Economy

The GDP Collapse: It Is What It Is

Jim discussed elements of the 2020Q2 advance release on Thursday. Here, I amplify some aspects that he mentioned.

Confirmation: A Catastrophe in the Making

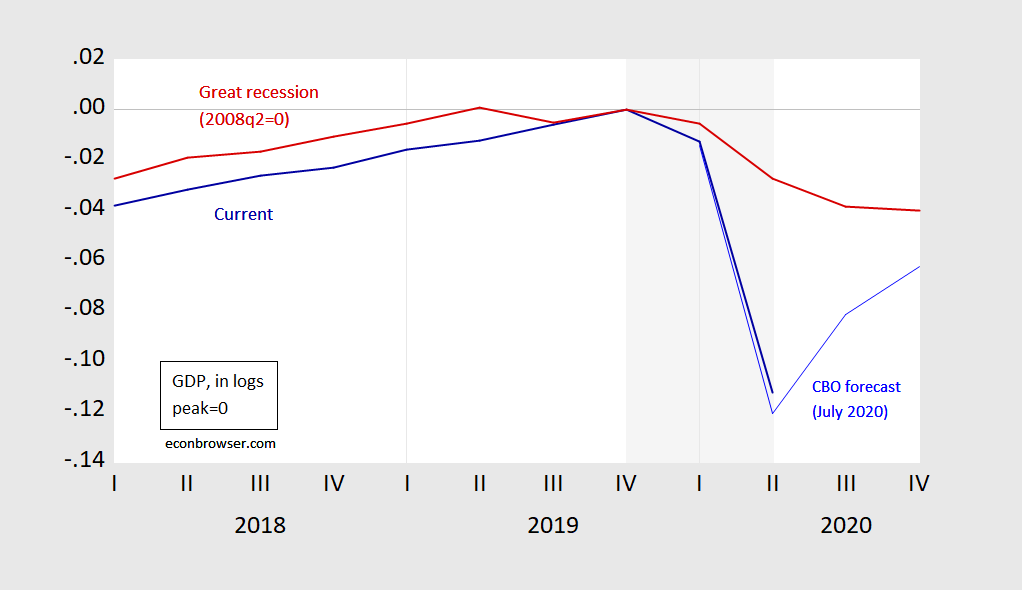

First, the Trump recession is truly catastrophic in scale; the pace of GDP decline is much greater than that in 2008. This is shown in Figure 1.

Figure 1: GDP in logs, normalized to 0 at 2019Q4 (NBER peak) (blue), and GDP normalized to 2008Q2 (red). NBER defined recession shaded gray, assuming trough at 2020Q2. Source: BEA, 2020Q2 advance release, NBER, author’s calculations.

A “No Confidence” Vote in Administration Policy and Investment

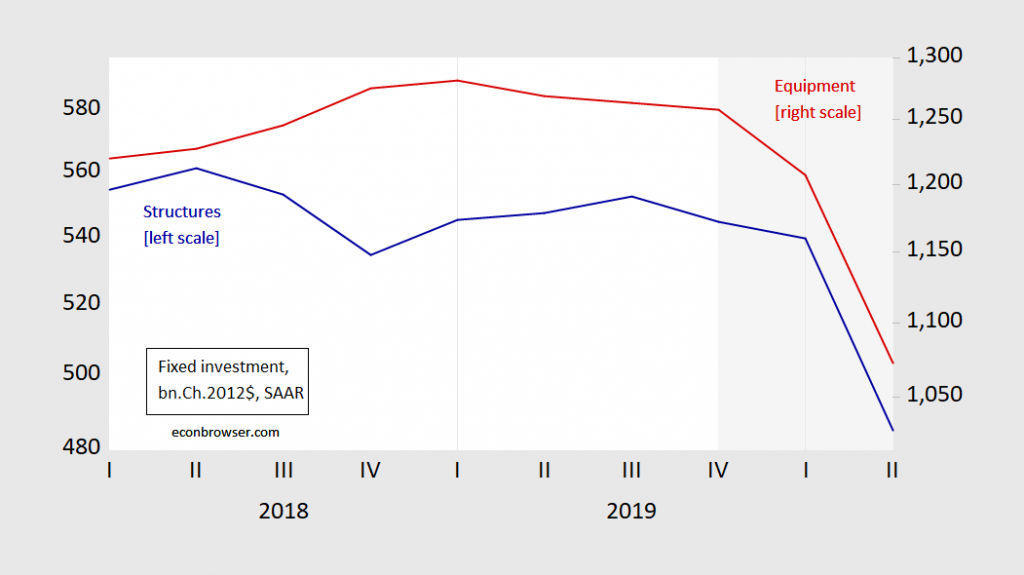

Second, investment has crashed — for both structures and equipment investment. That’significant insofar as capital investment is forward looking.

