Economy

IPA’s weekly links

Guest post by Jeff Mosenkis of Innovations for Poverty Action.

Some student-created infographic examples from the Communicating Economics website.

- Communicating Economics is a site with tools, tips, and videos of in-person college level lectures on, well, pretty much what the title says. It comes from the person behind Econ Films, whom I’ve worked with before and are very good at at what they do.

- A Belgian court has cleared the way for the remains of the first Prime Minister of an independent Republic of Congo (now the DRC) to be returned to his family. In 1961 Patrice Lumumba had been in the job for three months when the Belgian government had him killed, along with two family members. And his “remains” consists of a tooth, because the Belgian authorities also ordered his body to be dissolved in acid. Longer story (for those with strong stomachs) here.

- An interesting paper by Obie Porteous, analyzing 27,000 econ papers about Africa finds:

“45% of all economics journal articles and 65% of articles in the top five economics journals are about five countries accounting for just 16% of the continent’s population. I show that 91% of the variation in the number of articles across countries can be explained by a peacefulness index, the number of international tourist arrivals, having English as an official language, and population.”

The “big five” locations that dominate Western econ are Kenya, Uganda, South Africa, Ghana, and Malawi. On Conversations with Tyler recently, Tyler Cowen asked Nathan Nunn about this (particularly as relates to RCTs). Nunn responded that it’s very difficult to set up a research infrastructure, but once it’s there, it’s hard to go somewhere new and start again, and admitted that even though he doesn’t do RCTs he’s fallen into the same pattern.

- A cool-looking paper from Agyei-Holmes, Buehren, Goldstein, Osei, Osei-Akoto, & Udry looks at a land titling program in Ghana (I know, see above, but to be fair, I know that at least Udry’s been doing research in Ghana for 30 years, and two of the authors are at Ghanaian institutions). The paper looks at how giving formal ownership to farmers increased their investments into their land and agricultural output. Except that it did the opposite - interestingly, when people got titles to the land, the value of the land increased and the owners, particularly women, shifted to other types of work, and business profits went up.

The post IPA’s weekly links appeared first on Chris Blattman.

Economy

When Your Safety Becomes My Danger (Ep. 432)

The families of U.S. troops killed and wounded in Afghanistan are suing several companies that did reconstruction there. Why? These companies, they say, paid the Taliban protection money, which gave them the funding — and opportunity — to attack U.S. soldiers instead. A look at the messy, complicated, and heart-breaking tradeoffs of conflict-zone economies.

Listen and subscribe to our podcast at Apple Podcasts, Stitcher, or elsewhere. Below is a transcript of the episode, edited for readability. For more information on the people and ideas in the episode, see the links at the bottom of this post.

* * *

Gretchen PETERS: I’ve heard the argument that paying protection money was part of the cost of doing business in Afghanistan. And I think it is a terrible, terrible argument. It’s just self-defeating for an organization to pay protection money and not deal with the problem from the start.

Gretchen Peters calls herself a recovering journalist:

PETERS: I spent about two decades mostly covering conflict areas in some of the world’s garden spots.

Including Pakistan and Afghanistan. And these days:

PETERS: I’m the executive director of the Center on Illicit Networks and Transnational Organized Crime.

Also known as CINTOC. So, Peters is still focused on Afghanistan. Of particular focus are the reconstruction projects, run by U.S. and other Western firms, that have built highways, hospitals, and schools. And while paying protection money is a terrible model, she says, it often is the model. She recalls the story of a construction manager working there:

PETERS: He got a phone call one day from one of his team members saying the Taliban just fired a couple of R.P.G.’s at our project. Nobody’s been hurt. And so, he called up the Taliban commander and said, “What’s the problem? You told us you weren’t going to attack us anymore.” And he said, “No, no, nobody got hurt. We intentionally missed. But your payment’s due. You need to get over to the hawala market and send me my money.” And he said, “Oh, yes, I’m so sorry.” And went over and paid the money right away.

For the Taliban, Peters says, this is standard operating procedure.

PETERS: So, the Taliban would fire warning shots when the bills were due. And they would often launch non-lethal attacks just before a contract was due. And that seemed to be an effort to try and get their security contracts renewed. And that would perpetuate this completely corrupt system.

Underneath what Gretchen Peters calls this “completely corrupt system” lies a fundamental economic question:

Anja SHORTLAND: So, the question is, “Do you want to be economically active in territory that is controlled by the Taliban or not?”

That is the economist Anja Shortland.

SHORTLAND: If you do want to be active in that territory, you’ve got to make it somewhat in the interest of the Taliban. If they don’t get any economic benefit from your company being there, then they will attack you by any means possible.

But if the Taliban gets an economic benefit from, let’s say, your construction company in the form of protection money, what happens to my company if I don’t pay? And what happens to the U.S. military personnel who are also on the ground? A lawsuit brought by the families of U.S. soldiers killed by the Taliban says the companies who pay protection money are in part responsible for those deaths. Today on Freakonomics Radio: when your safety becomes my danger. It is a messy, complicated, and heart-breaking issue.

SHORTLAND: You probably can’t say, “I don’t care what happens to my employees.”

Carter MALKASIAN: Even though you don’t want it to happen, you’re going to cause some harm to innocent people.

August CABRERA: The headline was “17 killed outside of Kabul and a suicide bomber.” And I collapsed. And I said, “He’s gone.”

* * *

In 2007, the Taliban kidnapped 21 South Korean missionaries in Afghanistan. Many countries, including the U.S., do not officially pay ransoms. But South Korea does — in this case, a reported $10 to $20 million, and the hostages were promptly released. The Taliban then advertised that they used this money to fund their insurgency against U.S. and other coalition troops. The threat of kidnapping in conflict zones explains why most Fortune 500 companies buy kidnap insurance. But in most places — including Afghanistan — the real money comes from not kidnapping people.

SHORTLAND: Well, the way I view kidnapping is as a way of backing up demand by a protection racket.

That again is the economist Anja Shortland, from Kings College, London.

SHORTLAND: You minimize the kidnapping by making sure that the people who control the territory get a certain flow of funds.

Funds in the form of a protection payment.

SHORTLAND: That is actually 99 percent of the business. So, it is disequilibrium behavior — as long as everyone pays, there is no need to kidnap anybody.

Shortland has written a book called Kidnap: Inside the Ransom Business. She studies what she calls “tricky markets.”

SHORTLAND: I started off with Somali pirates, and what really struck me about piracy was how many happy ends there were. How generally nonviolent it was from the moment that the pirates got on board, and how well the trades functioned.

