Economy

The Surplus Process

How should we model surpluses and deficits? In finishing up a recent articleand chapter 5 and 6 of a Fiscal Theory of the Price Level update, a bunch of observations coalesced that are worth passing on in blog post form.

Background: The real value of nominal government debt equals the present value of real primary surpluses, [ frac{B_{t-1}}{P_{t}}=b_{t}=E_{t}sum_{j=0}^{infty}beta^{j}s_{t+j}. ] I ‘m going to use one-period nominal debt and a constant discount rate for simplicity. In the fiscal theory of the price level, the (B) and (s) decisions cause inflation (P). In other theories, the Fed is in charge of (P), and (s) adjusts passively. This distinction does not matter for this discussion. This equation and all the issues in this blog post hold in both fiscal and standard theories.

The question is, what is a reasonable time-series process for (left{s_{t}right} ) consistent with the debt valuation formula? Here are surpluses

The blue line is the NIPA surplus/GDP ratio. The red line is my preferred measure of primary surplus/GDP, and the green line is the NIPA primary surplus/GDP.

The surplus process is persistent and strongly procyclical, strongly correlated with the unemployment rate. (The picture is debt to GDP and surplus to GDP ratios, but the same present value identity holds with small modifications so for a blog post I won’t add extra notation.)

Something like an AR(1) quickly springs to mind, [ s_{t+1}=rho_{s}s_{t}+varepsilon_{t+1}. ] The main point of this blog post is that this is a terrible, though common, specification.

Write a general MA process, [ s_{t}=a(L)varepsilon_{t}. ] The question is, what’s a reasonable (a(L)?) To that end, look at the innovation version of the present value equation, [ frac{B_{t-1}}{P_{t-1}}Delta E_{t}left( frac{P_{t-1}}{P_{t}}right) =Delta E_{t}sum_{j=0}^{infty}beta^{j}s_{t+j}=sum_{j=0}^{infty}beta ^{j}a_{j}varepsilon_{t}=a(beta)varepsilon_{t}% ] where [ Delta E_{t}=E_{t}-E_{t-1}. ] The weighted some of moving average coefficients (a(beta)) controls the relationship between unexpected inflation and surplus shocks. If (a(beta)) is large, then small surplus shocks correspond to a lot of inflation and vice versa. For the AR(1), (a(beta)=1/(1-rho_{s}beta)approx 2.) Unexpected inflation is twice as volatile as unexpected surplus/deficits.

(a(beta)) captures how much of a deficit is repaid. Consider (a(beta)=0). Since (a_{0}=1), this means that the moving average is s-shaped. For any (a(beta)lt 1), the moving average coefficients must eventually change sign. (a(beta)=0) is the case that all debts are repaid. If (varepsilon_{t}=-1), then eventually surpluses rise to pay off the initial debt, and there is no change to the discounted sum of surpluses. Your debt obeys (a(beta)=0) if you do not default. If you borrow money to buy a house, you have deficits today, but then a string of positive surpluses which pay off the debt with interest.

The MA(1) is a good simple example, [ s_{t}=varepsilon_{t}+thetavarepsilon_{t-1}% ] Here (a(beta)=1+thetabeta). For (a(beta)=0), you need (theta=-beta ^{-1}=-R). The debt -(varepsilon_{t}) is repaid with interest (R).

Let’s look at an estimate. I ran a VAR of surplus and value of debt (v), and I also ran an AR(1).

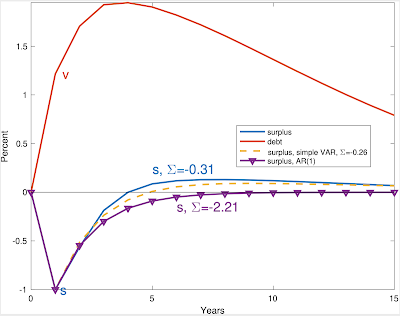

Here are the response functions to a deficit shock:

The blue solid line with (s=-0.31) comes from a larger VAR, not shown here. The dashed line comes from the two variable VAR, and the line with triangles comes from the AR(1).

