Finance

I am the one thing in life I can control

Three weeks ago, I drove from Portland to Colorado Springs to participate in Camp FI, a weekend retreat for people interested in financial independence and early retirement.

Under normal circumstances, I wouldn’t drive this distance. It’s a 1300-mile trip that takes at least twenty hours to cover. Or, if you’re me, it’s a 1400-mile trip that takes 23 hours of driving spread over two days.

But, in case you haven’t noticed, we’re in the middle of a global pandemic, and although I’m not nearly as cautious as many of my friends, I don’t relish the idea of confining myself to close quarters with dozens of strangers for hours on end in an airplane. Besides, I like to drive. And I love the beauty of the American west. And I needed some time alone to think deep thoughts — and to listen to the Hamilton soundtrack over and over and over again.

Around noon on Day Two, as I exited I-80 in south-central Wyoming, I was listening to Hamilton for the fourth time in 24 hours when I was smacked in the brain by a lyric I hadn’t heard before. I pulled off the side of the road to think about it — and to make some notes.

Wait for It

For those few who are unfamiliar, Hamilton is a hip-hop musical that tells the story of founding father Alexander Hamilton and his contentious relationship with, well, everyone — especially Aaron Burr. Burr is the nominal antagonist of the show (although, truly, he is no villain), Hamilton’s most prominent frenemy. Burr is also a complex character.

Alexander’s biggest beef with Aaron is that his rival seems wishy-washy, as if he has no moral compass. (“If you stand for nothing, Burr, what’ll you fall for?” Hamilton asks early on. It’s a question he asks repeatedly throughout the show.) To Burr, though, this chameleon-like nature isn’t a character flaw. It’s a survival mechanism. It’s a strength. He’s adaptable and patient; he believes Hamilton is too loud and too reckless.

Each major character in Hamilton gets a song to define who and what they are. Burr’s song, “Wait for It”, comes in the middle of the first act.

Burr sings:

Life doesn’t discriminate between the sinners and the saints. It takes and it takes and it takes, and we keep living anyway. We rise and we fall and we break and we make our mistakes. And if there’s a reason I’m still alive when so many have died, then I’m willing to wait for it.

And then Burr says: “I am the one thing in life I can control.” I’d never actually heard that line before. But there, in the middle of the rolling Wyoming hills, the lyric hit me like a ton of bricks.

This is a powerful line in the context of Hamilton, sure, but for me personally, it’s something close to a guiding principle. I’ve written extensively about the power (and necessity) of being self-directed. It’s one of the primary themes of this website.

But here’s the thing: As important as this notion is to me, I sometimes lose sight of it. This is particularly true when my struggles with mental health become severe, when the depression and anxiety threaten to pull me under. In these moments, I forget about personal agency and locus of control and related ideas. When I’m in the throes of depression, everything is overwhelming (even the simple stuff), and it feels like I’m in control of nothing.

A Very Strange Year

This has been a strange year. I know, I know. Everybody’s saying it. But it’s true! And while we, as a society, are “enjoying” this crazy year together, my own personal 2020 has had its own special flavor of weirdness.

As you’ll recall, 2019 sucked for me. Objectively, my life was great, and I could see that. But subjectively, I was miserable. My life-long depression reached some sort of crescendo and was made especially spicy thanks to some new, unwelcome generalized anxiety. Mental health issues stopped me in my tracks last year.

After several months working with a therapist, I made some progress. In January of this year, I took a break from alcohol and began waking at 4:00 or 4:30. It took a couple of weeks to adjust to this new routine, but by mid-January I felt great and was enjoying my greatest productivity in years. Yay!

As our country (and the world) descended into chaos in March, April, and May, I still felt great. I was insanely productive, both for business projects (such as creating my upcoming FIRE course for Audible) and household projects (such as landscaping the back yard). I was flying high. There was a stark contrast between the overall mood of the world around me and my personal mood. I almost felt guilty. (It’s an odd thing when you’re doing well individually while so many other people are suffering. I’m not sure I like it.)

Then, in mid-June, things went haywire. Slowly at first — then all at once — my depression and anxiety roared back with full force. I found myself paralyzed by fear once more. Blarg! Was I drinking too much beer? Taking on too much work? Overwhelmed by current events? Flustered by chaos here on the homestead? (Our fence fell down. The hot tub broke. The fridge is dying. The sewer line is clogged. And so on.) Whatever the cause, I’d reached a dark place by the end of June.

It felt like my life was out of control. Like Alexander Hamilton, I felt like I was stuck inside a hurricane.

Fortunately, I recognized the problem quickly. And that moment in Wyoming — hearing Burr sing “I am the one thing in life I can control” — was key, a wake-up call. It reminded me of my philosophy. I realized that I was focusing too much on my “circle of concern” rather than my “circle of control”.

I fought back.

