Share Market

Mindspace REIT IPO Review

Mindspace REIT IPO Details:

Issue Open Date: 27th July 2020

Issue Close Date: 29th July 2020

Equity Shares offered: 6.77 Cr

Price Band: 274-275

Issue Size: 4,500 Cr

Min Lot Size: 200 (Rs. 55,000)

Purpose of the offer

Net Proceeds of the issue are proposed to be utilized in:

- Repayment of certain debt facilities of the Asset SPVs availed from banks/financial institutions

- Purchase of Non-Convertible Redeemable Preference Shares of the company

- Offer for sale to existing investors

About Mindspace REITs

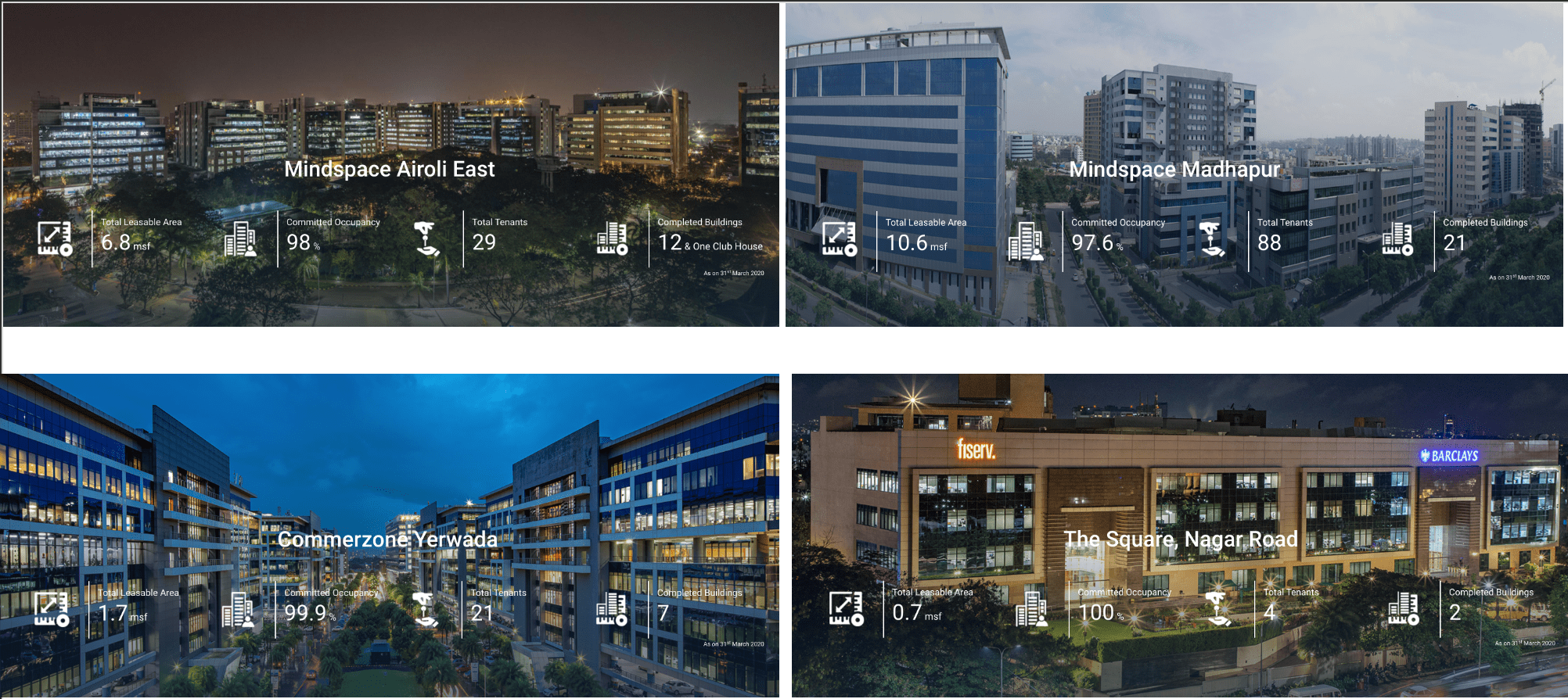

Promoted by Cape Trading LLP and Anbee Constructions LLP (Blackstone & K Raheja Group) Mindspace REIT was registered with SEBI on December, 2019, at Mumbai. Mindspace Business Parks REIT has a quality office portfolio in Mumbai, Hyderabad, Pune and Chennai.

