Economy

What If Public Schools Were Abolished?

In American culture, public schools are praised in public and criticized in private, which is roughly the opposite of how we tend to treat large-scale enterprises like Walmart. In public, everyone says that Walmart is awful, filled with shoddy foreign products and exploiting workers. But in private, we buy the well-priced, quality goods, and long lines of people hope to be hired.

Why is this? It has something to do with the fact that public schools are part of our civic religion, the primary evidence that people cite to show that local government serves us. And there is a psychological element. Most of us turn our kids over to them, so surely they must have our best interest at heart!

But do they? Murray N. Rothbard’s Education: Free and Compulsory explains that the true origin and purpose of public education is not so much education as we think of it, but indoctrination in the civic religion. This explains why the civic elite is so suspicious of homeschooling and private schooling: it’s not fear of low test scores that is driving this, but the worry that these kids aren’t learning the values that the state considers important.

But to blast public schools is not the purpose of this article. There are decent public schools and terrible ones, so there is no use generalizing. Nor is there a need to trot out data on test scores. Let me just deal with economics. All studies have shown that average cost per pupil for public schools is twice that of private schools (here is a sample study).

This runs contrary to intuition, since people think of public schools as free and private schools as expensive. But once you consider the source of funding (tax dollars vs. market tuition or donation), the private alternative is much cheaper. In fact, the public schools cost as much as the most expensive and elite private schools in the country. The difference is that the cost of public schooling is spread out over the entire population, whereas the private school cost is borne only by the families with students who attend them.

In short, if we could abolish public schools and compulsory schooling laws, and replace it all with market-provided education, we would have better schools at half the price, and be freer too. We would also be a more just society, with only the customers of education bearing the costs.

What’s not to like? Well, there is the problem of the transition. There are obvious and grave political difficulties. We might say that public education enjoys a political advantage here due to network effects. A significant number of “subscriptions,” etc. have been piled up in the status quo, and it is very difficult to change those.

But let’s pretend. Let’s say that a single town decided that the costs of public schooling are too vast relative to private schooling, and the city council decided to abolish public schools outright. The first thing to notice is that this would be illegal, since every state requires localities to provide education on a public basis. I don’t know what would happen to the city council. Would they be jailed? Who knows? Certainly they would be sued.

But let’s say we somehow get past that problem, thanks to, say, a special amendment in the state constitution that exempts certain localities if the city council approves. Then there is the problem of federal legislation and regulation. I am purely speculating since I don’t know the relevant laws, but we can guess that the Department of Education would take notice, and a national hysteria of some sort would follow. But let’s say we miraculously get past that problem too and the federal government lets this locality go its own way.

There will be two stages to the transition. In the first stage, many seemingly bad things will happen. How are the physical buildings handled in our example? They are sold to the highest bidder, whether that be to new school owners, businesses, or housing developers. And the teachers and administrators? All let go. You can imagine the outcry.

With property taxes abolished, people with kids in public schools might move away. There will be no premium for houses in school districts that are considered good. There will be anger about this. For the parents that remain, there is a major problem of what to do with the kids during the day.

With property taxes gone, there is extra money to pay for schools, but the assets have just fallen in market value (even without the Fed), which is a serious problem when it comes to shelling out for school tuition. There will, of course, be widespread hysteria about the poor too, who will find themselves without any schooling choices other than homeschool.

Now, all that sounds pretty catastrophic, doesn’t it? Indeed. But it is only phase one. If we can somehow make it to phase two, something completely different will emerge. The existing private schools will be filled to capacity and there will be a crying need for new ones. Entrepreneurs will quickly flood into the area to provide schools on a competitive basis. Churches and other civic institutions will gather the money to provide education.

At first, the new schools will be modeled on the public school idea. Kids will be there from 8 to 4 or 5, and all classes will be covered. But in short order, new alternatives will appear. There will be schools for half-day classes. There will be large, medium, and small schools. Some will have forty kids per class, and others four or one. Private tutoring will boom. Sectarian schools of all kinds will appear. Micro-schools will open to serve niche interests: science, classics, music, theater, computers, agriculture, etc. There will be single-sex schools. Whether sports would be part of school or something completely independent is for the market to decide.

And no longer will the “elementary, middle school, high school” model be the only one. Classes will not necessarily be grouped by age alone. Some will be based on ability and level of advancement too. Tuition would range from free to super expensive. The key thing is that the customer would be in charge.

Transportation services would spring up to replace the old school-bus system. People would be able to make money by buying vans and providing transportation. In all areas related to education, profit opportunities would abound.

In short, the market for education would operate the same as any other market. Groceries, for example. Where there is a demand, and obviously people demand education for their kids, there is supply. There are large grocery stores, small ones, discount ones, premium ones, and stores for groceries on the run. It is the same for other goods, and it would be the same for education. Again, the customer would rule. In the end, what would emerge is not entirely predictable—the market never is—but whatever happened would be in accord with the wishes of the public.

