Finance

How To Pay Off $10,000 Of Debt In One Year

It’s that time of year where we look back on what we have and haven’t accomplished and decide what to tackle in the second half of the year. Even though we’re in extraordinary times, most people will still have getting out of debt and building wealth as top goals.

If eliminating some of your debt while simultaneously improving other parts of your financial life are among your goals, this post is for you. It’s time to take back control and kick your debt to the curb.

It can sound like paying off large amounts of debt in a short period of time is impossible - but it’s not! You can even pay off $10,000 in debt in just one year. Whether you have student loan debt or credit card debt, there are options.

Here’s how you can pay off $10,000 in debt in one year.

Step 1: Work Backwards

The first step in any good debt pay-off plan is knowing how much money you need to come up with in order to meet your goal. Saying that you’re going to pay off $10,000 in debt in one year isn’t good enough. You need to breakdown that number so that you can hit smaller milestones.

The simplest way to make this calculation is to divide $10,000 by 12. This would mean you need to pay $833 per month to have contributed your goal amount to your debt pay-off plan. This number, though, doesn’t factor in the interest on your debt.

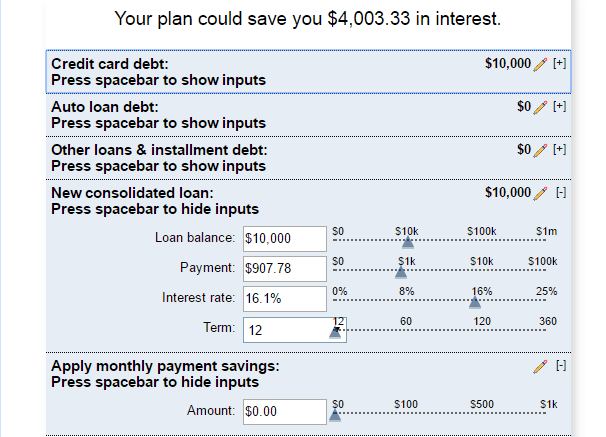

If you want to see the impact of interest and how much you can save by accelerating your debt pay off plan you can use a debt calculator like the one provided by BankRate.

In the example below we’re assuming a $10,000 credit card balance at a 16% interest rate. In order to pay the balance off in one year payments of $907 per would be needed which would save over $4,000 in interest – a huge savings!

You can use this calculator to tally up all of your current debts and see what you could save with an accelerated debt pay-off plan.

I can tell you that after a decade of helping people get out of debt, simply getting organized and understanding your debt is the number 1 reason why people don’t make forward progress.

Step 2: Decide On Your Strategy

If you only have one loan or credit card you don’t need to worry about coming up with a strategy. (Other than how much your monthly payments will be, of course.) You can simply choose to automate your payments and consider yourself done.

However, if you’re working with multiple loans and debts you’ll have to determine in what order you’d like to pay those off. There are two popular strategies for doing this: the debt snowball and the debt avalanche.

Debt Snowball Method – With this method you’ll list your debts from smallest balance to largest balance and work on paying off the smallest balance while making minimum payments on everything else. Once the smallest balance is paid off you move on to the next smallest while still meeting all other minimum payments.

This is the method popularized by Dave Ramsey, and the goal is to get some early wins by eliminating small debts - which in turn boost your attitude towards paying off the remaining debts. Plus, putting that extra money towards the next debt helps eliminate it faster.

Debt Avalanche – With this method you list all of your debts from highest interest rate to lowest interest rate. You then focus on putting all of your extra money toward your highest interest rate while making minimum payments on the rest.

This method is mathematically the lowest cost approach to paying off your debt, but it could also mean a longer stretch before you see wins.

There’s a lot of debate over which method you should use and there is NO right answer. The debt snowball method is a great option if you like quick wins and want to eliminate smaller bills. The debt avalanche method is great if you’re focused on saving the most money in interest.

Once you pick your strategy you should also consider how often you’ll make extra payments and whether or not to automate your plan.

Step 3: Free Up Money in Your Budget

At a glance, paying off $10,000 in a year can seem like a huge number. However, once broken down coming up with the extra money isn’t as hard as it seems.

If you’re serious about getting rid of your debt one of the first places you should look is your current spending. There are always ways to stretch more out of a budget with minimal effort.

Here are some things to consider:

Monitor Your Spending – It’s impossible to know where to cut back if you don’t know where you’re spending. You can sign up with a service like Personal Capital for free. Personal Capital will automatically monitor and categorize your spending after you link your bank accounts.

You can also check out our list of the best budgeting apps here.