The business parks in Mumbai are Mindspace Airoli East Business Park, Mindspace Airoli West Business Park, Paradigm Mindspace Malad and The Square, BKC(2). The properties in the Pune include Commerzone Yerwada Business Park, Gera Commerzone Kharadi Business Park and The Square, Nagar Road. The Chennai property of the company is Commerzone Porur. And, the office parks in Hydrabad are Commerzone Pocharam and Mindspace Madhapur.

The total leasable area of Mindspace Business Parks is 12.1 msf, 11.6 msf, 5.0 msf and 0.8 msf in Mumbai, Hyderabad, Pune and Chennai, respectively.

With total leasable area of 29.5 msf, it has one of the largest Grades-A office portfolios in India. The under-construction area of the company is 2.8 m sq ft. The future construction of Mindspace Business is spread across Hyderabad, Chennai, and Mumbai in a 3.6 m sq ft area.

MoneyWorks4me Opinion

Mindspace REIT holds premium properties in four different metropolitan cities where demand for commercial properties is high. It has close to 50% property leased to IT and ITes and no particular client contributes more than 8% in gross rentals.

India is experiencing high growth in captive support services of MNCs and existing IT services companies thanks to low cost human resources and English speaking population. This makes commercial REIT attractive as they will have good demand for companies shifting their backend/support to India.

From FY18 to FY20, Mindspace has leased 7.6 msf of office space and grown its portfolio by 4.9 msf primarily through strategic on-campus development. Maintained high occupancy of 92% and saw rental growth of 6.7% CAGR.

Risks

- Due to subdued economic activity, we may see slow employee additions and hence fall in demand for commercial real estate, this may lead to either low occupancy or lower yield due to aggressive negotiations impacting overall distribution (yield) from the REIT.

- Work from Home, currently at nascent stage, can gain traction causing oversupply in commercial real estate market at least in the near term again impacting occupancy and distribution.

Based on stated income distribution (yield) of 7.5%, it may appear reasonably priced but with risk of fall in distribution, limited growth component, this yield is inadequate. We recommend AVOID.

There might be fall in REIT price to reflect better yield as distribution may remain constant while fall in REIT price increases our Return on Investment. We will be tracking the REIT for investment at a later date.

We are very positive on the opportunity available to invest in Real Estate through REIT, but we are cautious to make any decision about making a Real Estate investment today due to i) lower yield, ii) uncertainty on near to medium term trend in real estate iii) limited growth avenues within this REIT to compensate paying up.

