Share Market

Mindspace REIT IPO Review

Mindspace REIT IPO Details:

Issue Open Date: 27th July 2020

Issue Close Date: 29th July 2020

Equity Shares offered: 6.77 Cr

Price Band: 274-275

Issue Size: 4,500 Cr

Min Lot Size: 200 (Rs. 55,000)

Purpose of the offer

Net Proceeds of the issue are proposed to be utilized in:

- Repayment of certain debt facilities of the Asset SPVs availed from banks/financial institutions

- Purchase of Non-Convertible Redeemable Preference Shares of the company

- Offer for sale to existing investors

About Mindspace REITs

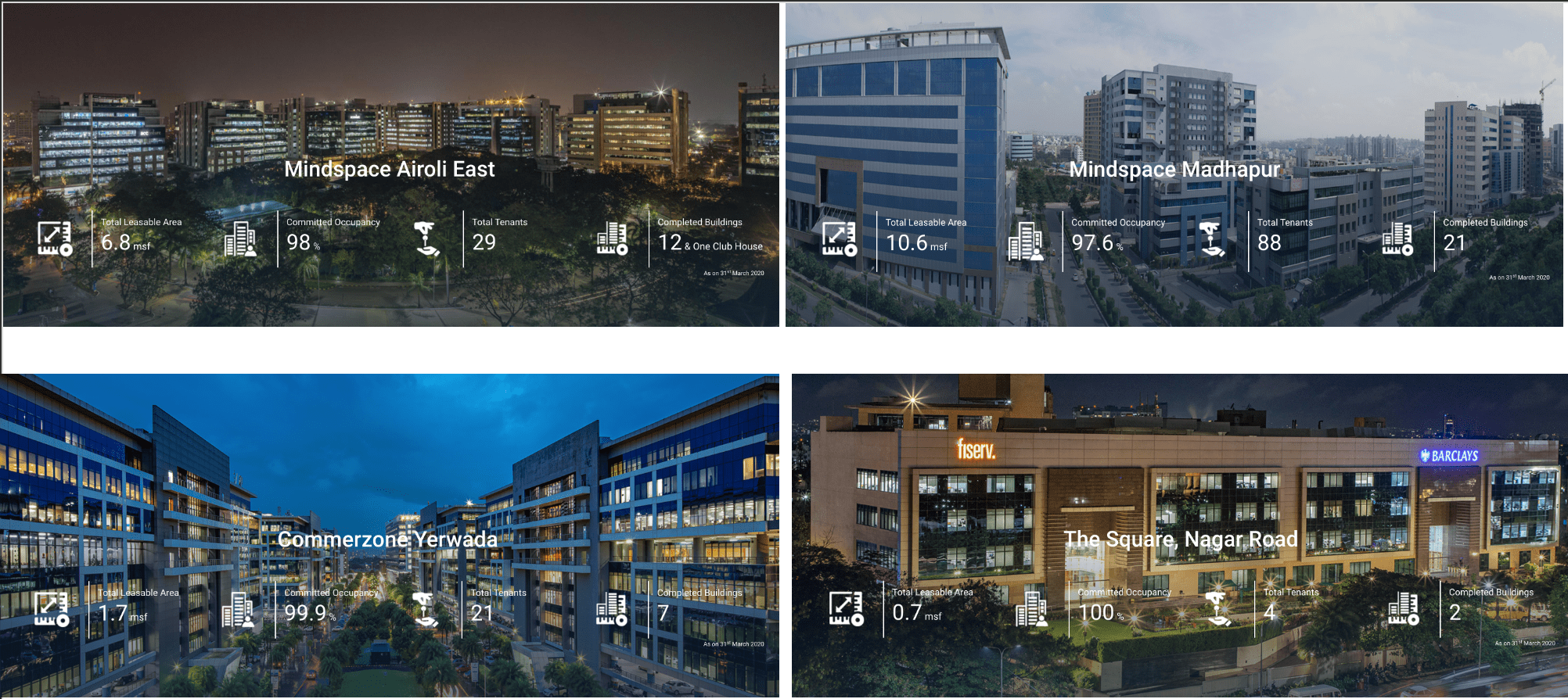

Promoted by Cape Trading LLP and Anbee Constructions LLP (Blackstone & K Raheja Group) Mindspace REIT was registered with SEBI on December, 2019, at Mumbai. Mindspace Business Parks REIT has a quality office portfolio in Mumbai, Hyderabad, Pune and Chennai.