After this phase two, this town would emerge as one of the most desirable in the country. Educational alternatives would be unlimited. It would be the source of enormous progress, and a model for the nation. It could cause the entire country to rethink education. And then those who moved away would move back to enjoy the best schools in the country at half the price of the public schools, and those without children in the house wouldn’t have to pay a dime for education. Talk about attractive!

So which town will be the first to try it and show us all the way?

[This article was originally published April 7, 2020]

Economy

Silence is Stupid, Argument is Foolish

When I was young, I never backed down in an intellectual argument. Part of the reason, admittedly, was that I was starved for abstract debate. Before the internet, anyone who wanted to talk ideas had to corner an actual human willing to do the same. Another big reason, though, was that I didn’t want to look stupid. A smart person always has a brilliant riposte, right? And if you shut up, it must be because you’re stumped.

At this stage in my life, much has changed. Public debates aside, I now only engage in intellectual arguments with thinkers who play by the rules. What rules? For starters: remain calm, take nothing personally, use probabilities, face hypotheticals head-on, and spurn Social Desirability Bias like the plague. If I hear someone talking about ideas who ignores these rules, I take evasive action. If cornered, I change the subject.

Why? Because I now realize that arguing with unreasonable people is foolish. Young people might learn something at the meta-level - such as “Wow, so many people are so unreasonable.” But I’m long past such doleful lessons. Note: “Being unreasonable” is not a close synonym for “Agrees with me.” Most people who agree with me are still aggressively unreasonable. Instead, being reasonable is about sound intellectual methods - remaining calm, taking nothing personally, using probabilities, facing hypotheticals head-on, spurning Social Desirability Bias, and so on.

In classic Dungeons & Dragons, characters have two mental traits: Intelligence and Wisdom. The meaning matches everyday English: high-Intelligence characters are good at solving complex puzzles; high-Wisdom characters have a generous helping of common-sense.

Using the game to illuminate life: Running out of things in say in an argument is indeed a sign of low Intelligence, just as I held when I was a teenager. A genius never runs out of rebuttals. At the same time, however, joining a fruitless dispute is a sign of low Wisdom. You have better things to do with your life than tell hyperventilating people all the reasons they’re wrong. A really wise person won’t merely break off such exchanges, but stop them before they start - and get back to work on his Bubble.

Here, in short, is wisdom: Be not a hostage to your own intellectual pride.

P.S. How do you know if a person plays by the rules until you actually engage them? Most obviously, watch how they argue with other people! If that’s inadequate, give promising strangers a brief trial period, but be ready to disengage if things go south.

(1 COMMENTS)

Source link

Economy

On the Impossibility of Intellectual Property

Abstract: The concept of intellectual property (IP) has been variously criticized as incompatible with natural rights and detrimental to the dissemination of innovations. In this paper I argue that it can be criticized on an even more fundamental level—namely as a praxeological impossibility. More specifically, it is suggested that since ideas are not economic goods, but preconditions of action, and since physical goods transformed by ideas become as heterogeneous (and thus as intellectually unique) as the individuals who enact such transformations, no economic goods can be meaningfully designated as appropriable in virtue of embodying the objectively definable value of one’s intellectual labor. In view of the above, I subsequently suggest that IP protection laws constitute an exceptionally arbitrary and thus exceptionally disruptive form of interventionism directed against the very essence of the entrepreneurial market process.

JEL Classification: K00, L26, O34, P48

Jakub Bożydar Wiśniewski ([email protected]) is an assistant professor at the Institute of Economics at the University of Wroclaw and an affiliated scholar with the Ludwig von Mises Institute Poland.

1. INTRODUCTION

The concept of intellectual property (IP) has been criticized from a number of distinct perspectives. Proponents of libertarian ethics have criticized it as incompatible with the axiom of self-ownership and the resultant structure of natural rights. More specifically, they have pointed out that the category of property applies exclusively to scarce goods, while ideas—that is, the fruits of intellectual labor—are superabundant in virtue of their infinite replicability. Thus, forcibly restricting their replication amounts to a major act of aggression against the bodily integrity and physical property of the replicating agent (Kinsella 2008).

On the other hand, mainstream economists have demonstrated that patents and copyrights, far from promoting innovation, actually hinder economic development and Schumpeterian creative destruction. This is due to the fact that patent and copyright holders are effectively intellectual monopolists, capable of nipping in the bud the commercial development of any given idea (Boldrine and Levine 2008).

While acknowledging the validity and significance of the above criticisms, this paper offers a different take on the titular concept. Instead of suggesting that intellectual property is morally indefensible or economically harmful, it suggests that it is praxeologically impossible. In other words, this paper suggests that intellectual property laws constitute not so much an attempt at monopolizing a praxeologically distinct category of resources, but rather an arbitrary curtailment of entrepreneurial initiatives aimed at resource heterogenization. This, in turn, implies that the so-called protection of intellectual property creates not so much “intellectual monopolists,” but rather uninvited institutional co-owners (Hülsmann 2006) of their potential business competitors’ arbitrarily selected physical property.