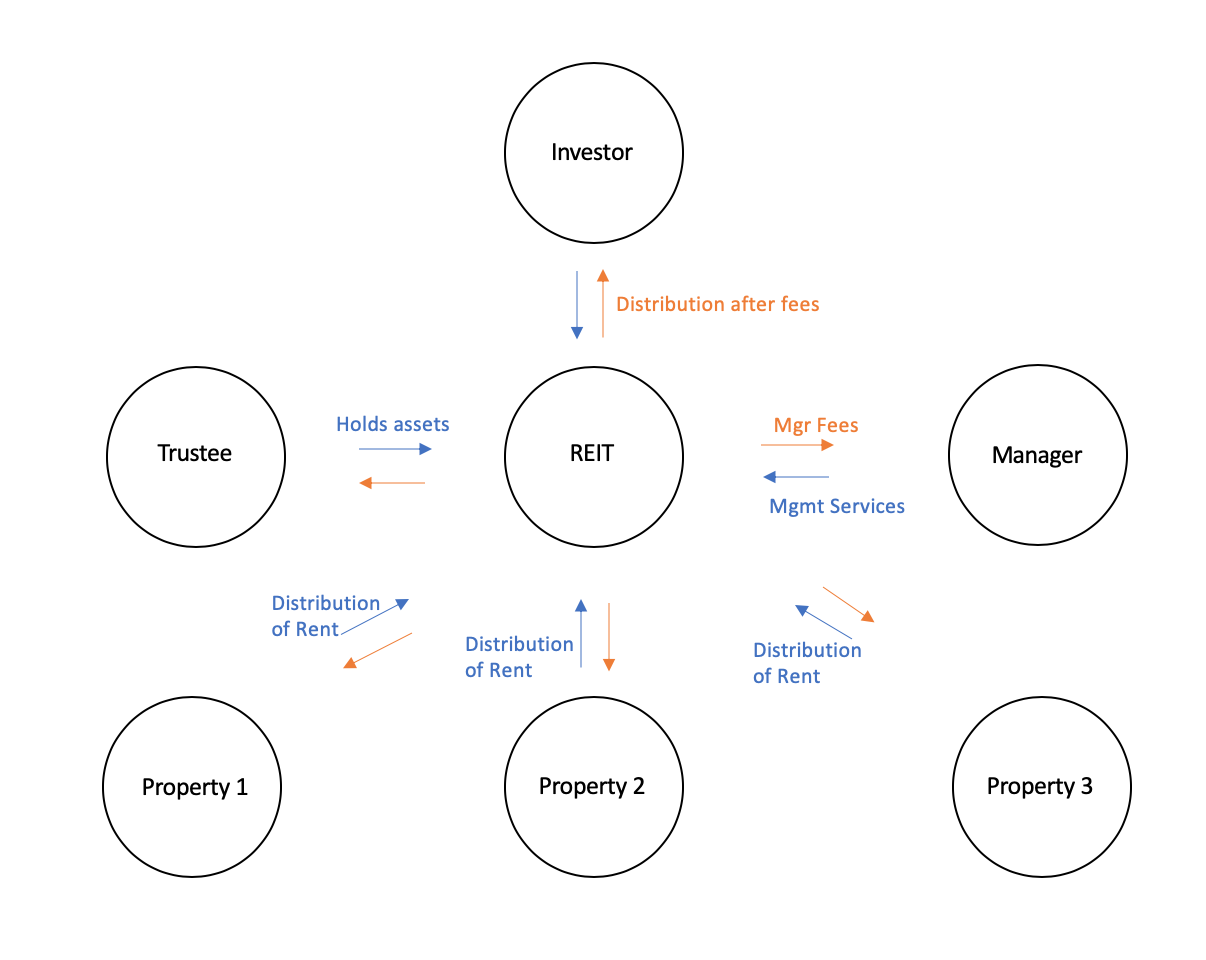

What is REIT?

REIT is a pool of developed assets held and protected by Trustee. It receives rental from lessee and managers handle the collection and maintenance of facilities. This is closet to holding actual real estate in exchange of earning a rent on the same. Usually commercial real estate are best to own as they accrue better rental yield and growth in yield in lines with inflation, assuming no competition or demand issues.

Real Estate as an asset class provides non-correlated returns to equity and gold. It also has regular income similar to Fixed income. Investors with smaller surplus (less than Rs. 3-5 Cr) can diversify their assets into real estate through REIT as smaller portfolio can’t invest in real estate directly due to large ticket size of property. For larger portfolio, investing in 1-2 commercial properties or shops is a good way to diversify their savings.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

The post Mindspace REIT IPO Review appeared first on Investment Shastra.

Share Market

Is This the Best Gold Stock to Buy in August?

Higher gold follows risk like one foot follows the other. But this year has seen gold stocks generate a momentum that exceeds the usual rush to safe havens characteristic of a frothy market. In fact, some gold stocks have come to resemble cannabis tickers at the height of pot stock fever.

And that risk looks set to continue mounting — albeit in a dangerous, quiet kind of way. The markets are yet to factor in the disruption potential from the U.S. election. And with the race for a workable vaccine heating up after Russia’s Sputnik V news, volatility is sure to be an issue in coming months.

Despite this strong, sustained positive momentum, exemplary miner Newmont (TSX:NGT)(NYSE:NEM) still exhibits decent valuation relative to its sector. From a P/E of 12.7 to a P/B of 2.3, Newmont is still a good play for value in 2020.