While Somali piracy or Taliban protection schemes may be “tricky” markets, they are fundamentally markets.

SHORTLAND: I do find that if they work, then it is because somebody is making them work, somebody is creating institutions that turn what can be very tricky, one-off trades into repeated interactions. It’s about creating self-enforcing contracts.

“Self-enforcing contracts” meaning a protection arrangement paid by a shipping company or a construction company. The company agrees to pay the protector as long as their workers and projects aren’t attacked, and the protector won’t attack as long as they’re being paid.

Who supplies this protection differs from place to place. In some countries, it’s the government itself; sometimes it’s a criminal cartel with government connections; or as in the case of Al-Shabaab in Somalia, it’s a terrorist group that provides the kind of services that governments typically provide: protecting property rights, for instance, and enforcing laws. This gives them populist support and, therefore, the leverage to set up their own tricky markets.

SHORTLAND: When there is a famine in southern Somalia, and you want to get relief supplies in there, basically, you have to contract the trucking out and you have to accept that 50 percent of the supplies will disappear. So, the question is, “Do you want to provide relief supplies, knowing that a large proportion of it will end up in the hands of the Shabaab?” If you say no, then there is no way of delivering the aid.

In most places, Shortland has found the relationship between protection agreements and kidnapping is predictable: a kidnapping is the result of a failure of the protection protocol.

SHORTLAND: That’s right. Or you’re trying to establish a protection protocol. But in general, it’s better for them to take their protection money and not bother anybody. And so, even if you’re working in a country that has an endemic kidnapping problem, it is possible for companies to keep their employees safe from kidnap by making some concession to whoever poses the risks to them.

Stephen DUBNER: When you say, “some concession,” usually in the form of some protection payment, yes?

SHORTLAND: Well, you would frame it in terms of, perhaps, a corporate social responsibility program, or you do a joint venture, or you do some community engagement. There are lots of words for this. The protection contract is implicit. It’s never spelled out. It is through subcontracting. And the more layers you can put between yourself and the warlord, the better this is going to work in terms of being caught by the media. It’s all about plausible deniability.

DUBNER: So, would “tax” be a better word generally?

SHORTLAND: Well, that’s effectively what it is. But if people are not really sure whether the cartel or the rebel group or the insurgents have the capacity to actually kidnap, they might skip a protection payment, which is effectively tax evasion and then they decide that they have to prove that they can do it, and then they will. And in a way, kidnap for ransom is a really good way of backing up that kind of threat because nobody needs to get hurt.

DUBNER: Now, of all the criminal enterprises and cartels and pirates that you’ve researched, how does the Taliban compare in terms of their efficacy and organization and ability to execute these plans?

SHORTLAND: Well, they control a lot of territory. And they use that territory to grow very high-value crops, like drugs. And therefore, they’re very well-resourced. And they also have a certain amount of legitimacy with the people whose territory they control. And therefore, they are very effective at delivering violence and that is and something that the U.S. government has recognized.

PETERS: In percentage, I can tell you that the Taliban were making about 25 percent of their budget in protection payments.

That, again, is Gretchen Peters of CINTOC.

PETERS: In absolute dollars, I can tell you that it was tens of millions of dollars.

DUBNER: And the rest of their budget is coming from where?

PETERS: Drugs, donations, other crime.

Her organization’s mission is to understand exactly how this plays out.

PETERS: We do a lot of work with the U.S. government to identify how criminal and other illegal networks are moving goods or moving money across a transnational sphere of operation. In particular, I was helping them to try and understand how the adversaries in Afghanistan and Pakistan were financing themselves.

Which led to the protection money.

PETERS: U.S. contractors — in other words, development companies and organizations that were funded by U.S. taxpayers to do development work in Afghanistan — were making protection payments to the insurgency in Afghanistan in order to keep their operations safe.

One consequence of this protection is that it deflected the Taliban’s aggression to other targets. Including: U.S. soldiers and other military personnel. That, at least, is the allegation in a lawsuit filed last year in federal court in Washington, D.C.

PETERS: I’m working as a research consultant to a class-action suit by Gold Star families and wounded vets and other American personnel who are alleging that these companies were illegally funding our adversaries, and undermining everything that we were trying to do in Afghanistan, and providing the insurgency with critical funds that were used to finance attacks against U.S. troops.

DUBNER: You write, “In short, the U.S. government provides money to local contractors in Afghanistan to build roads, schools, and bridges as part of the counterinsurgency campaign. But the contractors must pay off insurgents to avoid having these projects attacked.” Talk about how that actually works.

PETERS: Often what was happening was that a big American contracting firm would get a multi-million dollar contract to build roads or schools or hospitals somewhere in Afghanistan. And they would subcontract local construction firms to help support that work and subcontract local trucking firms to bring in the materials and then they would also have to have security. And so, they would hire local security teams. And there wasn’t adequate due diligence being done on who some of those subcontractors were. And in many cases, the subcontractors were either loyal to the insurgency or making payments to commanders in the insurgency in order to keep their projects functioning without attack.

DUBNER: Were the Western firms directly making protection payments to the insurgents, or was it all done through the middlemen, the subcontractors?

PETERS: I can’t say that it was never made directly by the Americans. I can say that it was usually going through a middleman, who was a local. But it’s factually inaccurate to say that the companies didn’t know this was going on. There was lots of reporting about this in the media. There were investigations by USAID, by the defense department, and by other oversight and investigative organizations. So, it was widely known by about 2011 that this was a problem.

Peters’s research argues that protection money collected by disparate Taliban commanders was part of a larger, centralized plan to destabilize the Afghan government and attack U.S. troops.

PETERS: Yes. The Taliban published a code of conduct which outlined at a fairly granular level the way in which the commanders had to pay a percentage of what they were earning back to the leadership. And it really revealed how important these local fundraising activities were to their war effort.

Peters says the Taliban also required other concessions. One of the defendants in the lawsuit is a South African telecom firm called M.T.N. At the Taliban’s request, they reportedly agreed to shut down cell service at night.

PETERS: The Taliban were convinced that the Americans were listening to them. M.T.N. admitted to both paying protection money to avoid getting their cell towers blown up, but also to shutting off certain towers in key areas at the request of the Taliban — again, to avoid getting their towers blown up.

We asked M.T.N. and all the other defendants in the lawsuit for an interview or a statement. They all either declined or failed to acknowledge the request. In court filings, M.T.N. argues that shutting down cell service at night was a long-standing accommodation in Afghanistan. Elsewhere in the court documents, M.T.N. and the other defendants argue that the links between any alleged protection payments and Taliban attacks on U.S. military personnel are too tenuous. Several defendants even claim that the Afghan subcontractors accused of wrongdoing came recommended by the U.S. government. So, you can see how difficult, and complicated, this situation was if you were the U.S. government.

