Finance

A 31 Year Old’s Journey to $5,000,000 in Rental Property Value

Today, I have a great article to share with you from Kyle Kroeger on how to invest in real estate. He has a goal of reaching $5,000,000 in rental property value, and is sharing his plan today.

The prospect of retiring early on real estate is highly intriguing to me. It should be for a number of people and I’ll highlight a bit more below.

For millennials, like me, we don’t have it easy. Despite the mainstream media’s thoughts, millennials have faced a Great Recession, massive student loans and a global pandemic already at a young age.

We’ve seen a lot but that can be used to our advantage for financial planning and life goals.

That’s okay if things are a bit harder for millennials financially. It’s a bit more fun when things are hard.

Here I’m ready to show you why real estate investing can be a great asset class.

Related content:

- How This 29 Year Old Is Building A Real Estate Empire

- How This 34 Year Old Owns 7 Rental Homes

- 20 Ways I Saved a 20% Deposit To Purchase My First Investment Property At 20

- 11 Tips For Renovating An Abandoned 115 Year Old House On A Budget

My Background

I’m the prototype millennial that loves buying expensive coffee, avocado toast, iPhone apps, blah blah.

So what? Life is short, so enjoy what you love.

I went to a large public university for undergrad and come from a very much middle of the road family in the Midwest. I knew I wanted to study finance in undergrad as I had more of an analytical mindset and liked numbers.

When I graduated from college, I had a decent amount of student loans. The total amount was somewhere over $60,000 worth of student loans. While I was at school, I really didn’t realize how much student debt I had and how that would impact my financial future.

My family has always had a hardworking mentality, so I worked part-time while attending undergrad (each year).

The problem was that money went to keeping the lights on and paying bills. Not tuition.

Upon graduating, I landed a job in investment banking in Chicago. It was tough to crack into, but the pay was intriguing and the opportunity to get some great experience was invaluable. Even if it meant dealing with unique personalities and long hours.

If I could slug it out for 3 years, I knew I could focus on working, saving and paying off my student loans. I followed a disciplined approach of prepaying my loans as much as possible.

After 5 years of working in finance, I was able to successfully extinguish my $60,000 of student loans. Following my student loan repayment, I quickly saved to purchase my first house. That became my first foray into my comforts of using real estate to build wealth.

Why Invest in Real Estate?

Working long hours and being chained to my desk made me realize quickly that there is so much more to life than work and making a ton of money. After my first house purchase, I realized that investing in real estate is very straightforward and manageable.

I believe the minor fixes, capital costs for repairs, etc. are generally overblown.

If you do it right, you can manage through those costs and use low cost of capital (mortgages) to build wealth over the long-term. The key thought here is long-term.

Real estate investing is a marathon, not a sprint. Multi-generational wealth can be built through real estate. There are plenty of case studies to back it up. The fact that real estate is illiquid actually works to your benefit.

If a macroeconomic event occurs, you simply can’t panic sell. You’ll have to stick it out and work through the issues firsthand. The best part is you are in control, so you can control your destiny in a way.

When you invest in index funds or stocks, you have no control. You can analyze and make decisions that may improve your odds of generating an attractive return, but you are not making the day to day decisions.

To me, the pros outweigh the cons on whether or not you should invest in real estate.

Here are some pros of real estate investing:

- You maintain full control of your holdings.

- There are multiple types of real estate (single-family, multi-family, apartment).

- There are income-oriented markets like providing options for low-income, suburban and urban communities.

- You can invest in specific markets. So specific that you can invest on a particular street that piques your interest.

- Real estate is simple. We aren’t investing in the next Facebook or Instagram.

Here are some cons of real estate investing:

- It can be time-consuming.

- The debate is out there whether real estate outperforms alternatives.

- It requires a learning curve. Even the most experienced investors are still learning.

Finally, there is no one-size-fits all approach to real estate investing. In fact, there are plenty of strategies out there that can tailor to your risk tolerance.

Related content: Renting or Buying? What’s the better decision?

Real Estate Investment Strategies

Here are some general investment strategies to help you understand the risk profile (in order of least risky to most risky). Generally, higher risk can lead to higher expected returns.

1. Core Real Estate

Think of core real estate as purchasing a property for cash flow. The property is in great shape, needs limited repairs and is fully leased. This is one of the most common forms of passive real estate investing. Core investing will end up being the least risky and lower returns.

2. Core Plus

Core plus has a little more risk. Think of core real estate as a base, but it requires you to provide some additional value to the property. For example, you are looking at a property that has 50% of the units in a 4-plex that are renovated. The other units need to be renovated and leased out at higher rates.

You can come in and provide additional value by renovating and finding new tenants. This is the in-between on the risk scale. There is an opportunity for improvement albeit at not too much risk.