Newmont’s dividend percentage yield may not be all that impressive compared with some of the rich-yielding heavy hitters on the TSX. But Newmont’s approximately 1.5% dividend is nevertheless worth the investment money. While that yield is small, it’s larger than those of many of its closest competitors.

Buying stocks for the super long term?

One thing that investors may want to keep an eye on is a company’s balance sheet. This is especially true if stocks are being bought for the long term. Newmont looks solid in this regard. Its debt-to-equity ratio is suitably low at 26.3%. This makes Newmont a strong choice for investors with a lower tolerance for risk in their stock portfolios. This is also a good name to hold for moderate growth.

The outlook for gold is solid with some analysts calling for the yellow metal to hit US$3,000. Having broken all kinds of records already in 2020, this kind of valuation might not be as ludicrous as it sounds. After all, investors are dealing with a bizarro market combining both the remnants of the longest bull run in history plus echoes of the Great Depression. This also makes gold stocks a buy for investors with narrow financial horizons.

In terms of track record and returns, Newmont will have bagged you around 80% in the past year compared with the metals sector’s average of 50%. Neither are bad returns by any means, but Newmont is clearly outperforming its own sector when it comes to rewarding investors. Looking forward, the outlook for Newmont is likely to see this trend in returns continuing into next summer.

Barrick Gold, Franco-Nevada, Kinross Gold, Kirkland Lake Gold — these stocks are all solid gold buys this year. But Newmont is arguably the best in terms of its all-around buying points. For its mix of decent scores in valuation, outlook, track record, dividend, and track record, Newmont is a strong buy. For investors with a focus on regular passive income, its 1.5% yield is a standout feature worthy of a place in a low-risk stock portfolio.

Gold is galloping, but good value for money can still be found. However, these FIVE stocks also match affordability with growth potential:

Just Released! 5 Stocks Under $49 (FREE REPORT)

Motley Fool Canada‘s market-beating team has just released a brand-new FREE report revealing 5 “dirt cheap” stocks that you can buy today for under $49 a share.

Our team thinks these 5 stocks are critically undervalued, but more importantly, could potentially make Canadian investors who act quickly a fortune.

Don’t miss out! Simply click the link below to grab your free copy and discover all 5 of these stocks now.

More reading

- How to Make Money Online With Stocks

- Investing in TSX Gold Stocks? Do This 1 Crucial Thing 1st

- Forget Bitcoin As a Gold Replacement in a Market Crash!

Fool contributor Victoria Hetherington has no position in any of the stocks mentioned.

The post Is This the Best Gold Stock to Buy in August? appeared first on The Motley Fool Canada.

Share Market

Monday Morning Markets – Moving Past 5 Million Virus Cases

5,045,564.

That's how many cases the US officially has (not that we are counting). 162,938 Americans are dead, that's much harder to cover up. Globally we are about to cross 20M cases at 19,877,261 with 731,570 deaths so the US has more than 25% of the global cases and 22% of the deaths - despite having just 3.7% of the population so Trump is right - America is leading the world by a factor of 6 - no one transmits the virus or dies from the virus like we do! MAGA!!!

The markets don't seem to mind and we're still up around record highs as the worst things are for the American people, the better things are for American Corporations, apparently, as the stimulus fairy comes and pays them visit after visit. President Trump played the fairy this weekend, waving his executive action wand and unconstitutionally wishing for various bribes to the voters:

- $400/week supplement to unemployment checks (states need to pay for it and Federal supplement comes from Disaster Fund that's meant for hurricanes, etc).

- Suspend payments on Student Loans through 12/31 (but not the interest).

- Extend eviction protection through 12/31 (the courts can't handle the backlog anyway)

- Defer Payroll Taxes through 12/31 (a disaster for the Social Security and Medicare System and also puts a huge tax burden on the employees at the end of the year they are unlikely to manage for, which will be blamed on Biden as a tax increase, of course)

In other words, Trump's Executive Orders are a whole lot of nothing but Congress and the White House have still failed to reconcile Democrats' $3.4Tn coronavirus-relief plan and Senate Republicans' far smaller $1.1Tn proposal. The Paycheck Protection Program expired Saturday. The future of the small business rescue plan is in limbo. “Meet us halfway and work together to deliver immediate relief to the American people,” Pelosi and Schumer said in a joint statement. “Lives are being lost, and time is of the essence.”

