Finance

Current Review: Checking Account App And Card With Premium Features

Teaching your teens about money management is more interesting when its hands on. But it’s impractical to follow your teen around everywhere they go so you can monitor their spending.

Instead, you can use a checking account app like the one from Current. It has plenty of parental controls to limit and monitor your teen’s spending.

But that’s not all, Current also has two day direct deposits and will also refund holds placed by gas stations. In this article, we’ll review what Current has to offer to anyone looking for a mobile-only checking account with terrific features.

|

Current Details |

|

|---|---|

|

Product Name |

Current |

|

Account Types |

Checking |

|

Min Deposit |

$0 |

|

Fees |

Personal Accounts: $0 to $4.95/month Teen Banking: $36/year per teen |

|

Promotions |

30-Free Trial of Teen Banking |

Who Is Current?

Current is not actually a bank but instead is a fintech that helps parents and children make smart money choices. It also provides various benefits through its checking account. It’s CEO is Stuart Sopp. Current was founded in June 2015 and is based in the Greater New York area. Current has raised $52.6M in funding up to a Series B round.

The debit card (called the Current White Prepaid Visa Card) provided by Current is issued through Metropolitan Commercial Bank (Member FDIC). The premium Current card is issued by Choice Financial Group (Member FDIC).

What Do They Offer?

Current offers checking accounts with a faster availability of your paycheck, removal of gas station holds, and great money management for teens.

For now, these accounts are mobile-only. So not only are there no local branches available to visit, but there is no desktop account access or management offered either. As of writing, account accessibility is only offered through one of the Current mobile apps.

Current also doesn’t pay any interest on its checking accounts. The features mentioned in the three plans outlined below will need to be attractive enough that you’d want to use Current for your checking despite no interest earnings.

Personal Checking Accounts

Presently, there are two plans available for customers that are looking to open a personal checking account. Below, you’ll see a quick breakdown of what each plan has to offer and its pricing.

|

Basic — Free |

Premium — $4.99/mo |

|---|---|

|

Everything included in the Basic plan, plus:

|

The free plan isn’t incredibly compelling. In fact, you could be better off with a free online bank account that might pay a little interest. Once you get into the $4.99/mo Premium plan, it’s still a tough sell. But, for the right person, features in the Premium may well be worth it.

The most compelling features are the faster direct deposits and gas hold refunds. Faster direct deposits mean money deposited from your paycheck should be available up to two days faster than the average direct deposit.

Unlike other banks, Current ignores the date that employers intend for your paycheck funds to be released. Instead, it credits your acount moments after receiving it. This is a common feature of prepaid debit cards.

The gas hold feature refunds holds placed on your card by gas stations. Some gas stations may apply a hold of up to $100 on your card. These holds basically lock the amount being held, making it unavailable for spending. Current will immediately refund the hold so that you don’t lose any availability of your funds.

Teen Banking

The teen plan is designed with parental supervision and money management in mind. It’s a great way to help teach your teen about using money. Parental features include:

- Cashless convenience

- Instant transfer to your teen’s card

- Notifications for all purchases

- Ability to block specific merchants

- Ability to set spending limits

- Set chores to complete

- Automate allowance payments

- Multiple family members can add funds

The Teen plan, however doesn’t include any savings pods (explained next). These plans come with a 30-day free trial, after which an annual subscription fee of $36/yr per teen will be charged to the account.

You might be better off finding a great starter checking account for kids.

Savings Pods

A savings pod is like a savings account but without the interest. It is meant to simply section off funds for a specific savings goal. You can label each pod and money can be deposited/moved into a pod directly from your checking account, direct deposit, or through round-ups (to the nearest dollar) from your card.

Transaction Limits

Current accounts do have a few limits worth noting. These include:

- $500 daily maximum in ATM withdrawals

- $2,000 daily maximum in card purchases

- $5,000 maximum transaction amount for peer-to-peer payments through Current Pay

Mobile App

Current accounts are managed through its mobile app. The mobile app is available for Android and iOS. Visit the Current website to download the app. On iOS, the app is rated a 4.7 out of 5 from 32.6k people. On Android, the app is rated 4.4 out of 5 from 18.3k people.

Are There Any Fees?

Yes. The Premium plan costs $4.99/mo and the Teen plan is $36/yr per teen.

How Do I Open An Account?

As mentioned previously, Current’s accounts are mobile-only. This means that you can only open an account through one of its mobile apps. You can download the app from the iOS or Android app store. Or you can text yourself a download link from it’s site.

Is My Money Safe?

Yes. Deposited funds are covered by FDIC insurance up to $250,000 through Current’s issuing bank, Choice Financial Group.

Is It Worth It?

If faster direct deposits is a need that you have and are willing to pay $4.99/mo for it, then Current could be worth it. And if gas station holds noticeably affect you, then Premium, again, may be worth considering.