The VAR (dashed line) shows a slight s shape. The moving average coefficients gently turn positive. But when you add it up, those overshootings bring us back to (a(beta)=0.26) despite 5 years of negative responses. (I use (beta=1)). The AR(1) version without debt has (a(beta)=2.21), a factor of 10 larger!

Clearly, whether you include debt in a VAR and find a slightly overshooting moving average, or leave debt out of the VAR and find something like an AR(1) makes a major difference. Which is right? Just as obviously, looking at (R^2) and t-statistics of the one-step ahead regressions is not going to sort this out.

I now get to the point.

Here are 7 related observations that I think collectively push us to the view that (a(beta)) should be a quite small number. The observations use this very simple model with one period debt and a constant discount rate, but the size and magnitude of the puzzles are so strong that even I don’t think time-varying discount rates can overturn them. If so, well, all the more power to the time-varying discount rate! Again, these observations hold equally for active or passive fiscal policy. This is not about FTPL, at least directly.

1) The correlation of deficits and inflation. Reminder, [ frac{B_{t-1}}{P_{t-1}}Delta E_{t}left( frac{P_{t-1}}{P_{t}}right) =a(beta)varepsilon_{t}. ] If we have an AR(1), (a(beta)=1/(1-rho_{s}beta)approx2), and with (sigma(varepsilon)approx5%) in my little VAR, the AR(1) produces 10% inflation in response to a 1 standard deviation deficit shock. We should see 10% unanticipated inflation in recessions! We see if anything slightly less inflation in recessions, and little correlation of inflation with deficits overall. (a(beta)) near zero solves that puzzle.

2) Inflation volatility. The AR(1) likewise predicts that unexpected inflation has about 10% volatility. Unexpected inflation has about 1% volatility. This observation on its own suggests (a(beta)) no larger than 0.2.

3) Bond return volatility and cyclical correlation. The one-year treasury bill is (so far) completely safe in nominal terms. Thus the volatility and cyclical correlation of unexpected inflation is also the volatility and cyclical correlation of real treasury bill returns. The AR(1) predicts that one-year bonds have a standard deviation of returns around 10%, and they lose in recessions, when the AR(1) predicts a big inflation. In fact one-year treasury bills have no more than 1% standard deviation, and do better in recessions.

4) Mean bond returns. In the AR(1) model, bonds have a stock-like volatility and move procyclically. They should have a stock-like mean return and risk premium. In fact, bonds have low volatility and have if anything a negative cyclical beta so yield if anything less than the risk free rate. A small (a(beta)) generates low bond mean returns as well.

Jiang, Lustig, Van Nieuwerburgh and Xiaolan recently raised this puzzle, using a VAR estimate of the surplus process that generates a high (a(beta)). Looking at the valuation formula [ frac{B_{t-1}}{P_{t}}=E_{t}sum_{j=0}^{infty}beta^{j}s_{t+j}, ] since surpluses are procyclical, volatile, and serially correlated like dividends, shouldn’t surpluses generate a stock-like mean return? But surpluses are crucially different from dividends because debt is not equity. A low surplus (s_{t}) raises our estimate of subsequent surpluses (s_{t+j}). If we separate out

[b_{t}=s_{t}+E_{t}sum_{j=1}^{infty}beta^{j}s_{t+j}=s_{t}+beta E_{t}b_{t+1} ] a decline in the “cashflow” (s_{t}) raises the “price” term (b_{t+1}), so the overall return is risk free. Bad cashflow news lowers stock pries, so both cashflow and price terms move in the same direction. In sum a small (a(beta)lt 1) resolves the Jiang et. al. puzzle. (Disclosure, I wrote them about this months ago, so this view is not a surprise. They disagree.)

5) Surpluses and debt. Looking at that last equation, with a positively correlated surplus process (a(beta)>1), as in the AR(1), a surplus today leads to larger value of the debt tomorrow. A deficit today leads to lower value of the debt tomorrow. The data scream the opposite pattern. Higher deficits raise the value of debt, higher surpluses pay down that debt. Cumby_Canzoneri_Diba (AER 2001) pointed this out 20 years ago and how it indicates an s-shaped surplus process. An (a(beta)lt 1) solves their puzzle as well. (They viewed (a(beta)lt 1) as inconsistent with fiscal theory which is not the case.)