Joe Biden, noting that Trump signed the “half-baked” orders at his golf club in New Jersey, said they short-change the unemployed and trigger a “new, reckless war on Social Security." “These orders are not real solutions,” soon to be President Biden said. “They

Share Market

The IPOX® Week, August 10th, 2020

- IPOX Indexes fall towards week-end, many still set weekly all-time Highs. Track SPACs with the IPOX® SPAC (SPAC).

- IPOX 100 U.S. (ETF: FPX) adds +0.80% to +12.64% YTD. IPOX International (ETF: FPXI) rises +2.31% to +40.58% YTD. IPOX 100 Europe (ETF: FPXE) gains +0.80% to +17.14% YTD.

- Issuer Flexibility matters: Rackspace (RXT) tanks while Rocket (RKT) rocks. More deals lined up.

Now track SPACs live with the IPOX® SPAC (Ticker: SPAC). IPOX is pleased to note the launch of the IPOX® SPAC, a benchmark portfolio focusing on Special Purpose Acquisition Vehicles.

IPOX Indexes fall towards week-end, many still set weekly all-time Highs. The IPOX Indexes rose last week to close at or near weekly-all-time highs. Trading Sentiment deteriorated towards the weekend on increased China-U.S. tensions with encouraging U.S. and European economic data driving some asset allocation away from the hugely outperforming growth-focused portfolios to conventional benchmark exposure and U.S. small-caps (RTY: +6.00%). In the U.S., e.g., the IPOX 100 U.S., underlying for the $1.5 billion “FPX” ETF, rose +0.80% to +12.64% YTD, lagging the S&P 500 (SPX) by -165 bps. on the week. Amid earnings and renewed corporate actions activity, weekly returns of portfolio holdings diverged sharply: While medical devices maker Irhytm Technologies (IRTC US: +62.33%) and security services provider ADT (ADT US: +41.70%) soared on strong earnings and an investment from Google, respectively, profit taking after earnings pressured infrastructure software makers Datadog (DDOG US: -19.80%) and Fastly (FSLY US: -17.70%). Abroad, we note a fresh weekly all-time

High recorded by number of IPOX Portfolios. The IPOX International, e.g., basis for the $220 million “FPXI” ETF, rose +2.31% to +40.58% YTD, extending the YTD lead vs. its benchmark to +4932 YTD. Here, big gains in Japan-traded exposure including leading courier services provider SG Holdings (9143 JP: +24.55%) and e-commerce firm Mercari (4385 JP: +16.97%) after blow-out earnings more than offset declines in some of the European-domiciled portfolio holdings including Swiss pharma products retailer Galenica (GALE SW: -6.99%) and German medical devices maker DAX-30 candidate Spin-off Siemens Healthineers (SHL GY: -6.07%) which fell after announcing the buy-out of U.S. medical equipment maker Varian (VAR US: +21.69%) last week-end.

| Select IPOX® Indexes Price Returns (%) | Last Week | 2019 | 2020 YTD |

| IPOX® Indexes: Global/International | |||

| IPOX® Global (IPGL50) (USD) | 1.63 | 27.93 | 32.47 |

| IPOX® International (IPXI)* (USD) (ETF: FPXI) | 2.31 | 31.37 | 40.58 |

| IPOX® Indexes: United States | |||

| IPOX® 100 U.S. (IPXO)* (USD) (ETF: FPX) | 0.80 | 29.60 | 12.64 |

| IPOX® ESG (IPXT) (USD) | 1.66 | - | - |

| IPOX® SPAC (SPAC) (USD) | 0.93 | - | - |

| IPOX® Indexes: Europe/Nordic | |||

| IPOX® 30 Europe (IXTE) (EUR) | 0.98 | 34.55 | 24.77 |

| IPOX® Nordic (IPND) | 3.70 | 38.52 | 37.05 |

| IPOX® 100 Europe (IPOE)* (USD) | 0.80 | 30.97 | 17.14 |

| IPOX® Indexes: Asia-Pacific/China | |||

| IPOX® Asia-Pacific (IPTA) (USD) | 4.12 | 4.41 | 23.31 |

| IPOX® China (CNI) (USD) | 3.44 | 26.31 | 44.31 |

| IPOX® Japan (IPJP)** (JPY) | 5.63 | 37.91 | 6.06 |

* Basis for ETFs: FPX US, FPX LN, FPXE US, FPXU FP, FPXI US, TCIP110 IT and CME-traded e-mini IPOX® 100 U.S. Futures (IPOM0). Source: Bloomberg L.P. & Refinitiv/Thomson Reuters. For IPOX Alternative Strategies Returns, please contact [email protected]

