Finance

How to Have the Ultimate Family Movie Night at Home

Why spend a ton of money at the movie theater when you can have an at-home movie night that’s just as fun and doesn’t break the bank? Plan the ultimate family movie night at home with these great tips and tricks!

{Psst! Looking for more ideas for frugal family fun? Check out these Kid Date Ideas, Creative Ideas for Family Fun at Home, and Inexpensive Ways to Have Fun at Home!}

Guest post from Ivana of Find Your Mom Tribe:

Before my husband and I received the coveted titles of Mom and Dad, a weekly night at the movies was our thing. We’d get tickets to the blockbuster of the week, eat overpriced snacks (or sometimes sneak a Reese’s cup in here and there), and have a fab time.

After our kids arrived, however, we had to get very creative with our movie night ideas. At first when they were babies, watching a full movie in one sitting seemed like a relic of a time gone by.

But now that they are older, we have lots of fun watching different movies as a family – mostly at home, though, since frequent trips to the movie theater as a family of four would definitely break our budget!

Besides, with so many streaming services available, it’s easy to plan a fun family movie night at home. (And if your kids start crying — or worse, fighting — you won’t have to deal with the glares of the entire movie theater).

How to Have the Ultimate Family Movie Night at Home

Over the past few years, we have really improved our family movie night game and I would love to share some ideas with you! And maybe they’ll become a family ritual in your household as well.

1. Make a concession stand.

Snacks are key for any movie-watching experience! You can always just get some popcorn, a couple of packs of M&Ms, some soft drinks, and call it a day.

But what we do to make it really fun is turn our kitchen into a concession stand! It doesn’t have to cost you a fortune either. I just use some colorful cardboard paper and a Sharpie to make a sign. Bonus points if you have some glitter glue to really kick things up a notch!

Years ago, I bought a few reusable popcorn tubs at the Dollar Store and they’re perfect for this sort of occasion, as they really make the kids feel like they’re at the movie theater.

My husband usually takes charge of running our DIY concession stand and we give the kids Monopoly money to “pay” for their snacks and drinks. (Don’t worry, we’re not as bad with the prices, although you could argue it would be a valuable life lesson!)

As we’re still trying to keep our kids from eating too much sugar, we try and only “sell” healthy snacks and drinks to our kids. The funny thing is, I think we could serve them broccoli like this and they would still eat it since they love role-playing so much.

It’s also important to set some ground rules so that you’re not getting up every 10 minutes to get something from the kitchen once the movie starts.

In our house, we usually take a break when the movie is halfway through so that everyone can get refills and run to the bathroom. Ten minutes is typically more than enough time for the whole family to take a break and gather back in the living room to watch the second half of the movie.

2. Design your own movie tickets.

Since the whole point of organizing a family movie night is to create fond memories for our kids to look back on, I also like to create “movie tickets” to give to the kids that they can hold onto as a keepsake.

Again, it doesn’t have to be anything too fancy – you can draw them by hand and color them with your kids as a fun activity.

But if you would like to go all out (and have a bit of experience using design tools or don’t mind learning), you can use computer software to design and print the tickets.

Personally, I love using Pixlr because it’s free, online (no need to download and install anything), and great for beginners!

With a bit of trial and error, you will get the hang of it pretty quickly and your kids will have really cool tickets to remind them of some great family moments.

If you’re short on time and can’t design your own, you can Google and find some free movie ticket printables to use.

3. Transform your living room.

One of my favorite movie night ideas is to give your living room a fun (but still reversible!) makeover to make the night even more memorable. We usually blow up our air mattresses, place them on the floor, and cover them either with old blankets or bed sheets.

In any case, I try and avoid the couch for one reason only – our kids are still quite clumsy and if they end up spilling their drink, it’s not as big of a deal. Plus, it’s much easier to get rid of any runaway popcorn or chips!

We also like to get all of the cushions out and arrange them on the mattresses so that everyone can lean back and get a comfy seat.

Or you can make a giant blanket fort for extra coziness! Just get the chairs out of the kitchen, drape them with all the blankets you can find and you’re good to go!

As a finishing touch, it’s nice to hang some inexpensive string lights to create a cozy atmosphere.