3. Opportunistic / Distressed

For simplicity, I’ll group opportunistic and distressed together. This is usually the higher risk and higher return investing within real estate. You’ll likely need some significant expertise in real estate and some sort of angle. A common example is a fix and flip strategy. You seek out properties that are dormant and attractively priced. You already know plenty of contractors and resources to fix the property for an eventual sale.

There are plenty of other strategies and subsets of these but the above should give you a general feel for high-level strategies.

For me, I like core plus because it’s straightforward enough and offers attractive risk/reward. You don’t need to know how to fix a water heater or know every nut and bolt of a house. You simply look for cash flow improvement opportunities in high-demand markets.

Journey to $5 Million in Real Estate Value

The main goal with direct real estate investing is to make cash flow passive while still maintaining as much control as possible. You can do things like real estate crowdfunding or invest in REITs, but you’ll lose control and have less flexibility if you are trying to create generational wealth for your family.

If you own a ton of stock and want to pass it down to your family, what’s stopping them from selling? If you do real estate investing right, you can pass a full-fledged business down to your family that also provides consistent cash flow.

Why $5 Million in Value

$5 million isn’t a hard number but rather a goal. This number also seems like a lot on it’s face and it is. But this is a total aggregate value of property. Not equity.

It doesn’t happen over the course of a year or two. It’s a multi-year process that takes time and patience. This amount of property value presents a great opportunity for income and scale without too much hassle.

You can remain a “small business” in the real estate space and not overload your life with stress.

The math of real estate investing for beginners

The math to why $5 million in rental property value is pretty straightforward. I’d like a six-figure ($100,000) income into perpetuity as a baseline. This would allow me to live comfortably from real estate only while also holding a substantial equity position.

So, the math is as follows:

Targeted Income divided by Cash Yield = Equity Value in Real Estate

Targeted Income = $100,000

Cash Yield = 8%

Cash yield represents the annual cash flow from rental properties relative to your equity position. For example, a rental property earning $8,000 per year of income to you on a $100,000 downpayment would equity to a cash yield of 8%.

This would equate to an equity value of $1.25 million in a real estate portfolio ($100,000/8%). So, if you can meet that bogey of a cash yield you are in good shape. If you exceed it (8+%), you can potentially reach your income goal faster.

So how do I get from $1,250,000 of equity in real estate to $5,000,000?

Well, for investment properties you should have a downpayment of 25% to purchase the property. So, $1.25 million of equity implies $5 million of real estate value ($1.25M/25%).

I built a rental property spreadsheet to help me stay accountable when pricing out real estate transactions. The model serves a number of purposes. Most importantly, I use it to:

- ensure I’m putting an offer on a property that meets the above criteria (realistically), and

- use it as a budget to track my forecast to what was actually received. The model can become a glorified 5-year forecast for each investment.

I walk through how I use the rental property spreadsheet here while walking you through an exact case study.

I hope you find the complete walkthrough helpful.

How to Get There / How Long It Takes

$1.25 million of equity is a lot of money. Absolutely, but you can get there over time. People do it everyday with their 401(k) and Roth IRA contributions.

It will absolutely take time.

Like your retirement contributions, you should have a full roadmap of how you plan to get there. I have 3 real estate properties right now so I’ve already gotten started on the plan.

With much more work to go, however.

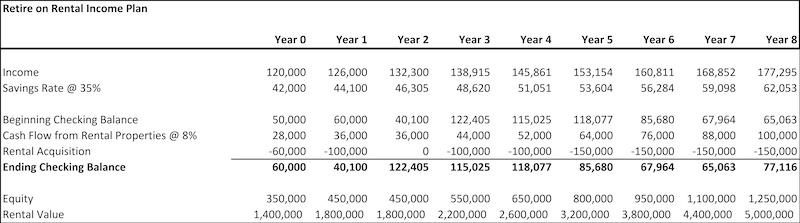

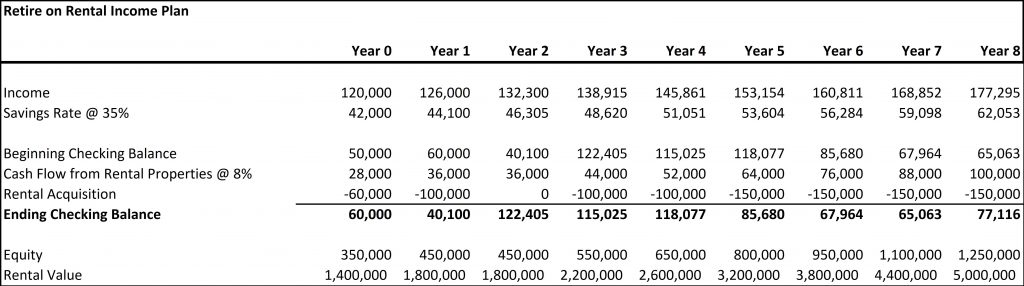

Here is a plan for 8 years to get to the desired income goals and a $5 million rental property value. The assumptions include:

- Starting income of $120,000 with a 5% income increase each year.