MALKASIAN: So, my name is Carter Malkasian. I finished, fairly recently, being the special assistant for strategy to the chairman of the Joint Chiefs of Staff.

He’s also worked for the State Department.

MALKASIAN: I’ve spent a lot of time in Afghanistan and Iraq and a few other places like Honduras, often doing conflict-stabilization kind of work.

And he developed a fondness for Afghanistan.

MALKASIAN: People say you get addicted to Afghanistan. The mountains, the rivers, the forests. It tends to take one’s breath away. And there’s also the Afghan people.

So, how does Malkasian think about the complicated balance of U.S. reconstruction efforts in a place like Afghanistan?

MALKASIAN: Now, none of this is perfect, right? If you’re dealing with an insurgency or a criminal group, they’ll probably have an ability to tax wherever you are. So, what you’re trying to do is to make sure, just as you would with corruption, that that level of taxation is low. And then I’m trying to see that when this project is done, that it’s having the effect that I want it to have — that kids are going to school, that people are traveling on the road, those positive benefits that I’m at least hoping they’re going to outweigh whatever the other side is getting from it.

But you’ll remember that Gretchen Peters from CINTOC argues this sort of taxation should not be considered a prerequisite.

PETERS: You don’t have to pay bribes to stay safe in that part of the world. There were many organizations that didn’t pay bribes and were able to complete their work.

DUBNER: How did those firms succeed without paying bribes? What did they do differently?

PETERS: The organizations that were able to function successfully got, in a sense, security from the community by engaging with community leaders, getting their buy-in to the project, whether it was a school or a road or a cell tower that the community wanted.

When we asked Gretchen Peters to name someone who was very good at getting this community buy-in, she named Carter Malkasian .

MALKASIAN: I thought, well, I’m going to work with people who are going to know that I think it’s unacceptable for them to work with the Taliban and are going to know that I’m trying to check to make sure that’s not happening.

Malkasian is a realist. And he appreciates the fact that benefits come with costs:

MALKASIAN: You have everything from canal clearing, on seed distribution, establishment of cooperatives, paving of roads, building of schools. My overall experience is that the good of a fairly well-run project far outweighs whatever the Taliban may be benefiting from it.

But, that said:

MALKASIAN: I never thought that I was going to pay off the Taliban to do something. That’s a dangerous game.

So, how did Malkasian typically get things done without buying into what Gretchen Peters calls a “completely corrupt system”?

MALKASIAN: Point No. 1 would be to work through the locals. Identify a partner who you can work with well, and a partner who cares about what’s going on in their community. You probably want some people that already have some influence because building someone up on your own is a big investment of effort and has its own perils associated with it.

What else does Malkasian suggest?

MALKASIAN: Don’t go to places that are overly dangerous, where you’re not going to have decent oversight, because that’s where you get into trouble. The other thing is you really have to have a moral compass. In the end, it’s going to come down to you.

How does Malkasian rate his own success?

MALKASIAN: So, I don’t know that I was all that much more successful in projects and stuff than a lot other people were. And look, I can’t say that my path was cheaper than the other path, it’s just I wasn’t going to follow that path.

Still, Malkasian appreciates — and acknowledges — how murky such operations can be.

MALKASIAN: I may have been unaware of something where some payment was made. I don’t think I was. But even if I was, what about the girls’ schools that were built? What about the other schools that are open up all up and down Garmsir? But the problem with arguing it is that it makes it sound like you think it’s all okay to pay people off or something. I don’t think that’s right.

So far, we’ve been hearing from the administrative and analytical sides of American reconstruction in Afghanistan. How about the actual reconstruction side?

YAHN: So, my name is Steve Yahn. I was a construction superintendent. I’ve been working in the paving and construction industry since high school and I got an opportunity to go to work in Afghanistan to build roads and one clinic and some bridges for 12 years.

Yahn, who’s from Massachusetts, had never worked in a conflict zone before.

YAHN: I tried to do a little bit of research, but nothing was to prepare me for what I was about to experience. When I first arrived in 2002, we stayed at this place called the Dreamland, which was across the street from that International Security Force.

This was in Kabul, the Afghan capital.

YAHN: And there were rockets that went over our heads at night. And two of the guests were Germans and they were walking around Kabul and one of them tripped a landmine and blew off his legs. And his buddy tried to help him, and he also died from a landmine. So, that was my introduction to Afghanistan.

Yahn wound up working for the Louis Berger Group, a huge global engineering and construction company based in New Jersey. They have since been acquired by W.S.P. Global. One project Yahn worked on was a 1,400-mile highway, circling the interior of Afghanistan, called the ring road. It was an obvious target for the opposition.

YAHN: From the very beginning, there was a thought from the Taliban that if we could stop the road construction, that they’ll just go away. I mean, they understood later on that the Americans were tenacious and they’re just going to keep working. Even if people were killed and stuff was blown up, they’re just going to keep working.

The Louis Berger Group is one of the defendants in the class-action lawsuit, accused of paying protection money that the Taliban used to attack American troops. Steve Yahn, interestingly, is cited by both sides in this lawsuit, based on interviews he’s given in the past. The plaintiffs say he acknowledges collusion with the Taliban; the defendants say he saw no direct evidence of payments. As Yahn describes trying to get local buy-in for the highway section he was working on, you can once again appreciate how complicated things were.

YAHN: I had to meet with the mayor many, many times. And the governor — he was difficult. He was trying to play both sides because no one really knew if the Americans were going to bail out or the Taliban were going to be successful. And then village elders, huge deal with the village elders to try to smooth things over for all these foreigners coming in there.

When it came to hiring or working with locals, Yahn acknowledges some of them probably were members of the Taliban.

YAHN: Yeah, they were identified as Taliban, but not militants.

The plaintiffs in the lawsuit find this distinction not so relevant; but to Yahn, it’s important.

YAHN: After speaking with these people many times, I got the impression they were more like very strict Quakers in a sense. They’d shunned modern ways. But that was fine for them. They were just subsistence farmers and they wanted to be left alone.

And Yahn says that he did not engage those members of the Taliban for protection or security, and that no money was directly paid for those purposes.

YAHN: I mean, no one made it clear that, “Hey, these are the Taliban guys, if we pay them some money they’ll make our roads secure.” I never experienced that.

Yahn says he was in a good position to know this.

YAHN: I was in charge of all the finances, all the quality control.

But of course, this was an enormous project, with layers of subcontracting in both construction and security.