4. Take it outdoors.

With summer right around the corner, one of the best at-home movie night ideas is to take it outside, although you might need a couple of extra gadgets for an outdoor movie night, such as a projector.

The good news is that these types of movie projectors are pretty affordable these days and you can use them indoors as well, so it’s good value for money.

This is also a perfect opportunity to invite the neighborhood kids over! Just make sure to tell everyone to bring a foldable garden chair or sleeping bag with them unless you want to spend days removing grass stains out of blankets.

5. Go offline.

When I say “go offline”, I don’t mean canceling your Netflix subscription and digging up old DVDs and VHS tapes.

Instead, grown-ups should put their phones on silent mode at the very least, although my husband and I make a point of turning the WiFi off on our phones during family movie nights.

Whatever work-related text pops up during those two hours can definitely wait, and all kids deserve to have time with their parents being fully present for the family fun!

What Movies to Watch

My husband and I often use the family movie night as an excuse to rewatch all the movies we liked when we were growing up. But our kids end up loving them just the same most of the time, so I don’t feel like we’re in the wrong here!

Of course, we always make room for the kids. I can’t count the number of times we watched Cars and Frozen (I know that my daughter wore her Elsa costume for at least 50 percent of those viewings) and luckily there is no shortage of good kids’ movies coming out on a yearly basis.

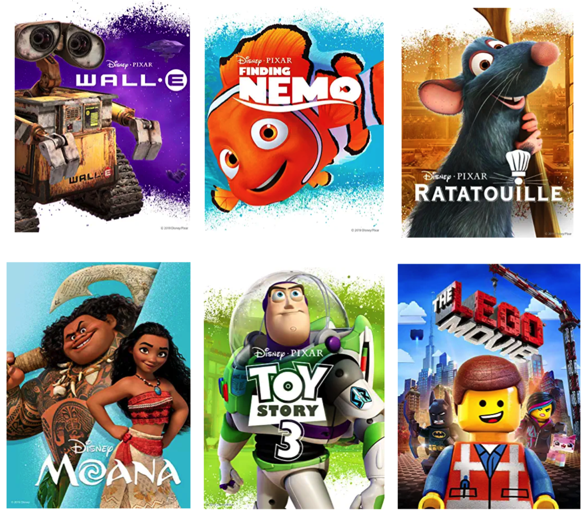

When it comes to movie night ideas with kids, you just can’t go wrong with an animated Disney movie or a beloved kids’ classic.

Here are some of our personal faves:

- Ratatouille - I could watch this story of Remy, a rat who dreams of working as a chef, any day, anytime;

- Moana - My seven-year-old daughter loves this one and knows all the words to “How Far I’ll Go”;

- The Lego Movie - If you haven’t watched this one yet, do yourself a favor and do it ASAP! It’s genuinely hilarious for all ages and I guarantee you’ll have the “Everything Is Awesome” theme song stuck in your head for days;

- Toy Story 3 - Any movie in this franchise is gold in my opinion, but the third installment in this series gets the most rotation in our household which is why I picked it over the others;

- Wall-E - Way more than just a kids’ movie, Wall-E does an amazing job at teaching little ones about the importance of protecting our environment;

- Harry Potter - This is a classic that we haven’t introduced to our kids for one simple reason – they’re still a bit too young, but we’re definitely counting down the days until they get to watch it for the first time!

- Shrek - Any movie with a talking donkey in it is an Oscar-worthy movie if you ask us. On a serious note, though, Shrek belongs to a category of kids’ movies that even grown-ups will fully enjoy!

- Finding Nemo - Who knew fish could be so funny and heartwarming at the same time? Apart from being a classic, it was my son’s favorite for the longest time, so I couldn’t leave it out.

A family movie night at home is guaranteed fun for your kids, even when you’re on a budget. Plus, it creates a kind of warm, family atmosphere that makes for wonderful memories later on in life!

Whether you decide to go all out or keep it simple with some snacks and comfy pajama pants, there’s always a way to incorporate fun movie night ideas into your family tradition – and it’s never too late to start!

Ivana Davies is an educator turned stay-at-home mom. She’s a proud mom of a beautiful 7 year old girl and a playful 5 year old boy. Since she didn’t have a clue about raising kids, she had to learn it all in a hard way. Ivana managed to find so much information online and it inspired her to turn to blogging to share her experiences and struggles as a mom. Her blog, Find Your Mom Tribe, is here to help you connect with other moms, as well as to share mom hacks, information, and tools to help you on this parenting journey.