The following section states the argument in more detail. Section 3 considers some potential counterarguments to the proposition, and section 4 concludes with a presentation of some of its further ramifications.

2. THE ARGUMENT

The fundamental insight of the marginalist-subjectivist tradition in economics is the observation that what makes a good is not its physical characteristics, but its ability to enter into causal relationships with subjective preference scales of purposive agents. Thus, even physically identical goods may differ significantly in terms of their economic value in virtue of their differing causal histories and ideational connections.

However, this crucial emphasis on the subjective nature of economic value does not change the fact that genuine economic goods, in order to qualify as such, have to exhibit objective physical scarcity. Otherwise they are not goods, but the “general conditions” of action (Rothbard 2004, 4). In other words, the marginalist-subjectivist tradition—particularly as exemplified by the Menger-Mises branch—avoids the twin pitfalls of hypersubjectivism and panphysicalism: it postulates that physically scarce objects become economic goods by being “mixed” with the ideational processes of intentional beings.

Hence, ideation turns out to be a psychological rather than a praxeological activity—in and of itself it does not fall within the purview of economic analysis, nor, by extension, within the purview of property valuation. It is only when it is translated into action that it becomes a fundamental datum of economic theory and history. And yet, as soon as it enters the realm of demonstrated preferences, it inevitably heterogenizes the resulting goods, thereby ensuring their intellectual and valuational distinctness.

This is because human action is necessarily future oriented and thus entrepreneurial in the broad sense of the term—it consists not in frictionless adjustment of supply and demand, but in the deployment of scarce means toward specific ends to be accomplished in the uncertain future (Salerno 2008). Hence, ideas, viewed as preconditions of agency, are never, strictly speaking, replicated—instead, they are adapted to one’s specific circumstances, plans, and capabilities. This, in turn, implies that as soon as a particular agent transforms particular physical objects in accordance with a given idea—even if this idea is “borrowed” from someone else—they become unique goods, infused with his unique productive touch. It should be noted here that this argument is independent of the contention that property rights apply exclusively to the physical integrity of a resource, not to its value, since the latter derives entirely from the mental states of all those individuals who are interested in putting it to some use (Hoppe and Block 2002). Although few may be willing to reject this contention in full and endorse the notion that maintaining the value of one’s resources can extend to owning others’ mental states, some may be willing to concede the inadmissibility of certain actions that diminish the value of another’s assets. Underselling the originator of a “novel product” by offering exact replicas of his merchandise could be thought of as a canonical example here. However, the argument advanced in the present paper uproots this issue entirely, since it points out that physically identical products cannot be regarded as identical in terms of the sources of their value, thus making their putative ownership and their potential positive externalities a moot point.

This observation is exceptionally striking in the context of entrepreneurship narrowly conceived—that is, in the context of exercising the ownership function over capital structures of production created and recreated under conditions of uncertainty (Foss and Klein 2012). After all, the essential determinant of the success of any given business plan is not the physical capabilities of the resources owned by a given businessman, nor even the objectively definable ideas embodied in them, but the subjective evaluation of the potential residing in these and other elements of the overall entrepreneurial vision and the corresponding capital stock (Kirzner 1997). Objectively definable inventions are technical, not economic, phenomena—it is only when they help bring about subjectively conceived innovations that they contribute to economic growth and development (McCloskey 2010). This is by no means simply a repetition of the anti-IP argument that an idea is a general prerequisite of production and not subject to ownership. It is also the realization that, as far as their productive potential is concerned, ideas implemented in concrete processes of production are entirely dissimilar to ideas conceived in abstract terms. Thus, to regard all physical objects whose creation involved some use of the fruits of one’s mental labor as falling within the ambit of one’s “intellectual property” is to commit a fundamental categorical mistake—i.e., to confuse the results of subjective plans with their objective mental preconditions.

If, on the other hand, one were to claim that it is precisely the specific conceptual content of those mental preconditions that can be subjected to intellectual property protection, then an equally flagrant categorical mistake would be made. After all, such a claim would amount to trying to obtain exclusive use not of the results of any given action, but of a necessary prerequisite of a potentially infinite range of actions. In other words, it would amount to trying to put a price tag on something that is naturally priceless—on something that is not just contingently nonscarce (as so-called free goods are), but is necessarily so (as all general conditions of action have to be).

To use a specific example, this would involve attempting to obtain exclusive use not of any particular product of, say, spelling or singing, but of the very concepts of spelling or singing. Taken to its ultimate conclusion, such an approach would paralyze all human action, destroying humankind almost on the spot by making everyone unsure of whether engaging in perfectly mundane activities violates someone else’s intellectual property rights. And if one tried to avoid this conclusion by suggesting that it is only sufficiently complex concepts that merit this kind of exclusive appropriation, one natural response would be to point out that such a suggestion smacks of sheer legalistic arbitrariness, since it has to rely on a purely discretionary standard of “sufficient complexity.” Admittedly, making it a matter of pure legal convention which ideas are subject to IP protection would not be a logically incoherent move, but it would be a move bereft of any appeal to economic justification. More specifically, it would offer no support for the claim that the purpose of licensing the use of complex concepts is to allow their authors to reap their full market value, since it would not involve laying down any precise methods of measuring the extent to which the market value of any given good derives from its embodying any such concept (Cordato 1992, 80).