During July, I took several steps to combat my depression. Among others:

- I stopped drinking alcohol. I had my last drinks on Independence Day. My goal is to go one year without the stuff. No, I’m not being 100% strict. If I find myself in a social situation where it’s better to drink than to make a fuss, I’ll drink. But not much. And these situations should be rare indeed. (I’ve had one such occasion since Independence Day.)

- I called my doctor to ask about medication. While I’m not opposed to meds, I generally don’t like them for myself. I don’t like the side effects. Plus, I have this stupid idea that I shouldn’t need them. Well, in reality I do need them, that much is clear. So, we’re playing with things to see what works.

- I uninstalled my stupid videogame. (Again.) If you’re a long-time reader, you know that computer games are my kryptonite. And in small doses, there’s nothing wrong with gaming. It can be a great way to relax! But when I’m in one of my funks, gaming becomes an escape, a way for me to avoid reality. Until I’m moving forward under my own steam again, it’s best that I simply avoid the temptation entirely.

- I shifted physical fitness to my top priority. Like it or not, my body image has a profound effect on my overall self image. I wish this weren’t the case, but it’s true. Plus, eating right and exercising is conducive to long life and an effective way to fight depression. So, with help from my buddy Jonathan at Choose FI, I’m embarking on a six-month quest to lose thirty pounds. (I’ll write more about this soon.)

In short, I stopped allowing myself to be a victim of external forces and started exercising agency. I am the one thing in life I can control. I need to exercise that control in whatever ways I can. It’s the only way out of the pit of despair.

It’s far too early to say how much these changes (and others I’m making) will help me, but I’m confident that things will improve in short order. They already have to some degree. I mean, the first thing I wanted to do this morning was write an article for Get Rich Slowly! (And I have a list of other things to write about too.)

Coming Out of the Dark

During my two weekends at Camp FI in Colorado Springs, I spoke about the true history of financial independence and early retirement. (These ideas have been around much longer than most people think.) My talk was rough, and I know it, but I hope to develop it into an interesting and useful presentation in years to come. And I hope to share a written version of this presentation here at Get Rich Slowly in the near future.

But for me, Camp FI is less about sharing what I know and more about connecting with like-minded friends and colleagues. I had a blast both weekends. I hung out with new friends and old.

I got to spend a bit of time with Michelle Jackson (who is one of my favorite people). Between weekends, I spent four nights in Mr. Money Mustache‘s basement. He and I hiked, swam in a creek, and had deep conversations on his delightful deck. I had lunch with Piggy from Bitches Get Riches (and met her chickens). I also had lunch with John from ESI Money. I got to know Mr. Refined from Refined by Fire. And so on.

By the final night of the second weekend, I was more relaxed than I have been in months. Maybe years. As I sat outside with the die-hards until the wee hours of the morning, telling stories and laughing, I felt alive. I felt myself. I felt as if I were in control of things once more.

My road trip helped me re-realize something else important about my depression and anxiety. My suffering is intensified when I spend too much time alone. I feel better about myself (and my fellow humans) when I interact with other people, whether friends or strangers. I genuinely like people. They’re amazing. I need to do a much better job of seeking out human contact if I want to maintain my mental health!

If only we weren’t in the midst of a global pandemic…

Finance

Top 10 Best Credit Card Bonus Offers - August 2020 (Updated)

Updated. I’m still collecting points and miles and maximizing the value of my credit card spending. Things are more quiet as credit card issuers get conservative, but that just means picking up some bonuses that I passed over previously.

That space in your wallet or purse is still valuable, and you should be the one to get that value. Selected banks are offering strong perks and $500+ value for a single card during the first year to encourage you to apply and try it out. These are the top 10 credit card offers that I would personally apply for right now, if I didn’t already have most of them. Notable recent changes:

- Added Southwest, United, Marriott, US Bank Altitude

- Added COVID Sapphire benefits.

- Removed IHG, NavyFed.

If you pay off your balances every month, then you can join me and many others in funding a huge chunk of your annual travel budget with cash credits, points, and miles. You don’t need to be a “I only fly business class” world traveler. I mostly use my rewards points on domestic economy flights, mid-range hotels, and cheap car rentals. If you have credit card debt, you should focus on paying that off first as the interest charges could offset most of the perks.

This is a companion post to my Top 10 Best Business Card Offers. Small business bonuses are on average even higher than those on consumer cards.

Note: Certain Chase cards have a “5/24 rule” which is an unofficial rule that they will automatically deny approval on new credit cards if you have 5 or more new credit cards from any issuer on your credit report within the past 2 years. This rule applies on a per-person basis, so if you are new, you might want to start with those Chase cards.

- 60,000 Ultimate Rewards points (worth $750 towards travel) after $4,000 in purchases within the first 3 months. See link for details.

- Short-term COVID-related benefits.

- 2X points on Travel and Dining at restaurants worldwide.