Finance

YOUR GUIDE FOR SAVING MONEY ON PET FOOD

If you are like most people, your dog is not simply a pet. He or she is a member of your family.

You want to provide them the best of everything. From toys to treats, you love to spoil them rotten

But the costs. Oh, how they can quickly get out of control!

WHY CHEAP IS NOT BETTER

Your first thought may be to buy the cheap dog food.

Please, don’t.

The problem is that the lower quality food can lead to health problems for your pet, which could end up costing you more. It is not the answer.

Instead, focus on ways you can save while still getting your favorite canine the food and treats that are best for them.

STOCK UP WHEN ON SALE

When you find a great deal on the dog food you need, buy extra! There is no reason to pick up one bag when you can get a couple and save.

BUY IN BULK

Oftentimes, the larger bags result in greater savings. Compare the price per ounce of the smaller items to the bigger bags to find the lowest cost.

TRY THE STORE BRAND

Just as with the store brands you buy, sometimes the store brand of pet foods is the same – simply in different packaging.

Carefully review the ingredients before making the switch. After all, if they are the same, why are you paying for the label?

SIGN UP FOR THE STORE REWARDS PROGRAM

Loyalty has its perks. Many stores offer loyalty programs to members. You can get exclusive offers, discounts and coupons that are only offered to those who have signed up.

Some programs also reward for your purchase in the form of points. Once you accumulate the points you can cash them in towards savings or freebies.

GET ON THE LIST

Even if you are a member of their program, make sure you are also on the list! You will get alerts for sales and may even find some awesome coupons to make their way into your inbox as well.

Tip: Make a secondary email address to use so your inbox is not cluttered with these types of emails.

USE ONLINE SERVICES

There are online pet product providers, such as Chewy, who sell pet food and other items, often at a discount. The added perk here is that they deliver it directly to you – so no lugging home huge bags of dog food from the store.

You can use apps such as Honey or Wikibuy to compare online prices to ensure you also find the lowest possible price for the items you need.

SET UP AUTOMATED DELIVERIES

Some sites, such as Amazon, offer discounts if you sign up for automated delivery of select products. Not only will it be delivered, but you also won’t have to worry about running out.

CHECK FOR REBATE OFFERS

Sometimes, manufacturers offer product rebates. If you can find these, you’ll get money back on your purchase.

PRAISE (OR COMPLAIN)

If you have a food your pet loves, send an email letting them know. They may send you coupons or vouchers for products as a thank you.

Alternatively, if you have a problem with a product, make sure to reach out. The company may offer a refund or alternative product for your trouble.

SHOP THE WAREHOUSE

Skip the big box stores and head to your local warehouse. You may find larger bags at a lower cost sold there – saving you time and money.

BECOME A TRACKER

All stores run sales in cycles. They do this on food, clothes, and more – including pet food! Keep track of the offers at your favorite stores.

You will start to learn their cycle and can then stock up when items are on sale.

SKIP THE STORE AND MAKE HOMEMADE DOG FOOD

You can even bypass the store and make your own dog food right at home. There are countless recipes on Pinterest that you can try.

But, before you rush to start a cooking frenzy, make sure to carefully research each ingredient to make sure it is safe for your pet to consume.

PUT COUPONS TO WORK

Before you head to the store, head online, and search for coupons for your pet’s food. You may find them on the manufacturer’s website or on coupon printing sites.

Make sure to also check the product packaging as you may find them stuck to the front of that big bag of dog food.

GET FREE SAMPLES FROM YOUR VET

Vets get free samples of the products they sell – so ask for one! The freebies do not cost them anything, so they should be more than happy to give you one if you inquire.

The post YOUR GUIDE FOR SAVING MONEY ON PET FOOD appeared first on Penny Pinchin' Mom.

Finance

A Peek Into the Last Few Weeks (and our family vacation!)

How to get a shower and get ready for the day when you’re taking care of two babies! 🙂

People ask me all the time how I’m doing with having two babies and I think this early morning picture says it all. Life is full, my hands are full, and my heart is so full! (By the way, I’m actually putting this post together while trying to bounce Kierstyn to sleep in the Baby K’tan… it’s rare that I don’t have at least one baby in my arms these days!)