Furthermore, it has to be borne in mind that all entrepreneurial activity involves resource heterogenization (Lewin and Baetjer 2011), even if it does not consist in the Schumpeterian kind of entrepreneurship, which is typically associated with the introduction of innovations and other quintessentially conceptual tasks. Hence, for instance, buying a trademarked product and simply relocating it from a relatively saturated market to a relatively unsaturated one in order to sell it at a profit suffices to create a substantially new product, associated with uniquely specific preference scales, valuational conditions, and organizational structures. In fact, in today’s age of electronic transactions an act of physical relocation is not even necessary: it suffices to engage in online arbitrage to heterogenize physically and conceptually identical goods in a productive manner. After all, if all human action is broadly entrepreneurial—that is, it requires creative confrontation with the uncertain future—then exploiting arbitrage opportunities is solidly innovative in its own right (Kirzner 2009).

In other words, even, say, using a general scientific formula in production without in any way altering it should count as an instance of adaptation rather than replication, since its successful commercialization requires integrating it with a specific, time- and space-bound capital structure of production. To repeat, ideational replication is a purely mental operation, and it is only entrepreneurial implementation of replicated ideas that can be economically meaningful in this context, since only the latter can be economically profitable or unprofitable, and thereby also more or less successful in addressing the problem of natural (i.e., nonartificial) scarcity.

Moreover, it must be stressed that the argument presented here is not reducible to the more familiar contention that ideas cannot be subject to property rights, since rights are, by definition, enforceable claims, with the “force” component tying in to the physical aspect of human control over scarce resources. Although this contention is perfectly reasonable, it does not immediately answer the objection that the originator of a certain idea may regard himself as a partial owner of all the scarce resources that in some degree embody its distinctive conceptual features. Of course, at this point one might make a solid case that the creative process, although certainly capable of increasing the value of specific goods, nevertheless does not automatically imply ownership of them, be it complete or partial. This, however, would shift the discussion to the normative level, having to do with defining the ethical or legal criteria of genuine appropriation. This argument is purely praxeological: it points out that there is no necessary valuational link between the conceptual features of ideas contemplated in abstract terms and the conceptual features of specific goods that incorporate those ideas.

In other words, the process of ideation might be thought of in terms of identifying potential profit opportunities, but from a realistically conceived entrepreneurial standpoint such opportunities are only imagined rather than discovered (Klein 2008). And since the fruits of one’s imagination can be translated into actual business ventures in an endless variety of ways, it is incoherent to claim that the value of imagined profit opportunities can be automatically imputed to their actually exploited counterparts, entitling the originators of the former to the proceeds from the latter.

In sum, the subjectivist theory of value coupled with a praxeological understanding of the market process leads to the conclusion that, economically speaking, intellectual property is a contradiction in terms. In short, ideas are not economic goods, but preconditions of action, while physical goods transformed by ideas become as heterogeneous (and thus as intellectually unique) as the individuals who enact such transformations. This, in turn, implies that as important as it is to point out the efficiency-reducing and normatively troubling consequences of so-called intellectual property protection, it is possible to raise doubts about the concept on an even more fundamental, purely logical level.

3. POTENTIAL COUNTERARGUMENTS

Let us now analyze some potential counterarguments to the suggestion advanced in the present paper.

First, it might be claimed that, regardless of one’s views on the normative aspects of the titular concept, it is an overstatement to deny its descriptive coherence. After all, one might say, it is perfectly reasonable to define the fruits of one’s intellectual labor as goal-specific technical recipes,1 readily identifiable in terms of the specific material effects that their implementation produces. This, in turn, should make it conceptually unobjectionable to designate the goods that embody such effects as bearing the marks of one’s intellectual property, even if we do not believe that such “property” is associated with enforceable natural rights or economically beneficial consequences.

The main problem with this suggestion is that, once again, it conceives of goods in technical rather than economic terms and treats ideas as if they were praxeological rather than psychological factors. Since, however, economics deals with subjective evaluations embodied in demonstrated preferences, not with scientific discoveries and their technical content, it must reject the notion that there always exists a unique, objective description of the way in which any given good can usefully incorporate a technical recipe. On the contrary, subjectivist economics, coupled with a mature theory of capital and entrepreneurship, clearly recognizes the fact that productive factors are essentially characterized in terms of their subjectively perceived attributes, functions, and uses (Foss, Foss, Klein, and Klein 2007). Hence, there is a potentially infinite number of ways in which any given technically defined object can be imbued with the fruits of entrepreneurial creativity, alertness, and foresight, thereby becoming not just conceptually novel, but also endowed with unique economic value.

