some people use our beliefs to manipulate us, when they prevent us from accomplishing our goals or contributing to the well being of those around us.

What would change your mind?

If we decide that our belief is actually true, we owe it to ourselves to be clear about what would have to happen for us to realize that it’s not. One of the frustrating things about conspiracies and modern memes is that as soon as they’re examined or contradicted, they’re simply replaced with a new variation. It’s one thing to change beliefs because the scientific method shows us a more clear view of what’s happening, it’s totally different to retreat to ever more unrelated stories in the face of reality. Sometimes, it’s easier for people to amend their belief with one more layer of insulation than it is to acknowledge how the world is likely to work.

Marketing Strategies

How to Turn One Piece of Content into Multiple for SEO

Posted by liambbarnes

As most SEO specialists have learned, you must create quality content to grow organically. The same thing can be said for businesses that are building a social media presence or a new newsletter following.

But as people consume more and more content each day, they become less receptive to basic content that doesn’t provide a new perspective. To counter this issue, you must make sure that your content is native to each platform you publish on.

However, that doesn’t mean that you need to start from scratch. There’s a way to take one content idea and turn it into multiple, which can scale across multiple platforms and improve your brand awareness.

It takes time to write a brand-new blog article every day, especially when you’re an in-house team with a low number of resources and budget. The biggest challenge here is building a content strategy at scale.

So, how do you create a lot of great content?

You start with video.

If you have a video on a relevant topic, it can be repurposed into various individual pieces of content and distributed over a period of time across the right channels. Let’s walk through the process.

Using video to scale content

Did you know that the average person types at 41 words per minute (WPM), but the average person speaks at about 150 WPM? That is about 3.5 times faster speaking rather than typing.

In fact, this article was transcribed.

For every article you write about, you must do extensive research, write out your first draft, edit, make changes, and more. It can consume an entire workday.

An easier way to do this? Record yourself on Loom or another video software, save it, and send the video file to an audio/video transcription service. There are so many tools, like Rev.com or TranscribeMe, that do this for relatively cheap.

Of course, even if you’re relying on text-to-speech, there’s still editing time to take into account, and some would argue it will take MORE time to edit a text-to-speech transcription. There isn’t a “best way” to create content, however, for those who aren’t strong writers but are strong speakers, transcription will be a powerful way to move at a quicker pace.

The step-by-step process

Once you write out your content, how do you ensure that people read it?

Like any other content strategy, make sure that the process of planning, creating, and executing is written down (most likely digitally in a spreadsheet or tracking tool) and followed.

Let’s break down how to get the most out of your content.

1. Grab attention with your topic

Sometimes, content ideation can be the most challenging part of the process. Depending on the purpose of your content, there are various starting points.

For example, if you’re writing a top-of-funnel blog article where the goal is to drive high amounts of organic traffic, start by performing keyword research to craft your topic. Why? You need to understand what your audience searches for and how to ensure you’re in the mix of search results.

If you’re creating a breakdown of your product or service, you may want to start by interviewing a subject matter expert (SME) to gain real-life details on the product/service and the solutions it provides to your target audience. Why? Note what they’re saying are the most important aspects or if there is a new feature/addition for the audience. These points can be tied into a topic that might pique the target reader’s interest.

2. Create an outline for the blog

When you’re building out your blog structure, record a video similar to how you would write a blog article.

In this case, by creating an outline for the article with the questions that you ask yourself, it’ll be easier to format the transcription and the blog after you record.

3. Pick your poison (distribution strategy)

Now that you’re ready to begin recording your video, decide where your content will be distributed.

The way you’ll distribute your content heavily influences the way you record your video, especially if you’re going to be utilizing the video as the content itself (Hello, YouTube!).

For example, if you run a business consultancy, the videos that you record should be more professional than if you run an e-commerce surf lifestyle brand. Or, if you know you’re going to be breaking the video up, leave time for natural “breaks” for easy editing later on.

By planning ahead of time, you give yourself a better idea of where the content will go, and how it will get there.

4. Your time to shine

There are numerous free video recording software available, including Zoom and Loom.

With Zoom, you can record the video of yourself speaking into your camera, and you will get an audio file after you hang up your call.

With Loom, you can use the chrome extension, which allows you to record yourself in video form while sharing your screen. If you have additional content, like a Powerpoint presentation or a walk-through, this might be the tool for you.

Regardless of the way that you record, you need an audio file to transcribe and transform into other content formats later on.

5. Transcribe your video

The average writer transcribes one hour of audio in around four hours, but some of the best transcribers can do it in as little as two hours.

To put that into perspective, the average one-hour audio file is about 7,800 words, which would take the average writer around three and a half hours to write.