Figure 2: Fixed investment in structures (blue, left log scale), and in equipment (red, right log scale), in billions Chained 2012$, SAAR. NBER defined recession shaded gray, assuming trough at 2020Q2. Source: BEA, 2020Q2 advance release, NBER, author’s calculations.

This decline is even more rapid than in 2008Q4; 31.5% now vs. 24% then.

Figure 3: Nonresidential fixed investment in logs, normalized to 0 in 2019Q4 (blue), and normalized to 0 in 2008Q2 (red). NBER defined recession shaded gray, assuming trough at 2020Q2. Source: BEA, 2020Q2 advance release, NBER, author’s calculations.

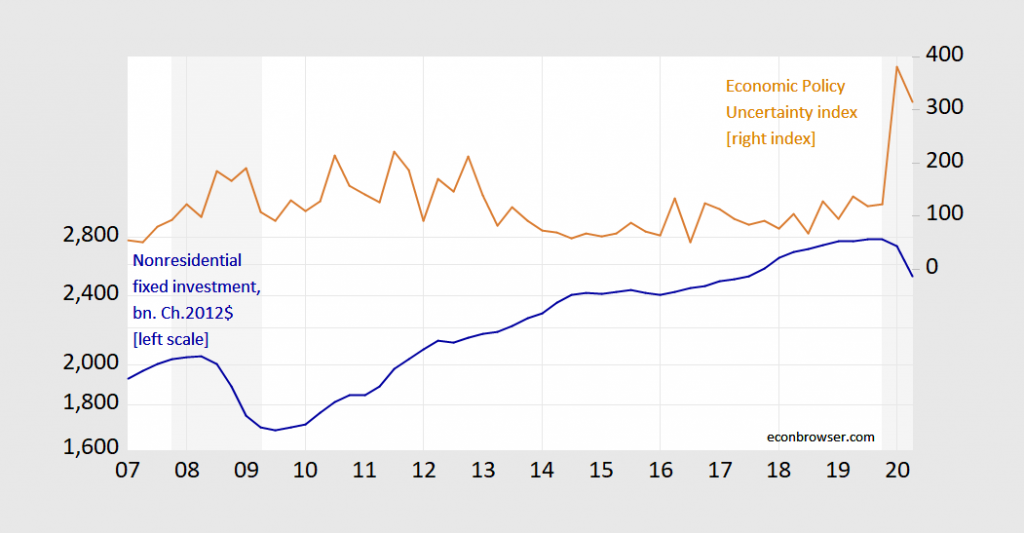

Certainly, some of the crash is due to the crash in aggregate demand — as in the 2007 recession — but some is due to uncertainty, including policy uncertainty. Policy uncertainty levels currently dwarf those of the Great Recession.

Figure 4: Nonresidential fixed investment in billions Chained 2012$ SAAR (blue, left log scale), Economic Policy Uncertainty index (tan, right scale). NBER defined recession shaded gray, assuming trough at 2020Q2. Source: BEA, 2020Q2 advance release, NBER, policyuncertainty.com via FRED, and author’s calculations.