YAHN: The subcontractors hired locals from the community, 700 or more workers. We had South African security, maybe 300 Afghan guards.

And if there was protection money being paid — to the Taliban or someone else — Yahn says it wasn’t necessarily effective. On just one road project, a 60-mile highway in eastern Afghanistan, Yahn lost 16 workers — 13 dead and 3 missing — over a 15-month period. It’s worth noting that highway construction was generally the most dangerous work in Afghanistan, accounting for 30 percent of the more than 2,000 contractors killed and nearly 3,000 wounded. The ring road, remember, was a massive project, covering 1,400 miles. For someone like Steve Yahn, the Taliban was hardly the only concern, or compromise.

YAHN: There was a warlord, he was indicted for killing, I don’t know, 100-plus people. And we hired a bunch of these soldiers that he had and incorporated them into our security. We convinced him to be a subcontractor and he got his guys, his local people, to do some construction work. And he was supervising it.

There was also the famed Haqqani group, known for its close ties to the Taliban and known for its violence.

YAHN: They would ambush us and so on. I do know the Haqqani group, through the U.S. military briefings that they were being paid to try to disrupt the road, to try to set I.E.D.’s.

In a New York Times article for which Steve Yahn was interviewed, the reporter claimed to have traced money from one of Yahn’s road projects to a South African security subcontractor to a local middleman and ultimately to a member of the Haqqanis. Yahn told us he personally didn’t know about this.

YAHN: Everybody that we talked to and all the village elders and the subgovernors and even the governor of Khost province, as I know, nobody had any direct dealing with the Haqqani group.

Yahn also says the dollar figures cited in the Times and in the lawsuit are unrealistically high.

YAHN: There’s no way that my projects could funnel off that sort of money and not be noticed. There’s no way.

He also notes that, due to the strategic importance of the ring road, there was significant oversight.

YAHN: There was a couple of audits by the U.S. government and they could find nothing irregular at all. They gave us high marks.

The Office of the Special Inspector General for Afghanistan Reconstruction, which performed these audits, did find that billions of dollars across all projects — though not Yahn’s specifically — had been lost to corruption and bribes. These payoffs, they wrote, “exacerbated conflicts” and “bolstered support for insurgents.” This doesn’t necessarily mean Steve Yahn is wrong; it just means that the Gretchen Peters argument is right.

PETERS: This completely corrupt system.

Again, there is nothing simple about the U.S. reconstruction of Afghanistan. And Carter Malkasian, for one, suggests looking at the actual accomplishments of such work.

MALKASIAN: I’m happy to argue with anyone who thinks that the ring road construction was a bad investment. Yes, there is corruption and yes, the maintenance on it isn’t perfect. But do you really think a gravel, poorly built road between Kandahar and Kabul is better than having a road that people can get up and forth in five hours? Where women can get to the clinic? Where we can move transportation and logistics on? Out of all the things we do, that is probably one of the best investments that we make.

But as with most investments — when there’s a winner, there’s usually a loser, too.

* * *

When we first started working on this story, about whether protection money was paid to the Taliban by Western firms doing reconstruction projects in Afghanistan, and whether the Taliban then used that money to fund attacks on U.S. servicemen, I thought of a story Steve Levitt once told me. Steve Levitt is my Freakonomics friend and co-author; he’s an economist at the University of Chicago. The story goes like this:

Steven LEVITT: So, you’ve got a car, you don’t want your car to be stolen.

That’s right, this story has to do with car theft. Back in the late 80’s, there was a common anti-theft device called the Club.

LEVITT: You could walk down a street, you’d see every single car, one after another, would have the Club on its steering wheel.

It was essentially a steering-wheel lock, which meant even if you broke into the car, you’d have a hard time driving it away. Interestingly, the Club’s inventor was said to have been inspired by his service in the Korean War, when he used a chain to lock the steering wheel of military vehicles. So anyway, this Club anti-theft device:

LEVITT: The real idea is that not only did it make it harder to steal your car, but it was really, really visible and the thieves were supposed to see those Clubs.

The hope was that if thieves could see the Club, they wouldn’t bother to break your window in the first place.

LEVITT: Now, that’s a great idea from the perspective of the person who doesn’t want their car stolen. But it turns out to not be such a great idea from the perspective of the neighbor of the person who has the Club. Because if you think about the decision that a potential auto thief looks at, they see a whole block of cars lined up and maybe there’s one car they want a little bit more than another one. But if it’s got a Club — well, it’s not like they go and say, “I don’t want to be an auto thief, I’m going to go work at McDonald’s instead.” They say, “Well, I’m going to steal the next car.”

So, if it prevents my car from being stolen, it means that someone else’s car is more likely to be stolen. From a social perspective, the Club is no good. The Club is really just about how you transfer the risk that you bear onto your neighbors. And that’s what economists call a negative externality. That’s when a decision that I make has a negative impact on another person who doesn’t get to be part of that decision. My neighbors don’t get directly compensated when I buy the Club. They get directly hurt by the fact that the Club is shifting crime from me to them.

This idea of risk deflection is, essentially, the argument being made in the class-action lawsuit by more than 200 U.S. military personnel and their families who were wounded or killed in Afghanistan by the Taliban. They argue that Western contractors, by paying off the Taliban to protect their own employees, provided the funding and the motivation for the Taliban to attack U.S. soldiers instead. As we’ve been hearing today, the circumstances in Afghanistan were not only dangerous but complicated and murky. One question worth asking: what was the relationship between, say, a U.S. construction firm and the U.S. military?

SHORTLAND: If you want to challenge the protector, then you can do that. But that requires a military effort.

That, again, is Anja Shortland, the economist who studies criminal markets.

SHORTLAND: You can clear the territory of the Taliban if you want to commit the resources, and then the protection problem will disappear because you control that territory.

But that was not the route the U.S. government took.

YAHN: So, in the early days, there was only maybe less than 8,000 U.S. troops in-country?

And that again is Steve Yahn, a U.S. construction superintendent who spent 12 years in Afghanistan building highways and clinics.

YAHN: So, there’s no way we were going to call on the U.S. to secure our roads. And that was not their mission.

That remained the case even as the U.S. sent more troops to Afghanistan.

YAHN: Into 2011, ’12 — the U.S. military didn’t provide direct security, but more oversight. For instance, they got intel there was going to be an attack. So, they sent the drone low to fly over the camp so the bad guys would know that they were being watched. That kind of stuff. And there were more patrols up and down the road. But we were responsible for our own security.