Given that so many financial institutions offer methods for parents to control their children’s spending, parental spending features may not offer much of a selling point. But if your financial institution doesn’t have anything like that, Current’s Teen plan for $36/yr could definitely worth it.

It’s important to point, however, that other banks (especially online banks) are able to match many of Current’s checking account features while also offering savings accounts and other products. Check out our list of the best online banks.

And be sure to compare Current’s teen banking options with our favorite starter checking accounts for kids.

Current Features

|

Account Types |

Checking |

|

Minimum Deposit |

$0 |

|

Minimum Balance |

$0 |

|

APY |

None |

|

Maintenance Fees |

|

|

Branches |

None (online-only bank) |

|

ATM Availability |

55,000 Fee-Free ATMs |

|

Customer Service Number |

1-888-851-1172 |

|

Customer Service Hours |

Phone: Weekdays 9AM-6PM EST Chat: 24/7 availability |

|

Mobile App Availability |

iOS and Android |

|

Bill Pay |

Yes |

|

Mobile Check Deposit |

Yes |

|

FDIC Certificate |

9423 |

|

Promotions |

30-free trial of Teen Banking |

The post Current Review: Checking Account App And Card With Premium Features appeared first on The College Investor.

Finance

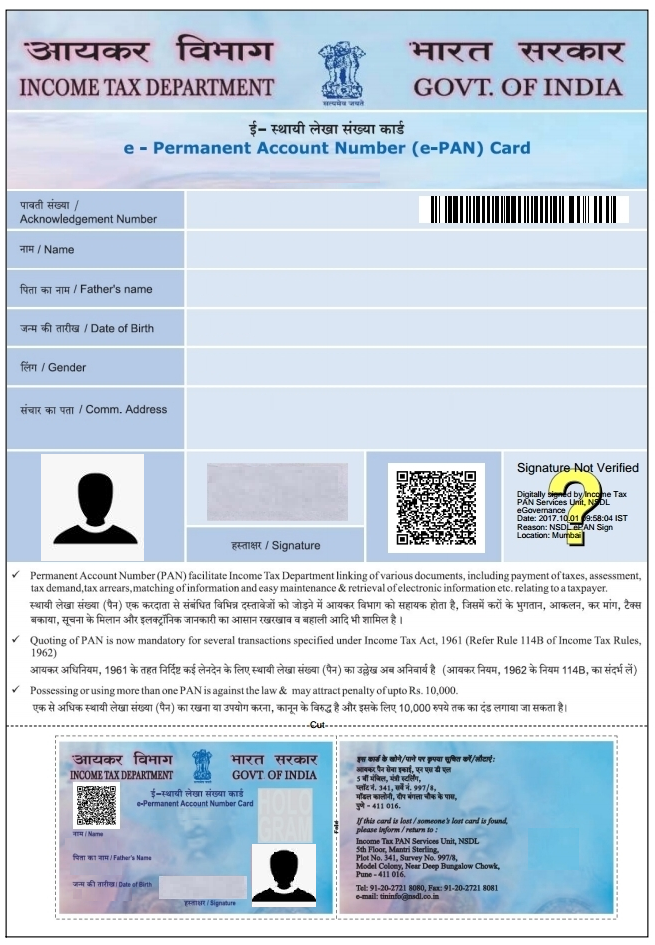

Instant ePAN Card using Aadhaar Card: 5 Things to Know

A PAN Card is a 10-digit alpha-numeric unique code issued by the Income Tax Department of India to file the Income Tax Returns or to make banking transactions exceeding Rs. 50,000. Moreover, a PAN Card is also considered as one of the important identification documents for opening a bank account, purchasing a property, investing in mutual funds, applying for a debit/credit card and more.

According to the Union Government of India, it is now mandatory for all the individuals to link their Aadhaar Card with a PAN Card and failure to do the same will result in an inoperative PAN Card. You will also be fined Rs. 10,000 for using an inoperative PAN Card under the Section 272B of the Income Tax Act. The deadline for linking PAN with Aadhaar has been extended to 31st March 2021.

However, getting a PAN Card has now become quite easy as compared to the offline procedure which was lengthy, paper-heavy and tedious. You can instantly get your PAN Card Application through an Aadhaar Card. It is worth mentioning that in order to avail this facility of getting an instant PAN Card through Aadhaar Card, your mobile number must be registered with Aadhaar to generate One Time Password(OTP) for the verification.

This facility of instant and free PAN Card through Aadhaar based e-KYC has been recently launched by the Finance Minister of India , Nirmala Sitharam on 25th June 2020.

Let us now understand what are those five important things for instant PAN Card Application using Aadhaar Card.