Participate in Uber Frugal Month – Cutting back on spending has just as much to do with mindset as it does with actual needs. Early retirees Mr. and Mrs. Frugalwoods have had immense financial success through practicing frugality and without feeling deprived. In January they are hosting an Uber Frugal challenge for a month. This challenge can help you lower your costs and discover alternative ways of utilizing your money.

You can sign up for the challenge here.

Easily Save an Extra $500 per Month – It’s very likely that you are needlessly spending money without realizing it! This post breaks down fifteen simple ways you can squeeze an extra $500 out of your budget each month. If all of these ideas are applicable to your situation you’ll free up $7,000 over the course of the year.

Budget for Your Personality – One of the biggest mistakes new budgeters make is trying to adopt a system that doesn’t fit their personality and that they won’t stick with. The trick to making a budget work is finding a way to make it a regular part of your life.

This post will breakdown different ways you can create a budget that works for you.

Step 4: Earn More If You Need To

While it’s always a good idea to trim away the fluff in your budget it’s also important to look for ways to earn more if needed.

Depending on how much extra money you need you may be able to get by with putting in a couple hours per week overtime or you could start a side hustle to earn more.

Earning more money is a perfectly viable option for the majority of the U.S. population. You can look at some of the hundreds of different ideas already listed on this blog.

This was one of the most important strategies for myself when it came to paying off my student loan debt. I was able to earn an extra $2,000 per month by selling stuff on eBay and starting this blog.

Step 5: Track Your Progress

Paying off $10k in a one year is not an easy feat. It will take hard work and you’ll probably have to recommit to your goal a few times. One of the best ways to keep yourself motivated is to continually track your progress and celebrate the small wins.

When things get hard don’t give up. In a year from now you’ll be thanking yourself for sticking with the plan!

Finally, make sure you do reward yourself at small milestones. It’s a lot of work to pay off debt, so congratulate yourself every now and then!

Looking for more ways to improve your finances? Check out these 21 tips to overhaul your finances in the New Year.

Check Out These Related Articles:

The post How To Pay Off $10,000 Of Debt In One Year appeared first on The College Investor.

Finance

Advice needed. I’m a cheapskate and I have a compulsive tendency to NOT SPEND any money at all.

I am 22M, single, and just recently finished college. I don't have a job yet, but I do have a part-time online gig that pays decently (compared to our country's minimum wage). I don't have a credit card, only a bank savings account and a prepaid debit card. Our family's socio-economic status is a little below middle-class for our country's standard, but we don't have any crippling debts and we have a comfortable savings.

I have this urge to avoid spending money at all costs. I only now realized that during my 5 years in college, I have never spent anything outside of the most critical necessities. I'm too cheap to even treat myself to a nice restaurant or some material items. It's not even about spending on "luxury" items like a brand new phone, laptop etc. Sometimes, I feel the need to not spend even on necessities like shoes, clothes, etc.

I only have two pairs of sneakers, one is my daily beater which I bought for like $40 and have worn for virtually every single day of my entire college life. By the time I finished college, it's already all beat up, the soles have already cracked and water is already able to seep in. Up to this day, I'm still wearing it and I'm determined to keep on wearing it until it splits into two (to be fair, I'm a small guy, so there's not much wear and tear happening). The other pair of sneakers I have, is something I received from my bigger cousin because his feet has outgrown it. It is still a little too big for me, so I only really wear it when my main beater is unavailable.

Same goes with my backpack. Until now, I'm still using the same Jansport that I had from high school. It has accumulated some lacerations throughout the years, but I just stiched and patched them up. The zipper failed at some point, which I brought to a seamstress for repair. I'm pretty sure people might mistake me for a homeless guy because of how beaten up my wardrobe is, but I don't give a care.

The laptop that we bought way back in 2011 is still my main daily driver up until now. It's replacement battery has long gone to shit and barely holds 30 minutes of charge, but it still does all the workload that I throw at it.

It's not only in real life that I have this compulsive need to avoid spending, even in free to play video games, I tend to hoard the in-game currency. I don't like seeing my gold numbers drop below an imaginary threshold that I have in mind.

During the past 6 months, the only thing that I have bought outside of necessities is a $20 headphone. Before I graduated college, family and some friends asked me what I want as a gift, I just told them "cash or anything would do".

I realize that I might have a problem and I need advice.

submitted by /u/seagullofwhite

[comments]

Source link

Finance

Should You Have Life Insurance If You Don’t Have Children?

The following is a sponsored partnership with Aflac. All opinions are 100% my own.

Lately, I have received many emails from readers about life insurance.

