Finance

10 Steps to Take When You’re Facing a Forced Retirement

You spend decades of your life working toward the goal of retiring someday. There’s a ton of guesswork involved about when it will happen, how much you’ll need each year and even how long you’re expecting to live.

But when retirement happens sooner than you anticipated — due to a layoff, health issue or some other life event — your decades of retirement planning gets thrown off course.

Suddenly, your time to save is over. Now you have to make less money last even longer than you’d imagined.

10 Steps to Take When You’re Forced to Retire Early

Whether you’ve been forced to retire early due to circumstances beyond your control or you’re preparing for a worst-case scenario, know you still have options for a financially sound retirement. Follow these steps to help you adjust your plans.

1. Find Affordable Health Coverage

When you have to retire early, you’re hit with a big unexpected expense: paying for your health care, since most people aren’t eligible for Medicare until age 65.

“Paying for individual health insurance on one’s own is more expensive than most people budget for,” said Mitchell Kraus, a certified financial planner and registered principal with Capital Intelligence Associates in Santa Monica, California. “If you add in the higher deductibles and co-pays, in most individual and family health plans the costs can be a budget buster.”

If you worked for a company with 20 or more employees, you’ll probably have the option to continue your coverage under COBRA, or the Continued Omnibus Budget Reconciliation Act, for up to 18 months. However, this is an expensive option. You’ll be on the hook for both your share of the plan’s cost and your employer’s share, plus a 2% surcharge.

The federal health insurance marketplace offers a variety of plans at differing levels of coverage and cost. It’s worthwhile to shop there. Depending on your income, you may qualify for a subsidy to help pay for your insurance.

“If money is tight, knowing what subsidies might be available in your state through the Affordable Care Act can save your overall financial well-being,” Kraus said.

2. Apply for Unemployment if You’ve Been Laid off

If you’ve decided to retire because of a layoff, make sure you take advantage of any unemployment benefits you qualify for, even if you don’t plan to return to the workforce.

If you lost your job earlier in 2020, you may be able to retroactively apply for unemployment. As of this writing on July 24, the $600 a week federal unemployment bonus is about to expire, but you can still apply for state benefits — though some states may require you to still look for work.

Unemployment benefits aren’t going to be much help in the long run. But they can be a valuable lifeline if they buy you time to think through major decisions about your Social Security benefits and retirement accounts.

3. Make a Budget for Your Retirement Life

A rule of thumb in financial planning is that most retirees will need to replace about 70% to 80% of their pre-retirement income.

You may need less if you’ve paid off your mortgage and have no other debt. Or you may need significantly more if you have major health expenses or children who still live at home.

Before you make any big decisions about your money, create a retirement budget that accounts for your new lifestyle.

You may need to budget more for certain expenses, like health care, but you may also find other expenses you can reduce or eliminate altogether. For example, if you’re a two-car household, maybe you and your spouse can get by with a single vehicle since you’re no longer commuting.

We get that estimating your needs can be a challenge when you’re newly retired, especially during a time of widespread uncertainty. One solution is to make three budgets so that you have a plan for lean times, good times and somewhere in between.

4. Review Your Mix of Investments

It’s essential that you review your asset allocation, i.e., how much you have invested in stocks, bonds and cash equivalents, like certificates of deposit (CDs), with a pro.

“The strategies used to save for retirement are very different than those needed when living on these assets,” said Mark Wilson, CFP and president of MILE Wealth Management LLC in Irvine, California. “Protect one to three years’ of your projected spending in cash-like investments; invest the remainder in an asset mix that has some growth opportunities.”

One part that gets tricky: You can’t afford as much risk once you’re retired as you could during your working years. But you also can’t afford not to take some risk. You need your money to earn income so you don’t eat away at the principal.

5. Decide Which Retirement Accounts to Tap First

If you leave your job for any reason when you’re 55 or older, you’re allowed to tap into your current 401(k) without paying a 10% early withdrawal penalty, though you’ll owe income taxes unless you have a Roth 401(k).