Another objection that might be leveled against the titular contention is that it cannot claim universal economic validity, since it refers to a strictly normative concept (i.e., property), while economics is a positive science. Thus, one might argue, it is a category mistake to ascribe inherent incoherence to a phenomenon whose definition is ultimately a matter of legal convention or moral imagination.

The primary error of this counterargument lies in confusing the value freedom of economics with its supposed value irrelevance. Although clearly value-free as far as the contents of its theorems are concerned, economics is crucially dependent on the evaluative and normative concepts contained in its descriptions of the catallactic order (Casey 2012). For instance, the theorem of the impossibility of rational economic calculation under socialism clearly refers to the importance of certain normative institutions (private property in the means of production, free exchange of private property titles, etc.), but it does so exclusively in order to elucidate the nature of the corresponding logically necessary causal relations, without proclaiming their ethical desirability. By the same token, the theorem in question also demonstrates that certain normative visions—such as that of an economically thriving socialist commonwealth—are not so much ethically wrong as they are inherently unviable. To put it differently, ethical evaluations of intrinsically incoherent concepts are inevitably futile, since they run afoul of the principle of “ought implies can,” which often reveals such concepts to be misleading placeholders for something altogether different.

Thus, the fact that the titular contention refers to a normative concept in no way detracts from its strictly positive character. After all, it does not matter in this context whether or not one endorses the notion of intellectual property on ethical grounds—what matters is that such an endorsement cannot be couched in economically meaningful language. Consequently, the argument of this text does not violate the distinction between the positive and the normative—instead, it aims at demonstrating that it is the proponents of intellectual property who necessarily violate the distinction between the psychological and the praxeological.

At this point, one might argue that the above train of thought rests on the dubious premise that if an idea is by nature a general condition of action, this cannot be changed by legal enactment. In fact, however, no such premise is presupposed. Although it is clearly possible to legislate artificial scarcity into existence, it is impossible to ground such legislation in praxeologically meaningful facts. In other words, although it is possible to prosecute individuals or organizations for the supposed unlawful use of another’s ideas, it does not change the purely praxeological observation that anchoring any given abstract idea in the specific circumstances of one’s individual venture turns it into a fundamentally distinct idea, with no necessary valuational link between the two akin to that postulated by the Mengerian law of imputation. Hence, appealing to the conceivability of artificial scarcity in no way impugns the value freedom of this paper’s contention.

Finally, it might be suggested that the supposed economic coherence of the notion of intellectual property can be established by pointing to the specificity of the interventionist effects caused by IP protection laws. If, for instance, one subscribes to the claim that such laws hinder economic development and the corresponding creation and dissemination of innovations, then one implicitly recognizes the existence of a special category of goods whose preemptive appropriation by patent and copyright holders leads to economically suboptimal results. Thus, one might argue, intellectual property emerges as an economically meaningful concept in virtue of the economically meaningful effects of its legal enforcement.

The chief weakness of the above contention is the implicit assumption that praxeologically specific consequences must be associated with a praxeologically distinct category of goods in order to retain their analytical meaningfulness. It is the case, however, that they might as well be associated with a praxeologically distinct kind of activities. For example, in the context under consideration it might be suggested that IP protection laws hamper not so much the production and dissemination of “intellectual goods,” but the very process of heterogenization of goods—that is, the process whereby physically scarce objects become increasingly differentiated through their association with individual entrepreneurial visions. In other words, IP laws might be plausibly regarded not as a means of preemptive appropriation of “intellectual goods,” but as a tool for implementing the principles of “conservative socialism” (Hoppe 1989, chap. 5). Hence, it seems perfectly feasible to recognize the economically harmful effects of interventions aimed at the suppression of entrepreneurial utilization and reutilization of generally accessible ideas without being simultaneously committed to accepting the economic meaningfulness of the concept of intellectual property.

In sum, far from being an exaggeration, the claim that so-called intellectual property is incoherent as an economic notion appears to be a solidly justifiable proposition. Let me now conclude by briefly exploring some of its further analytical ramifications and practical implications.

4. CONCLUSION

If intellectual property is indeed a praxeologically meaningless concept, then, as proposed in the previous section, IP laws do not prevent entrepreneurs from utilizing freely a specific, precisely definable category of goods, but instead serve as a pretext for essentially arbitrary acts of opportunistic interventionism. This indicates that they are far more capable of paralyzing the operation of the market process than is suggested by the traditional arguments centered on the economically stifling influence of “intellectual monopolies.” More concretely, IP laws’ definitional arbitrariness appears particularly capable of saddling entrepreneurs with a highly troublesome layer of regime uncertainty (Higgs 1997), which does not generate additional (though predictable) costs for entrepreneurial activity so much as it makes such activity essentially unpredictable on the institutional level (Kinsella 1995, 150–51).