- Focus on saving 35% of your pre-tax salary each year for real estate investing.

- Reinvest any cash flow earned from existing rental properties.

Financial Wolves’s Retire on Rental Income Plan:

These are not my exact income and checking account balances but they are a somewhat close representation.

So, as a 31 year old millennial it should take me about 8 years of hard work to eventually retire on real estate. That would put me in a position to earn a steady living from real estate before I’m 40 years old.

There are a few interesting things that stand out from this plan:

- Income is very important: Increasing your income is crucial with real estate investing. Without a continuous flow of reinvestable cash, it becomes harder to acquire more real estate.

- Compound interest is no joke: Compound interest from the cash flow of your properties is a huge value driver. When you are in property acquisition mode, you should harvest as much cash as possible to continually make acquisitions. The sooner the better as the cash flow snowball benefits are massive. Finally, you can see at the tail end of the investing cycle you can start investing in larger properties. Once you start dealing in larger dollar amounts, you are in the big leagues.

- Rental properties cash flow can be substantial: If you can do real estate investing as a side hustle to your ordinary income, the cash flow benefits can be exponential. Look at the cash balance build up during the back end years (years 5-8). You simply can’t acquire enough property.

Once you achieve scale, you’ll have a ton of financial flexibility. Plus, the above assumes no amortization on the loans so your equity balance will likely be compounding along the way. This will give you extraordinary residual value to work with.

Tips for Getting Started In Real Estate Investing

Here are some tips for getting started with real estate investing.

1. Just Start

One of the best pieces of advice I received was from a savvy real estate investor. They said you simply just need to give it a go. It’s true.

If all goes wrong or you don’t like it, at least you can cross it off your bucket list… Hey, I was a real estate investor once.

Not only should you just start. You should start by trying to manage your real estate properties without an asset management firm helping you. This will help you understand your properties. You’ll get used to the ins and outs of repairs, requests and leasing.

With technology now, you should be able to efficiently manage everything. As you scale, start thinking about how an asset management firm can help you. Yeah, back to the reduce time without sacrificing too much income point.

2. Use Technology

Technology continues to be a very underrated component of real estate investing. Back in the day people would have to manually account for everything.

Some old-time real estate investors still think that you need to take 2 am calls about a leaky pipe… Or, you need to manually collect checks from tenants to bring them to your bank. Reduce your time by using resources like Landlord Studio to do all the required bookkeeping.

Or, a tool like Cozy to manage rent payment with multiple tenants in one unit. You’ll get paid instantly and Cozy even sends out rent payment reminders. What’s not to love?

3. If You Struggle That’s Okay

If you struggle with your property and it requires capital contributions from you right away, that’s okay. Let’s be honest. No one invests to lose money. A property can require a ton of work one year but then nothing for the next 5 years.

Just because something bad happens in the short-term doesn’t mean you completely messed up the long-term. At the end of the day, things can get resolved. When I sold my first property, I realized that anxieties and the stress that I had about the property at the onset were definitely not worth it.

Conclusion – Is Real Estate Investing Worth It?

At the end of the day, real estate is not for everyone. However, you can use this as a baseline for whatever asset class you are interested in. To me, real estate provides the optimal solution for building long-term wealth that requires limited time.

You can build a fully operating business out of your real estate holdings that will give you the flexibility to do the things that you enjoy in life. Here are a few tips that I will try to follow along the my real estate investing journey:

- Stay disciplined with your investing. Stick to one strategy and be excellent at it.

- Focus on the long-term.

- Scale your time and don’t be afraid to outsource.

- Build a team of people you trust.

- Retire early and enjoy life.

It’s not that simple and will take a ton of work to get there, but my early estimations is that it will be totally worth it. Between blogging income and a small real estate business, I should be able to work where I want and when I want.

Have you or will you try real estate investing? Let me know in the comments below. I’d love to answer any questions.

Author Bio: Kyle Kroeger is the owner of FinancialWolves.com. Financial Wolves is a blog focused on helping you make more money to achieve financial freedom. After repaying student loans, I’ve shifted my focus to make more money from side hustles, real estate, freelancing, and the online economy. Follow us on Pinterest, YouTube, Twitter, and Facebook.

The post A 31 Year Old’s Journey to $5,000,000 in Rental Property Value appeared first on Making Sense Of Cents.

Finance

YOUR GUIDE FOR SAVING MONEY ON PET FOOD

If you are like most people, your dog is not simply a pet. He or she is a member of your family.