Note that this rule doesn’t apply to 401(k)s you have with past employers. For old 401(k)s and traditional IRAs, you have to wait until you’re 59 ½ to withdraw money in most cases to avoid the 10% penalty.

Your Roth IRA provides tax-free income when you withdraw it, provided that you’re 59 ½ and you’ve had the account for at least five years.

If you have multiple retirement accounts, it’s essential that you review your situation with a tax professional to determine how to minimize your taxes. You may also want to discuss whether to roll over your 401(k) into an IRA.

6. Make a Plan for Taking Social Security

If you have a serious cash shortfall, you may not have the luxury of waiting until you’re 67 or 70 to collect a higher Social Security benefit. But for most people who have other sources of income, it pays to delay for as long as possible.

When you take Social Security when you become eligible at 62, your monthly benefits will be about 30% lower than they would be if you waited until your full retirement age of 66 or 67. Each year you wait beyond that will push your benefit up by another 8% until you have to start taking it at 70.

There are some circumstances when claiming your benefits earlier does make sense.

“The two big exceptions are when your life expectancy is below average or if you will incur debt that must be repaid to pay current bills,” Kraus said. “Individuals should look at their tax bracket and decide if it is best to take some money out of retirement plans or out of savings. They should review their budget and their emergency reserves.”

7. Look for Part-Time or Freelance Work

You can find ways to earn extra income without going back to working 40-plus hours a week. You could find a work-from-home job or find a side gig, like online tutoring or delivering groceries, or you may be able to do freelance or consulting work in the field you retired from.

Earning extra money will pay off big time if it helps you delay Social Security. But if you’re already getting benefits and you haven’t reached your full retirement age, be aware of Social Security earning limits that could temporarily reduce your benefits.

8. Talk to Your Kids About Your New Normal

A 2015 Pew Research poll found that 61% of adults in the U.S. say they help out their adult children financially. If you’re among them, you need to have a frank talk with your children about how your financial situation has changed.

If your kids turn to you when they need help in an emergency, it’s best to have the conversation now — as in, before an emergency happens — about how you can no longer afford to be the person who bails them out. While this may be difficult, securing your own future so you don’t need to depend on your kids someday is the best thing you can do for them in the long run.

9. Downsize if You Need to Reduce Expenses

If your income sources aren’t enough to make ends meet, it may be time to downsize by moving into a smaller home or an area with a lower cost of living. If you don’t want to leave your home, renting out a room or getting a reverse mortgage could be options.

10. Find Something You Truly Enjoy

Retirement doesn’t just change your finances. It’s a complete change of lifestyle.

“The first question one usually asks someone they meet is, ‘What do you do?’” Kraus said. “Work also takes up about half of most adults’ waking hours when you include the time to get ready, commuting hours and time spent thinking about one’s job.”

Retirement can be isolating. You no longer have daily interactions with co-workers and clients. Plus, it leaves you with way more time on your hands. It’s essential that you find hobbies and ways to stay connected with others.

Knowing how you plan to fill that time will not only make you happier — it can also help you budget better, according to Kraus.

“A retirement of gardening and playing bridge has a very different price tag than a retirement of travel and golf,” he said.

Robin Hartill is a certified financial planner and a senior editor at The Penny Hoarder. She writes the Dear Penny personal finance advice column. Send your tricky money questions to [email protected].

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

Finance

How to Be More Creative

Those of us who weren’t fortunate enough to be born the next Picasso may think there’s no way we can learn to be more creative. But is that really true? According to some of the most creative people in the business, it’s not.

I recently interviewed Brian Koppelman, a renowned filmmaker, producer, and writer. He has worked on some of my favorite movies, like Rounders, Ocean’s Thirteen, and The Illusionist. He also created the popular T.V. show Billions, which has won many prestigious awards. Brian’s creativity has resulted in massive career success, and he’s spent years perfecting his creative process. We sat down together and he gave me his best advice on how anyone can be more creative.

Quick Tips on How to Be More Creative:

- Tip #1: Don’t be afraid to fail

- Tip #2: Don’t try to get it right on the first try

- Tip #3: Accept that creating can be uncomfortable

- Tip #4: Limit your time

- Tip #5: Reduce your anxiety

- Tip #6: Use rejection as a tool

You can watch my full interview with Brian below.