Furthermore, the laws in question are especially likely to cripple the operations of specifically “Schumpeterian” firms (Mueller 2003, chap. 4), that is, those that rely exceptionally heavily on creating value through resource heterogenization based on ingenious adaptation of existing technical recipes. Such firms, which are typically at the forefront of robust economic development, are especially exposed to the arbitrary interventionism of the established players, who are constantly on the lookout for excuses to accuse the newcomers of “intellectual free riding.” In addition, this kind of environment gives the management of Schumpeterian firms an extra incentive to join the establishment’s interventionist game as soon as possible, thereby perpetuating and further strengthening the vicious circle of rent seeking, cronyism, and enforced economic petrification.

Finally, the unhampered entrepreneurial transformation of various technical concepts is a phenomenon whose continuation is particularly important to a globally interconnected and organizationally complex society. If such a society suddenly becomes irresponsive to the economic challenges continually generated by its dynamically changing environment, which is bound to happen under conditions of repressed resource heterogenization, it will fall victim to institutional fragility (Taleb 2012) and become incapable of sustaining its complexity, ultimately collapsing under its own weight.

In conclusion, since intellectual property is a praxeologically incoherent term, IP laws turn out to constitute an exceptionally arbitrary and thus exceptionally disruptive form of interventionism directed against the very essence of the entrepreneurial market process (Kirzner 2017). Hence, intellectual property laws should be viewed as an even more fundamental obstacle to robust economic development than has been suggested by hitherto prevailing arguments.

- 1. For the purpose of this paper, the terms “recipe,” “idea,” and “concept” are treated as interchangeable.