How could my heart not be full when this is an almost daily site at our house!

Silas had another weekend baseball tournament at a town about an hour away (Murfreesboro). We had fans set up with a generator, tents, lots of cold drinks in coolers, and these cold wraps to keep everyone cooled down

Champ has been learning how to hold his head up and roll over!

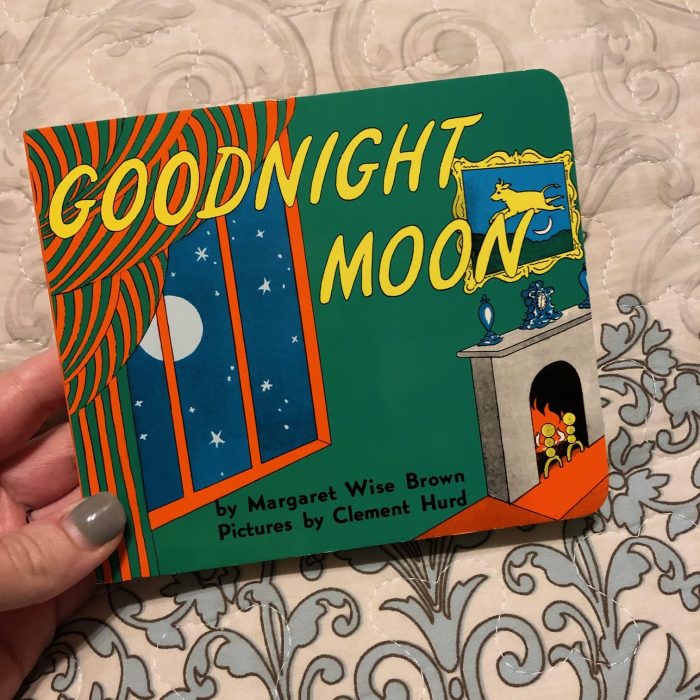

The babies have started to love having books read to them. Goodnight Moon was Silas’ favorite book when he was little, so it’s been so fun to introduce the babies to this book!

We packed for our family trip in tubs — each person got a tub for the week. This saved so much space in our vehicle and made things much more organized!

Our one out of state trip this summer was to go meet up with my family at Bull Shoals Lake in Arkansas. We weren’t sure if the trip was going to happen due to COVID-19, but because of a number of safety measures we put into place, DCS gave us special permission to be able to go and take Champ with us.

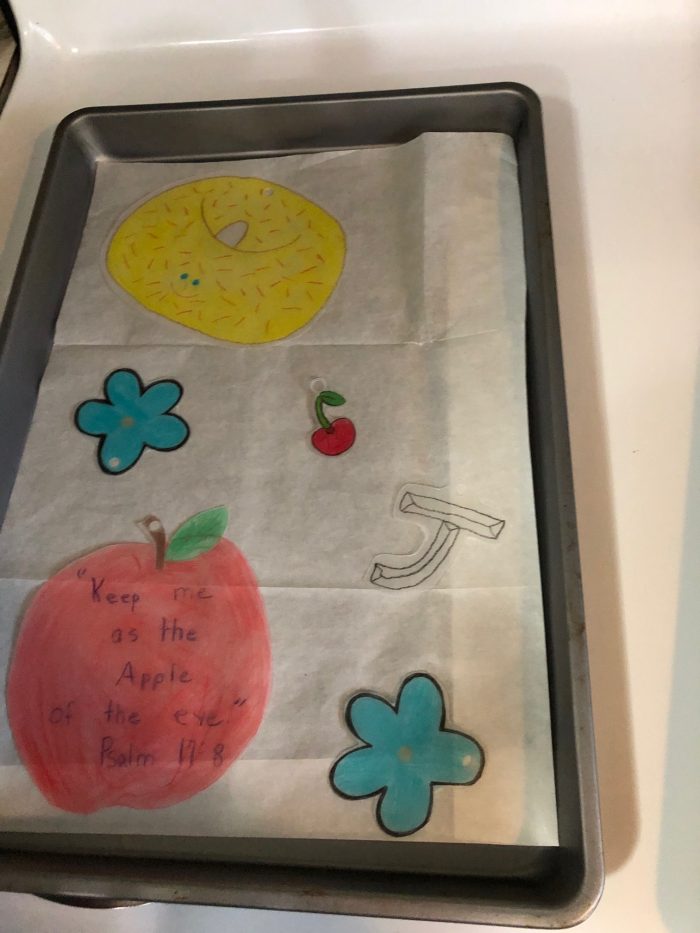

Every afternoon during our annual extended family lake vacation, my mom has “Grandma Time” with her grandkids. She teaches them a Bible lesson, they do a craft, have a snack, and do a game together.