Tip #1: Don’t be afraid to fail

Brian says, “Whatever your favorite movie is, at some point during the writing of it the screenwriter felt completely lost”. When you’re working on a big creative project, you run the risk that it will be a complete failure. People often forget this, because they only see the finished successful product. But we know that for every movie that gets made, there are thousands of movies that don’t. If you’re afraid to fail, you’ll never be able to get to that amazing finished product. Even if it takes a few tries to get it right, it’s worth it to create something brilliant in the end.

Tip #2: Don’t try to get it right on the first try

There are two steps to creating something new: the first step is making the first draft, or coming up with something from scratch. The second step is editing that draft into a beautiful finished product. If you want to be more creative, you need to be careful not to combine these two steps (most people do). When you’re creating something from scratch, you need to silence your inner critic and just create with as much freedom and passion as possible. THEN once you have a first draft, you can go back over it with a critical eye and make it better.

If you try to edit it while you create, you’re limiting your creativity in a big way. You have to be able to try something new, and edit it out later if it doesn’t work. If you edit it out before you try it, you’ll never know if that would have ended up being the perfect addition.

Tip #3: Accept that the process of creating can be uncomfortable

We all have times where we’re working on something and we think it’s terrible. Brian explains that when he was working on his ESPN documentary on Jimmy Conners, he would come home feeling like he made it worse rather than better. But you have to get up the next day and attack it again. Once you realize that this discomfort is part of the process of making something great, you can learn to work through this tough part of the process and become even more creative.

Tip #4: Limit the amount of time you have

You don’t need a lot of time to make something great. It’s actually a huge advantage If you only have an hour a day to work on your creativity, because it forces you to focus and work with intensity. If you give yourself too much time, it’s too tempting for your mind to wander. By limiting your time, you’ll produce more creative work at a faster pace. Brian also advises to “Leave yourself ‘a wet edge’, or a little roadmap for tomorrow, at the end of your creative practice”. This way your subconscious will keep working on it, and when you come back the next day, you’ll be able to hit the ground running.

Tip #5: Eliminate sources of anxiety

When Brian and his partner David Levien were writing their first screenplay, they were both working full time. Brian advises aspiring creators not to quit their jobs, because it creates too much pressure. If there is a lot of pressure on you to create something magnificent, it can actually thwart your creative abilities. Instead, focus on eliminating anxiety wherever you can so you can truly focus on your creativity.

Tip #6: Use rejection as a tool

A lot of times when we hear “No”, it’s crushing, and it feels like a huge judgement on our work and our character. But Brian points out that you never know what’s going on behind closed doors, “Maybe that morning the head of the agency said ‘hey guys, don’t tell anybody but we can’t afford to take on any new clients. So for the next month you need to pass on everything’”. Your work could get passed up because of something internal you don’t know about, but if you take it personally and give up, you might miss your chance.

Rejection can actually be a useful tool to help you look objectively at your work.

Take your Creativity to the next level

Overall, creativity is a skill that you can improve over time. If you follow the tips Brian laid out above, you’ll be well on your way to being more creative.

Once you’ve honed your creative process, you may want to take it to the next level. Many great creators have started businesses from their work, and you could too.

If you want even more inspiration on how improving your creativity could transform your life, take my earnings potential quiz below.

How to Be More Creative is a post from: I Will Teach You To Be Rich.

Finance

YOUR GUIDE FOR SAVING MONEY ON PET FOOD

If you are like most people, your dog is not simply a pet. He or she is a member of your family.

You want to provide them the best of everything. From toys to treats, you love to spoil them rotten

But the costs. Oh, how they can quickly get out of control!

WHY CHEAP IS NOT BETTER

Your first thought may be to buy the cheap dog food.

Please, don’t.

The problem is that the lower quality food can lead to health problems for your pet, which could end up costing you more. It is not the answer.

Instead, focus on ways you can save while still getting your favorite canine the food and treats that are best for them.

STOCK UP WHEN ON SALE

When you find a great deal on the dog food you need, buy extra! There is no reason to pick up one bag when you can get a couple and save.