- $95 annual fee.

- Subject to 5/24 rule.

- Alternative: Chase Sapphire Reserve Card. 3X on Travel and Dining, Priority Pass airport lounge access, $550 annual fee, $300 annual travel credit, 1-year Lyft Pink membership.

Southwest Rapid Rewards Plus Card

- 65,000 Rapid Rewards points. Earn 65,000 points after $2,000 in purchases in first 3 months.

- Southwest still gives everyone two free checked bags.

- More than halfway to Companion Pass. If you can sign up for this one and also the small business version, you can qualify for a Companion Pass in 2020/2021.

- $69 annual fee.

- Subject to 5/24 rule.

- 60,000 bonus United miles. 60,000 miles after $3,000 in purchases within 3 months. Limited-time offer. See link for details.

- Free first checked bag for both you and a companion (a savings of up to $120 per roundtrip) when you use your Card to purchase your United ticket.

- Expanded award availability. Having this card makes it easier to find that saver award economy ticket.

- Up to $100 Global Entry or TSA PreCheck fee credit.

- $0 annual fee for the first year, then $95.

- Subject to 5/24 rule.

Gold Delta Skymiles Card from American Express

- Bonus varies. Enter your Delta Skymiles number and last name to see if you are targeted for a special offer.

- 50,000 Skymiles are worth at least $500 in Delta airfare with “Pay with Miles” option.

- First checked bag free on Delta flights ($60 value per roundtrip, per person). Main Cabin 1 Priority Boarding.

Citi / AAdvantage Platinum Mastercard

- 60,000 American Airlines miles after $3,000 in purchases in the first 3 months. See link for details.

- First checked bag free on domestic AA flights ($60 value per roundtrip, per person).

- $0 annual fee for the first year, then $99.

Marriott Bonvoy Boundless Card

- 100,000 Marriott Bonvoy points after $3,000 in purchases within the first 3 months. Limited-time offer. See link for details.

- Free Night after each account anniversary year (valued up to 35,000 Marriott points).

- $95 annual fee.

- Subject to 5/24 rule.

- 60,000 TrueBlue points after $1,000 in purchases within the first 90 days. Limited-time offer. See link for details.

- Free first checked bag for you and up to 3 companions when you use your JetBlue Plus Card.

- $99 annual fee.

Barclays AAdvantage Aviator Red World Elite Mastercard

- 60,000 American Airlines miles after any purchase in the first 90 days and paying the $99 annual fee. See link for details.

- $99 Companion certificate offer. Earn a certificate good for 1 guest at $99 (plus taxes and fees) after making your first purchase and paying the $99 annual fee in the first 90 days.

- First checked bag free on domestic AA flights ($60 value per roundtrip, per person).

- $99 annual fee.

- 60,000 points (worth $750 towards travel booked at ThankYou.com) after $4,000 in purchases in the first 3 months. See link for details.

- 3X points for every $1 spent on travel including gas stations.

- Must not have gotten bonus from or closed a Citi Rewards+, ThankYou Preferred, Premier, or Prestige card in the past 24 months.

- $95 annual fee.

Bank of America Premium Rewards Card

- 50,000 points (worth $500 towards travel) after $3,000 in purchases within the first 90 days. See link for details.

- 2 points for every $1 spent on travel and dining purchases and 1.5 points for every $1 spent on all other purchases.

- $100 annual Airline Incidental Statement Credit.

- Up to $100 credit towards TSA PreCheck or Global Entry application fee.

- $95 annual fee.

Hawaiian Airlines World Elite MasterCard

- 50,000 Hawaiian miles after $2,000 in purchases within 90 days. See link for details.

- Free first checked bag for primary cardmember when using your card to purchase eligible tickets directly from Hawaiian Airlines.

- Receive a one-time 50% off companion discount for roundtrip coach travel between Hawaii and The Mainland on Hawaiian Airlines.

- $99 annual fee.

U.S. Bank Altitude Reserve Credit Card

- 50,000 bonus points ($750 value towards airfare) after $4,500 in purchases within 90 days. See link for details.

- $325 in annual statement credits towards travel per Cardmember year (based on account opening date)

- Up to $100 statement credit for Global Entry or TSA PreCheck.

- Priority Pass Select membership for airport lounge access.

- $400 annual fee. (Bigger bonus, big annual fee.)

- Up to 50,000 Hyatt points. 25,000 Bonus Points after $3,000 in purchases in the first 3 months. Plus an additional 25,000 Bonus Points after a total of $6,000 in purchases within the first 6 months. See link for details and rough valuation of points.

- $95 annual fee, free night award upon card anniversary.

- Subject to 5/24 rule.

“The editorial content here is not provided by any of the companies mentioned, and has not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are the author’s alone. This email may contain links through which we are compensated when you click on or are approved for offers.”

Top 10 Best Credit Card Bonus Offers - August 2020 (Updated) from My Money Blog.