Process of Instant PAN Card through Aadhaar Card

You must know the steps involved for availing Instant PAN through Aadhar Card. The steps are as follows:

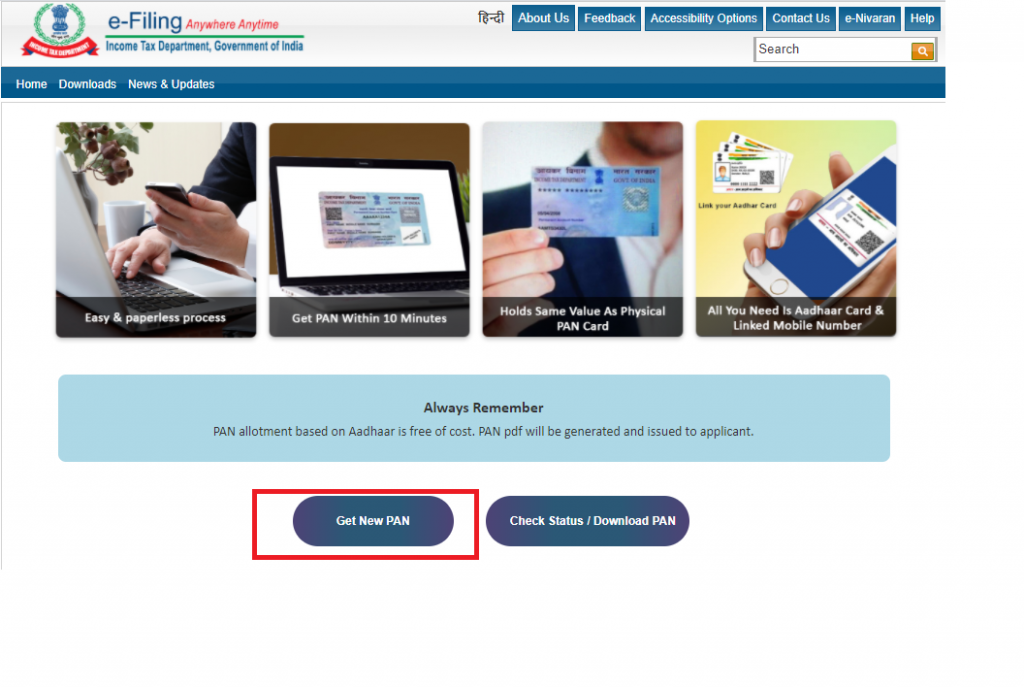

Step 1: You have to visit the official website of the Income Tax Department at https://www.incometaxindiaefiling.gov.in/e-PAN/

Step 2: Click on the ‘ Get New PAN’ option

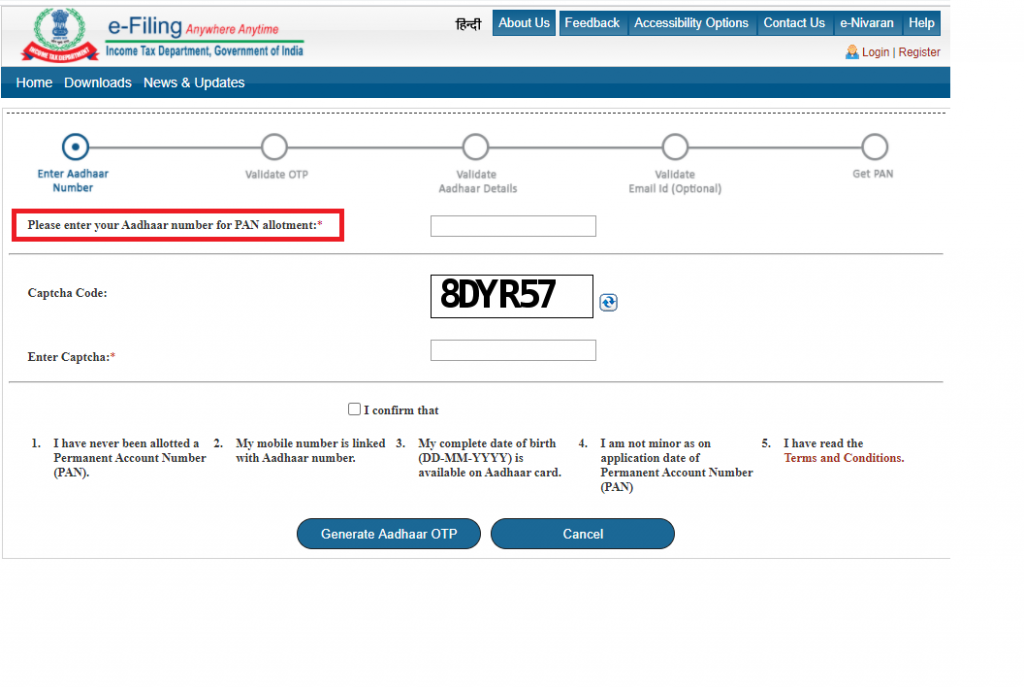

Step 3: You will be redirected to a new page. Enter your 12-digit Aadhaar Number for PAN allotment

Step 4: Enter the ‘Captcha Code’ for verification

Step 5: Now, you need to confirm the following details:

-

- I have never been allotted a PAN Card

- My mobile number is linked with Aadhaar number

- My complete date of birth is available on the Aadhaar Card (DD/MM/YY)

- I am not minor as on application date of Permanent Account Number (PAN)

- I have read the Terms and Conditions

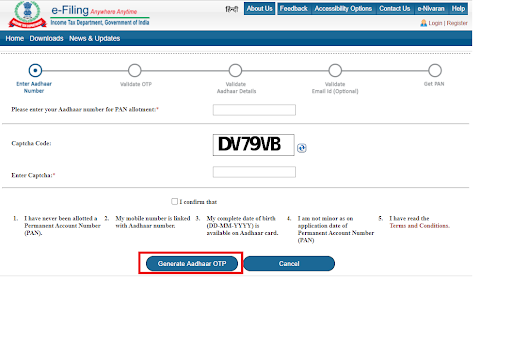

Step 6: Once done, click on the ‘Generate Aadhaar OTP’ button

Step 7: You have to enter the OTP be sent on your registered mobile number

Step 7: You have to enter the OTP be sent on your registered mobile number

Step 8: You have to validate your Aadhaar details, your email address (optional)

Step 9: Once all the details will be validated from the database UIDAI, your e-PAN will also be sent if the email ID of the applicant is registered with Aadhaar

Note: You will receive a 15-digit acknowledgement number for further tracking of PAN Card Status

Format of of Instant PAN Card facility through Aadhaar based e-KYC

The issued instant PAN Card is in the format of pdf which also has a QR code containing all the demographic information such as your name, date of birth, gender and the photograph too. Morerver, this instant e-PAN can be downloaded through the 15-digit acknowledgement number sent to you once the process of PAN Card application is completed on your registered mobile number and email address. Moreover, you will also be sent a soft copy of your PAN Card on your email address (if registered with Aadhaar Card).

Note: Sometimes, the applicants get confused whether the e-PAN is considered equally valid or not, but as per the recent rules of the Income Tax Department of India, the e-PAN is equivalent to a laminated PAN Card.

Charges for Instant PAN Card through Aadhaar Card

You can also get your PAN Card through the official website of NSDL and UTIITSL, but both these PAN Card issuing authorities charge for the PAN Card application whereas the issuing of a 10-digit alphanumeric number is free of cost at the Income Tax Department’s portal.

Read more at: PAN Card Fees and Charges

Documents Required for Instant PAN Application

There is no documentation required for the Instant PAN Application facility through Aadhaar Card as the data will be automatically fetched from the database of the Unique Identification Authority of India (UIDAI) once you enter your Aadhaar number.

The income tax department says the turnaround time for issuing an instant PAN is just about 10 minutes. So far more than 6.7 lakh such instant PAN cards have been issued.

How to Check Status of Instant PAN Application

You can also check the status of your Instant PAN Application by following the steps mentioned below:

Step 1: Go to the official e-filing home page of the Income Tax Department (https://www.incometaxindiaefiling.gov.in/home)

Step 2: Click on the ‘Instant PAN through Aadhaar’ option under the ‘Quick Links’ section on the homepage which will redirect you to the instant PAN allotment webpage

Step 3: Now, you need to select the ‘Check Status/Download PAN’ option

Step 4: Enter your Aadhar number and captcha code

Step 5: Click on the ‘Submit’ button

Step 6: You have to validate the OTP which will be sent to your registered mobile number. Once again click on the ‘Submit’ button

Step 7: A new page will appear on your screen to check the status of your Instant PAN Card Application

Step 8: Upon successful approval of your PAN Application, you will receive a PDF link within ten minutes to download the PAN

Note: The PDF which will be generated will be password protected and you need to use your date of birth in the format ‘DDMMYYYY’ as the password to open the PDF file.

The post Instant ePAN Card using Aadhaar Card: 5 Things to Know appeared first on Compare & Apply Loans & Credit Cards in India- Paisabazaar.com.

Finance

How To Stick To A Budget (10 Budgeting Tips & Tricks)

(The following is a transcription from a video Linda and I recorded. Please excuse any typos or errors.)

All right. Today, we’re talking about 10 incredibly useful hacks to stick with your budgets. And, I’m really excited to share them with you.

We have really honed in on what it takes to have a budget that you can enjoy, that makes you feel good about life.

We’ve done it wrong so much that we’ve just learned how to do it right, and how to have fun in the process.

If you haven’t gotten Our Free Budgeting Worksheet, I’ve spent a lot of time making this thing and I think it’s awesome.

It’s a good first step to see how your income and expenses stack up. It’s just a good way to get started with your budget.

You can just pick that up by clicking here, and you’ll be on your way to starting your budget!