BUY IN BULK

Oftentimes, the larger bags result in greater savings. Compare the price per ounce of the smaller items to the bigger bags to find the lowest cost.

TRY THE STORE BRAND

Just as with the store brands you buy, sometimes the store brand of pet foods is the same – simply in different packaging.

Carefully review the ingredients before making the switch. After all, if they are the same, why are you paying for the label?

SIGN UP FOR THE STORE REWARDS PROGRAM

Loyalty has its perks. Many stores offer loyalty programs to members. You can get exclusive offers, discounts and coupons that are only offered to those who have signed up.

Some programs also reward for your purchase in the form of points. Once you accumulate the points you can cash them in towards savings or freebies.

GET ON THE LIST

Even if you are a member of their program, make sure you are also on the list! You will get alerts for sales and may even find some awesome coupons to make their way into your inbox as well.

Tip: Make a secondary email address to use so your inbox is not cluttered with these types of emails.

USE ONLINE SERVICES

There are online pet product providers, such as Chewy, who sell pet food and other items, often at a discount. The added perk here is that they deliver it directly to you – so no lugging home huge bags of dog food from the store.

You can use apps such as Honey or Wikibuy to compare online prices to ensure you also find the lowest possible price for the items you need.

SET UP AUTOMATED DELIVERIES

Some sites, such as Amazon, offer discounts if you sign up for automated delivery of select products. Not only will it be delivered, but you also won’t have to worry about running out.

CHECK FOR REBATE OFFERS

Sometimes, manufacturers offer product rebates. If you can find these, you’ll get money back on your purchase.

PRAISE (OR COMPLAIN)

If you have a food your pet loves, send an email letting them know. They may send you coupons or vouchers for products as a thank you.

Alternatively, if you have a problem with a product, make sure to reach out. The company may offer a refund or alternative product for your trouble.

SHOP THE WAREHOUSE

Skip the big box stores and head to your local warehouse. You may find larger bags at a lower cost sold there – saving you time and money.

BECOME A TRACKER

All stores run sales in cycles. They do this on food, clothes, and more – including pet food! Keep track of the offers at your favorite stores.

You will start to learn their cycle and can then stock up when items are on sale.

SKIP THE STORE AND MAKE HOMEMADE DOG FOOD

You can even bypass the store and make your own dog food right at home. There are countless recipes on Pinterest that you can try.

But, before you rush to start a cooking frenzy, make sure to carefully research each ingredient to make sure it is safe for your pet to consume.

PUT COUPONS TO WORK

Before you head to the store, head online, and search for coupons for your pet’s food. You may find them on the manufacturer’s website or on coupon printing sites.

Make sure to also check the product packaging as you may find them stuck to the front of that big bag of dog food.

GET FREE SAMPLES FROM YOUR VET

Vets get free samples of the products they sell – so ask for one! The freebies do not cost them anything, so they should be more than happy to give you one if you inquire.

The post YOUR GUIDE FOR SAVING MONEY ON PET FOOD appeared first on Penny Pinchin' Mom.

Finance

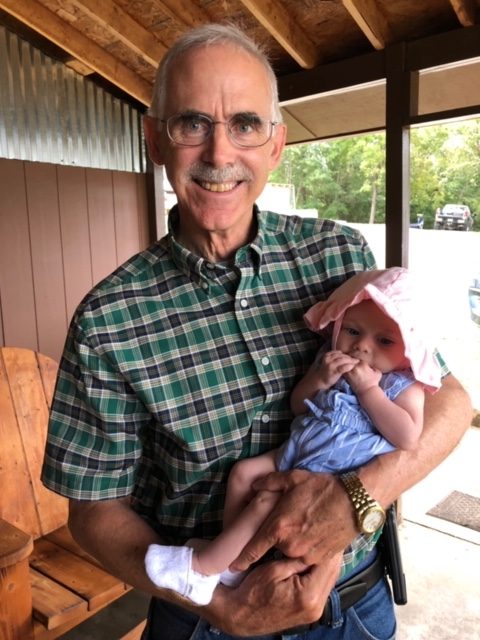

A Peek Into the Last Few Weeks (and our family vacation!)