No Recovery Without Recovery in Services Demand

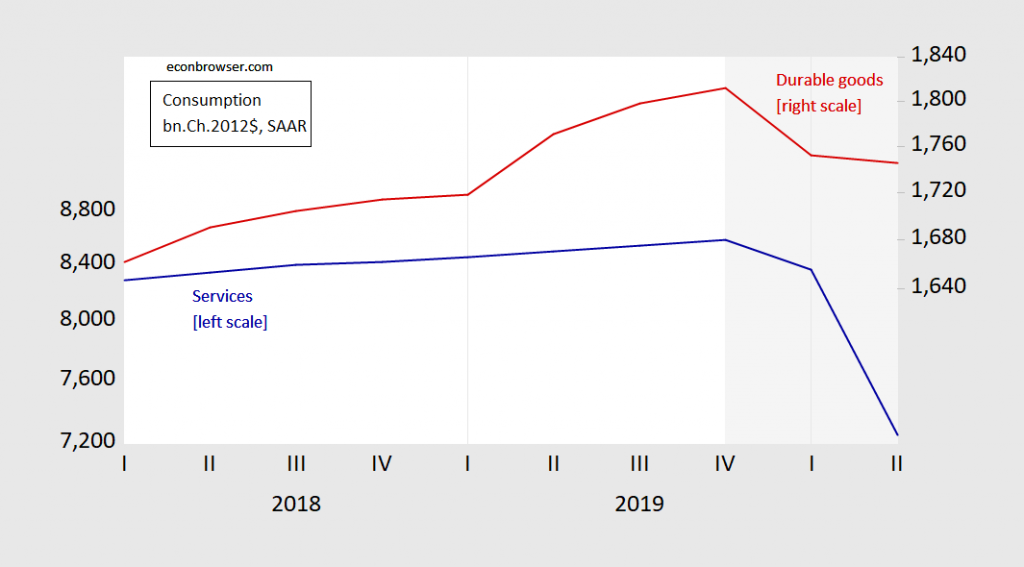

Third, this is a different kind of recession, in many ways, but importantly in the sectoral origin. As Jim Hamilton noted, the decline in services consumption was 43.5% on an annualized basis, while durable goods consumption was relatively flat.

Figure 5: Services consumption (blue, left log scale), and durable goods consumption (red, right log scale), all in billions Chained 2012$ SAAR. NBER defined recession shaded gray, assuming trough at 2020Q2. Source: BEA, 2020Q2 advance release, NBER, and author’s calculations.

Of the 9.8 percentage point decline in GDP (not annualized), 5.9 percentage points were accounted for (in a mechanical sense) by services consumption decline. Jim provides a breakdown of the services consumption decline in his post.

Services consumption will not fully recover until such time as the Covid-19 infection rates are at manageable levels that do not deter such consumption activities. The Administration’s current policy stance is unlikely to encourage that development; one could argue that it — in toto — is impeding that outcome.

State and Local Government Spending Collapses

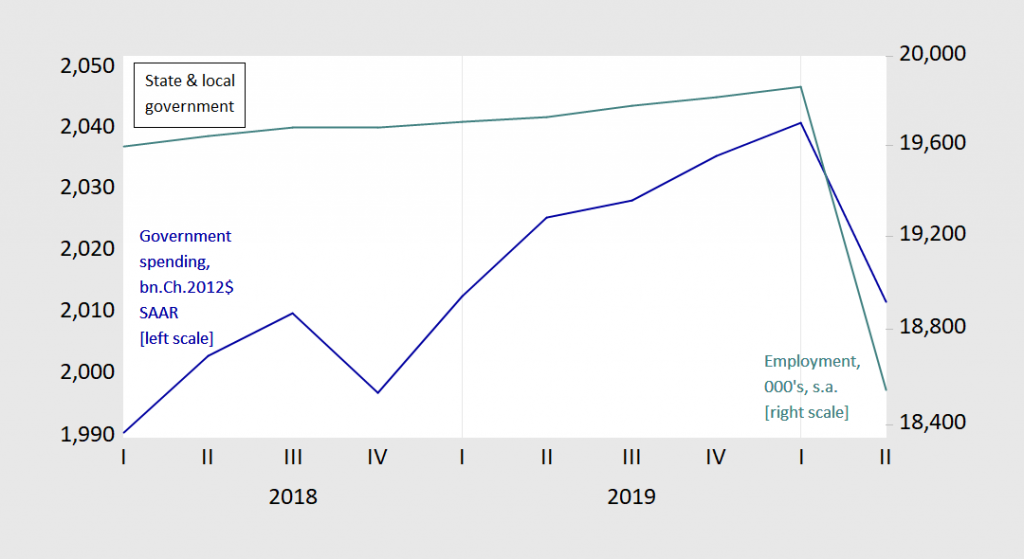

Fourth, the biggest threat to the economy may be avoidable. One of the lessons of the Great Recession is that constraints on state and local government spending — exacerbated by ill-advised state income tax cuts — was one of the reasons for the torpid pace of recovery. So far, we have not replicated completely that experience, but with Republican opposition to further Federal transfers to the state, we are in danger of repeating that error.

Figure 6: State and local government spending, billions Chained 2012$ SAAR (blue, left log scale), and state and local employment, 000’s, s.a. (teal, right log scale). Source: BEA 2020Q2 advance release, BLS employment situation June release.

This is why it is critical, as many economists have argued, for the next recovery package to include substantial aid to the states and localities.

Economy

Blaming the voters

In the Times, Matthew Parris wrote: "this Prime Minister is ultimately our [the electorate's] fault." I tweeted that this was absolutely right, but got a little pushback. I should therefore elaborate.

What I and Matthew meant was that Johnson is not doing anything unexpected. He is merely living down to what everybody knew about him. As Matthew wrote:

There was never any reason for confidence in Boris Johnson’s diligence, his honesty, his directness, his mastery of debate, his people-skills with colleagues, his executive ability or his policy grip. We’d seen no early demonstration of any of these qualities but we just blanked that out.