You want to provide them the best of everything. From toys to treats, you love to spoil them rotten

But the costs. Oh, how they can quickly get out of control!

WHY CHEAP IS NOT BETTER

Your first thought may be to buy the cheap dog food.

Please, don’t.

The problem is that the lower quality food can lead to health problems for your pet, which could end up costing you more. It is not the answer.

Instead, focus on ways you can save while still getting your favorite canine the food and treats that are best for them.

STOCK UP WHEN ON SALE

When you find a great deal on the dog food you need, buy extra! There is no reason to pick up one bag when you can get a couple and save.

BUY IN BULK

Oftentimes, the larger bags result in greater savings. Compare the price per ounce of the smaller items to the bigger bags to find the lowest cost.

TRY THE STORE BRAND

Just as with the store brands you buy, sometimes the store brand of pet foods is the same – simply in different packaging.

Carefully review the ingredients before making the switch. After all, if they are the same, why are you paying for the label?

SIGN UP FOR THE STORE REWARDS PROGRAM

Loyalty has its perks. Many stores offer loyalty programs to members. You can get exclusive offers, discounts and coupons that are only offered to those who have signed up.

Some programs also reward for your purchase in the form of points. Once you accumulate the points you can cash them in towards savings or freebies.

GET ON THE LIST

Even if you are a member of their program, make sure you are also on the list! You will get alerts for sales and may even find some awesome coupons to make their way into your inbox as well.

Tip: Make a secondary email address to use so your inbox is not cluttered with these types of emails.

USE ONLINE SERVICES

There are online pet product providers, such as Chewy, who sell pet food and other items, often at a discount. The added perk here is that they deliver it directly to you – so no lugging home huge bags of dog food from the store.

You can use apps such as Honey or Wikibuy to compare online prices to ensure you also find the lowest possible price for the items you need.

SET UP AUTOMATED DELIVERIES

Some sites, such as Amazon, offer discounts if you sign up for automated delivery of select products. Not only will it be delivered, but you also won’t have to worry about running out.

CHECK FOR REBATE OFFERS

Sometimes, manufacturers offer product rebates. If you can find these, you’ll get money back on your purchase.

PRAISE (OR COMPLAIN)

If you have a food your pet loves, send an email letting them know. They may send you coupons or vouchers for products as a thank you.

Alternatively, if you have a problem with a product, make sure to reach out. The company may offer a refund or alternative product for your trouble.

SHOP THE WAREHOUSE

Skip the big box stores and head to your local warehouse. You may find larger bags at a lower cost sold there – saving you time and money.

BECOME A TRACKER

All stores run sales in cycles. They do this on food, clothes, and more – including pet food! Keep track of the offers at your favorite stores.

You will start to learn their cycle and can then stock up when items are on sale.

SKIP THE STORE AND MAKE HOMEMADE DOG FOOD

You can even bypass the store and make your own dog food right at home. There are countless recipes on Pinterest that you can try.

But, before you rush to start a cooking frenzy, make sure to carefully research each ingredient to make sure it is safe for your pet to consume.

PUT COUPONS TO WORK

Before you head to the store, head online, and search for coupons for your pet’s food. You may find them on the manufacturer’s website or on coupon printing sites.

Make sure to also check the product packaging as you may find them stuck to the front of that big bag of dog food.

GET FREE SAMPLES FROM YOUR VET

Vets get free samples of the products they sell – so ask for one! The freebies do not cost them anything, so they should be more than happy to give you one if you inquire.

The post YOUR GUIDE FOR SAVING MONEY ON PET FOOD appeared first on Penny Pinchin' Mom.

Finance

A Peek Into the Last Few Weeks (and our family vacation!)

How to get a shower and get ready for the day when you’re taking care of two babies! 🙂

People ask me all the time how I’m doing with having two babies and I think this early morning picture says it all. Life is full, my hands are full, and my heart is so full! (By the way, I’m actually putting this post together while trying to bounce Kierstyn to sleep in the Baby K’tan… it’s rare that I don’t have at least one baby in my arms these days!)