How to get a shower and get ready for the day when you’re taking care of two babies! 🙂

People ask me all the time how I’m doing with having two babies and I think this early morning picture says it all. Life is full, my hands are full, and my heart is so full! (By the way, I’m actually putting this post together while trying to bounce Kierstyn to sleep in the Baby K’tan… it’s rare that I don’t have at least one baby in my arms these days!)

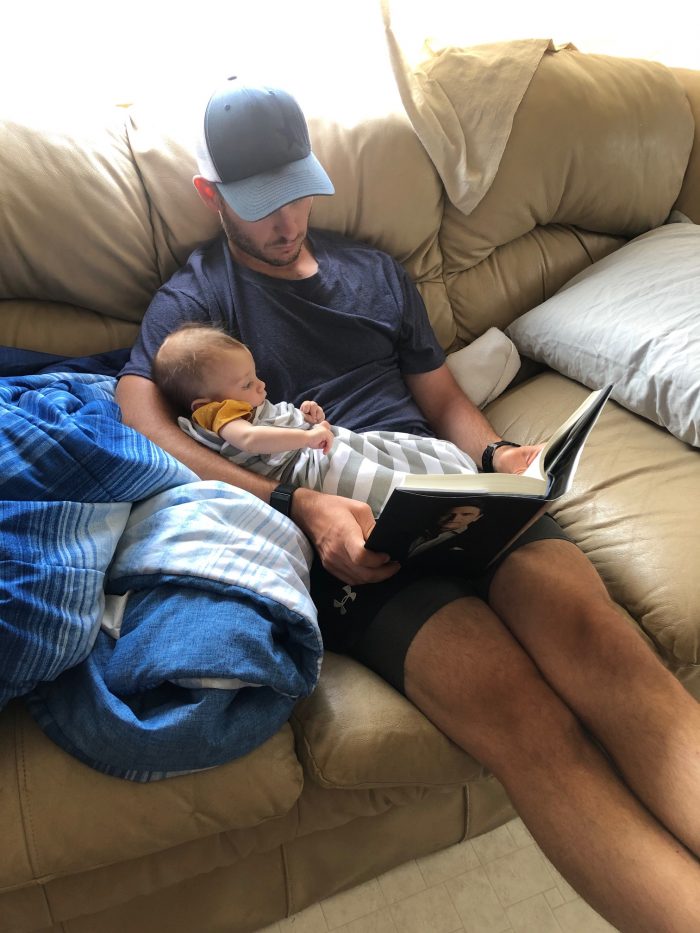

How could my heart not be full when this is an almost daily site at our house!