Voters, then, are getting what they voted for. Those who voted Labour in 2001 could say of the Iraq war “I never voted for that”. Those who voted Lib Dem in 2010 could say of the tripling of tuition fees “I never voted for that.” Those who voted Tory last year, however, cannot say the same. They got what they wanted. They should own it.

There are some objections to this, most of which I find inadequate.

The first is that voters were deceived by our dishonest grifter media. There’s some truth in this. The media does have some influence, if less than its critics claim.

But people have agency. They are responsible for believing the media’s lies: the victims of conmen are not always wholly deserving of our sympathy. And voters are quite capable of being wrong without the media’s help. They are systematically mistaken about many social facts, such as how many immigrants there are. They don’t understand economics (or, I suspect, the social sciences generally). Some of their preferences – for benefit cuts and a hostile environment for immigrants - are plain vicious. And they have cognitive biases which support inequality. The media amplify these failings. But to believe they are the sole cause of them is to regard voters as childlike noble savages who are corrupted by a few billionaires. That’s just romantic twaddle.

You don’t need to believe in Marxian ideas of false consciousness (a phrase Marx never used) to accept this. Bryan Caplan and Jason Brennan have said similar things from a non-Marxian point of view.

Another objection to Parris’s claim is that the Tories got only a minority of the vote and so it is our electoral system to blame rather than the voters.

Let’s leave aside the fact that the electorate support this system: they rejected mild reform in the 2011 referendum. And let’s also leave aside the fact that it’s not just Tory voters to blame. Those who abstained or voted Lib Dem thereby allowing a Tory candidate to win in their constituency are also guilty.

And let’s also leave aside the fact those using this argument must be careful – because it will undoubtedly be weaponized by the right to delegitimize even a mildly social democratic government.

Instead, there’s another problem. If voters do have vicious, biased and ill-informed preferences – whether caused by the media or anything else – then the last thing we should want is for parliament to better reflect these. (Of course, some Labour supporters might have such bad preferences too.)

Our problem is not how to get a more representative parliament but rather how to filter voters’ preferences so they reflect the wisdom rather than stupidity of crowds.

Traditionally, small-c conservatives have been alive to this question. It is why Edmund Burke thought that MPs’ judgment should over-ride the “hasty opinion” of their constituents. And it’s why they have prized an independent civil service and judiciary, as these too restrain hasty, silly and nasty preferences: it is no accident that populists everywhere attack such institutions.

But there is a more radical alternative – to use devices of deliberative (pdf) democracy such as citizens juries to increase our chances of getting the best rather than worst of public opinion. It is these we need more than electoral reform.

You might object here that it is futile to complain about the electorate as we must work with the world as it is, not as we’d like it.

Public opinion, however, is malleable – a fact our most successful recent Prime Ministers have recognised. Thatcher sought to change it not just by persuasion but by introducing a property-owning democracy to incentivize people to vote Tory. And Blair’s expansion of higher education has (inadvertently?) created a large cohort of liberal-minded youngsters: there’s a reason why Tories are attacking universities.

There’s a further objection to Parris’s claim. Some of us (not enough!) voted Labour. Surely we’re not to blame?

There’s an irony here. Many people using this to exculpate themselves also believe in the idea of collective guilt – that, for example, Britons collectively were responsible for the slave trade and imperialism. But if our ancestors, many of whom never owned slaves or participated in imperialism, were collectively guilty of these crimes, mightn’t we too be collectively responsible for the Tory government?

Mightn’t even we Labour supporters be partly to blame by for example not campaigning sufficiently or sufficiently well or for making bad political choices ourselves – be they choosing a Labour leader who didn’t appeal sufficiently to voters or not accepting the Brexit referendum result?

Which brings me to another irony. Part of Johnson’s appeal is like Trump’s: it’s a backlash against metropolitan elites who think they know better than “the people”. And yet those of us who claim that (some) voters are ill-informed and vicious are making the same mistake Hillary Clinton made when she called Trump supporters “deplorables”: we’re inviting a backlash against us arrogant know-alls.

This is a dilemma. The solution to it – if there is one – is to try to separate talk about outcomes from talk about process. We must ask: what sort of processes and institutions are likely to best deliver policies that are both good (by whatever lights you want) and democratic? Few people, however, want such a debate.

Economy

More on debt

Following my last post on debt I’ve thought a bit more, and received some very useful emails from colleagues.

A central clarifying thought emerges.

The main worry I have about US debt is the possibility of a debt crisis. I outlined that in my last post, and (thanks again to correspondents) I’ll try to draw out the scenario later. The event combines difficulty in rolling over debt, the lack of fiscal space to borrow massively in the next crisis. The bedrock and firehouse of the financial system evaporates when it’s needed most.