One of the most common questions I hear is, “Should I consider a life insurance policy before I have children?”

No matter your age, the necessity of life insurance can be a hard topic to consider. However, while the subject might be difficult to reflect on, it is also an insurance option that can benefit your loved ones significantly, regardless of whether you have started a family.

Whenever I am asked the above question, my answer is always the same. Regardless of your family situation, life insurance is still a product to consider.

However, I understand the hesitation — you might think there is no reason to take out a life insurance policy if you don’t have children. September is Life Insurance Awareness Month, so it is the perfect time to talk about Aflac life insurance and why you may want it!

What is life insurance?

Before we begin, you may be wondering what exactly life insurance is.

Life insurance is a policy that pays money to a beneficiary you designate in the event of death. Naturally, if you are the sole or primary wage earner in your family, then there are a lot of people who rely on you financially, meaning life insurance may be a necessity.

The cash benefits can be used to help pay for funeral costs, personal expenses, payment of debt and so on.

The primary reason to get life insurance is to help your loved ones or anyone who depends on you in the event of a sudden loss of income after a death.

This way, they still have help paying the bills and grieve without having to worry about their immediate source of money.

When do you need life insurance?

Life insurance is not only for individuals who are the primary income earners of their household. Even if you are young, single and have no children, life insurance can still help support your loved ones. For example, a life insurance policy can support your family if you have co-signed loans with your parents (such as student loans), taken out a loan to start a small business or if you are financially responsible for another family member.

If you have co-signers on your debt, you should consider getting life insurance.

If something were to happen to you, you don’t want your co-signer (your parents, partner, siblings, friend, etc.) to be responsible for paying off your personal debt unexpectedly.

I can’t help but think of an article I read about a young adult who did not have life insurance. They passed away suddenly, leaving behind their student loan debt to their parents who co-signed the loan. They were suddenly responsible for monthly student loan payments of around $2,000 and had to entirely restructure their finances as a result.

If you have a partner, it is also important to consider the benefits of life insurance. If you have credit card debt, student loans, or if your partner relies on your income for rent or mortgage payment, a life insurance plan can help relieve those you care about from unnecessary financial burden.

Perhaps most importantly to note, life insurance is often cheaper while one is younger. By enrolling in a life insurance policy before you have children, you can typically secure a policy with lower premiums than when you are older.

If you plan on getting life insurance anyway, enroll early to ensure a more affordable rate.

Where do I find life insurance?

One popular life insurance company to look into is Aflac.

Aflac is a Fortune 500 company that provides supplemental insurance, including life insurance, to more than 50 million people through its subsidiaries in Japan and the U.S., where it is a leading supplemental insurer, by paying cash fast to help with the expenses health insurance doesn’t cover.

For consumers who place a premium on corporate ethics, Aflac is also a socially responsible company. For 25 years, Aflac has contributed over $146 million to help children facing cancer and their families, including establishing the Aflac Cancer and Blood Disorders Center in Atlanta.* If this interests you, then you can go to ESG.Aflac.com to explore how Aflac is dedicated to being a good and decent company.

If you are interested in learning more about insurance options that are available to you, I recommend heading to Aflac’s life insurance calculator, which allows you to identify how much coverage you need. You can see a screenshot of some of the questions below. It only took me about two minutes to answer the questions, and it offered a holistic overview of my personal benefit options.

Once you’ve answered the questions, it is easy to request a life insurance quote.

According to a 2019 Insurance Barometer Study by LIMRA, a worldwide research, consulting and professional development trade association, consumers think that life insurance is more costly than what it actually is. The study asked people to guess how much a $250,000 term life insurance policy costs for a healthy 30-year-old.

More than 50% estimated that it would be over $500 per year.

However, that’s very far from the truth.

The average cost of a life insurance plan is actually only around $160 a year, or $13 a month.

If you are interested in opting into a life insurance plan, $13 a month may make it an easy choice.

There are a lot of reasons why you may want to apply for life insurance, but remember that it makes sense to take one out early and save money in the long term.

I’d love to hear from you. Do you have life insurance? Why or why not?

*Aflac company statistic, 2020.

This is a brief product overview only. Coverage may not be available in all states. Benefits/premium rates may vary based on plan selected. Optional riders may be available at an additional cost. The policy/rider has limitations and exclusions that may affect benefits payable. Refer to the specified policy/rider form(s) for complete details, benefits, limitations, and exclusions. For availability and costs, please contact your local Aflac agent

Coverage is underwritten by Aflac | WWHQ | 1932 Wynnton Road | Columbus, GA 31999 | In New York, coverage is underwritten by Aflac New York | 22 Corporate Woods Blvd, Suite 2 | Albany, NY 12211

Z200625 Exp. 9/21

The post Should You Have Life Insurance If You Don’t Have Children? appeared first on Making Sense Of Cents.