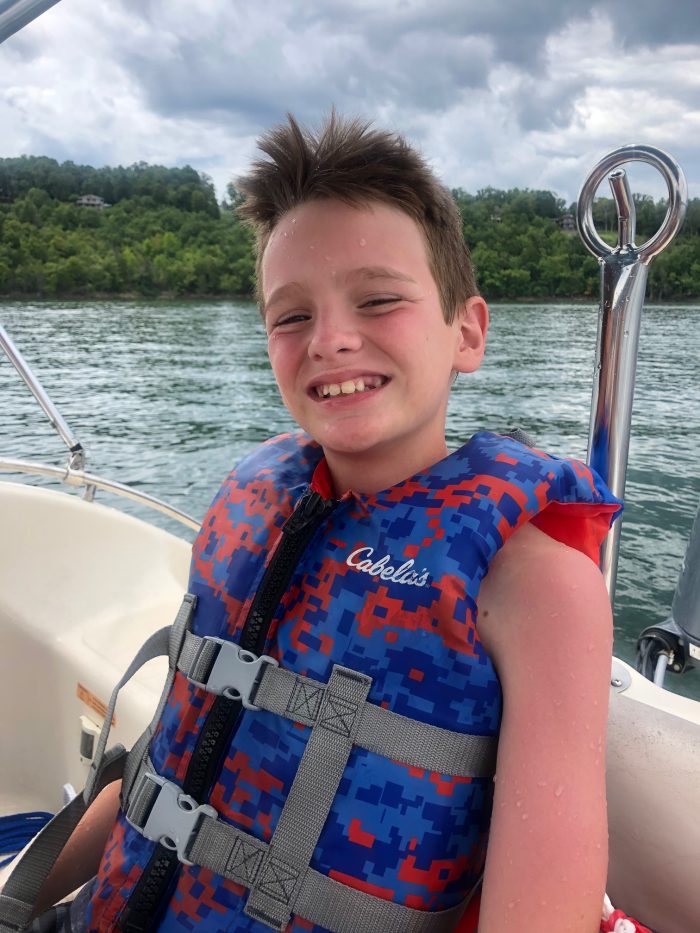

Silas had another weekend baseball tournament at a town about an hour away (Murfreesboro). We had fans set up with a generator, tents, lots of cold drinks in coolers, and these cold wraps to keep everyone cooled down

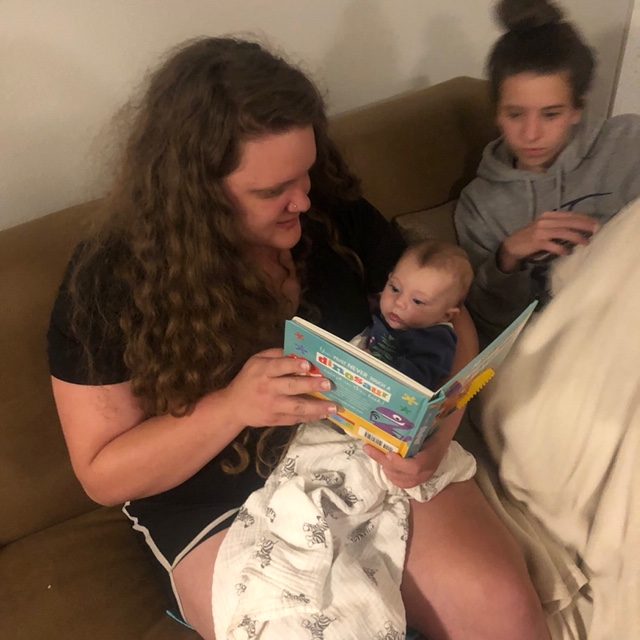

Champ has been learning how to hold his head up and roll over!

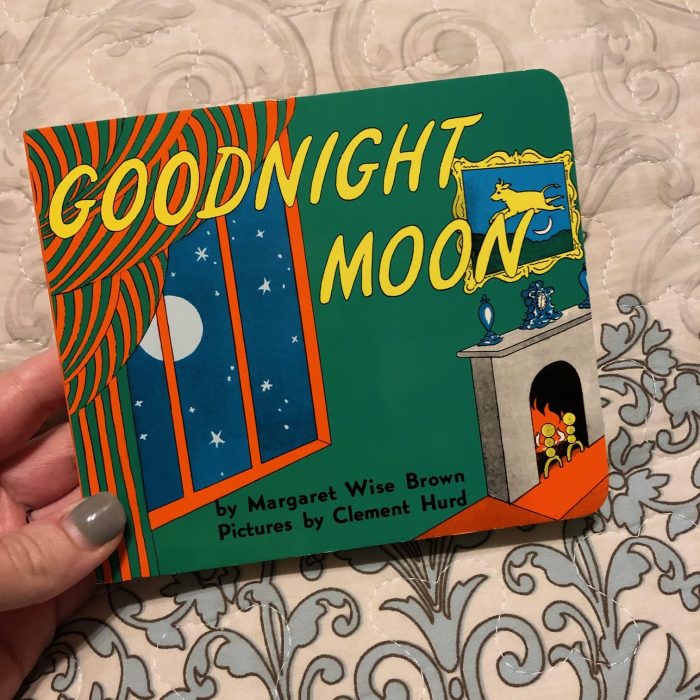

The babies have started to love having books read to them. Goodnight Moon was Silas’ favorite book when he was little, so it’s been so fun to introduce the babies to this book!