To the issue of a debt crisis, the whole debate about r<g, dynamic inefficiency, sustainability, transversality conditions and so forth is largely irrelevant.

We agree that there is some upper limit on the debt to GDP ratio, and that a rollover crisis becomes more likely the larger the debt to GDP ratio. Given that fact, over the next 20-30 years and more, the size of debt to GDP and the likelihood of a debt crisis is going to be far more influenced by fiscal policy than by r-g dynamics.

In equations with D = debt, Y = GDP, r = rate of return on government debt, s = primary surplus, we have* [frac{d}{dt}frac{D}{Y} = (r-g)frac{D}{Y} - frac{s}{Y}.] In words, growth in the debt to GDP ratio equals the difference between rate of return and GDP growth rate, less the ratio of primary surplus (or deficit) to GDP.

Now suppose, the standard number, r>g, say r-g = 1% or so. That means to keep long run average 100% debt/GDP ratio, the government must run a long run average primary surplus of 1% of GDP, or $200 billion dollars. The controversial promise r<g, say r-g = -1%, offers a delicious possibility: the government can keep the debt/GPD ratio at 100% forever, while still running a $200 billion a year primary deficit!

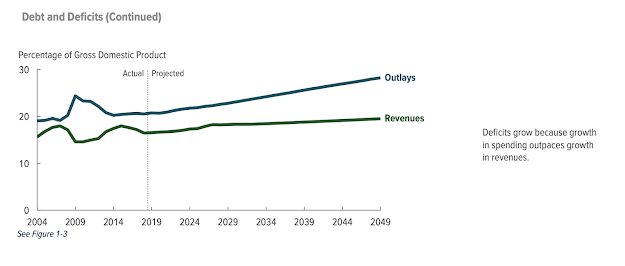

But this is couch change! Here are current deficits from the CBO September 2 budget update

Now that this is clear, I realize I did not emphasize enough that Olivier Blanchard’s AEA Presidential Address acknowledges well the possibility of a debt crisis:

Fourth, I discuss a number of arguments against high public debt, and in particular the existence of multiple equilibria where investors believe debt to be risky and, by requiring a risk premium, increase the fiscal burden and make debt effectively more risky. This is a very relevant argument, but it does not have straightforward implications for the appropriate level of debt.

See more on p. 1226. Blanchard’s concise summary

there can be multiple equilibria: a good equilibrium where investors believe that debt is safe and the interest rate is low and a bad equilibrium where investors believe that debt is risky and the spread they require on debt increases interest payments to the point that debt becomes effectively risky, leading the worries of investors to become self-fulfilling.

Let me put this observation in simpler terms. Let’s grow the debt / GDP ratio to 200%, $40 trillion relative to today’s GDP. If interest rates are 1%, then debt service is $400 billion. But if investors get worried about the US commitment to repaying its debt without inflation, they might charge 5% interest as a risk premium. That’s $2 trillion in debt service, 2/3 of all federal revenue. Borrowing even more to pay the interest on the outstanding debt may not work. So, 1% interest is sustainable, but fear of a crisis produces 5% interest that produces the crisis.

Brian Riedi at the Manhattan Institute has an excellent exposition of debt fears. On this point,

… there are reasons rates could rise. …

market psychology is always a factor. A sudden, Greece-like debt spike—resulting from the normal budget baseline growth combined with a deep recession—could cause investors to see U.S. debt as a less stable asset, leading to a sell-off and an interest-rate spike. Additionally, rising interest rates would cause the national debt to further increase (due to higher interest costs), which could, in turn, push rates even higher.

***********

So how far can we go? When does the crisis come? There is no firm debt/GDP limit.

Countries can borrow a huge amount when they have a decent plan for paying it back. Countries have had debt crises at quite low debt/GDP ratios when they did not have a decent plan for paying it back. Debt crises come when bond holders want to get out before the other bond holders get out. If they see default, haircuts, default via taxation, or inflation on the horizon, they get out. r<g contributes a bit, but the size of perpetual surplus/deficit is, for the US, the larger issue. Again, r<g of 1% will not help if s/Y is 6%. Sound long-term financial strategy matters.

From the CBO’s 2019 long term budget outlook (latest available) the outlook is not good. And that’s before we add the new habit of massive spending.

Here though, I admit to a big hole in my understanding, echoed in Blanchard and other’s writing on the issue. Just how does a crisis happen? “Multiple equilibria” is not very encouraging. Historical analysis suggests that debt crises are sparked by economic and political crises in the shadow of large debts, not just sunspots. We all need to understand this better.

******

Policy.