Finance

Survey: Half of America Doesn’t Check Their Credit Score at All

Credit scores aren’t just a tool to determine loan and mortgage eligibility. Monthly point differences could define whether you’re offered better interest rates or stay in the shadows of less than ideal credit-based products. And checking your credit score periodically could improve not only your chances at landing a great mortgage rate or personal loan, but improve your long term financial health. Yet, 51% of Americans never check their credit score, according to a new survey conducted by The Simple Dollar.

Survey results

- We surveyed 879 American adults and found that over half say they never check their credit score.

- 39.7% of respondents say they periodically check their credit score (once a month or so)

- Credit checkers are rare in America, with only 8.6% of respondents saying they check their score more than once per month.

How often do you check your credit score?

!function(e,i,n,s){var t=”InfogramEmbeds”,d=e.getElementsByTagName(“script”)[0];if(window[t]&&window[t].initialized)window[t].process&&window[t].process();else if(!e.getElementById(n)){var o=e.createElement(“script”);o.async=1,o.id=n,o.src=”https://e.infogram.com/js/dist/embed-loader-min.js”,d.parentNode.insertBefore(o,d)}}(document,0,”infogram-async”);

The benefits of knowing your credit score

There are several benefits of knowing your credit score, mainly if you use credit frequently in your financial life (personal loans, credit cards, etc).

Saves you time on loan shopping

If you search for “personal loans,” you’ll find a deluge of financial products and websites promoting themselves. It’s tough to know what you’re actually qualified for without knowing the nature of your current credit score. Are those advertised rates only for very qualified buyers? Are you one of those?

Helps you prevent frauds

A credit report is often the first place fraud victims notice unusual activity being conducted in their name. With data breaches on the rise, the average American has had their data stolen at least four times in the past year. This means keeping an eye on the accounts opened in your name is more important than ever.

Creates a course for the future

If you have a low credit score or no credit history, checking your credit score periodically is a great way to stay on course for the future. You can set goals for yourself and watch as specific actions you take affect the score. When the time comes to get that business loan or student loan, you’ll know where you’re at now and where you need to be to qualify.

Allows you to qualify for emergency or personal loans

Sometimes we don’t know what the future will hold for our financial lives. You may not think you’ll need a personal loan in an emergency, but if you do, you’ll want to make sure your credit is in good shape. There could be fraud or inaccuracies on your record that prevent you from obtaining that loan in an emergency. Knowing your credit score can help make sure you have access to those types of loans at any time. That being said, even if you have poor credit, you could still obtain a loan.

Possible reasons for not checking your credit score

We spoke to several office mates, friends and family members about how they check their credit score. Anecdotally, the 51% non-checkers number held up within our circles. When asked why they don’t check their credit scores, here were some of the answers:

- “I don’t use credit cards or plan on taking on loans anytime soon.”

- “I already know I have horrible credit.”

- “Didn’t know it was that important”

- “My spouse does that stuff.”

Survey methodology

We surveyed 879 Americans over the age of 24 (conducted Aug. 26-31, 2020). Respondent’s age, location and gender data was also collected at the time, but we found no statistically significant differences worth noting in our report. The survey was conducted in conjunction with Google Surveys.

We welcome your feedback on this article. Contact us at [email protected] with comments or questions.

Image credit: Pavel Bezkorovainyi / Getty Images

The post Survey: Half of America Doesn’t Check Their Credit Score at All appeared first on The Simple Dollar.

-

Business2 months ago

Business2 months agoBernice King, Ava DuVernay reflect on the legacy of John Lewis

-

World News2 months ago

Heavy rain threatens flood-weary Japan, Korean Peninsula

-

Technology2 months ago

Technology2 months agoEverything New On Netflix This Weekend: July 25, 2020

-

Finance4 months ago

Will Equal Weighted Index Funds Outperform Their Benchmark Indexes?

-

Marketing Strategies9 months ago

Top 20 Workers’ Compensation Law Blogs & Websites To Follow in 2020

-

World News8 months ago

World News8 months agoThe West Blames the Wuhan Coronavirus on China’s Love of Eating Wild Animals. The Truth Is More Complex

-

Economy11 months ago

Newsletter: Jobs, Consumers and Wages

-

Finance10 months ago

Finance10 months ago$95 Grocery Budget + Weekly Menu Plan for 8