We packed for our family trip in tubs — each person got a tub for the week. This saved so much space in our vehicle and made things much more organized!

Our one out of state trip this summer was to go meet up with my family at Bull Shoals Lake in Arkansas. We weren’t sure if the trip was going to happen due to COVID-19, but because of a number of safety measures we put into place, DCS gave us special permission to be able to go and take Champ with us.

Every afternoon during our annual extended family lake vacation, my mom has “Grandma Time” with her grandkids. She teaches them a Bible lesson, they do a craft, have a snack, and do a game together.

Over the past two years, the older grand kids have started helping out. This year, each of the older ones signed up to help out with a craft and/or a snack and then Kathrynne is in charge of games (complete with an elaborate ticketing system and prizes they can turn their tickets in for at the end of the week ala Chuckie Cheese style!)

As many of you know, my mom had some serious health issues last year, including multiple extensive surgeries and skin grafts for skin cancer. She also got really sick with pneumonia in the middle of all that.

She almost didn’t get to come on the annual lake vacation last year. She did come, but she was so weak and sickly that I wondered if she’d make it another year.

This year, at 66 years old, she’s stronger than ever — not only leading Grandma Time, but also skiing and helping with the babies and cooking and looking for ways to reach out and serve all day long.

I know many of you prayed for her last year and I just wanted to tell you thank you, again! I look at this photo I snapped earlier this week and it just reminds me to be grateful for the many gifts it represents.

Her first time in a pool!

They had this sign at the pool! 😉

For details on how we all pitch in on meals and clean up, check out this post.

One of my favorite parts of our extended family vacations: the daily salad bars we have.

On our way home, we stopped by Ozark, MO so the girls and I could go in to the discount store there. (More details on what we bought coming this weekend!)

Jesse’s parents and his sister, Lisa, drove from Kansas to meet up with us so they could meet the babies, too.

I’m so grateful we got to spend time with extended family. This year certainly has made us so much more grateful for this!

A year ago, we were in the middle of our foster care home study and praying for who God would bring into our home for us to love on.

We were at peace about pursuing this path, but we were still apprehensive and wondering what it might mean for our future. There were so many unknowns, so many what if’s, and so many things outside our control.

I look back on this last year and the 5 children we’ve had the privilege to have in our home — 4 for just a very short-term stint and sweet little Champ who has been with us for almost 4 months.

There are still just as many unknowns, what if’s, and things outside our comfort zone. My heart has been broken in a hundred little pieces over the things we’ve seen and witnessed firsthand and the many kids and their stories whom we weren’t able to say yes to. I’ve cried more tears in the last 10 months than I’ve cried in the last 10 years (okay, pregnancy and postpartum probably played a part in that!).

And yet, my heart is fuller and happier than I can ever remember. The opportunity to love, pour into, and nurture has filled me up in the deepest of places. Seeing my husband and kids sacrifice and serve and love so well has been one of the most amazing experiences.

I don’t know what the future holds. I can imagine it will be full of heartbreak and beauty, tears and love, a roller coaster of emotions, and many things I can’t even imagine.

There are many unknowns, but this one thing I know: I don’t regret for one second saying “yes” to foster care. I look at these pictures and think, “We could have missed this.”

-

Business3 weeks ago

Business3 weeks agoBernice King, Ava DuVernay reflect on the legacy of John Lewis

-

World News2 weeks ago

Heavy rain threatens flood-weary Japan, Korean Peninsula

-

Technology2 weeks ago

Technology2 weeks agoEverything New On Netflix This Weekend: July 25, 2020

-

Finance3 months ago

Will Equal Weighted Index Funds Outperform Their Benchmark Indexes?

-

Marketing Strategies7 months ago

Top 20 Workers’ Compensation Law Blogs & Websites To Follow in 2020

-

World News7 months ago

World News7 months agoThe West Blames the Wuhan Coronavirus on China’s Love of Eating Wild Animals. The Truth Is More Complex

-

Economy9 months ago

Newsletter: Jobs, Consumers and Wages

-

Finance8 months ago

Finance8 months ago$95 Grocery Budget + Weekly Menu Plan for 8