As Blanchard points out, small changes do not make much of a difference.

a limited decrease in debt—say, from 100 to 90 percent of GDP, a decrease that requires a strong and sustained fiscal consolidation—does not eliminate the bad equilibrium. …

Now I disagree a bit. Borrowing 10% of GDP wasn’t that hard! And the key to this comment is that a temporary consolidation does not help much. Lowering the permanent structural deficit 2% of GDP would make a big difference! But the general point is right. The debt/GDP ratio is only a poor indicator of the fiscal danger. 5% interest rate times 90% debt/GDP ratio is not much less debt service than 5% interest rate times 100% debt/GDP ratio. Confidence in the country’s fiscal institutions going forward much more important.

At this point the discussion usually devolves to “Reform entitlements” “No, you heartless stooge, raise taxes on the rich.” I emphasize tax reform, more revenue at lower marginal rates. But let’s move on to unusual policy answers.

Borrow long. Debt crises typically involve trouble rolling over short-term debt. When, in addition to crisis borrowing, the government has to find $10 trillion new dollars just to pay off $10 trillion of maturing debt, the crisis comes to its head faster.

As blog readers know, I’ve been pushing the idea for a long time that especially at today’s absurdly low rates, the US government should lock in long-term financing. Then if rates go up either for economic reasons or a “risk premium” in a crisis, government finances are much less affected. I’m delighted to see that Blanchard agrees:

to the extent that the US government can finance itself through inflation-indexed bonds, it can actually lock in a real rate of 1.1 percent over the next 30 years, a rate below even pessimistic forecasts of growth over the same period

contingent increases in primary surpluses when interest rates increase.

I’m not quite sure how that works. Interest rates would increase in a crisis precisely because the government is out of its ability or willingness to tax people to pay off bondholders. Does this mean an explicit contingent spending rule? Social security benefits are cut if interest rates exceed 5%? That’s an interesting concept.

Or it could mean interest rate derivatives. The government can say to Wall Street (and via Wall Street to wealthy investors) “if interest rates exceed 5%, you send us a trillion dollars.” That’s a whole lot more pleasant than an ex-post wealth tax or default, though it accomplishes the same thing. Alas, Wall Street and wealthy bondholders have lately been bailed out by the Fed at the slightest sign of trouble so it’s hard to say if such options would be paid.

Growth. Really, the best option in my view is to work on the g part of r-g. Policies that raise economic growth over the next decades raise the Y in D/Y, lowering the debt to GDP ratio; they raise tax revenue at the same tax rates; and they lower expenditures. It’s a trifecta. In my view, long-term growth comes from the supply side, deregulation, tax reform, etc. Why don’t we do it? Because it’s painful and upsets entrenched interests. For today’s tour of logical possibilities if you think demand side stimulus raises long term growth, or if you think that infrastructure can be constructed without wasting it all on boondoggles, logically, those help to raise g as well.

********

*Start with (frac{dD}{dt} = rD - s.) Then ( frac{d}{dt}frac{D}{Y} = frac{1}{Y}frac{dD}{dt}-frac{D}{Y^2}frac{dY}{dt}.)

***

Update: David Andolfatto writes, among other things,

“Should we be worried about hyperinflation? Evidently not, as John does not mention it”

For these purposes, hyperinflation is equivalent to default. In fact, a large inflation is my main worry, as I think the US will likely choose default via inflation to explicit default. This series of posts is all about inflation. Sorry if that was not clear.

also

Is there a danger of “bond vigilantes” sending the yields on USTs skyward? Not if the Fed stands ready to keep yields low.

All the Fed can do is offer overnight interest-paying government debt in exchange for longer-term government debt. If treasury markets don’t want to roll over 1 year bonds at less, than, say, 10%, why would they want to hold Fed reserves at less than 10%? If the Fed buys all the treasurys in exchange for reserves that do not pay interest, that is exactly how we get inflation. And mind the size. The US rolls over close to $10 trillion of debt a year. Is the Fed going to buy $10 trillion of debt? Who is going to hold $10 trillion of reserves, who did not want to hold $10 trillion of debt.

In a crisis, even the Fed loses control of interest rates.