Copyright © 2019 MyMoneyBlog.com. All Rights Reserved. Do not re-syndicate without permission.

Finance

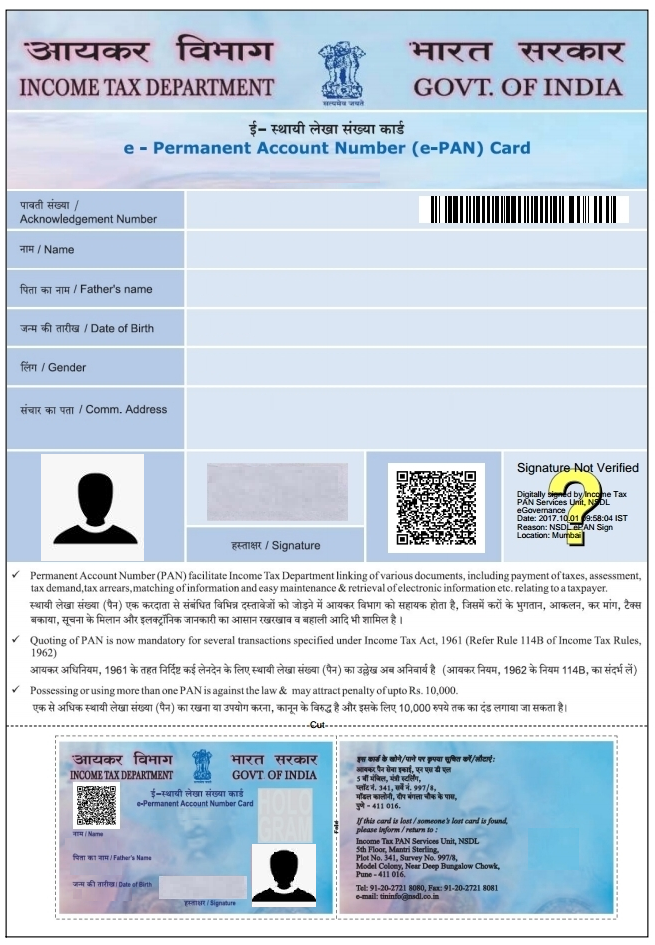

Instant ePAN Card using Aadhaar Card: 5 Things to Know

A PAN Card is a 10-digit alpha-numeric unique code issued by the Income Tax Department of India to file the Income Tax Returns or to make banking transactions exceeding Rs. 50,000. Moreover, a PAN Card is also considered as one of the important identification documents for opening a bank account, purchasing a property, investing in mutual funds, applying for a debit/credit card and more.

According to the Union Government of India, it is now mandatory for all the individuals to link their Aadhaar Card with a PAN Card and failure to do the same will result in an inoperative PAN Card. You will also be fined Rs. 10,000 for using an inoperative PAN Card under the Section 272B of the Income Tax Act. The deadline for linking PAN with Aadhaar has been extended to 31st March 2021.

However, getting a PAN Card has now become quite easy as compared to the offline procedure which was lengthy, paper-heavy and tedious. You can instantly get your PAN Card Application through an Aadhaar Card. It is worth mentioning that in order to avail this facility of getting an instant PAN Card through Aadhaar Card, your mobile number must be registered with Aadhaar to generate One Time Password(OTP) for the verification.

This facility of instant and free PAN Card through Aadhaar based e-KYC has been recently launched by the Finance Minister of India , Nirmala Sitharam on 25th June 2020.

Let us now understand what are those five important things for instant PAN Card Application using Aadhaar Card.

Process of Instant PAN Card through Aadhaar Card

You must know the steps involved for availing Instant PAN through Aadhar Card. The steps are as follows:

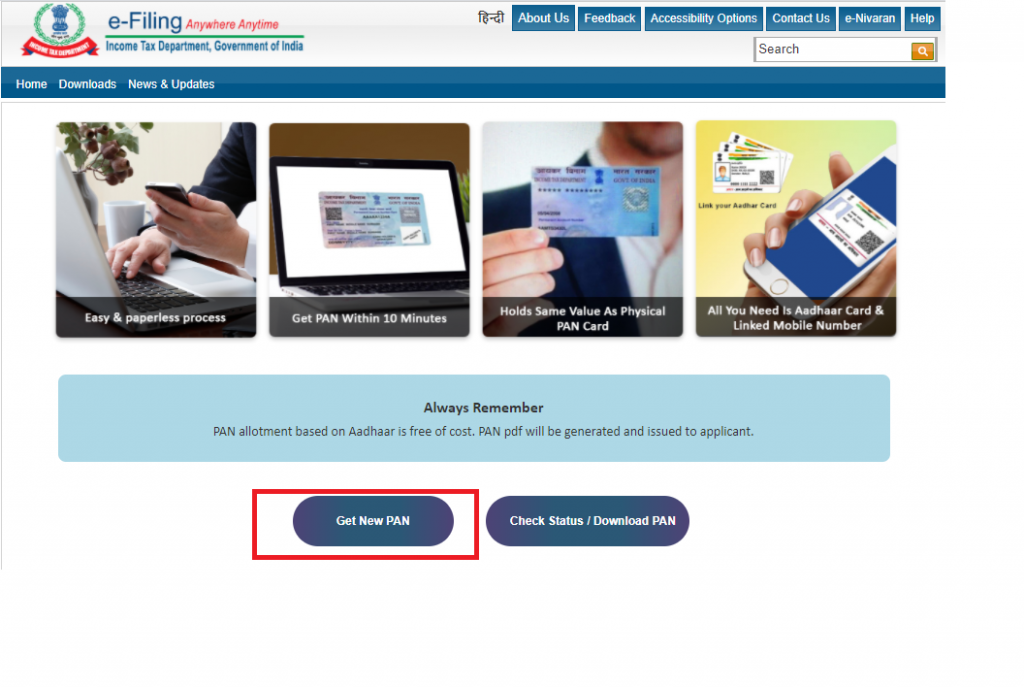

Step 1: You have to visit the official website of the Income Tax Department at https://www.incometaxindiaefiling.gov.in/e-PAN/

Step 2: Click on the ‘ Get New PAN’ option

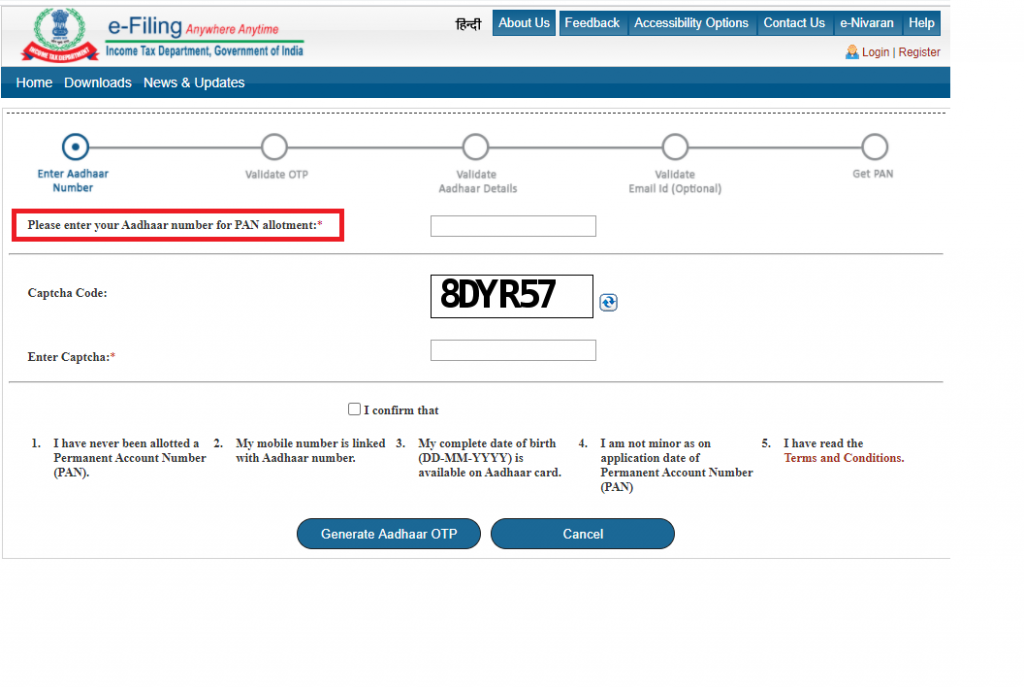

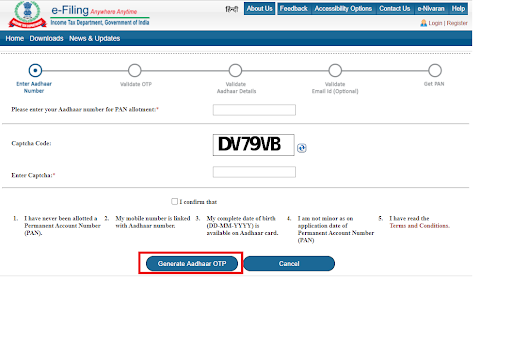

Step 3: You will be redirected to a new page. Enter your 12-digit Aadhaar Number for PAN allotment

Step 4: Enter the ‘Captcha Code’ for verification

Step 5: Now, you need to confirm the following details:

-

- I have never been allotted a PAN Card

- My mobile number is linked with Aadhaar number

- My complete date of birth is available on the Aadhaar Card (DD/MM/YY)

- I am not minor as on application date of Permanent Account Number (PAN)