Economy

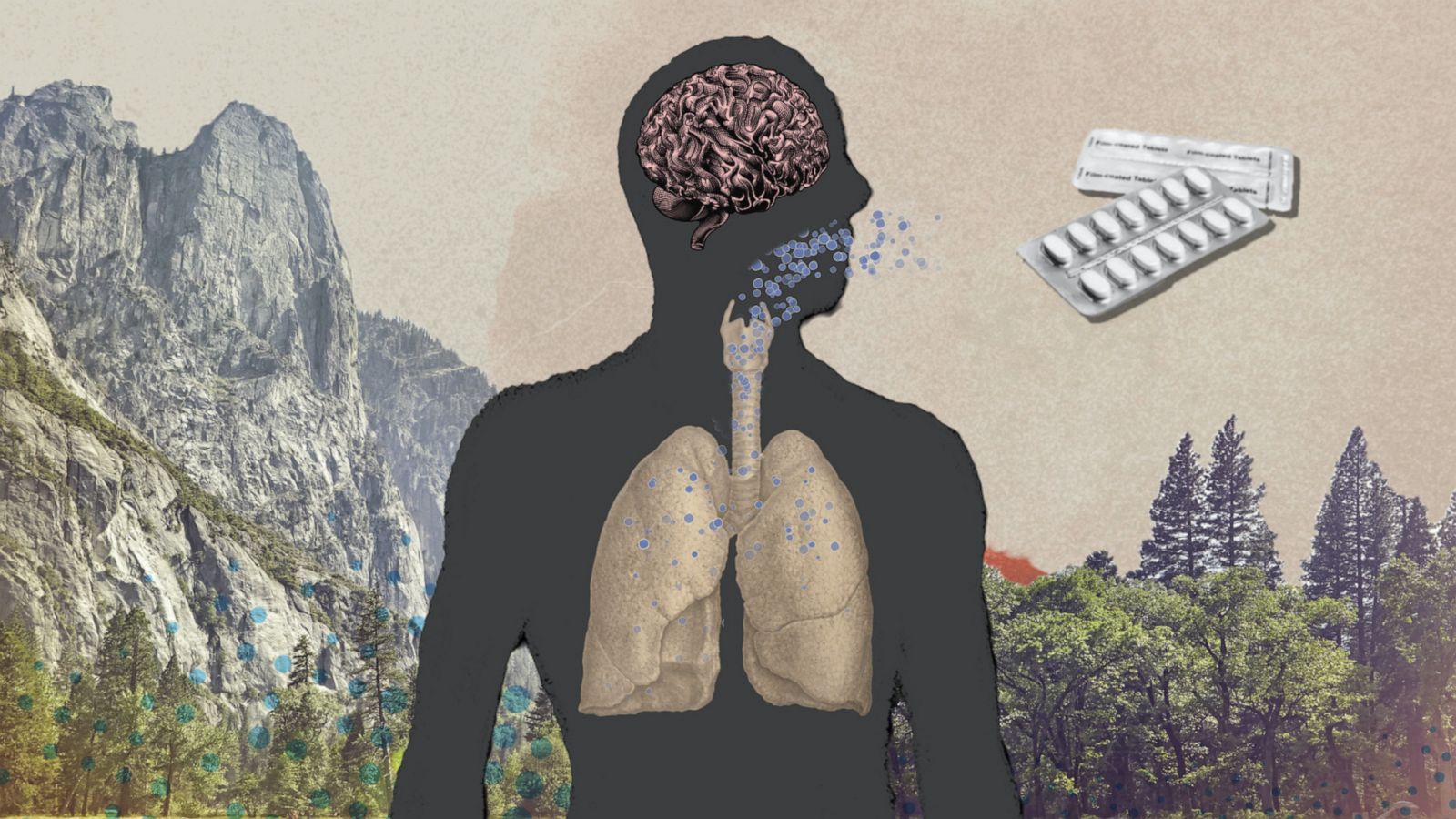

How The Pandemic Could Force A Generation Of Mothers Out Of The Workforce

For the past few months, Alicia Wertz has barely seen her husband. Since schools closed in their northern Alabama town in March, they’ve been single-mindedly focused on a single goal: making sure that someone was watching their three kids. At first, Wertz tried working from home. But she wasn’t getting anything done, so they tried splitting the hours: Wertz’s husband watches the children in the morning, then a sitter comes to relieve him in the afternoon until Wertz takes over when she returns from work.

“When we’re not working, we’re by ourselves with the children. It almost feels like you’re a single parent. All you do is go to work and care for the kids,” Wertz said.

In her mind, Wertz is counting down the days until schools reopen. But there’s a nagging worry at the back of her head — what if they don’t open at all? “The thought of [my kids] not going back in the fall is devastating,” Wertz said when we spoke in early July. “It raises this question of — if one of us has to stay home with the children, whose job is more important? I think it was something that we did have conversations about before, but COVID-19 has made it much worse.”

[Related: Where The Latest COVID-19 Models Think We’re Headed — And Why They Disagree]

Wertz isn’t the only working mother for whom the thought of the fall calendar sparks both relief and dread. And what comes next could have disproportionate — and long-lasting — effects on the careers of countless women across the country. Studies have shown that women already shoulder much of the burden of caring for and educating their children at home; now, they’re also more likely than men to have lost their jobs thanks to the pandemic. And the collapse of the child care and public education infrastructure that so many parents rely on will only magnify these problems, even pushing some women out of the labor force entirely.

“We’re in danger of erasing the limited gains we’ve made for women over the past few decades, and especially women of color,” said Melissa Boteach, Vice President for Income Security and Child Care/Early Learning at the National Women’s Law Center.

The crux of the issue: Child care just isn’t as available as it was before the pandemic. Data provided to FiveThirtyEight by the job-search website Indeed shows that child-care services have been much slower to hire again (a useful proxy for re-opening) than other areas of the economy:

Combine that with the news that many schools will remain closed in the fall, and it’s easy to see the crisis at hand. If polling is any indication, the vast majority of the fallout is being weathered by mothers, who were already doing the majority of household work even before the pandemic began.

In 2015, the Pew Research Center asked parents about how they divide family responsibilities when both work full-time.1 Some tasks were split relatively evenly: Twenty percent of respondents said the mother disciplined children more, 17 percent said the father disciplined more, and 61 percent said that responsibility was shared equally. For every task, however, more respondents reported that the mother carried a greater amount of the load than those who said the father did — including areas involving managing children’s schedules, caring for children when they’re sick and handling household chores.

Moms usually shoulder more of the load at home

Share of parents in households with two full-time working parents who say each parent does more work in a given category, according to a Pew poll

| Share of parents who say… | |||

|---|---|---|---|

| Category | Mother does more | Father does more | Work split equally |

| Managing children’s schedules/activities | 54% | 6% | 39% |

| Taking care of sick children | 47 | 6 | 47 |

| Handling household chores, etc. | 31 | 9 | 59 |

| Playing/doing activities with children | 22 | 13 | 64 |

| Disciplining children | 20 | 17 | 61 |

Along similar lines, Pew also found in a poll from 2019 that 80 percent of women living with a partner who had children did the primary grocery shopping and meal-preparation duties for their families. And according to the Bureau of Labor Statistics’ American Time Use Survey — which tracks the average amount of time people spend per day on different categories of activity — married mothers with full-time jobs spent 56 percent more time doing childcare and housework than corresponding fathers. By contrast, fathers spent more time on work-related tasks, travel and leisure activities.2

All that extra time moms spend really adds up

Daily time spent doing various activities by married parents of children under 18 who both worked full-time, according to the American Time Use Survey

| Hours spent per day | |||

|---|---|---|---|

| Activity | Mothers | Fathers | Diff. |

| Household activities | 1.87 | 1.23 | +0.64 |

| Physical care for children | 0.59 | 0.28 | 0.31 |

| Child care - other | 0.36 | 0.22 | 0.14 |

| Child-related travel | 0.25 | 0.13 | 0.12 |

| Education-related activities | 0.10 | 0.06 | 0.04 |

| Reading with children | 0.05 | 0.03 | 0.02 |

| Playing/hobbies with children | 0.27 | 0.29 | -0.02 |

| Total | 3.49 | 2.24 | 1.25 |

Even under normal circumstances, it was difficult for mothers of young children to balance work against the heavy burden of child care. The BLS found that in 2019, the labor force participation rate for women with children under age 6 was 66.4 percent, well below the rate for women with children age 6 or older3 (76.8 percent). According to a 2014 survey by the U.S. Census Bureau, 61 percent of women who were out of a job and have young children listed “caretaking” as a reason why they were not employed. Forty-six percent of women who were out of a job and have older children said the same. To put that in perspective, only 10 percent of all respondents who were out of work gave caregiving as a reason.4

A similar strain is apparent in working mothers’ decisions to take unpaid leave, or even part-time jobs instead of full-time ones. According to that same census survey from 2014, 30 percent of women who were part-time workers with young children — and 19 percent of women with older children — said caretaking was a reason they worked part-time. (Among part-time workers, the overall share is just 7 percent.)5

Now, with schools closed and day cares struggling to remain open, even more women may conclude that the best — or perhaps the only — choice for their family and their own sanity is to reduce their hours, or even press “pause” on their career.