Economy

Briefly Noted for 2020-09-23

William Cohan: Jay Powell Adds Voice to Small Business Cry for Help https://www.ft.com/content/60d8bd2b-0bb5-4e8a-99bc-93653277ec42: ‘US recovery will never come until the companies that account for most jobs get back on their feet…

Teresa Nielsen Hayden: Stupid Plot Tricks http://sff.net/paradise/plottricks.htm: ‘The Evil Overlord Devises a Plot…

John Davis: The Mystery of Fort Zinderneuf in Beau Geste https://mysteriouswritings.com/the-mystery-of-fort-zinderneuf-in-beau-geste-by-john-davis/…

Simple Minds: Don’t You Forget About Me https://www.youtube.com/watch?v=Zfcwq44q-vA…

Keri Leigh Merritt: ‘Am absolutely THRILLED to announce my new fall #Merrittocracy series (in both @youtube & #podcast formats!) 🔥🔥🔥 https://twitter.com/KeriLeighMerrit/status/1303317030133805056. In the 6 weeks leading up to 2020 Election, I will interview 6 top scholars on: The 2020 Election & Beyond: The Possibilities & Pitfalls of a Post-Trump America…

Wikipedia: Lusitania https://en.wikipedia.org/wiki/Lusitania: ‘an ancient Iberian Roman province located where modern Portugal (south of the Douro river) and part of western Spain (the present autonomous community of Extremadura and a part of the province of Salamanca) lie…

Bertholt Brecht: To Those Born After http://languagehat.com/page/4/: ‘Men’s strength was little. The goal/Lay far in the distance,/Easy to see if for me/Scarcely attainable./So the time passed away/Which on earth was given me…

Elizabeth Bear: What to Do When You Feel Awful & Nothing Seems to Make Sense: Identifying & Navigating Gaslighting https://medium.com/@matociquala_57740/what-to-do-when-you-feel-awful-nothing-seems-to-make-sense-identifying-navigating-gaslighting-62918f7946c: ‘One mistake we often make is to assume that gaslighting is intentional and calculated. It’s not: like most abuse, it’s reactive and triggered. This status is precisely why the behaviors can seem so random and incomprehensible that they make us, the targets or observers of the behavior, feel out of control ourselves, or as if our own perceptions must be skewed…

Branko seems here to be saying something that is both true and not true: John Woodbridge: ‘An old debate https://twitter.com/JVWoodster/status/1306101839205720064 https://youtube.com/watch?v=nsT6gQmesdQ between DeLong and Tim Kane. I feel like these right wing talking points of 1) things are much better than they were in 1910 (or pick a date) and 2) and the impact of technology and it’s raising of living standards isn’t captured by official statistics seem, honestly, pretty hollow. Branko Milanovic wrote about this comparison in a far more intelligent way than I can: “Had anyone tried grand-parental comparison in Eastern Europe in 1989, he would have been laughed out. And yet, there was not a single indicator (income, life expectancy, education level, housing space) that in 1989 was not better than in 1949…

How to be publicly effective in the dysfunctional public sphere created by the age of Trump—and after: Jonathan Crowe: Opposition in the Age of Gish Gallops https://www.jonathancrowe.net/2016/12/opposition-in-the-age-of-gish-gallops/: ‘The Gish Gallop, named after creationist Duane Gish, is a rhetorical strategy of “drowning your opponent in a flood of individually weak arguments in order to prevent rebuttal of the whole argument collection without great effort…

How to be privately effective in the dysfunctional world created by the age of Trump—and after: Masha Gessen (2016): Autocracy: Rules for Survival https://www.nybooks.com/daily/2020/11/10/trump-election-autocracy-rules-for-survival/: ‘The electoral college… two elections in which Republicans won with the minority of the popular vote. That should not be normal. But resistance—stubborn, uncompromising, outraged—should be…

Norm-breaking as the road to catastrophe: historical analogy: Plutarch: Life of Tiberius Gracchus http://penelope.uchicago.edu/Thayer/E/Roman/Texts/Plutarch/Lives/Tiberius_Gracchus*.html: ‘This is said to have been the first sedition at Rome, since the abolition of royal power, to end in bloodshed and the death of citizens; the rest though neither trifling nor raised for trifling objects, were settled by mutual concessions, the nobles yielding from fear of the multitude, and the people out of respect for the senate…

J. Bradford DeLong: Imperialism & Underdevelopment, 1870-1914: Intro https://share.mmhmm.app/71d9afc8ded940af83fcfdb582f0f658…

J. Bradford DeLong & A. Michael Froomkin (1999): Speculative Microeconomics for Tomorrow’s Economy http://osaka.law.miami.edu/~froomkin/articles/spec.htm: ‘Adam Smith’s case for the invisible hand… will be familiar to almost all…. The revolutions in data processing and data communications may shake these foundations…

Plus:

Teresa Nielsen Hayden (2003): As you know, Bob… http://nielsenhayden.com/makinglight/archives/004046.html: ‘I have to quote this one. LanguageHat posted it in the Egoscanning comment thread, in the wake of Arthur Hlavaty’s remark that “I cast no first stones; I was egoscanning when the Web was a scientifictional dream”…

Ralph 4CR looked around in astonishment. “You mean… there are invisible beams all around us, carrying information to all parts of the globe, even as we speak?” The Master of Communications turned towards him solemnly. “Yes,” he asseverated, “and the information is not carried whole, but is broken up into a myriad of infinitesimal packets, to be reassembled without fail when they reach their destination.” “You astonish me,” breathed Ralph. “And this information is accessible to all?” “It is,” nodded the Master. “The issues of the day are debated by all citizens, no matter where they may be located, and communication no longer waits on tides or weather.”