- I have read the Terms and Conditions

Step 6: Once done, click on the ‘Generate Aadhaar OTP’ button

Step 7: You have to enter the OTP be sent on your registered mobile number

Step 7: You have to enter the OTP be sent on your registered mobile number

Step 8: You have to validate your Aadhaar details, your email address (optional)

Step 9: Once all the details will be validated from the database UIDAI, your e-PAN will also be sent if the email ID of the applicant is registered with Aadhaar

Note: You will receive a 15-digit acknowledgement number for further tracking of PAN Card Status

Format of of Instant PAN Card facility through Aadhaar based e-KYC

The issued instant PAN Card is in the format of pdf which also has a QR code containing all the demographic information such as your name, date of birth, gender and the photograph too. Morerver, this instant e-PAN can be downloaded through the 15-digit acknowledgement number sent to you once the process of PAN Card application is completed on your registered mobile number and email address. Moreover, you will also be sent a soft copy of your PAN Card on your email address (if registered with Aadhaar Card).

Note: Sometimes, the applicants get confused whether the e-PAN is considered equally valid or not, but as per the recent rules of the Income Tax Department of India, the e-PAN is equivalent to a laminated PAN Card.

Charges for Instant PAN Card through Aadhaar Card

You can also get your PAN Card through the official website of NSDL and UTIITSL, but both these PAN Card issuing authorities charge for the PAN Card application whereas the issuing of a 10-digit alphanumeric number is free of cost at the Income Tax Department’s portal.

Read more at: PAN Card Fees and Charges

Documents Required for Instant PAN Application

There is no documentation required for the Instant PAN Application facility through Aadhaar Card as the data will be automatically fetched from the database of the Unique Identification Authority of India (UIDAI) once you enter your Aadhaar number.

The income tax department says the turnaround time for issuing an instant PAN is just about 10 minutes. So far more than 6.7 lakh such instant PAN cards have been issued.

How to Check Status of Instant PAN Application

You can also check the status of your Instant PAN Application by following the steps mentioned below:

Step 1: Go to the official e-filing home page of the Income Tax Department (https://www.incometaxindiaefiling.gov.in/home)

Step 2: Click on the ‘Instant PAN through Aadhaar’ option under the ‘Quick Links’ section on the homepage which will redirect you to the instant PAN allotment webpage

Step 3: Now, you need to select the ‘Check Status/Download PAN’ option

Step 4: Enter your Aadhar number and captcha code

Step 5: Click on the ‘Submit’ button

Step 6: You have to validate the OTP which will be sent to your registered mobile number. Once again click on the ‘Submit’ button

Step 7: A new page will appear on your screen to check the status of your Instant PAN Card Application

Step 8: Upon successful approval of your PAN Application, you will receive a PDF link within ten minutes to download the PAN

Note: The PDF which will be generated will be password protected and you need to use your date of birth in the format ‘DDMMYYYY’ as the password to open the PDF file.

The post Instant ePAN Card using Aadhaar Card: 5 Things to Know appeared first on Compare & Apply Loans & Credit Cards in India- Paisabazaar.com.

Finance

How To Stick To A Budget (10 Budgeting Tips & Tricks)

(The following is a transcription from a video Linda and I recorded. Please excuse any typos or errors.)

All right. Today, we’re talking about 10 incredibly useful hacks to stick with your budgets. And, I’m really excited to share them with you.

We have really honed in on what it takes to have a budget that you can enjoy, that makes you feel good about life.

We’ve done it wrong so much that we’ve just learned how to do it right, and how to have fun in the process.

If you haven’t gotten Our Free Budgeting Worksheet, I’ve spent a lot of time making this thing and I think it’s awesome.

It’s a good first step to see how your income and expenses stack up. It’s just a good way to get started with your budget.

You can just pick that up by clicking here, and you’ll be on your way to starting your budget!

Now let’s get to these 10 amazing hacks to help you stick with your budget…

10. Make Savings Automatic

Bob: One of the biggest mistakes that most people make is they spend their money and then they try to save or give afterwards. You have to do it the opposite way, the things that are most important to you: giving money, savings, whatever those are, that needs to come first. If you don’t do it that way, if you don’t have some automatic thing in place, the reality is, we all know this.

Linda: It’s not going to happen.

Bob: We all know this, it’s probably not going to happen. You’re going to get to the end of the month, there’s not anything there. And so, that’s why making it automatic is incredibly important.

9. Reward Yourself

Bob: Or if you’re a Parks and Recreation fan, we could call it, treat yo self.

Linda: Treat yo self. This comes across though, as like, “I’m just going to treat myself all the time,” which is something I would do, but we’re not talking about that. Right?

Bob: Yeah. But the key in terms of sticking to your budget, you need rewards. You need incentives to stay the course. And so, yeah, when we were paying off our debt, this was a big part of that. Our budget was a big piece of us being able to pay off our debt. But in order to reach that goal, we had to have milestones. It was too big of a thing, it was too much, it was too long of a road for us to walk without some rewards. And so, we made sure to keep them in there and because we did, we were able to stick with it. Right?