Now let’s get to these 10 amazing hacks to help you stick with your budget…

10. Make Savings Automatic

Bob: One of the biggest mistakes that most people make is they spend their money and then they try to save or give afterwards. You have to do it the opposite way, the things that are most important to you: giving money, savings, whatever those are, that needs to come first. If you don’t do it that way, if you don’t have some automatic thing in place, the reality is, we all know this.

Linda: It’s not going to happen.

Bob: We all know this, it’s probably not going to happen. You’re going to get to the end of the month, there’s not anything there. And so, that’s why making it automatic is incredibly important.

9. Reward Yourself

Bob: Or if you’re a Parks and Recreation fan, we could call it, treat yo self.

Linda: Treat yo self. This comes across though, as like, “I’m just going to treat myself all the time,” which is something I would do, but we’re not talking about that. Right?

Bob: Yeah. But the key in terms of sticking to your budget, you need rewards. You need incentives to stay the course. And so, yeah, when we were paying off our debt, this was a big part of that. Our budget was a big piece of us being able to pay off our debt. But in order to reach that goal, we had to have milestones. It was too big of a thing, it was too much, it was too long of a road for us to walk without some rewards. And so, we made sure to keep them in there and because we did, we were able to stick with it. Right?

Linda: Yeah. And I think this was especially key for me because he was watching the numbers of our debt go down, down, down. And he was really, really involved. But for me, I was more on the sidelines. And if I wouldn’t have had this incentive, it would have been really difficult for me to keep going. I think I would have just gotten discouraged and given up. So, I think this was extremely key for me since I was not as involved.

Bob: Yeah. Definitely.

8. Budget With Accountability

Bob: I’ve had the unique advantage of being able to try out and test out a whole bunch of different budgeting methods, budgeting softwares and tools and spreadsheets, and all this stuff over the years. I’ve been a financial blogger for almost 13 years, and I have reviewed almost everything out there, and I’ve tried out so much of the stuff. Because we’ve actually tried it ourselves.

The thing that I’ve come to realize is that most budgeting methods don’t actually hold you accountable. There’s this false sense of accountability. And so, the only tool that I’m aware of that ever actually hold you accountable are cash envelopes, if you do that and put cash in envelopes and do that type of budgeting.

Linda: Yeah. And that wasn’t going to work for us because we use plastic sometimes because we online shop or whatever.

Bob: Yeah. Then the other option is The Real Money Method. And this is kind of our hack to do that, to have a budgeting method that actually holds you accountable. So, we have an entire course teaching this method in which you’re welcome to check out if you’re interested. But the bottom line is that for most of us to stick with a budget, we need accountability. We need a budget that’ll hold us accountable. And so, if you’ve ever failed with budgeting, this might be the reason why. So, just find something that will hold you accountable.

7. Don’t Save Your Credit Card Info On Any Site Where You Shop

Bob: This is a good hack. This, yeah, because adding that friction, I think that would definitely, yeah. It just doesn’t seem like much, but having to spend the extra minute or two to go through with the purchase to type all that in, it just slows you down.

Linda: All right. So, I think you’ve told me about this before, where there’s something almost physical that happens in your body when you pay for something and you have to hand over cash.

Bob: Because it’s just real money and you get to feel it.

Linda: Yeah. And you’re like, “There’s my money and it’s leaving.”

Bob: It’s disappearing, yeah.

Linda: But when you write a check, you told me it’s less, but it’s still more of a process that you still feel like…

Bob: A little bit less real, yeah.

Linda: And then, less when you are swiping your credit card.

Bob: Yeah.

Linda: I think you told me this years ago, really before online shopping was as big as it is now. And I can only imagine how little you feel that when it’s like click, click, and it’s, “I bought it.”

Bob: Yeah.

Linda: It’s done.

Bob: I mean, that’s what Amazon has done. It’s like literally-

Linda: Oh, my gosh.

Bob: Add To Cart, boom. Done.

Linda: Well, and you can even hit Buy It Now. And it’s like click, you’re done.

Bob: Yeah. You’re right. It’s one click. So, it’s brilliant on their part. But the point is, is that adding that friction will overall reduce the spending that we make. So yeah, it’s an important move to make.

6. Only Use Gift Cards To Shop On Amazon

Linda: Number six ties right into what we were just talking about. Only use gift cards to shop on Amazon.

Bob: This is an interesting idea that the author had to basically go to the grocery store, buy an Amazon gift card for $100 or whatever, and then load that on your account and then make purchases with that. And so, this kind of takes that friction to a whole new level in that you need to go to the store and buy an Amazon gift card. But at the same time, it kind of undoes the previous thing we were just talking about because the gift card is loaded in there and it’s still pretty easy to buy. So, it’s kind of like, yeah, I don’t know. It might work for some people, but something to consider.

5. Never Buy Anything That You Put In An Online Shopping Cart Until The Next Day

Linda: Number five, never buy anything that you put in an online shopping cart until the next day.