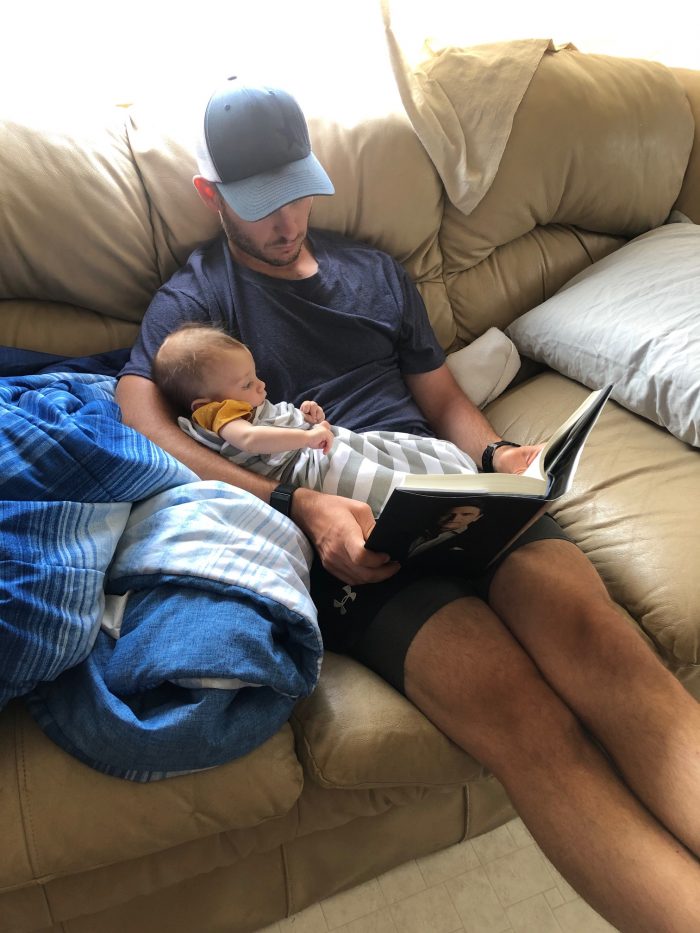

How could my heart not be full when this is an almost daily site at our house!

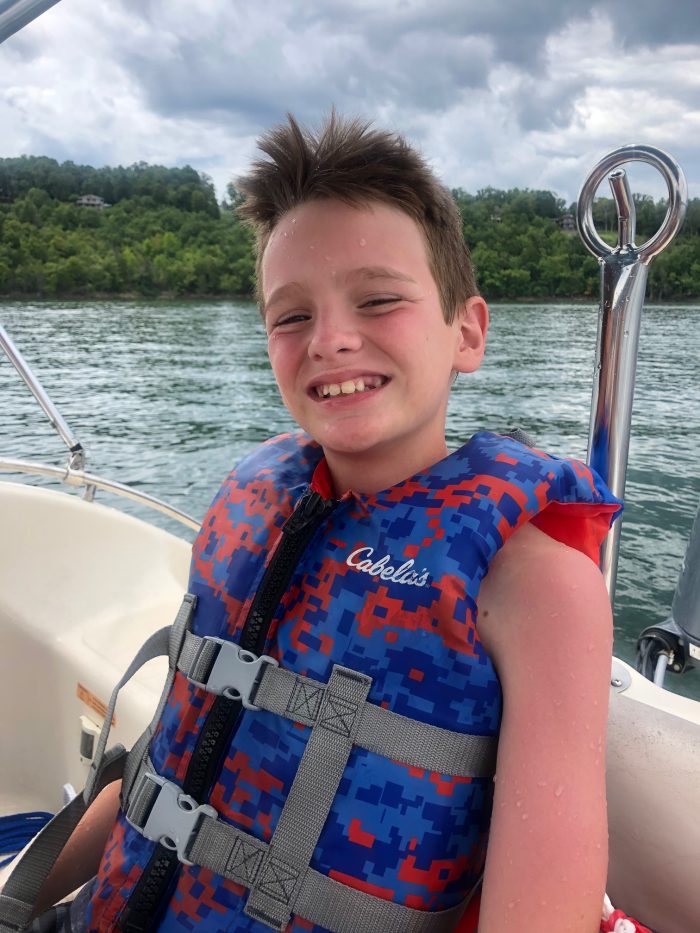

Silas had another weekend baseball tournament at a town about an hour away (Murfreesboro). We had fans set up with a generator, tents, lots of cold drinks in coolers, and these cold wraps to keep everyone cooled down

Champ has been learning how to hold his head up and roll over!

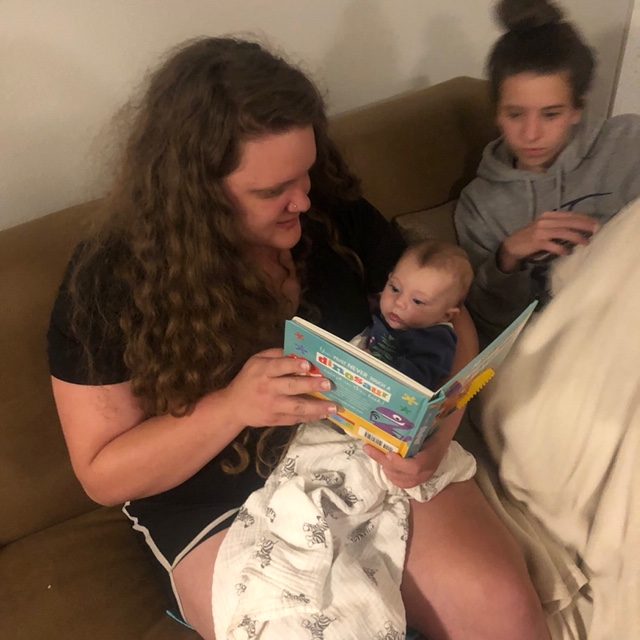

The babies have started to love having books read to them. Goodnight Moon was Silas’ favorite book when he was little, so it’s been so fun to introduce the babies to this book!