Linda: Yeah. And I think this was especially key for me because he was watching the numbers of our debt go down, down, down. And he was really, really involved. But for me, I was more on the sidelines. And if I wouldn’t have had this incentive, it would have been really difficult for me to keep going. I think I would have just gotten discouraged and given up. So, I think this was extremely key for me since I was not as involved.

Bob: Yeah. Definitely.

8. Budget With Accountability

Bob: I’ve had the unique advantage of being able to try out and test out a whole bunch of different budgeting methods, budgeting softwares and tools and spreadsheets, and all this stuff over the years. I’ve been a financial blogger for almost 13 years, and I have reviewed almost everything out there, and I’ve tried out so much of the stuff. Because we’ve actually tried it ourselves.

The thing that I’ve come to realize is that most budgeting methods don’t actually hold you accountable. There’s this false sense of accountability. And so, the only tool that I’m aware of that ever actually hold you accountable are cash envelopes, if you do that and put cash in envelopes and do that type of budgeting.

Linda: Yeah. And that wasn’t going to work for us because we use plastic sometimes because we online shop or whatever.

Bob: Yeah. Then the other option is The Real Money Method. And this is kind of our hack to do that, to have a budgeting method that actually holds you accountable. So, we have an entire course teaching this method in which you’re welcome to check out if you’re interested. But the bottom line is that for most of us to stick with a budget, we need accountability. We need a budget that’ll hold us accountable. And so, if you’ve ever failed with budgeting, this might be the reason why. So, just find something that will hold you accountable.

7. Don’t Save Your Credit Card Info On Any Site Where You Shop

Bob: This is a good hack. This, yeah, because adding that friction, I think that would definitely, yeah. It just doesn’t seem like much, but having to spend the extra minute or two to go through with the purchase to type all that in, it just slows you down.

Linda: All right. So, I think you’ve told me about this before, where there’s something almost physical that happens in your body when you pay for something and you have to hand over cash.

Bob: Because it’s just real money and you get to feel it.

Linda: Yeah. And you’re like, “There’s my money and it’s leaving.”

Bob: It’s disappearing, yeah.

Linda: But when you write a check, you told me it’s less, but it’s still more of a process that you still feel like…

Bob: A little bit less real, yeah.

Linda: And then, less when you are swiping your credit card.

Bob: Yeah.

Linda: I think you told me this years ago, really before online shopping was as big as it is now. And I can only imagine how little you feel that when it’s like click, click, and it’s, “I bought it.”

Bob: Yeah.

Linda: It’s done.

Bob: I mean, that’s what Amazon has done. It’s like literally-

Linda: Oh, my gosh.

Bob: Add To Cart, boom. Done.

Linda: Well, and you can even hit Buy It Now. And it’s like click, you’re done.

Bob: Yeah. You’re right. It’s one click. So, it’s brilliant on their part. But the point is, is that adding that friction will overall reduce the spending that we make. So yeah, it’s an important move to make.

6. Only Use Gift Cards To Shop On Amazon

Linda: Number six ties right into what we were just talking about. Only use gift cards to shop on Amazon.

Bob: This is an interesting idea that the author had to basically go to the grocery store, buy an Amazon gift card for $100 or whatever, and then load that on your account and then make purchases with that. And so, this kind of takes that friction to a whole new level in that you need to go to the store and buy an Amazon gift card. But at the same time, it kind of undoes the previous thing we were just talking about because the gift card is loaded in there and it’s still pretty easy to buy. So, it’s kind of like, yeah, I don’t know. It might work for some people, but something to consider.

5. Never Buy Anything That You Put In An Online Shopping Cart Until The Next Day

Linda: Number five, never buy anything that you put in an online shopping cart until the next day.

Bob: This is a good idea. I can’t tell you how many times I’m struggling with some annoying problem around the house and I need to go buy this. I’m like, “I need to go buy this thing to fix it,” whatever it is. And I’ll put the thing in a cart and just because I forget to go buy it and I’ll come back a couple of days later, I’m like, I actually solved that problem already. Or it’s not even that big of a problem. It seemed like a big problem in the moment, but it really isn’t that big of a problem. And it is amazing. We’ve all heard this, just sit on a purchase for a little bit and then, half the time, you don’t want to make it later on. But I like this idea of throwing it in the cart. That way, you won’t forget about it. And you can check in a couple of days.

Linda: Yeah.

Bob: And see.

Linda: Well, and I think this is really key for stuff that you just want.

Bob: Yeah, especially.