The business parks in Mumbai are Mindspace Airoli East Business Park, Mindspace Airoli West Business Park, Paradigm Mindspace Malad and The Square, BKC(2). The properties in the Pune include Commerzone Yerwada Business Park, Gera Commerzone Kharadi Business Park and The Square, Nagar Road. The Chennai property of the company is Commerzone Porur. And, the office parks in Hydrabad are Commerzone Pocharam and Mindspace Madhapur.

The total leasable area of Mindspace Business Parks is 12.1 msf, 11.6 msf, 5.0 msf and 0.8 msf in Mumbai, Hyderabad, Pune and Chennai, respectively.

With total leasable area of 29.5 msf, it has one of the largest Grades-A office portfolios in India. The under-construction area of the company is 2.8 m sq ft. The future construction of Mindspace Business is spread across Hyderabad, Chennai, and Mumbai in a 3.6 m sq ft area.

MoneyWorks4me Opinion

Mindspace REIT holds premium properties in four different metropolitan cities where demand for commercial properties is high. It has close to 50% property leased to IT and ITes and no particular client contributes more than 8% in gross rentals.

India is experiencing high growth in captive support services of MNCs and existing IT services companies thanks to low cost human resources and English speaking population. This makes commercial REIT attractive as they will have good demand for companies shifting their backend/support to India.

From FY18 to FY20, Mindspace has leased 7.6 msf of office space and grown its portfolio by 4.9 msf primarily through strategic on-campus development. Maintained high occupancy of 92% and saw rental growth of 6.7% CAGR.

Risks

- Due to subdued economic activity, we may see slow employee additions and hence fall in demand for commercial real estate, this may lead to either low occupancy or lower yield due to aggressive negotiations impacting overall distribution (yield) from the REIT.

- Work from Home, currently at nascent stage, can gain traction causing oversupply in commercial real estate market at least in the near term again impacting occupancy and distribution.

Based on stated income distribution (yield) of 7.5%, it may appear reasonably priced but with risk of fall in distribution, limited growth component, this yield is inadequate. We recommend AVOID.

There might be fall in REIT price to reflect better yield as distribution may remain constant while fall in REIT price increases our Return on Investment. We will be tracking the REIT for investment at a later date.

We are very positive on the opportunity available to invest in Real Estate through REIT, but we are cautious to make any decision about making a Real Estate investment today due to i) lower yield, ii) uncertainty on near to medium term trend in real estate iii) limited growth avenues within this REIT to compensate paying up.