Bob: This is a good idea. I can’t tell you how many times I’m struggling with some annoying problem around the house and I need to go buy this. I’m like, “I need to go buy this thing to fix it,” whatever it is. And I’ll put the thing in a cart and just because I forget to go buy it and I’ll come back a couple of days later, I’m like, I actually solved that problem already. Or it’s not even that big of a problem. It seemed like a big problem in the moment, but it really isn’t that big of a problem. And it is amazing. We’ve all heard this, just sit on a purchase for a little bit and then, half the time, you don’t want to make it later on. But I like this idea of throwing it in the cart. That way, you won’t forget about it. And you can check in a couple of days.

Linda: Yeah.

Bob: And see.

Linda: Well, and I think this is really key for stuff that you just want.

Bob: Yeah, especially.

Linda: Because I mean, so many times, you’re just trying to numb yourself. You’re like, “I’ve had a bad day, so I’m going to go online shop.” And I know that’s what I do. So, just sitting on that, having it in your cart kind of gives you a little bit of satisfaction, and then being able to sit on it for a little bit, I think really helps. And then you can make a decision when you’re a little bit more clearheaded.

Bob: Yeah.

4. Read The One-Star Reviews For The Products Before You Buy Them

Linda: Okay, I really like this one. Read the one-star reviews for the products before you buy them.

Bob: This is a great idea. Because it definitely gives you a whole different perspective on the product.

Linda: Yeah.

Bob: And yeah, and you just might not be as interested when you see all the negative things about it.

Linda: Right.

Bob: Now, I do this for really, most products I buy, because I want to see what people are saying the bad is.

Linda: Yeah. You don’t want to buy a product that’s going to be terrible and it’s not what you want.

Bob: Well, yeah, if you have 20 people in a row saying that whatever, “it stopped working after three months,” it’s like, all right, there might be a trend here. So, just from a smart shopping perspective, I think this is good, but it also will help you. Yeah, I think it will deter you from buying more things if you’re looking at the bad.

3. Don’t Go To The Grocery Store Hungry

Linda: All right. Number three, this one is classic.

Bob: But it works. It works.

Linda: Don’t go to the grocery store hungry.

Bob: Yeah. It just really, really works. It’s such a big difference when you, yeah, when you’re…

Linda: When you’re full and you’re not hungry.

Bob: Yeah.

Linda: You should go to the grocery store only full. It’s where you’re just like, “None of this sounds good.”

Bob: No, this is what you should do. You should go to the grocery store after a Thanksgiving meal, when you’re so bloated and just be like, “I don’t want any food.” You’re tired. That’s when you go to the grocery store.

Linda: You won’t be buying much. But then, you’ll regret it later because you’ll be like, “Why is there no food in the house?”

2. Only Make Major Purchases In The Morning

Linda: Number two, only make major purchases in the morning.

Bob: Yeah. I think this is really interesting. I remember, I think Tim Ferriss was talking about decision fatigue, and this idea that we only have a limited number of decisions that we can make any given day. And after that point, we’re just tapped out and we can’t actually make any more decisions.

Linda: Yeah.

Bob: And so, what happens is, so many of us in busy lives, we get to the end of the day and we’re just worn down and we don’t have good decision-making abilities. Whereas at the beginning of the day, we’re fresher. And we have, if you think of it in terms of a bank account, we have a lot more decisions sitting there that we can tap into. So, making these purchases, especially big purchases in the morning when we’re stronger, it’s just a better approach.

1. Choose A Major Category Each Month To Attack

Linda: Okay. Number one, choose a major category each month to attack.

Bob: I think this is a good idea. I think too many people try to solve 10 problems at once. And I think focusing your energy on just one, find one category in your budget that you’re struggling with, even though you might be struggling with four or five of them, find one, focus your energy on solving that particular one, whatever that is. If it’s groceries, if it’s household goods, whatever that category is, try to solve that one.

Linda: Yeah. And we’ve talked about this before, where you should not base your budget around what your personal goals are. You need to base it around where you actually are in your life. So, if you were going to Starbucks every day and you want to change that, do that one month. And then, once you’ve got that down, work on the next habit. Don’t try and do it all at once, because you’re going to blow your budget. It’s not going to work. And you’re just going to be mad.

What Budgeting Tip Would You Add To This List?

Yeah. So, those are our top 10. I’d love to hear yours in the comments.

Don’t Forget The Free Budgeting Worksheet!

Like I mentioned at the beginning, if you are new to budgeting, or if you just need a little help, be sure to get our free budgeting worksheet.

Source article that inspired this video/article: 13 incredibly useful budgeting hacks to help you stick to your budget.

Finance

Should I Take Money Out of My 401(k) Now?

Is taking money from your 401(k) plan a good idea? Generally speaking, the common advice for raiding your 401(k) is to only take this step if you absolutely have to. After all, your retirement funds are meant to grow and flourish until you reach retirement age and actually need them. If you take money from your 401(k) and don’t replace it, you could be putting your future self at a financial disadvantage.