Linda: Because I mean, so many times, you’re just trying to numb yourself. You’re like, “I’ve had a bad day, so I’m going to go online shop.” And I know that’s what I do. So, just sitting on that, having it in your cart kind of gives you a little bit of satisfaction, and then being able to sit on it for a little bit, I think really helps. And then you can make a decision when you’re a little bit more clearheaded.

Bob: Yeah.

4. Read The One-Star Reviews For The Products Before You Buy Them

Linda: Okay, I really like this one. Read the one-star reviews for the products before you buy them.

Bob: This is a great idea. Because it definitely gives you a whole different perspective on the product.

Linda: Yeah.

Bob: And yeah, and you just might not be as interested when you see all the negative things about it.

Linda: Right.

Bob: Now, I do this for really, most products I buy, because I want to see what people are saying the bad is.

Linda: Yeah. You don’t want to buy a product that’s going to be terrible and it’s not what you want.

Bob: Well, yeah, if you have 20 people in a row saying that whatever, “it stopped working after three months,” it’s like, all right, there might be a trend here. So, just from a smart shopping perspective, I think this is good, but it also will help you. Yeah, I think it will deter you from buying more things if you’re looking at the bad.

3. Don’t Go To The Grocery Store Hungry

Linda: All right. Number three, this one is classic.

Bob: But it works. It works.

Linda: Don’t go to the grocery store hungry.

Bob: Yeah. It just really, really works. It’s such a big difference when you, yeah, when you’re…

Linda: When you’re full and you’re not hungry.

Bob: Yeah.

Linda: You should go to the grocery store only full. It’s where you’re just like, “None of this sounds good.”

Bob: No, this is what you should do. You should go to the grocery store after a Thanksgiving meal, when you’re so bloated and just be like, “I don’t want any food.” You’re tired. That’s when you go to the grocery store.

Linda: You won’t be buying much. But then, you’ll regret it later because you’ll be like, “Why is there no food in the house?”

2. Only Make Major Purchases In The Morning

Linda: Number two, only make major purchases in the morning.

Bob: Yeah. I think this is really interesting. I remember, I think Tim Ferriss was talking about decision fatigue, and this idea that we only have a limited number of decisions that we can make any given day. And after that point, we’re just tapped out and we can’t actually make any more decisions.

Linda: Yeah.

Bob: And so, what happens is, so many of us in busy lives, we get to the end of the day and we’re just worn down and we don’t have good decision-making abilities. Whereas at the beginning of the day, we’re fresher. And we have, if you think of it in terms of a bank account, we have a lot more decisions sitting there that we can tap into. So, making these purchases, especially big purchases in the morning when we’re stronger, it’s just a better approach.

1. Choose A Major Category Each Month To Attack

Linda: Okay. Number one, choose a major category each month to attack.

Bob: I think this is a good idea. I think too many people try to solve 10 problems at once. And I think focusing your energy on just one, find one category in your budget that you’re struggling with, even though you might be struggling with four or five of them, find one, focus your energy on solving that particular one, whatever that is. If it’s groceries, if it’s household goods, whatever that category is, try to solve that one.

Linda: Yeah. And we’ve talked about this before, where you should not base your budget around what your personal goals are. You need to base it around where you actually are in your life. So, if you were going to Starbucks every day and you want to change that, do that one month. And then, once you’ve got that down, work on the next habit. Don’t try and do it all at once, because you’re going to blow your budget. It’s not going to work. And you’re just going to be mad.

What Budgeting Tip Would You Add To This List?

Yeah. So, those are our top 10. I’d love to hear yours in the comments.

Don’t Forget The Free Budgeting Worksheet!

Like I mentioned at the beginning, if you are new to budgeting, or if you just need a little help, be sure to get our free budgeting worksheet.

Source article that inspired this video/article: 13 incredibly useful budgeting hacks to help you stick to your budget.

-

Business4 weeks ago

Business4 weeks agoBernice King, Ava DuVernay reflect on the legacy of John Lewis

-

World News3 weeks ago

Heavy rain threatens flood-weary Japan, Korean Peninsula

-

Technology3 weeks ago

Technology3 weeks agoEverything New On Netflix This Weekend: July 25, 2020

-

Finance3 months ago

Will Equal Weighted Index Funds Outperform Their Benchmark Indexes?

-

Marketing Strategies7 months ago

Top 20 Workers’ Compensation Law Blogs & Websites To Follow in 2020

-

World News7 months ago

World News7 months agoThe West Blames the Wuhan Coronavirus on China’s Love of Eating Wild Animals. The Truth Is More Complex

-

Economy10 months ago

Newsletter: Jobs, Consumers and Wages

-

Finance8 months ago

Finance8 months ago$95 Grocery Budget + Weekly Menu Plan for 8

![This graphic by James Clear shows the Mr. Money Mustache version of Stephen Covey's circles. Confused? I don't blame you! [Circle of Concern vs. Circle of Control]](../../../../wp-content/uploads/23783342876_61fe34d89c_z.jpg)