SHORTLAND: So, what is impossible is to have three things at the same time: do business in such a territory that’s extralegally governed, keep your people safe, and aggravate the protector. If you naively go in there and just say, “Go build something, keep your people safe, and tell us when you finished it,” you shouldn’t be surprised if they make some arrangements that will keep their people safe and that will allow them to complete their contract. So, there’s gotta be cooperation. You can say, “Okay, we just don’t want to be there.” And that’s fine. You probably can’t say, “I don’t care what happens to my employees.”

DUBNER: Because they’ll just start getting killed.

SHORTLAND: Exactly. I think probably a lot of people didn’t realize exactly what compromises would be necessary to deliver on these promises of reconstruction.

One way to look at the reconstruction effort was that the U.S. government decided to pay contractors to work in areas controlled by Afghan insurgents but also decided that the U.S. military in Afghanistan would not be used to fully protect those workers. The lawsuit alleges that the construction firms paid off the Taliban for protection, and then what?

SHORTLAND: Protectors then use money to extend their territory. Generally that is the problem. In this case, if you pay the Taliban protection money, you would expect them to invest it into extending that territory and therefore to clash with the U.S. military.

CABRERA: Maybe I’m super naive. But I just — unimaginable that this was a conscious decision.

That is August Cabrera. She is a mother:

CABRERA: I have two kids of my own, 14 and 15, and then I have what I call my bonus kids, which are Dave’s first kids, and they are 22 and 20.

She’s also a writer. Working on her first book:

CABRERA: It’s a memoir called A Bad Widow. And it’s about my story of my relationship with Dave before and after he died.

Dave, also known as Army Lt. Col. David Cabrera.

CABRERA: He actually joined the military as a clinical social worker, working directly with soldiers and their families.

He eventually got his Ph.D., also in social work. Cabrera’s specialty was troubled adolescent boys:

CABRERA: Of which there are many in the military. I mean, talk about job security. He loved helping people and he was so good at it.

He was first deployed to Bosnia in the 1990s:

CABRERA: And then he went to Iraq in 2006 with a Stryker Brigade, basically on-the-ground forces. He was the sole clinical person for I believe 3,500 soldiers. The numbers were just astounding. And then Afghanistan in 2011. He had volunteered to go — not just volunteered. He had fought through, I believe, six levels of command to be allowed to go to Afghanistan to work with the soldiers directly.

DUBNER: So, what would he actually do when he’s there as one of very, very few of his type of personnel among so many other military personnel?

CABRERA: So, he would get on a convoy and travel for hours out to forward operating bases. And he would spend 12 to 15 hours seeing soldiers that were coming off of combat. The soldier that had just seen his best friend blown up, Dave could sit with him for an hour and get his brain to no longer be triggered by the memory.

DUBNER: So, tell us then what you know about the circumstances of his death.

CABRERA: The night before he was killed, we were on the phone and he said, “I’m taking a convoy out, going to the FOB.” It was supposed to be about a four-hour ride. And I said, “You understand, you have a target on your back that whole four hours.” And he said, “No, no, it’s fine. This is the route we always take.” And I said, “Great, so you know about it and so does everybody else.” And I was right. Afghanistan is eight-and-a-half hours ahead from D.C. I woke up about 2:00 in the morning, panicked that something was wrong and I went back to sleep and went on. And one of the rules when your husband deploys is you never, ever read the news.

DUBNER: Because why?

CABRERA: It’ll just torment you. You’re getting reports that people have been killed, bases have been blown up, and you never know if it’s yours. And so, I violated my rule and I looked up Huffington Post. And the headline at the top of it was “17 killed outside of Kabul and a suicide bomber.” And I collapsed. And I said, “He’s gone.” And my dad comes around and, “No, you don’t know it’s him. It’s fine. Like we don’t know.” And less than 24 hours later, I had dress-blue uniforms walking up my driveway.

DUBNER: Oh boy.

CABRERA: But I knew. I knew he was gone. There was — there was no question in my mind.

DUBNER: What do you know about the killers? Do you know much definitively about who carried out the attack?

CABRERA: I know that the Taliban immediately took responsibility for it. They released the name of the bomber. And — yeah, my kids and I spent a couple of years praying for him. Really hard to teach a 5- and 7-year-old how to forgive the person that killed their daddy. And I didn’t know how to do it, so I did the best I could.

DUBNER: So, the lawsuit in which you are a plaintiff discusses the arrangement of mostly Western firms paying the Taliban and others for protection. I’m curious whether you knew anything of that arrangement or that type of arrangement before your husband was deployed to Afghanistan?

CABRERA: No, honestly, I could never have imagined that there would be. I never imagined people could be that callous and heartless and cruel. I don’t understand how they can live with themselves. Honestly, I don’t get it. I just don’t.

DUBNER: Why is participation in this case important to you?

CABRERA: Well, first of all, I don’t think rebuilding is a bad thing. I mean, these wars have devastated countries and generations and education systems and health care. And if we’re going to ruin it, we should try to go back and fix it. And so, I don’t have a problem with that. I just don’t want corporations to see this as a viable way of doing business.

You know, Dave believed in making a difference. And he was doing it one soldier and one family at a time. And the idea that choices were being made that put them at risk would have really upset him. And I want to change the way business is done in war zones. That’s what this is about for me. That’s why I’m involved. I don’t want these companies to get away with this because they think no one is paying attention.

August Cabrera’s sentiment — that Afghanistan deserves, at the very least, the fruits of this reconstruction — was shared by everyone we spoke with. Including Gretchen Peters of CINTOC, one of the harshest critics of how the reconstruction was carried out:

PETERS: I’ve always supported helping to rebuild Afghanistan. Its economy has been completely shattered, so it’s going to need international development aid. However, that aid has to be distributed at a sustainable pace and I think some of the programs that were thought up for Afghanistan were too ambitious. And the amount of money flowing in there was too large to be properly managed.

Also — Steve Yahn, the construction superintendent.

YAHN: Their intentions were well-founded. It’s just that— well, I think it was a little bit too much, too quick.

And Carter Malkasian, formerly of the State Department and the Joint Chiefs of Staff.

MALKASIAN: So, it’s partly that too much money was poured in too quickly. Partly it’s just too much money, period, overall. At the height of things, there were probably 50 or so projects going on at once. There wasn’t enough oversight over all of it.

Lawsuits like the one we’ve discussed today have made it through the legal system before. But the plaintiffs, if they clear this first hurdle, still have a long way to go. And it’s made tougher by the fact that the Anti-Terrorism Act under which they’ve brought the lawsuit only applies to organizations that have been designated by the State Department as Foreign Terrorist Organizations, or F.T.O.’s. The Haqqani Network wasn’t declared an F.T.O. until 2012 — after the occurrence of many incidents in the lawsuit.