“Sometimes I’ll get to a point where I’m like, ‘I’m so tired, I’ll have to go part-time to make it all work,’” said Lee Dunham, a lawyer who lives in Delaware. Since the pandemic started, Dunham has been mostly responsible for her 10-month-old daughter during the day — which means her work day doesn’t start until 8 p.m. and usually wraps around 2 a.m.. “I’m just basically not getting enough sleep because I’m watching the baby 40 hours a week and doing my job 40 hours a week. It’s really rough.”

Dunham feels she’s lucky to have an understanding employer who told her earlier this year that they’d be cutting all of their employees some slack because of the pandemic. But at the time, she added, everyone was assuming day care would be up and running by mid-summer. “It might be that I have to dial back my hours, which of course means I will get paid less.”

Subscribe to our coronavirus podcast, PODCAST-19

This kind of calculus already depresses women’s wages and makes it harder for their careers to progress. According to the National Women’s Law Center, mothers are typically only paid 71 cents for every dollar paid to fathers. In fact, a lot of recent research into the gender pay gap has found that much of it is simply due to the constraints on working mothers. For instance, a 2018 analysis of data from Denmark — which offers a counterpoint to the United States in terms of social safety net, yet still has a very large and persistent gender wage gap — found that women’s earnings drop significantly after having their first child, while men’s earnings aren’t affected at all. And crucially, several studies in the U.S. and other countries have found that the trajectory of wages for women who don’t have children resembles those of men, whether they have kids or not (although some research has actually suggested that becoming a father can contribute to men’s career success).

This disparity is particularly intense for women of color. Black mothers are paid only 54 cents for every dollar paid to a white father, according to NWLC; for Latina mothers, it’s 46 cents. Low-income women of color are also among the likeliest to have lost their jobs in the current recession. And they’re disproportionately likely to be the child-care workers who are being asked to come back to work, sometimes in unsafe working conditions, for low wages. “We’re in a vicious cycle where we need child care as one of the tools to get women to equal pay, and yet unequal pay is one of the primary reasons that women are pushed into staying home,” Boteach said.

[Related: How Americans View The Coronavirus Crisis And Trump’s Response]

Leaving the workforce, even if it’s just for a year or two, has ripple effects that can follow a woman for the rest of her life, even depressing her earnings in retirement. Finding a new job after a few years on hiatus can be very difficult for mothers, who may be stereotyped as less serious about their careers because they took time off to be with their children. One study from 2007 found that mothers were perceived to be less competent than fathers, and their recommended salaries were also lower.

During this pandemic, you can already see the disproportionate impact taking shape. The unemployment rate for women in April was 16.2 percent, higher than it has been in any month since at least 1948, before dropping to 11.7 percent in June — a percentage point higher than the rate for men (10.6 percent). Even more striking, labor force participation for women dipped to 54.7 percent in April before rising to 56.1 percent last month. Both of those numbers are reminiscent of the rates for women from the 1980s — back when the very notion of women in the workforce was still gaining momentum.6

Wertz has no plans to leave her job — at least for now. “I worked incredibly hard to get to where I am now,” she said. “I essentially paid my way through school with no family support. For years I worked entirely too hard for not enough money.” Already, she worries that she’s perceived differently in the workplace because she’s a mother. “Even if it was just a year, I know how that gap would look on my resume,” she said. “If I had to take that step back, I just don’t know if I’d recover from it.”

-

Business2 weeks ago

Business2 weeks agoBernice King, Ava DuVernay reflect on the legacy of John Lewis

-

World News2 weeks ago

Heavy rain threatens flood-weary Japan, Korean Peninsula

-

Technology2 weeks ago

Technology2 weeks agoEverything New On Netflix This Weekend: July 25, 2020

-

Finance3 months ago

Will Equal Weighted Index Funds Outperform Their Benchmark Indexes?

-

Marketing Strategies7 months ago

Top 20 Workers’ Compensation Law Blogs & Websites To Follow in 2020

-

World News7 months ago

World News7 months agoThe West Blames the Wuhan Coronavirus on China’s Love of Eating Wild Animals. The Truth Is More Complex

-

Economy9 months ago

Newsletter: Jobs, Consumers and Wages

-

Finance8 months ago

Finance8 months ago$95 Grocery Budget + Weekly Menu Plan for 8