Still, we all know that times are hard right now, and that there are situations where removing money from a 401(k) plan seems inevitable. In that case, you should know all your options when it comes to withdrawing from a 401(k) plan early or taking out a 401(k) loan.

If you take money from your 401(k) and don’t replace it, you could be putting your future self at a financial disadvantage.

401(k) Withdrawal Options if You’ve Been Impacted by COVID-19

First off, you should know that you have some new options when it comes to taking money from your 401(k) if you have been negatively impacted by coronavirus. Generally speaking, these new options that arose from the CARES Act include the chance to withdraw money from your 401(k) without the normal 10% penalty, but you also get the chance to take out a 401(k) loan in a larger amount than usual.

Here are the specifics:

401(k) Withdrawal

The CARES Act will allow you to withdraw money from your 401(k) plan before the age of 59 ½ without the normal 10% penalty for doing so. Note that these same rules apply to other tax-deferred accounts like a traditional IRA or a 403(b).

To qualify for this early penalty-free withdrawal, you do have to meet some specific criteria. For example, you, a spouse, or a dependent must have been diagnosed with a CDC-approved COVID-19 test. As an alternative, you can qualify if you have “experienced adverse financial consequences as a result of certain COVID-19-related conditions, such as a delayed start date for a job, rescinded job offer, quarantine, lay off, furlough, reduction in pay or hours or self-employment income, the closing or reduction of your business, an inability to work due to lack of childcare, or other factors identified by the Department of Treasury,” notes the Consumer Financial Protection Bureau (CFPB).

Due to this temporary change, you can withdraw up to $100,000 from your 401(k) plan regardless of your age and without the normal 10% penalty. Also be aware that the CARES Act also removed the 20 percent automatic withholding that is normally set aside to pay taxes on this money. With that in mind, you should save some of your withdrawal since you will owe income taxes on the money you remove from your 401(k).

401(k) Loan

The Cares Act also made it possible for consumers to take out a 401(k) loan for twice the amount as usual, or $100,000 instead of $50,000. According to Fidelity, you may be able to take out as much as 50% of the amount you have saved for retirement. However, not all employers offer 401(k) loan options through their plans and they may not have adopted the new CARES Act provisions at all, so you should check with your current employer to find out.

A 401(k) loan is unique from a 401(k) withdrawal since you’ll be required to pay the money back (plus interest) over the course of 5 years in most cases. However, the interest you pay actually goes back into your retirement account. Further, you won’t owe income taxes on money you take out in the form of a 401(k) loan.

Taking Money out of Your 401(k): What You Should Know

Only you can decide whether taking money from your 401(k) is a good idea, but you should know all the pros and cons ahead of time. You should also be aware that the advantages and disadvantages can vary based on whether you borrow from your 401(k) or take a withdrawal without the intention of paying it back.

If You Qualify Through the CARES Act

With a 401(k) withdrawal of up to $100,000 and no 10% penalty thanks to the CARES Act, the major disadvantage is the fact that you’re removing money from retirement that you will most certainly need later on. Not only that, but you are stunting the growth of your retirement account and limiting the potential benefits of compound interest. After all, money you have in your 401(k) account is normally left to grow over the decades you have until retirement. When you remove a big chunk, your account balance will grow at a slower pace.

As an example, let’s say you have $300,000 in a 401(k) plan and you leave it alone to grow for 20 years. If you achieved a return of 7 percent and never added another dime, you would have $1,160,905.34 after that time. If you removed $100,00 from your account and left the remaining $200,000 to grow for 20 years, on the other hand, you would only have $773,936.89.

Also be aware that, while you don’t have to pay the 10% penalty for an early 401(k) withdrawal if you qualify through the CARES Act, you do have to pay income taxes on amounts you take out.

When you borrow money with a 401(k) loan using new rules from the CARES Act, on the other hand, the pros and cons can be slightly different. One major disadvantage is the fact that you’ll need to repay the money you borrow, usually over a five-year span. You will pay interest back into your retirement account during this time, but this amount may be less than what you would have earned through compound growth if you left the money alone.

Also be aware that, if you leave your current job, you may be required to pay back your 401(k) loan in a short amount of time. If you can’t repay your loan because you are still experiencing hardship, then you could wind up owing income taxes on the amounts you borrow as well as a 10% penalty.

Note: The same rules will generally apply if you quit your job and move out of the United States as well, so don’t think that moving away can get you off the hook from repaying your 401(k) loan. If you’re planning to leave the U.S. and you’re unsure how to handle your 401(k) or 401(k) loan, speaking with a tax expert is your best move.

Keep in mind that, with both explanations of a 401(k) loan and a 401(k) early withdrawal above, these pros and cons are predicated on the idea you can qualify for the special benefits included in the CARES Act. While the IRS rules for qualifying for a coronavirus withdrawal are fairly broad, you do have to be facing financial hardship or lack of childcare due to coronavirus. You can read all the potential qualification categories on this PDF from the Internal Revenue Service (IRS).