Additionally, you have to add research time, internal linking, and many other factors to this, so on average it’ll take around an hour to write 1,000 words of a high-quality blog post.

Transcription shortens the length of this process.

When looking to transcribe your audio, you can send files out to transcription tools including Rev or TranscribeMe. Once you send them the audio file, you’ll typically receive the audio file back in a few hours (depending on the demand).

6. Alter transcription into blog format

You’ll receive the transcribed content via email, broken out by speaker. This makes it much easier to format post-transcription.

If you properly outlined the blog prior to recording, then this editing process should be simple. Copy and paste each section into the desired area for your blog and add your photos, keywords, and links as desired.

7. Chop your video into digestible parts

Here’s where things get interesting.

If you’re using your video for social media posts, shorten the video into multiple parts to be distributed across each platform (and make sure they’re built to match each platform’s guidelines).

Additionally, quotes from the video can be used to create text graphics, text-based social posts, or entire articles themselves.

Think of the watering holes that your target audience consumes information on the internet:

- YouTube

Each platform requires creating a different experience that involves new, native content. But that doesn’t mean you have to start at zero.

If you have a 10-minute-long video, it can be transcribed into a 2,500-word blog that takes about 10-15 minutes to read.

Boom. You have another resource to share, which can also include proper keywords so it ranks higher on the SERP.

Let’s say you end up editing the video down to about five minutes. From here, you can make:

- A five minute video to post on YouTube and your blog

- Ten 30-second videos to post across several social media platforms

- Twenty 100-word posts on LinkedIn

- Thirty 50 to 60-word posts on Twitter

Woah.

Not to mention there are other platforms like Reddit and Quora, as well as email marketing, that you can also distribute your content with. (Turn one of the 100-word LinkedIn posts into the opening in your latest newsletter, and attach the full video for those who want to learn more!)

By starting off with an all-encompassing video, you extend your content capabilities from a regular blog article into 50+ pieces of content across multiple social media platforms and search engines.

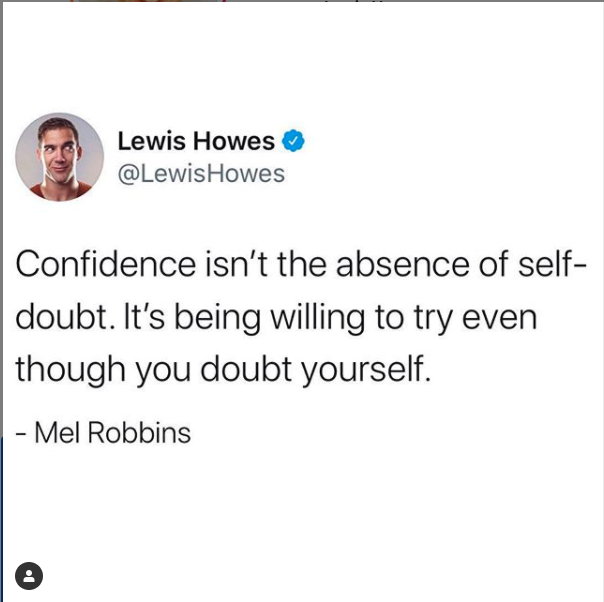

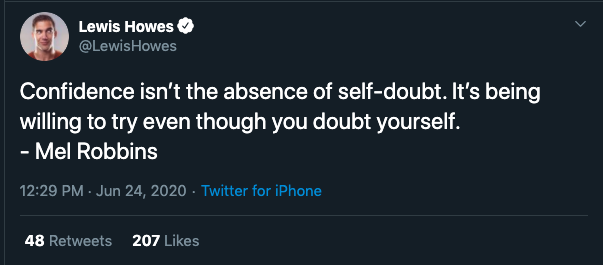

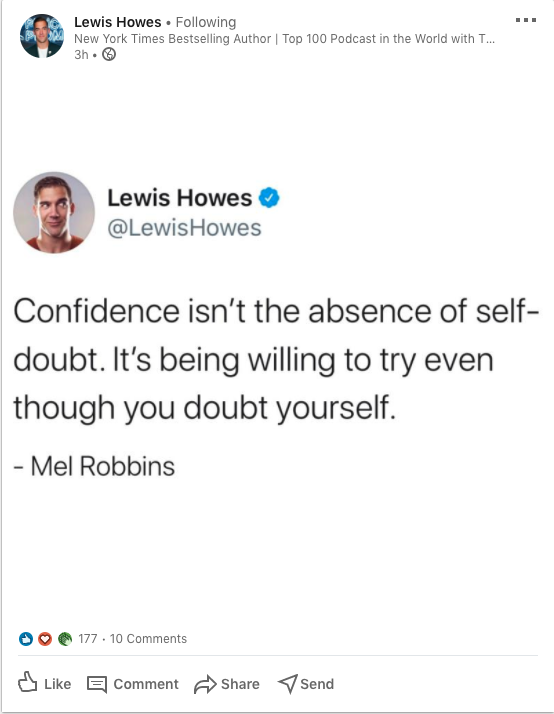

For example, Lewis Howes (and many other brands and marketers) are famous for utilizing this method.