The Pakistani Taliban was listed as an F.T.O. in 2010, but the Afghan Taliban has never been listed. Even though a sniff test would suggest that is ludicrous, at least from an American perspective. Even though it was recently reported that Russia paid Taliban-linked militants bounties to kill U.S. troops in Afghanistan. So, why wasn’t the Afghan Taliban listed as a foreign terrorist organization? One consideration is that it is illegal for the U.S. government to negotiate with an F.T.O. And the U.S. did indeed begin negotiations with the Taliban — and, back in February, they signed a peace deal.

SHORTLAND: Basically, it is impossible to get peace in Afghanistan without some sort of level of accommodation with the Taliban.

Anja Shortland again. The decision by the U.S. government to negotiate with the Taliban themselves, she says:

SHORTLAND: Is absolutely in recognition of the ability of that organization to deliver violence — on a vast scale, enough to trouble the U.S. military. So, I think they’re winning.

MALKASIAN: The deal includes that in 14 months from February that we’re supposed to completely withdraw all our forces.

Carter Malkasian again.

MALKASIAN: In return, the Taliban are supposed to stop supporting al-Qaeda, move forward in a political settlement with the government, move towards a cease fire line and so that’s the direction we’re on right now. I think that there is a chance for peace, because I think the Taliban definitely want us to leave. I think there’s Taliban who do want peace and are willing to cooperate with the government.

Indeed, just a couple weeks ago — after we spoke with Malkasian — Afghanistan’s government began direct peace talks with the Taliban, the first after nearly 20 years of fighting. These talks were brokered by the U.S. government.

MALKASIAN: Now, this peace process is going to be a long, arduous trial. You know, they’re going to have to write a new constitution, probably. They’re going to have to decide what the structure of their armed forces should be. They’re going to have to decide who gets to rule. Do they want a democracy? What kind of democracy? They have to decide on the role of Islam in the country, which is going to be dramatic. So, this is going to be difficult and it may fail anywhere along the line.

The lawsuit that August Cabrera and her co-plaintiffs are bringing against the Louis Berger Group, M.T.N., and several other firms is trying to change how such companies operate in conflict zones. The bigger question may be whether the U.S. government will change its approach. Anja Shortland again:

SHORTLAND: So, it is a political decision.

It was, after all, the government that first sent troops to Afghanistan to fight terrorism; and then organized and funded the reconstruction; and then proved unwilling, or unable, to protect the employees of those firms.

SHORTLAND: If you want to be in territory that is controlled by the Taliban and you want to create a major infrastructural installation, it can only happen with the toleration of the Taliban. If that’s what you want to do, then that is the price that you have to pay. And it would then be unfair to sue the companies for delivering on their contract. I mean, there would be a naivete about it.

I asked August Cabrera, the widow of Lt. Col. David Cabrera, how she thinks about assigning blame for her husband’s death between the construction firms, the U.S. government, and of course the killers themselves.

CABRERA: War sucks, right? I mean, not to put too fine a point on it. But I’d like to say I understand it. I will admit that I understand it less now than I did the night I met Dave. And I wish I could say, you know, “These six people are responsible for this. We should go after them.” But I know it’s too complicated to give a simple answer. It took me a long time to be able to go to Arlington. And he’s in section 60 and his grave site is 173. So, I have to walk pretty far into section 60 to get to him. And I don’t know what’s harder, sitting at his grave site or walking past all the other ones.

* * *

Freakonomics Radio is produced by Stitcher and Dubner Productions. This episode was produced by Matt Hickey. Our staff also includes Alison Craiglow, Greg Rippin, Mary Diduch, Corinne Wallace, Daphne Chen, and Zack Lapinski. Our intern is Emma Tyrrell. We had help this week from Nellie Osbourne. Our theme song is “Mr. Fortune,” by the Hitchhikers; all the other music was composed by Luis Guerra. You can subscribe to Freakonomics Radio on Apple Podcasts, Stitcher, or wherever you get your podcasts.

Here’s where you can learn more about the people and ideas in this episode:

SOURCES

- Gretchen Peters, executive director of the Center on Illicit Networks and Transnational Organized Crime.

- Anja Shortland, economist from Kings College, London.

- Carter Malkasian, former special assistant for strategy to the chairman of the Joint Chiefs of Staff.

- Steve Yahn, construction superintendent and vice president of The Yahn Group, Inc.

- August Cabrera, author of A Bad Widow.

RESOURCES

- “Afghanistan peace talks begin – but will the Taliban hold up their end of the deal?” by Sher Jan Ahmadzai (The Conversation, 2020).

- “How Opium Profits the Taliban,” by Gretchen Peters (United States Institute of Peace, 2009).

EXTRA

- We Want to Negotiate: The Secret World of Kidnapping, Hostages and Ransom, by Joel Simon.

- Kidnap: Inside the Ransom Business, by Anja Shortland.

The post When Your Safety Becomes My Danger (Ep. 432) appeared first on Freakonomics.

Economy

Blaming the voters

In the Times, Matthew Parris wrote: "this Prime Minister is ultimately our [the electorate's] fault." I tweeted that this was absolutely right, but got a little pushback. I should therefore elaborate.

What I and Matthew meant was that Johnson is not doing anything unexpected. He is merely living down to what everybody knew about him. As Matthew wrote:

There was never any reason for confidence in Boris Johnson’s diligence, his honesty, his directness, his mastery of debate, his people-skills with colleagues, his executive ability or his policy grip. We’d seen no early demonstration of any of these qualities but we just blanked that out.

Voters, then, are getting what they voted for. Those who voted Labour in 2001 could say of the Iraq war “I never voted for that”. Those who voted Lib Dem in 2010 could say of the tripling of tuition fees “I never voted for that.” Those who voted Tory last year, however, cannot say the same. They got what they wanted. They should own it.

There are some objections to this, most of which I find inadequate.

The first is that voters were deceived by our dishonest grifter media. There’s some truth in this. The media does have some influence, if less than its critics claim.

But people have agency. They are responsible for believing the media’s lies: the victims of conmen are not always wholly deserving of our sympathy. And voters are quite capable of being wrong without the media’s help. They are systematically mistaken about many social facts, such as how many immigrants there are. They don’t understand economics (or, I suspect, the social sciences generally). Some of their preferences – for benefit cuts and a hostile environment for immigrants - are plain vicious. And they have cognitive biases which support inequality. The media amplify these failings. But to believe they are the sole cause of them is to regard voters as childlike noble savages who are corrupted by a few billionaires. That’s just romantic twaddle.