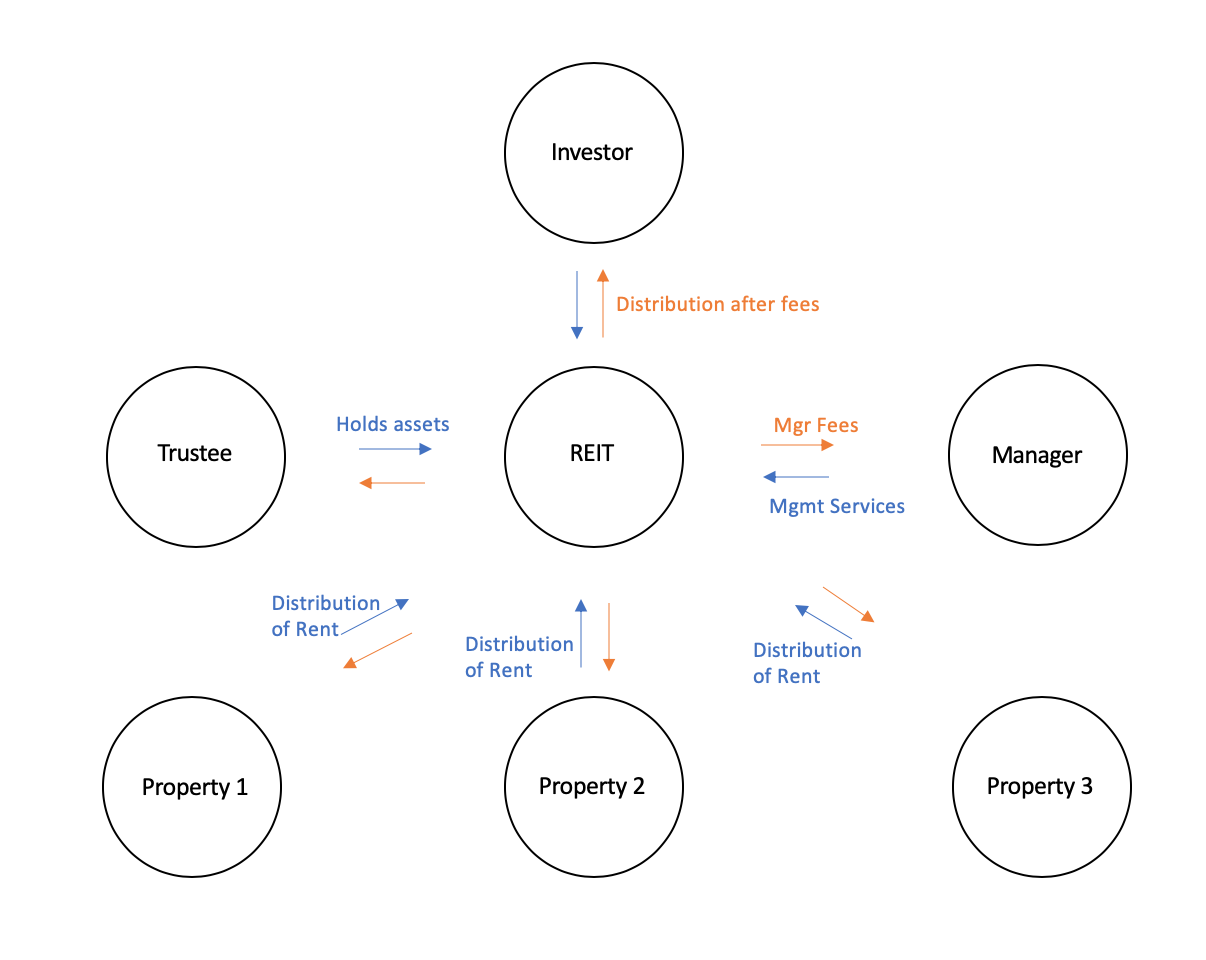

What is REIT?

REIT is a pool of developed assets held and protected by Trustee. It receives rental from lessee and managers handle the collection and maintenance of facilities. This is closet to holding actual real estate in exchange of earning a rent on the same. Usually commercial real estate are best to own as they accrue better rental yield and growth in yield in lines with inflation, assuming no competition or demand issues.

Real Estate as an asset class provides non-correlated returns to equity and gold. It also has regular income similar to Fixed income. Investors with smaller surplus (less than Rs. 3-5 Cr) can diversify their assets into real estate through REIT as smaller portfolio can’t invest in real estate directly due to large ticket size of property. For larger portfolio, investing in 1-2 commercial properties or shops is a good way to diversify their savings.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

The post Mindspace REIT IPO Review appeared first on Investment Shastra.

Share Market

No Respite for Aurora Cannabis (TSX:ACB) Investors

The shares of the top pot producer Aurora Cannabis (TSX:ACB)(NYSE:ACB) soared more than 15% on Tuesday on higher expectations of its quarterly earnings. However, it was again the same, old story from Aurora. It reported a weaker-than-expected revenues and posted one of the biggest losses in history.

Aurora Cannabis: Yet another disappointing quarter

For fiscal Q4 2020, Aurora Cannabis reported $72 million in revenues, a decline of more than 5% from the previous quarter. Its net loss jumped to $1.8 billion driven by goodwill writedowns and asset impairment charges. The company reported $2.9 billion in impairment charges in the entire fiscal year 2020.

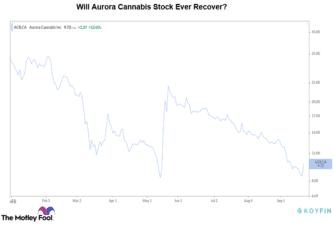

The recent gains of the top pot stock might evaporate, given Aurora’s disappointing results. Once investors’ favourite, Aurora Cannabis stock has lost almost 70% so far this year.