As you can see below, Howes had an interview for his podcast with Mel Robbins, which is scaled across YouTube and podcast platforms, but he took a quote from her in the interview and scaled it across Instagram, Twitter, and LinkedIn.

When you build out your content calendar, simply copy and paste certain sections into an excel spreadsheet, and organize them based on date and platform. Make sure they make sense on the platform, add an extra line or two if you need to, and work your magic.

This will save you hours of time in your planning process.

8. Distribute

Now that you have created your various forms of content, it’s time to make sure it appears before the right eyes.

Having a consistent flow of relevant content on your website and social media platforms is a crucial part of empowering your brand, building credibility, and showing that you’re worth trusting as a potential partner.

As you repurpose older content as well, you can repeat this process and pull together another 50+ pieces of content from a previously successful article.

Improving organic search visibility

“Discoverability” is a popular term in marketing. Another way to say it is “organic search visibility”. Your brand’s search visibility is the percentage of clicks that your website gets in comparison to the total number of clicks for that particular keyword or group of keywords.

Normally, you can improve your visibility through writing a piece of content that reflects a target keyword the best and build links to that page, which improves your rankings for that keyword and long-tail variations of that keyword.

However, as you begin to grow your business, you may begin heavily relying on branded search traffic.

In fact, one of the biggest drivers of organic traffic is branded traffic. If you don’t have an authoritative brand, it’s challenging to receive backlinks naturally, and therefore more difficult to rank organically.

One of the biggest drivers of brand awareness is through social media. More than 4.5 billion people are using the internet and 3.8 billion are using social media.

If you want more people to search for your brand, push relevant social media campaigns that do just that.

But even further than that, we are seeing more and more social media platforms such as Pinterest, YouTube, and Twitter showing up as search results and snippets. For example, below is the SERP for the keyword “how to make cookies”, where a series of YouTube videos show up:

And this SERP for the keyword “Moz“ has the most recent Tweets from Moz’s Twitter.

Writing content that ranks will continue to be important — but as Google keeps integrating other forms of social media into the SERPs, make time to post on every social media platform to improve search visibility and make your brand discoverable.

But, duplicate content?

Duplicate content can be defined as the same content used across multiple URLs, and can be detrimental to your website’s health. However, from what we have seen through multiple conversations with marketers in the SEO world, there is no indication that websites are getting penalized for duplicate content when reposting said content on social media platforms.

Conclusion

Say goodbye to the time drain of creating one piece of content at a time. The most effective way to create a successful content marketing strategy is to share thought-provoking and data-driven content. Take advantage of this process to maximize your output and visibility.

Here are some final tips to take away to successfully launch a content marketing strategy, using this method:

- Consistently analyze your results and double down on what works.

- Don’t be afraid to try new tactics to see what your audience is interested in (Check out a real-world content strategy I helped get results for here).

- Analyze the response from your audience. They’ll tell you what is good and what is not!

Have other ideas? Let me know in the comments!

Sign up for The Moz Top 10, a semimonthly mailer updating you on the top ten hottest pieces of SEO news, tips, and rad links uncovered by the Moz team. Think of it as your exclusive digest of stuff you don’t have time to hunt down but want to read!

-

Business2 months ago

Business2 months agoBernice King, Ava DuVernay reflect on the legacy of John Lewis

-

World News2 months ago

Heavy rain threatens flood-weary Japan, Korean Peninsula

-

Technology2 months ago

Technology2 months agoEverything New On Netflix This Weekend: July 25, 2020

-

Finance4 months ago

Will Equal Weighted Index Funds Outperform Their Benchmark Indexes?

-

Marketing Strategies9 months ago

Top 20 Workers’ Compensation Law Blogs & Websites To Follow in 2020

-

World News8 months ago

World News8 months agoThe West Blames the Wuhan Coronavirus on China’s Love of Eating Wild Animals. The Truth Is More Complex

-

Economy11 months ago

Newsletter: Jobs, Consumers and Wages

-

Finance9 months ago

Finance9 months ago$95 Grocery Budget + Weekly Menu Plan for 8