You don’t need to believe in Marxian ideas of false consciousness (a phrase Marx never used) to accept this. Bryan Caplan and Jason Brennan have said similar things from a non-Marxian point of view.

Another objection to Parris’s claim is that the Tories got only a minority of the vote and so it is our electoral system to blame rather than the voters.

Let’s leave aside the fact that the electorate support this system: they rejected mild reform in the 2011 referendum. And let’s also leave aside the fact that it’s not just Tory voters to blame. Those who abstained or voted Lib Dem thereby allowing a Tory candidate to win in their constituency are also guilty.

And let’s also leave aside the fact those using this argument must be careful – because it will undoubtedly be weaponized by the right to delegitimize even a mildly social democratic government.

Instead, there’s another problem. If voters do have vicious, biased and ill-informed preferences – whether caused by the media or anything else – then the last thing we should want is for parliament to better reflect these. (Of course, some Labour supporters might have such bad preferences too.)

Our problem is not how to get a more representative parliament but rather how to filter voters’ preferences so they reflect the wisdom rather than stupidity of crowds.

Traditionally, small-c conservatives have been alive to this question. It is why Edmund Burke thought that MPs’ judgment should over-ride the “hasty opinion” of their constituents. And it’s why they have prized an independent civil service and judiciary, as these too restrain hasty, silly and nasty preferences: it is no accident that populists everywhere attack such institutions.

But there is a more radical alternative – to use devices of deliberative (pdf) democracy such as citizens juries to increase our chances of getting the best rather than worst of public opinion. It is these we need more than electoral reform.

You might object here that it is futile to complain about the electorate as we must work with the world as it is, not as we’d like it.

Public opinion, however, is malleable – a fact our most successful recent Prime Ministers have recognised. Thatcher sought to change it not just by persuasion but by introducing a property-owning democracy to incentivize people to vote Tory. And Blair’s expansion of higher education has (inadvertently?) created a large cohort of liberal-minded youngsters: there’s a reason why Tories are attacking universities.

There’s a further objection to Parris’s claim. Some of us (not enough!) voted Labour. Surely we’re not to blame?

There’s an irony here. Many people using this to exculpate themselves also believe in the idea of collective guilt – that, for example, Britons collectively were responsible for the slave trade and imperialism. But if our ancestors, many of whom never owned slaves or participated in imperialism, were collectively guilty of these crimes, mightn’t we too be collectively responsible for the Tory government?

Mightn’t even we Labour supporters be partly to blame by for example not campaigning sufficiently or sufficiently well or for making bad political choices ourselves – be they choosing a Labour leader who didn’t appeal sufficiently to voters or not accepting the Brexit referendum result?

Which brings me to another irony. Part of Johnson’s appeal is like Trump’s: it’s a backlash against metropolitan elites who think they know better than “the people”. And yet those of us who claim that (some) voters are ill-informed and vicious are making the same mistake Hillary Clinton made when she called Trump supporters “deplorables”: we’re inviting a backlash against us arrogant know-alls.

This is a dilemma. The solution to it – if there is one – is to try to separate talk about outcomes from talk about process. We must ask: what sort of processes and institutions are likely to best deliver policies that are both good (by whatever lights you want) and democratic? Few people, however, want such a debate.

Economy

More on debt

Following my last post on debt I’ve thought a bit more, and received some very useful emails from colleagues.

A central clarifying thought emerges.

The main worry I have about US debt is the possibility of a debt crisis. I outlined that in my last post, and (thanks again to correspondents) I’ll try to draw out the scenario later. The event combines difficulty in rolling over debt, the lack of fiscal space to borrow massively in the next crisis. The bedrock and firehouse of the financial system evaporates when it’s needed most.

To the issue of a debt crisis, the whole debate about r<g, dynamic inefficiency, sustainability, transversality conditions and so forth is largely irrelevant.

We agree that there is some upper limit on the debt to GDP ratio, and that a rollover crisis becomes more likely the larger the debt to GDP ratio. Given that fact, over the next 20-30 years and more, the size of debt to GDP and the likelihood of a debt crisis is going to be far more influenced by fiscal policy than by r-g dynamics.

In equations with D = debt, Y = GDP, r = rate of return on government debt, s = primary surplus, we have* [frac{d}{dt}frac{D}{Y} = (r-g)frac{D}{Y} - frac{s}{Y}.] In words, growth in the debt to GDP ratio equals the difference between rate of return and GDP growth rate, less the ratio of primary surplus (or deficit) to GDP.

Now suppose, the standard number, r>g, say r-g = 1% or so. That means to keep long run average 100% debt/GDP ratio, the government must run a long run average primary surplus of 1% of GDP, or $200 billion dollars. The controversial promise r<g, say r-g = -1%, offers a delicious possibility: the government can keep the debt/GPD ratio at 100% forever, while still running a $200 billion a year primary deficit!

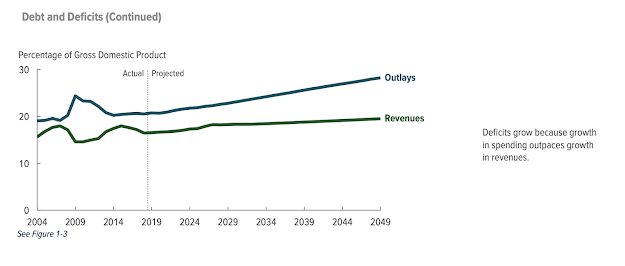

But this is couch change! Here are current deficits from the CBO September 2 budget update

Now that this is clear, I realize I did not emphasize enough that Olivier Blanchard’s AEA Presidential Address acknowledges well the possibility of a debt crisis:

Fourth, I discuss a number of arguments against high public debt, and in particular the existence of multiple equilibria where investors believe debt to be risky and, by requiring a risk premium, increase the fiscal burden and make debt effectively more risky. This is a very relevant argument, but it does not have straightforward implications for the appropriate level of debt.

See more on p. 1226. Blanchard’s concise summary

there can be multiple equilibria: a good equilibrium where investors believe that debt is safe and the interest rate is low and a bad equilibrium where investors believe that debt is risky and the spread they require on debt increases interest payments to the point that debt becomes effectively risky, leading the worries of investors to become self-fulfilling.

Let me put this observation in simpler terms. Let’s grow the debt / GDP ratio to 200%, $40 trillion relative to today’s GDP. If interest rates are 1%, then debt service is $400 billion. But if investors get worried about the US commitment to repaying its debt without inflation, they might charge 5% interest as a risk premium. That’s $2 trillion in debt service, 2/3 of all federal revenue. Borrowing even more to pay the interest on the outstanding debt may not work. So, 1% interest is sustainable, but fear of a crisis produces 5% interest that produces the crisis.