| IRHYTHM TECHNOLOGIES | 62.33 | DATADOG INC | -19.80 |

| ADT INC | 41.70 | FASTLY INC - CLASS A | -17.70 |

| SG HOLDINGS CO LTD | 24.55 | EVERGY INC | -14.92 |

| CARVANA CO | 23.91 | ASSETMARK FINANCIAL | -13.03 |

| SOLAREDGE | 20.77 | CAMPING WORLD | -11.61 |

| MERCARI INC | 16.97 | CORTEVA INC | -11.34 |

| SOLARWINDS CORP | 16.88 | BLACKLINE INC | -10.85 |

| INARI MEDICAL INC | 16.10 | TWILIO INC | -10.24 |

| VARTA AG | 15.91 | CROWDSTRIKE HOLDINGS | -10.11 |

| MEITUAN DIANPING | 15.89 | CERIDIAN HCM HOLDING | -10.07 |

| ASTON MARTIN LAGONDA | 15.46 | DYNATRACE INC | -9.54 |

Issuer Flexibility matters: Rackspace (RXT US) tanks while Rocket (RKT US) rocks. More deals lined up. At least 11 companies went public across the global regions last week, with the average (median) equally weighted deal adding +40.37% (+13.30%) based on the difference between the final offering price and respective Friday’s close. Reception to last week’s deals was mixed: While Apollo-backed cloud company Rackspace (RXT US: -26.67%) fell, Detroit mortgage giant Rocket Companies (RKT US: +38.33%) climbed strongly after its 1/3 scaled-back, below-range offer. Shopify (SHOP US: +2.92%) competitor BigCommerce (BIGC US: +229.17%) tripled. China’s largest CRO Tigermed (3347 HK: +13.30%) also debuted strongly in HK, marking the largest healthcare-related IPO in Asia YTD. Insurtech unicorn Duck Creek (DCT US), Tencent & SoftBank-backed Chinese real estate broker KE Holdings (BEKE US), PE-backed Brazilian home furnishing retailer Lojas Quero-Quero (LJQQ3 BZ) and Philippine’s first REIT IPO AyalaLand REIT (AREIT PM) are lined up to list this week. Other IPO news Include: 1) Chinese EV-maker XPeng to add on recent EV-maker IPO fest, 2) Lufthansa’s Technik maintenance unit spin-off IPO still on the table, and 3) KKR reported to revive IPO of defense supplier Hensoldt in Germany.

Track global deal flow live on: https://bit.ly/2WMvnT9

The post The IPOX® Week, August 10th, 2020 appeared first on Low Cost Stock & Options Trading | Advanced Online Stock Trading | Lightspeed |.

-

Business3 weeks ago

Business3 weeks agoBernice King, Ava DuVernay reflect on the legacy of John Lewis

-

World News3 weeks ago

Heavy rain threatens flood-weary Japan, Korean Peninsula

-

Technology2 weeks ago

Technology2 weeks agoEverything New On Netflix This Weekend: July 25, 2020

-

Finance3 months ago

Will Equal Weighted Index Funds Outperform Their Benchmark Indexes?

-

Marketing Strategies7 months ago

Top 20 Workers’ Compensation Law Blogs & Websites To Follow in 2020

-

World News7 months ago

World News7 months agoThe West Blames the Wuhan Coronavirus on China’s Love of Eating Wild Animals. The Truth Is More Complex

-

Economy9 months ago

Newsletter: Jobs, Consumers and Wages

-

Finance8 months ago

Finance8 months ago$95 Grocery Budget + Weekly Menu Plan for 8