The company management expects $62 million in revenues for Q1 2021, lower compared to the recently reported quarter. According to management guidance, Aurora Cannabis was expected to turn EBITDA positive by Q1 2021. However, now the target has been pushed back by a quarter. On the net income front, Aurora has reported a loss for the last seven straight quarters.

Aurora announced the closure of several production facilities in June in order to increase efficiency. It currently operates an annual production capacity of 142,000 kg per year.

Aurora Cannabis was successful in lowering its production costs during the fiscal fourth quarter. It spent around $0.89 to produce a gram of cannabis, lower from $1.22 per gram in the earlier quarter.

Concern for investors

Too many players amid lower-than-expected demand have dominated the marijuana industry in the last few years. The industry once looked promising due to its steep growth prospects, but the industry as a whole has been on a decline lately.

Aurora Cannabis has some of the geographically diversified operations across the globe. However, its international sales have failed to pick up and continued to burn cash. Along with falling stock price, Aurora’s continued losses and declining revenue growth might bother investors. Additionally, a prolonged equity dilution will also be one of the major concerns for them.

A higher number of retail shops, along with an innovative recreational product range, should boost Aurora Cannabis’s sales. Product differentiation will be vital here, as many pot players are working on launching similar goods. Notably, top-line growth and consistent efforts on pruning operating costs will help the company reach breakeven.

Declining stock price

Aurora Cannabis still seems far from turning profitable. The top pot stock has dug a deep hole in investors’ pockets in the last few years. While Aurora stock has lost around 90%, cannabis stocks at large have lost approximately 55% in the last 12 months.

Aurora Cannabis is currently trading at a forward price-to-sales valuation multiple of four. This looks expensive against its average historical valuation as well as compared to peers. The stock will likely continue to trade volatile and could be a risky bet for conservative investors.

Where should you invest $1,000 today?

The 10 Best Stocks to Buy This Month

Renowned Canadian investor Iain Butler just named 10 stocks for Canadians to buy TODAY. So if you’re tired of reading about other people getting rich in the stock market, this might be a good day for you.

Because Motley Fool Canada is offering a full 65% off the list price of their top stock-picking service, plus a complete membership fee back guarantee on what you pay for the service. Simply click here to discover how you can take advantage of this.

More reading

- Aurora Cannabis Q4 Earnings: Where Did Things Go Wrong?

- Aurora Cannabis (TSX:ACB): The Perfect 5-Year Contrarian Bet?

- Why Aurora Cannabis (TSX:ACB) Stock Gained 15% Yesterday

- TSX NEWS: Why These 2 Stocks Rose by Over 5% On Tuesday

- Is Aurora Cannabis (TSX:ACB) Stock a Buy Before Tuesday Earnings?

Fool contributor Vineet Kulkarni has no position in any of the stocks mentioned.

The post No Respite for Aurora Cannabis (TSX:ACB) Investors appeared first on The Motley Fool Canada.

Share Market

Which Way Wednesday – Fed Edition

And once again the Futures are up.

As you can see from the S&P chart, we have had some massive gaps up in the thinly traded open and then drifted down during real trading at the end of the day. This is like someone who works for the auction house shouting "100 Million Dollars" on the first bid for a painting to make sure the other suckers in the audience start bidding higher.

In the case of the markets, the Banksters buy up the Futures on thin trading (so it's very cheap to do) and cause the Retail Suckers to pour in and chase the momentum so the Banksters can dump their stocks all day long during real volume trading. This is how rich people exit the market - they create a buying atmosphere and they take their profits while poor people follow their advice - which doesn't actually apply to their own actions. You see the big brokerage houses doing that all the time, exiting positions while their analysts are pumping the Tesla stock.

We had a good day yesterday shorting the Dow (/YM) Futures from our trade idea in the Morning Report and congratulations to all who played along. Our morning call for our Members was:

We had a good day yesterday shorting the Dow (/YM) Futures from our trade idea in the Morning Report and congratulations to all who played along. Our morning call for our Members was:

So we're sticking with our strategy of shorting the indexes (which didn't work yesterday) as we're likely to be rejected here (Dow (/YM) 28,100, S&P (/ES) 3,405, Nasdaq (/NQ) 11,475 and Russell (/RTY) 1,550) and, as usual, we can just short the laggards, which would be /ES crossing below 3,400 and /YM confirming below 28,000 - we should catch a quick ride down but the Fed goes tomorrow and that should give the marketsupport until they are disappointed by that so tight stops above!