We packed for our family trip in tubs — each person got a tub for the week. This saved so much space in our vehicle and made things much more organized!

Our one out of state trip this summer was to go meet up with my family at Bull Shoals Lake in Arkansas. We weren’t sure if the trip was going to happen due to COVID-19, but because of a number of safety measures we put into place, DCS gave us special permission to be able to go and take Champ with us.

Every afternoon during our annual extended family lake vacation, my mom has “Grandma Time” with her grandkids. She teaches them a Bible lesson, they do a craft, have a snack, and do a game together.

Over the past two years, the older grand kids have started helping out. This year, each of the older ones signed up to help out with a craft and/or a snack and then Kathrynne is in charge of games (complete with an elaborate ticketing system and prizes they can turn their tickets in for at the end of the week ala Chuckie Cheese style!)

As many of you know, my mom had some serious health issues last year, including multiple extensive surgeries and skin grafts for skin cancer. She also got really sick with pneumonia in the middle of all that.

She almost didn’t get to come on the annual lake vacation last year. She did come, but she was so weak and sickly that I wondered if she’d make it another year.

This year, at 66 years old, she’s stronger than ever — not only leading Grandma Time, but also skiing and helping with the babies and cooking and looking for ways to reach out and serve all day long.

I know many of you prayed for her last year and I just wanted to tell you thank you, again! I look at this photo I snapped earlier this week and it just reminds me to be grateful for the many gifts it represents.

Her first time in a pool!

They had this sign at the pool! 😉

For details on how we all pitch in on meals and clean up, check out this post.

One of my favorite parts of our extended family vacations: the daily salad bars we have.

On our way home, we stopped by Ozark, MO so the girls and I could go in to the discount store there. (More details on what we bought coming this weekend!)

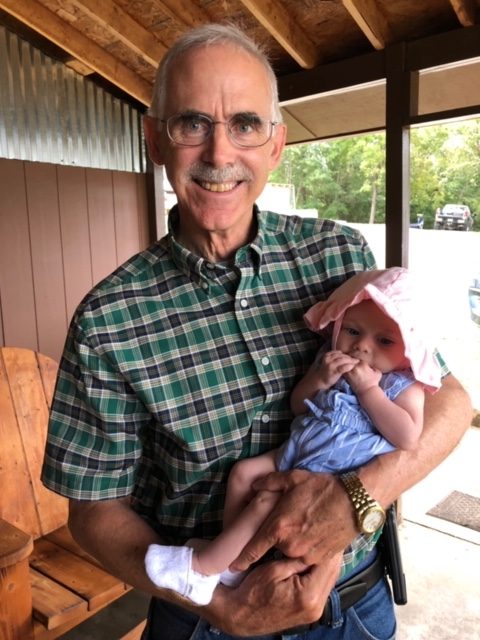

Jesse’s parents and his sister, Lisa, drove from Kansas to meet up with us so they could meet the babies, too.

I’m so grateful we got to spend time with extended family. This year certainly has made us so much more grateful for this!

A year ago, we were in the middle of our foster care home study and praying for who God would bring into our home for us to love on.

We were at peace about pursuing this path, but we were still apprehensive and wondering what it might mean for our future. There were so many unknowns, so many what if’s, and so many things outside our control.

I look back on this last year and the 5 children we’ve had the privilege to have in our home — 4 for just a very short-term stint and sweet little Champ who has been with us for almost 4 months.

There are still just as many unknowns, what if’s, and things outside our comfort zone. My heart has been broken in a hundred little pieces over the things we’ve seen and witnessed firsthand and the many kids and their stories whom we weren’t able to say yes to. I’ve cried more tears in the last 10 months than I’ve cried in the last 10 years (okay, pregnancy and postpartum probably played a part in that!).

And yet, my heart is fuller and happier than I can ever remember. The opportunity to love, pour into, and nurture has filled me up in the deepest of places. Seeing my husband and kids sacrifice and serve and love so well has been one of the most amazing experiences.

I don’t know what the future holds. I can imagine it will be full of heartbreak and beauty, tears and love, a roller coaster of emotions, and many things I can’t even imagine.

There are many unknowns, but this one thing I know: I don’t regret for one second saying “yes” to foster care. I look at these pictures and think, “We could have missed this.”