Over the past two years, the older grand kids have started helping out. This year, each of the older ones signed up to help out with a craft and/or a snack and then Kathrynne is in charge of games (complete with an elaborate ticketing system and prizes they can turn their tickets in for at the end of the week ala Chuckie Cheese style!)

As many of you know, my mom had some serious health issues last year, including multiple extensive surgeries and skin grafts for skin cancer. She also got really sick with pneumonia in the middle of all that.

She almost didn’t get to come on the annual lake vacation last year. She did come, but she was so weak and sickly that I wondered if she’d make it another year.

This year, at 66 years old, she’s stronger than ever — not only leading Grandma Time, but also skiing and helping with the babies and cooking and looking for ways to reach out and serve all day long.

I know many of you prayed for her last year and I just wanted to tell you thank you, again! I look at this photo I snapped earlier this week and it just reminds me to be grateful for the many gifts it represents.

Her first time in a pool!

They had this sign at the pool! 😉

For details on how we all pitch in on meals and clean up, check out this post.

One of my favorite parts of our extended family vacations: the daily salad bars we have.

On our way home, we stopped by Ozark, MO so the girls and I could go in to the discount store there. (More details on what we bought coming this weekend!)

Jesse’s parents and his sister, Lisa, drove from Kansas to meet up with us so they could meet the babies, too.

I’m so grateful we got to spend time with extended family. This year certainly has made us so much more grateful for this!

A year ago, we were in the middle of our foster care home study and praying for who God would bring into our home for us to love on.

We were at peace about pursuing this path, but we were still apprehensive and wondering what it might mean for our future. There were so many unknowns, so many what if’s, and so many things outside our control.

I look back on this last year and the 5 children we’ve had the privilege to have in our home — 4 for just a very short-term stint and sweet little Champ who has been with us for almost 4 months.

There are still just as many unknowns, what if’s, and things outside our comfort zone. My heart has been broken in a hundred little pieces over the things we’ve seen and witnessed firsthand and the many kids and their stories whom we weren’t able to say yes to. I’ve cried more tears in the last 10 months than I’ve cried in the last 10 years (okay, pregnancy and postpartum probably played a part in that!).

And yet, my heart is fuller and happier than I can ever remember. The opportunity to love, pour into, and nurture has filled me up in the deepest of places. Seeing my husband and kids sacrifice and serve and love so well has been one of the most amazing experiences.

I don’t know what the future holds. I can imagine it will be full of heartbreak and beauty, tears and love, a roller coaster of emotions, and many things I can’t even imagine.

There are many unknowns, but this one thing I know: I don’t regret for one second saying “yes” to foster care. I look at these pictures and think, “We could have missed this.”

Finance

Are Penny Stocks Worth It? 7 Tips to Help You Reduce the Risk

As share prices for giants like Netflix and Amazon surge, it’s easy to feel priced out of the stock market. As of Aug. 3, a single share of Netflix would cost you $502.19; for Amazon, you’d pay $3,134.82 per share.

If you’re a beginning investor, the high prices may tempt you to seek out a bargain. Enter penny stocks.

Penny stocks seem like an opportunity to buy into an up-and-coming company for dirt cheap. You can buy hundreds or even thousands of shares for the price of an S&P 500 company share.

But watch out: Investing in penny stocks could easily leave you broke.

What Is a Penny Stock? Are Penny Stocks Worth It?

The U.S. Securities and Exchange Commission defines a penny stock as one that trades for $5 or less per share. Most investors, though, take a narrower definition. Many define it as one that trades for under $1.

But it isn’t just the low trading prices that define penny stocks.