“And what are the great issues so decided?” The Master cast a glance at the poll on his screen: Which Jedi Knight Are You? He looked severe. “I fear our issues would mean nothing to you across the great gulf of time you have traversed. You should go now and refresh yourself. We will speak later. You have much to learn. Vanna, show our young guest to his room.” A lissome blonde appeared from behind a curtain and beckoned…

Joseph A. Schumpeter (1946): John Maynard Keynes 1883-1946 https://github.com/braddelong/public-files/blob/master/readings/article-schumpeter-keynes-obituary.pdf: ‘He was not the sort of man who would bend the full force of his mind to the individual problems of coal, textiles, steel, shipbuilding…. He was the English intellectual, a little deracine… childless and his philosophy of life was essentially a short-run philosophy…

…So he turned resolutely to the only “parameter of action” that seemed left… monetary management…. It might heal…. It would sooth…. Return to a gold system at pre-war parity was more than his England could stand…. Keynesianism is a seedling which cannot be transplanted into foreign soil: it dies there and becomes poisonous….

The social vision first revealed in the Economic Consequences of the Peace… in which investment opportunity flags and saving habits nevertheless persist, is… implemented in the General Theory of Employment, Interest, and Money… consumption function… efficiency-of-capital… liquidity-preference… the given wage-unit and the… quantity of money “determine” income and ipso facto employment… the great dependent variables to be “explained.”… With Marx, capitalist evolution issues into breakdown…. With Keynes, it issues into a stationary state that constantly threatens to break down…. In both theories, the breakdown is motivated by causes inherent to the working of the economic engine…. This feature naturally qualifies Keynes’s theory for the role of “rationalizer” of anti-capitalist volition….

[In] the General Theory, we find… overstatements, moreover, which cannot be reduced to the defensible level, because results depend precisely upon the excess…. One word in the book that cannot be defended… the word “general.”… Keynesians may hold that these special cases are the actual ones of our age. They cannot hold more than that…. Keynes wished to secure his major results without appeal to the element of rigidity, just as he spurned the aid he might have derived from imperfections of competition. There were points, however, at which he was unable to do so…. And at other points, rigidities stand in reserve….

It is, of course, always possible to show that the economic system will cease to work if a sufficient number of its adaptive organs are paralyzed. Keynesians like this fire escape no more than do other theorists. Nevertheless, it is not without importance. The classical example is equilibrium under-employment….

Most orthodox Keynesians are “radicals” in one sense or another…. Disciples… see one thing only-an indictment of private thrift and the implications… with respect to the managed economy and inequality of incomes…. Saving had come to be regarded as the last pillar of the bourgeois argument…. Adam Smith[‘s]… system… amounts to all-around vituperation directed against “slothful” landlords and grasping merchants or “masters”…. Marshall and Pigou were in this boat… took it for granted that inequality… was “undesirable.”… Many… who entered the field… in the twenties and thirties had renounced allegiance to the bourgeois scheme… sneered at the profit motive and at the element of personal performance in the capitalist process. But… they still had to pay respect to saving-under penalty of losing caste…. Keynes broke their fetters: here, at last, was theoretical doctrine that not only obliterated the personal element and was… at least mechanizable, but also smashed the pillar into dust…. Via saving, “the unequal distribution of income is the ultimate cause of unemployment.” This is what the Keynesian Revolution amounts to…

.#brieflynoted #noted #2020-09-23

-

Business2 months ago

Business2 months agoBernice King, Ava DuVernay reflect on the legacy of John Lewis

-

World News2 months ago

Heavy rain threatens flood-weary Japan, Korean Peninsula

-

Technology2 months ago

Technology2 months agoEverything New On Netflix This Weekend: July 25, 2020

-

Finance4 months ago

Will Equal Weighted Index Funds Outperform Their Benchmark Indexes?

-

Marketing Strategies9 months ago

Top 20 Workers’ Compensation Law Blogs & Websites To Follow in 2020

-

World News8 months ago

World News8 months agoThe West Blames the Wuhan Coronavirus on China’s Love of Eating Wild Animals. The Truth Is More Complex

-

Economy11 months ago

Newsletter: Jobs, Consumers and Wages

-

Finance9 months ago

Finance9 months ago$95 Grocery Budget + Weekly Menu Plan for 8