As you can see, this wasn't rocket science, the pivot points on the Dow were 28,014 and 27,795 and we simply allowed for the pre-market BS pump job and took a stab at shorting early but once we confirmed the move below 28,000, it was a no-brained to jump in for the 200-point drop on the Dow (at $5 per point, per contract!). This morning we're back to 28,000 again but we have a Fed Meeting at 2pm so it's not a good day to play the futures - too volatile.

Speaking of volatile,

IN PROGRESS

Share Market

The IPOX® Week, September 21th, 2020

- Futures and Options expiration week delivers pain for most global equity investors, strong gains for investors in IPOX Strategies. IPOX SPAC Index (SPAC) extends big run-up.

- IPOX 100 U.S. (ETF: FPX) adds +1.73% to +15.32% YTD. IPOX International (ETF: FPXI) rises +1.98% to +43.52% YTD. IPOX Europe (ETF: FPXE) adds +2.00% to +16.07% YTD.

- More U.S. deals lined up as IPO window open in Europe

Track the performance of U.S. SPACs live with the IPOX® SPAC Index (BBG: SPAC, Reuters: .SPAC): The liquid IPOX SPAC (SPAC) added +3.81% last week, to +19.31% since its 07/30 live launch, outperforming the S&P 500 (SPX) and Russell 2000 (RTY) anew. SPAC news include: 1) fleet electrification solution provider XL Fleet to merge with Pivotal Investment Corp II; 2) 9 SPACs launched last week and at least 12 new SPACs filings include Apollo sponsored Apollo Strategic Growth Capital; 3) Playboy Enterprises explores “going public” via SPAC merger.

Expiration week delivers pain for most global equity investors, strong gains for investors in IPOX. U.S. Futures and Options expiration left investors in the IPOX Strategies (ETFs: FPX, FPXI, FPXE) towards

the top of the weekly performance rankings, as U.S. equity risk declined (VIX: -3.87%), rates steadied, and large-cap U.S. technology stocks drifted anew (NDX: -1.36%). In the U.S., e.g., the broad-based IPOX 100 U.S. (ETF: FPX), benchmark for U.S. IPO and Spin-off performance, added +1.73% to +15.32% YTD, extending the YTD/YY lead vs. the S&P 500 (SPX) to +1257 (857) bps. Strength extended to markets abroad, with the IPOX International (ETF: FPXI) and IPOX Europe (ETF: FPXE) all rising. Strength in IPOX-tracked specialty exposure often untracked in the conventional portfolios drove the good showing, including Michael Jordan-backed SPAC IPOX 100 U.S. member (ETF: FPX) online entertainment services provider DraftKings (DKNG US: +33.60%), online collaborations platform operator Zoom Video (ZM US: +14.55%), Dutch Payment processor Adyen (ADYEN NA: +10.76%) and key Saudi Arabia’s health care services provider Dr. Sulaiman Al-Habib (SULAIMAN AB: +6.86%). Corporate Actions and seasonality pressured select names including security services firm ADT (ADT US: -20.07%) and outdoor products/services providers vehicle maker Camping World (CWH US: -12.72%) and cooler maker Yeti (YETI US: -8.68%).