You can find stocks trading for under $5 a share on major stock exchanges, like the Nasdaq or New York Stock Exchange (NYSE). But most investors don’t consider these to be penny stocks.

Penny stocks generally trade on the over-the-counter (OTC) market. The transaction takes place between the broker-dealers for the buyer and seller. They use the OTC market to name their prices. There’s no central exchange facilitating the trade, which can happen without anyone else knowing the transaction price.

The transaction may feel the same as it does when you invest in stocks listed on a major exchange. You can typically use whatever brokerage account you normally use to trade stocks. You place the order in the same way you would for any other stock.

The only thing that may stand out: Your broker is required by the SEC to obtain your signature on a risk disclosure document before placing your first penny stock order.

Why Are Penny Stocks So Risky?

If you’re wondering, “Are penny stocks worth it?”, the answer is pretty much a resounding, “NO!” Here’s why penny stock is among the riskiest investments you can make.

They Lack Transparency

Big companies that trade on major stock exchanges are required to file lots of information with the SEC. The information is publicly available at SEC.gov.

But a company with less than $10 million in assets or 2,000 individual investors may not have to file with the SEC at all. Plus, investment analysts and news reporters scrutinize bigger publicly traded corporations. A company with under $10 million in assets is unlikely to draw any of this scrutiny.

Companies traded on over-the-counter exchanges are subject to far less oversight than companies on a big stock exchange. Most penny stocks trade on the pink sheets, an electronic stock listing service that gets its name because it used to be published on — you guessed it — pink sheets. Companies listed on the pink sheets aren’t required to disclose any information.

There’s Usually No Minimum Listing Requirements

Any stock that trades on a major exchange is subject to strict requirements.

For example, for a stock to start trading on the NYSE, these are just a few of the requirements:

- At least 400 shareholders who each own at least 100 of the company’s shares.

- A minimum of 1.1 million publicly traded shares with a value of at least $40 million.

- The stock price must be at least $4 per share.

The companies that issue penny stocks usually can’t meet these stringent listing requirements.

Maybe they have no proven track record. Or maybe they do have a track record, but it’s a troubled one. If a stock listed on the NYSE or Nasdaq falls below $1 per share and stays there for an extended period, it will be delisted. Then, you’ll see it on the OTC markets.

“Penny stocks are typically highly speculative investments,” said Matt Frankel, a certified financial planner (CFP) at The Motley Fool’s The Ascent. “Not only are many penny stocks issued by companies that are yet to achieve profitability or even revenue in many cases, but there’s a significant amount of fraud in the penny stock world.”

They’re Highly Volatile

A single piece of good or bad news can make or break your penny stock investment. The companies are so small that their success may be contingent on getting FDA approval for a single drug or obtaining a patent. A relatively small change in demand for the stock can also result in major gains or losses.

“A penny stock that goes from a few cents to a few dollars can represent massive return on

investment, sometimes in the thousands of percents,” said Evan Tarver, senior financial analyst at Fit Small Business. “However, there is a much higher likelihood that a penny stock will drop to nothing, meaning you would lose your entire investment.”

You May Not Be Able to Sell Your Shares

Most penny stocks have a low trading volume. That means they trade infrequently, which is bad news for you when you want to sell.

Let’s say you owned 5,000 shares of a company, but the trading volume is only 1,000 per day. You’d realistically have to wait five days to sell all your shares. Even then, you may have to sell for much lower than your ask price.

In investor speak, this is known as low liquidity: To quickly convert your investment to cash, it’s likely that you’ll have to do so by discounting the price.

Penny Stocks Are Rife With Fraud

The world of penny stocks is filled with fraudsters who prey on inexperienced investors. Two of the most common penny stock scams are the pump and dump and the short and distort.

Pump and dump: Scammers drum up hype about a company to drive up share prices. They may say that a company has found the cure for coronavirus or that it’s found a new gold mine. Then they offload their inflated shares on unsuspecting investors.

“Penny stock scams use email newsletters, message boards, and bogus press releases to try to create interest in the stock,” Frankel said. “Some even pay analysts to write up legitimate looking ‘research’ reports on the company, and many even cold call unsuspecting investors to tell them about the ‘incredible opportunity.’”