Finance

Are Penny Stocks Worth It? 7 Tips to Help You Reduce the Risk

As share prices for giants like Netflix and Amazon surge, it’s easy to feel priced out of the stock market. As of Aug. 3, a single share of Netflix would cost you $502.19; for Amazon, you’d pay $3,134.82 per share.

If you’re a beginning investor, the high prices may tempt you to seek out a bargain. Enter penny stocks.

Penny stocks seem like an opportunity to buy into an up-and-coming company for dirt cheap. You can buy hundreds or even thousands of shares for the price of an S&P 500 company share.

But watch out: Investing in penny stocks could easily leave you broke.

What Is a Penny Stock? Are Penny Stocks Worth It?

The U.S. Securities and Exchange Commission defines a penny stock as one that trades for $5 or less per share. Most investors, though, take a narrower definition. Many define it as one that trades for under $1.

But it isn’t just the low trading prices that define penny stocks.

You can find stocks trading for under $5 a share on major stock exchanges, like the Nasdaq or New York Stock Exchange (NYSE). But most investors don’t consider these to be penny stocks.

Penny stocks generally trade on the over-the-counter (OTC) market. The transaction takes place between the broker-dealers for the buyer and seller. They use the OTC market to name their prices. There’s no central exchange facilitating the trade, which can happen without anyone else knowing the transaction price.

The transaction may feel the same as it does when you invest in stocks listed on a major exchange. You can typically use whatever brokerage account you normally use to trade stocks. You place the order in the same way you would for any other stock.

The only thing that may stand out: Your broker is required by the SEC to obtain your signature on a risk disclosure document before placing your first penny stock order.

Why Are Penny Stocks So Risky?

If you’re wondering, “Are penny stocks worth it?”, the answer is pretty much a resounding, “NO!” Here’s why penny stock is among the riskiest investments you can make.

They Lack Transparency

Big companies that trade on major stock exchanges are required to file lots of information with the SEC. The information is publicly available at SEC.gov.

But a company with less than $10 million in assets or 2,000 individual investors may not have to file with the SEC at all. Plus, investment analysts and news reporters scrutinize bigger publicly traded corporations. A company with under $10 million in assets is unlikely to draw any of this scrutiny.

Companies traded on over-the-counter exchanges are subject to far less oversight than companies on a big stock exchange. Most penny stocks trade on the pink sheets, an electronic stock listing service that gets its name because it used to be published on — you guessed it — pink sheets. Companies listed on the pink sheets aren’t required to disclose any information.

There’s Usually No Minimum Listing Requirements

Any stock that trades on a major exchange is subject to strict requirements.

For example, for a stock to start trading on the NYSE, these are just a few of the requirements:

- At least 400 shareholders who each own at least 100 of the company’s shares.

- A minimum of 1.1 million publicly traded shares with a value of at least $40 million.

- The stock price must be at least $4 per share.

The companies that issue penny stocks usually can’t meet these stringent listing requirements.

Maybe they have no proven track record. Or maybe they do have a track record, but it’s a troubled one. If a stock listed on the NYSE or Nasdaq falls below $1 per share and stays there for an extended period, it will be delisted. Then, you’ll see it on the OTC markets.

“Penny stocks are typically highly speculative investments,” said Matt Frankel, a certified financial planner (CFP) at The Motley Fool’s The Ascent. “Not only are many penny stocks issued by companies that are yet to achieve profitability or even revenue in many cases, but there’s a significant amount of fraud in the penny stock world.”

They’re Highly Volatile

A single piece of good or bad news can make or break your penny stock investment. The companies are so small that their success may be contingent on getting FDA approval for a single drug or obtaining a patent. A relatively small change in demand for the stock can also result in major gains or losses.

“A penny stock that goes from a few cents to a few dollars can represent massive return on

investment, sometimes in the thousands of percents,” said Evan Tarver, senior financial analyst at Fit Small Business. “However, there is a much higher likelihood that a penny stock will drop to nothing, meaning you would lose your entire investment.”

You May Not Be Able to Sell Your Shares

Most penny stocks have a low trading volume. That means they trade infrequently, which is bad news for you when you want to sell.

Let’s say you owned 5,000 shares of a company, but the trading volume is only 1,000 per day. You’d realistically have to wait five days to sell all your shares. Even then, you may have to sell for much lower than your ask price.

In investor speak, this is known as low liquidity: To quickly convert your investment to cash, it’s likely that you’ll have to do so by discounting the price.

Penny Stocks Are Rife With Fraud

The world of penny stocks is filled with fraudsters who prey on inexperienced investors. Two of the most common penny stock scams are the pump and dump and the short and distort.