| Select IPOX® Indexes Price Returns (%) | Last Week | 2019 | 2020 YTD |

| IPOX® Indexes: Global/International | |||

| IPOX® Global (IPGL50) (USD) | 1.87 | 27.93 | 37.88 |

| IPOX® International (IPXI)* (USD) (ETF: FPXI) | 1.98 | 31.37 | 43.52 |

| IPOX® Indexes: United States | |||

| IPOX® 100 U.S. (IPXO)* (USD) (ETF: FPX) | 1.73 | 29.60 | 15.32 |

| IPOX® ESG (IPXT) (USD) | 3.05 | - | - |

| IPOX® SPAC (SPAC) (USD) | 3.81 | - | - |

| IPOX® Indexes: Europe/Nordic | |||

| IPOX® 30 Europe (IXTE) (EUR) | 2.11 | 34.55 | 21.70 |

| IPOX® Nordic (IPND) | 2.54 | 38.52 | 36.02 |

| IPOX® 100 Europe (IPOE)* (USD) | 2.00 | 30.97 | 16.07 |

| IPOX® Indexes: Asia-Pacific/China | |||

| IPOX® Asia-Pacific (IPTA) (USD) | 3.34 | 4.41 | 32.49 |

| IPOX® China (CNI) (USD) | 2.25 | 26.31 | 51.61 |

| IPOX® Japan (IPJP)** (JPY) | 3.05 | 37.91 | 12.82 |

* Basis for ETFs: FPX US, FPX LN, FPXE US, FPXU FP, FPXI US, TCIP110 IT and CME-traded e-mini IPOX® 100 U.S. Futures (IPOM0). Source: Bloomberg L.P. & Refinitiv/Thomson Reuters. For IPOX Alternative Strategies Returns, please contact [email protected]

| DRAFTKINGS | 33.60 | NETWORK INTERN’TL | -32.69 |

| STILLFRONT GROUP | 19.53 | GOOSEHEAD INSUR. | -20.50 |

| TESLA | 18.63 | ADT INC | -20.07 |

| MYOKARDIA | 18.23 | CAMPING WORLD | -12.72 |

| ADC THERAPEUTICS | 17.63 | INARI MEDICAL | -11.01 |

| ZEALAND PHARMA | 15.43 | YETI HOLDINGS | -8.68 |

| ADAPTIVE BIOTECH | 15.21 | SOFTWAREONE | -8.07 |

| SHOP APOTHEKE EUROPE | 15.05 | PINDUODUO | -5.82 |

| ZOOM VIDEO | 14.55 | FARFETCH | -5.75 |

| ARGENX SE | 13.89 | REYNOLDS CONSUMER | -5.47 |

IPO Deal-flow Review and Outlook: At least 26 firms IPO’d across the eligible global markets last week, with the average (median) equally-weighted deal adding +57.67% (+11.81%) based on the difference between the final offer price and respective Friday’s close. U.S. cloud data warehouse Snowflake (SNOW US: +100.00%), DevOps software developer JFrog (FROG US: +47.23%), game software company Unity (U US: +31.44%) and portable dialysis firm Outset Medical (OM: +122.26%) all surged on debut. Abroad, Canadian payment firm Nuvei (NVEI CN: +77.50%) and British e-commerce unicorn The Hut Group (THG LN: +18.40%) also recorded strong gains, while Kuwait stock exchange operator Boursa Kuwait (BOURSA KK: +939.00%) rose more than tenfold. While high-profile data analytics unicorn Palantir (PLTR US) pushed its Direct Listing to month-end, select key deals lined up include Silver Lake-backed telemedicine firm GoodRx (GDRX US), PE-backed motorhome maker Knaus Tabbert (KTA GR) and German defense supplier Hensoldt (5UH GR). Other IPO news include: 1) Macquarie prepares IPO for its data analytic company Nuix; 2) mortgage lender LoanDepot to revive IPO plan; 3) TikTok weighs U.S. IPO upon U.S. ban whereas its rival Kuaishou mulls $5B Hong Kong IPO; 4) more homecoming secondary offerings from U.S.-listed Chinese companies include Zai Lab, ZTO Express, Baozun, and Huazhu.

Track global deal flow live on: https://bit.ly/32zolmG

The post The IPOX® Week, September 21th, 2020 appeared first on Low Cost Stock & Options Trading | Advanced Online Stock Trading | Lightspeed |.

-

Business2 months ago

Business2 months agoBernice King, Ava DuVernay reflect on the legacy of John Lewis

-

World News2 months ago

Heavy rain threatens flood-weary Japan, Korean Peninsula

-

Technology2 months ago

Technology2 months agoEverything New On Netflix This Weekend: July 25, 2020

-

Finance4 months ago

Will Equal Weighted Index Funds Outperform Their Benchmark Indexes?

-

Marketing Strategies9 months ago

Top 20 Workers’ Compensation Law Blogs & Websites To Follow in 2020

-

World News8 months ago

World News8 months agoThe West Blames the Wuhan Coronavirus on China’s Love of Eating Wild Animals. The Truth Is More Complex

-

Economy11 months ago

Newsletter: Jobs, Consumers and Wages

-

Finance9 months ago

Finance9 months ago$95 Grocery Budget + Weekly Menu Plan for 8