Short and distort: Investors use a complicated maneuver called short selling when they’re betting a stock’s value will drop or become worthless. With the short-and-distort scam, fraudsters short the stock, then spread false negative rumors about the company. When share prices plummet, they profit.

But Couldn’t I Pick the Next Facebook?

Theoretically, yes. But that’s highly unlikely.

Most wildly successful companies were never traded as penny stocks, even though early investors who stuck around reaped huge profits.

“Most successful stocks, such as Microsoft (MSFT), Facebook (FB), and Tesla (TSLA), all first listed their shares on the NYSE or Nasdaq with prices above $10,” Investopedia reports.

7 Rules to Follow if You’re Still Determined to Trade Penny Stocks

We hope we’ve convinced you that buying penny stocks isn’t worth the risk. You’re much more likely to profit by investing in an ETF or mutual fund that represents the entire stock market.

But what if you’re determined to do it anyway? Follow these rules to mitigate the risks.

1. Only Invest What You Can Afford to Lose

Would you be OK with losing this money at the poker table? Don’t invest it in penny stocks if the answer is “no.”

“Any money that you are prepared to invest, you should be comfortable losing 100% of that investment,” said Lou Haverty, a chartered financial analyst (CFA) with Financial Analyst Insider. “In other words, only invest money that you can afford to speculate with.”

2. Research Before You Buy

If you can’t obtain information about a company from SEC filings, that’s a sign that you should pick a different stock. Also, make sure you understand the basics of the industry and how the company makes money. A little knowledge will help you see through overhyped claims.

3. Look for Stocks With a Decent Market Capitalization

Be wary of stocks with extremely low market caps. That means the overall value of its shares is very low.

Most penny stocks are either nano-cap companies (market capitalization of $50 million or less) or microcap companies (market capitalization of $50 million to $300 million).

“As a general rule of thumb, I won’t even consider investing in stocks with market capitalizations under $200 million, which eliminates most of the penny stock world,” Frankel said.

4. Pay Attention to Trading Volume

A stock’s trading volume shows how many shares are bought or sold on a given day. Look for penny stocks with a minimum trading volume of 100,000 to 200,000 to improve your chances of having a willing buyer should you need to sell.

5. Use Automatic Stop Loss Triggers

Haverty recommends setting up stop loss triggers if you’re determined to buy penny stocks. If your share prices fall by the amount you specify, your brokerage will automatically put them up for sale.

6. Watch Out for the Hype

Look out for outrageous claims about a stock’s potential. They may pop up in investment newsletters, emails, websites and message boards.

“If an investment opportunity sounds too good to be true, it probably is,” Frankel said. “For example, if you see a penny stock discussed in a newsletter or on a message board claiming something to the effect of ‘make 200% in 1 week,’ you can be pretty sure you’re looking at a pump-and-dump scam.”

7. Put No More Than 10% of Your Portfolio in High-Risk Investments

High-risk investments should never take up more than 10% of your portfolio at the absolute max.

That’s 10% for ALL the risky investments. You don’t get 10% for penny stocks, 10% for bitcoin and 10% to invest in gold.

It’s essential to keep the other 90% in a diversified portfolio that’s invested across the stock and bond markets.

Boring? Yes.

But pretty much any experienced investor will tell you that boring is better in the long run.

Robin Hartill is a certified financial planner and a senior editor at The Penny Hoarder. She writes the Dear Penny personal finance advice column. Send your tricky money questions to [email protected].

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

-

Business3 weeks ago

Business3 weeks agoBernice King, Ava DuVernay reflect on the legacy of John Lewis

-

World News2 weeks ago

Heavy rain threatens flood-weary Japan, Korean Peninsula

-

Technology2 weeks ago

Technology2 weeks agoEverything New On Netflix This Weekend: July 25, 2020

-

Finance3 months ago

Will Equal Weighted Index Funds Outperform Their Benchmark Indexes?

-

Marketing Strategies7 months ago

Top 20 Workers’ Compensation Law Blogs & Websites To Follow in 2020

-

World News7 months ago

World News7 months agoThe West Blames the Wuhan Coronavirus on China’s Love of Eating Wild Animals. The Truth Is More Complex

-

Economy9 months ago

Newsletter: Jobs, Consumers and Wages

-

Finance8 months ago

Finance8 months ago$95 Grocery Budget + Weekly Menu Plan for 8