Pump and dump: Scammers drum up hype about a company to drive up share prices. They may say that a company has found the cure for coronavirus or that it’s found a new gold mine. Then they offload their inflated shares on unsuspecting investors.

“Penny stock scams use email newsletters, message boards, and bogus press releases to try to create interest in the stock,” Frankel said. “Some even pay analysts to write up legitimate looking ‘research’ reports on the company, and many even cold call unsuspecting investors to tell them about the ‘incredible opportunity.’”

Short and distort: Investors use a complicated maneuver called short selling when they’re betting a stock’s value will drop or become worthless. With the short-and-distort scam, fraudsters short the stock, then spread false negative rumors about the company. When share prices plummet, they profit.

But Couldn’t I Pick the Next Facebook?

Theoretically, yes. But that’s highly unlikely.

Most wildly successful companies were never traded as penny stocks, even though early investors who stuck around reaped huge profits.

“Most successful stocks, such as Microsoft (MSFT), Facebook (FB), and Tesla (TSLA), all first listed their shares on the NYSE or Nasdaq with prices above $10,” Investopedia reports.

7 Rules to Follow if You’re Still Determined to Trade Penny Stocks

We hope we’ve convinced you that buying penny stocks isn’t worth the risk. You’re much more likely to profit by investing in an ETF or mutual fund that represents the entire stock market.

But what if you’re determined to do it anyway? Follow these rules to mitigate the risks.

1. Only Invest What You Can Afford to Lose

Would you be OK with losing this money at the poker table? Don’t invest it in penny stocks if the answer is “no.”

“Any money that you are prepared to invest, you should be comfortable losing 100% of that investment,” said Lou Haverty, a chartered financial analyst (CFA) with Financial Analyst Insider. “In other words, only invest money that you can afford to speculate with.”

2. Research Before You Buy

If you can’t obtain information about a company from SEC filings, that’s a sign that you should pick a different stock. Also, make sure you understand the basics of the industry and how the company makes money. A little knowledge will help you see through overhyped claims.

3. Look for Stocks With a Decent Market Capitalization

Be wary of stocks with extremely low market caps. That means the overall value of its shares is very low.

Most penny stocks are either nano-cap companies (market capitalization of $50 million or less) or microcap companies (market capitalization of $50 million to $300 million).

“As a general rule of thumb, I won’t even consider investing in stocks with market capitalizations under $200 million, which eliminates most of the penny stock world,” Frankel said.

4. Pay Attention to Trading Volume

A stock’s trading volume shows how many shares are bought or sold on a given day. Look for penny stocks with a minimum trading volume of 100,000 to 200,000 to improve your chances of having a willing buyer should you need to sell.

5. Use Automatic Stop Loss Triggers

Haverty recommends setting up stop loss triggers if you’re determined to buy penny stocks. If your share prices fall by the amount you specify, your brokerage will automatically put them up for sale.

6. Watch Out for the Hype

Look out for outrageous claims about a stock’s potential. They may pop up in investment newsletters, emails, websites and message boards.

“If an investment opportunity sounds too good to be true, it probably is,” Frankel said. “For example, if you see a penny stock discussed in a newsletter or on a message board claiming something to the effect of ‘make 200% in 1 week,’ you can be pretty sure you’re looking at a pump-and-dump scam.”

7. Put No More Than 10% of Your Portfolio in High-Risk Investments

High-risk investments should never take up more than 10% of your portfolio at the absolute max.

That’s 10% for ALL the risky investments. You don’t get 10% for penny stocks, 10% for bitcoin and 10% to invest in gold.

It’s essential to keep the other 90% in a diversified portfolio that’s invested across the stock and bond markets.

Boring? Yes.

But pretty much any experienced investor will tell you that boring is better in the long run.

Robin Hartill is a certified financial planner and a senior editor at The Penny Hoarder. She writes the Dear Penny personal finance advice column. Send your tricky money questions to [email protected].

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

-

Business3 weeks ago

Business3 weeks agoBernice King, Ava DuVernay reflect on the legacy of John Lewis

-

World News2 weeks ago

Heavy rain threatens flood-weary Japan, Korean Peninsula

-

Technology2 weeks ago

Technology2 weeks agoEverything New On Netflix This Weekend: July 25, 2020

-

Finance3 months ago

Will Equal Weighted Index Funds Outperform Their Benchmark Indexes?

-

Marketing Strategies7 months ago

Top 20 Workers’ Compensation Law Blogs & Websites To Follow in 2020

-

World News7 months ago

World News7 months agoThe West Blames the Wuhan Coronavirus on China’s Love of Eating Wild Animals. The Truth Is More Complex

-

Economy9 months ago

Newsletter: Jobs, Consumers and Wages

-

Finance8 months ago

Finance8 months ago$95 Grocery Budget + Weekly Menu Plan for 8