Brian Riedi at the Manhattan Institute has an excellent exposition of debt fears. On this point,

… there are reasons rates could rise. …

market psychology is always a factor. A sudden, Greece-like debt spike—resulting from the normal budget baseline growth combined with a deep recession—could cause investors to see U.S. debt as a less stable asset, leading to a sell-off and an interest-rate spike. Additionally, rising interest rates would cause the national debt to further increase (due to higher interest costs), which could, in turn, push rates even higher.

***********

So how far can we go? When does the crisis come? There is no firm debt/GDP limit.

Countries can borrow a huge amount when they have a decent plan for paying it back. Countries have had debt crises at quite low debt/GDP ratios when they did not have a decent plan for paying it back. Debt crises come when bond holders want to get out before the other bond holders get out. If they see default, haircuts, default via taxation, or inflation on the horizon, they get out. r<g contributes a bit, but the size of perpetual surplus/deficit is, for the US, the larger issue. Again, r<g of 1% will not help if s/Y is 6%. Sound long-term financial strategy matters.

From the CBO’s 2019 long term budget outlook (latest available) the outlook is not good. And that’s before we add the new habit of massive spending.

Here though, I admit to a big hole in my understanding, echoed in Blanchard and other’s writing on the issue. Just how does a crisis happen? “Multiple equilibria” is not very encouraging. Historical analysis suggests that debt crises are sparked by economic and political crises in the shadow of large debts, not just sunspots. We all need to understand this better.

******

Policy.

As Blanchard points out, small changes do not make much of a difference.

a limited decrease in debt—say, from 100 to 90 percent of GDP, a decrease that requires a strong and sustained fiscal consolidation—does not eliminate the bad equilibrium. …

Now I disagree a bit. Borrowing 10% of GDP wasn’t that hard! And the key to this comment is that a temporary consolidation does not help much. Lowering the permanent structural deficit 2% of GDP would make a big difference! But the general point is right. The debt/GDP ratio is only a poor indicator of the fiscal danger. 5% interest rate times 90% debt/GDP ratio is not much less debt service than 5% interest rate times 100% debt/GDP ratio. Confidence in the country’s fiscal institutions going forward much more important.

At this point the discussion usually devolves to “Reform entitlements” “No, you heartless stooge, raise taxes on the rich.” I emphasize tax reform, more revenue at lower marginal rates. But let’s move on to unusual policy answers.

Borrow long. Debt crises typically involve trouble rolling over short-term debt. When, in addition to crisis borrowing, the government has to find $10 trillion new dollars just to pay off $10 trillion of maturing debt, the crisis comes to its head faster.

As blog readers know, I’ve been pushing the idea for a long time that especially at today’s absurdly low rates, the US government should lock in long-term financing. Then if rates go up either for economic reasons or a “risk premium” in a crisis, government finances are much less affected. I’m delighted to see that Blanchard agrees:

to the extent that the US government can finance itself through inflation-indexed bonds, it can actually lock in a real rate of 1.1 percent over the next 30 years, a rate below even pessimistic forecasts of growth over the same period

contingent increases in primary surpluses when interest rates increase.

I’m not quite sure how that works. Interest rates would increase in a crisis precisely because the government is out of its ability or willingness to tax people to pay off bondholders. Does this mean an explicit contingent spending rule? Social security benefits are cut if interest rates exceed 5%? That’s an interesting concept.

Or it could mean interest rate derivatives. The government can say to Wall Street (and via Wall Street to wealthy investors) “if interest rates exceed 5%, you send us a trillion dollars.” That’s a whole lot more pleasant than an ex-post wealth tax or default, though it accomplishes the same thing. Alas, Wall Street and wealthy bondholders have lately been bailed out by the Fed at the slightest sign of trouble so it’s hard to say if such options would be paid.

Growth. Really, the best option in my view is to work on the g part of r-g. Policies that raise economic growth over the next decades raise the Y in D/Y, lowering the debt to GDP ratio; they raise tax revenue at the same tax rates; and they lower expenditures. It’s a trifecta. In my view, long-term growth comes from the supply side, deregulation, tax reform, etc. Why don’t we do it? Because it’s painful and upsets entrenched interests. For today’s tour of logical possibilities if you think demand side stimulus raises long term growth, or if you think that infrastructure can be constructed without wasting it all on boondoggles, logically, those help to raise g as well.

********

*Start with (frac{dD}{dt} = rD - s.) Then ( frac{d}{dt}frac{D}{Y} = frac{1}{Y}frac{dD}{dt}-frac{D}{Y^2}frac{dY}{dt}.)

***

Update: David Andolfatto writes, among other things,

“Should we be worried about hyperinflation? Evidently not, as John does not mention it”

For these purposes, hyperinflation is equivalent to default. In fact, a large inflation is my main worry, as I think the US will likely choose default via inflation to explicit default. This series of posts is all about inflation. Sorry if that was not clear.

also

Is there a danger of “bond vigilantes” sending the yields on USTs skyward? Not if the Fed stands ready to keep yields low.

All the Fed can do is offer overnight interest-paying government debt in exchange for longer-term government debt. If treasury markets don’t want to roll over 1 year bonds at less, than, say, 10%, why would they want to hold Fed reserves at less than 10%? If the Fed buys all the treasurys in exchange for reserves that do not pay interest, that is exactly how we get inflation. And mind the size. The US rolls over close to $10 trillion of debt a year. Is the Fed going to buy $10 trillion of debt? Who is going to hold $10 trillion of reserves, who did not want to hold $10 trillion of debt.

In a crisis, even the Fed loses control of interest rates.

-

Business2 months ago

Business2 months agoBernice King, Ava DuVernay reflect on the legacy of John Lewis

-

World News2 months ago

Heavy rain threatens flood-weary Japan, Korean Peninsula

-

Technology2 months ago

Technology2 months agoEverything New On Netflix This Weekend: July 25, 2020

-

Finance4 months ago

Will Equal Weighted Index Funds Outperform Their Benchmark Indexes?

-

Marketing Strategies9 months ago

Top 20 Workers’ Compensation Law Blogs & Websites To Follow in 2020

-

World News8 months ago

World News8 months agoThe West Blames the Wuhan Coronavirus on China’s Love of Eating Wild Animals. The Truth Is More Complex

-

Economy11 months ago

Newsletter: Jobs, Consumers and Wages

-

Finance9 months ago

Finance9 months ago$95 Grocery Budget + Weekly Menu Plan for 8