If You Don’t Qualify Through the CARES Act

If you don’t qualify for special accommodation through the CARES Act, then you will have to pay a 10% penalty on withdrawals from your 401(k) as well as income taxes on amounts you take out. With a traditional 401(k) loan, on the other hand, you may be limited to borrowing just 50% of your vested funds or $50,000, whichever is less.

However, you should note that the IRS extends other hardship distribution categories you may qualify for if you’re struggling financially . You can read about all applicable hardship distribution requirements on the IRS website.

Taking Money Out of Your 401(k): Main Pros and Cons

The situations where you might take money out of your 401(k) can be complicated, but there are some general advantages and disadvantages to be aware of. Before you take money from your 401(k), consider the following:

Pros of taking money out of your 401(k):

- You are able to access your money, which could be important if you’re suffering from financial hardship.

- If you qualify for special accommodations through the CARES Act, you can avoid the 10% penalty for taking money from your 401(k) before retirement age.

- You can take out more money (up to $100,000) than usual from your 401(k) with a 401(k) withdrawal or a 401(k) loan thanks to CARES Act rules.

Cons of taking money out of your 401(k):

- If you take money out of your 401(k), you’ll have to pay income taxes on those funds.

- Removing money from your 401(k) means you are reducing your current retirement savings.

- Not only are you removing retirement savings from your account, but you’re limiting the growth on the money you take out.

- If you take out a 401(k) loan, you’ll have to pay the money back.

Alternatives to Taking Money from your 401(k)

There may be some situations where taking money out of your 401(k) makes sense, including instances where you have no other option but to access this money to keep the lights on and food on the table. If you cash out your 401(k) and the market tanks afterward, you could even wind up feeling like a genius. Then again, the chances of optimally timing your 401(k) withdrawal are extremely slim.

With that being said, if you don’t have to take money out of your 401(k) plan or a similar retirement plan, you shouldn’t do it. You will absolutely want to retire one day, so leaving the money you’ve already saved to grow and compound is always going to leave you ahead in the long run.

With that in mind, you should consider some of the alternatives of taking money from a 401(k) plan:

- See if you qualify for unemployment benefits. If you were laid off or furloughed from your job, you may qualify for unemployment benefits you don’t even know about. To find out, you should contact your state’s unemployment insurance program.

- Apply for temporary cash assistance. If you are facing a complete loss in income, consider applying for Temporary Assistance for Needy Families (TANF), which lets you receive cash payments. To see if you qualify, call your state TANF office.

- Take out a short-term personal loan. You can also consider a personal loan that does not use funding from your 401(k). Personal loans tend to come with competitive interest rates for consumers with good or excellent credit, and you can typically choose your repayment term.

- Tap into your home equity. If you have more than 20% equity in your home, consider borrowing against that equity with a home equity loan or home equity line of credit (HELOC). Both options let you use the value of your home as collateral, and they tend to offer low interest rates as a result.

- Consider a 0% APR credit card. Also look into 0% APR credit cards that allow you to make purchases without any interest charged for up to 15 months or potentially longer. Just remember that you’ll have to repay all the purchases you charge to your card, and that your interest rate will reset to a much higher variable rate after the introductory offer ends.

The Bottom Line

In times of financial turmoil, it may be tempting to pull money out of your 401(k). After all, it is your money. But the ramifications to your future financial wellbeing may be substantial. The CARES Act has introduced new options to leverage your 401(k), without the normal penalties. Find out if you qualify and take time to understand the details behind the options. We recommend speaking to a tax expert if you have any questions or concerns regarding possible tax penalties.

The traditional wisdom is to leave your retirement untouched, and we agree with that. If you’re in a financial bind, consider other options to get you through the rough patch. Tapping into your 401(k) should really be your last resort.

The post Should I Take Money Out of My 401(k) Now? appeared first on Good Financial Cents®.

-

Business4 weeks ago

Business4 weeks agoBernice King, Ava DuVernay reflect on the legacy of John Lewis

-

World News3 weeks ago

Heavy rain threatens flood-weary Japan, Korean Peninsula

-

Technology3 weeks ago

Technology3 weeks agoEverything New On Netflix This Weekend: July 25, 2020

-

Finance3 months ago

Will Equal Weighted Index Funds Outperform Their Benchmark Indexes?

-

Marketing Strategies7 months ago

Top 20 Workers’ Compensation Law Blogs & Websites To Follow in 2020

-

World News7 months ago

World News7 months agoThe West Blames the Wuhan Coronavirus on China’s Love of Eating Wild Animals. The Truth Is More Complex

-

Economy10 months ago

Newsletter: Jobs, Consumers and Wages

-

Finance8 months ago

Finance8 months ago$95 Grocery Budget + Weekly Menu Plan for 8