6) Financing deficits. With (a(beta)geq1), the government finances all of each deficit by inflating away outstanding debt, and more. With (a(beta)=0), the government finances deficits by selling debt. This statement just adds up what’s missing from the last one. If a deficit leads to lower value of the subsequent debt, how did the government finance the deficit? It has to be by inflating away outstanding debt. To see this, look again at inflation, which I write [ frac{B_{t-1}}{P_{t-1}}Delta E_{t}left( frac{P_{t-1}}{P_{t}}right) =Delta E_{t}s_{t}+Delta E_{t}sum_{j=1}^{infty}beta^{j}s_{t+j}=Delta E_{t}s_{t}+Delta E_{t}beta b_{t+1}=1+left[ a(beta)-1right] varepsilon_{t}. ] If (Delta E_{t}s_{t}=varepsilon_{t}) is negative — a deficit — where does that come from? With (a(beta)>1), the second term is also negative. So the deficit, and more, comes from a big inflation on the left hand side, inflating away outstanding debt. If (a(beta)=0), there is no inflation, and the second term on the right side is positive — the deficit is financed by selling additional debt. The data scream this pattern as well.

7) And, perhaps most of all, when the government sells debt, it raises revenue by so doing. How is that possible? Only if investors think that higher surpluses will eventually pay off that debt. Investors think the surplus process is s-shaped.

All of these phenomena are tied together. You can’t fix one without the others. If you want to fix the mean government bond return by, say, alluding to a liquidity premium for government bonds, you still have a model that predicts tremendously volatile and procyclical bond returns, volatile and countercyclical inflation, deficits financed by inflating away debt, and deficits that lead to lower values of subsequent debt.

So, I think the VAR gives the right sort of estimate. You can quibble with any estimate, but the overall view of the world required for any estimate that produces a large (a(beta)) seems so thoroughly counterfactual it’s beyond rescue. The US has persuaded investors, so far, that when it issues debt it will mostly repay that debt and not inflate it all away.

Yes, a moving average that overshoots is a little unusual. But that’s what we should expect from debt. Borrow today, pay back tomorrow. Finding the opposite, something like the AR(1), would be truly amazing. And in retrospect, amazing that so many papers (including my own) write this down. Well, clarity only comes in hindsight after a lot of hard work and puzzles.

In more general settings (a(beta)) above zero gives a little bit of inflation from fiscal shocks, but there are also time-varying discount rates and long term debt in the present value formula. I leave all that to the book and papers.

(Jiang et al say they tried it with debt in the VAR and claim it doesn’t make much difference. But their response functions with debt in the VAR, at left, show even more overshooting than in my example, so I don’t see how they avoid all the predictions of a small (a(beta)), including a low bond premium.)

A lot of literature on fiscal theory and fiscal sustainability, including my own past papers, used AR(1) or similar surplus processes that don’t allow (a(beta)) near zero. I think a lot of the puzzles that literature encountered comes out of this auxiliary specification. Nothing in fiscal theory prohibits a surplus process with (a(beta)=0) and certainly not (0 lt a(beta)lt 1).

Update

Jiang et al. also claim that it is impossible for any government with a unit root in GDP to issue risk free debt. The hidden assumption is easy to root out. Consider the permanent income model, [ c_t = rk_t + r beta sum beta^j y_{t+j}] Consumption is cointegrated with income and the value of debt. Similarly, we would normally write the surplus process [ s_t = alpha b_t + gamma y_t. ] responding to both debt and GDP. If surplus is only cointegrated with GDP, one imposes ( alpha = 0), which amounts to assuming that governments do not repay debts. The surplus should be cointegrated with GDP and with the value of debt. Governments with unit roots in GDP can indeed promise to repay their debts.

Source link

Economy

IPA’s weekly links

Guest post by Jeff Mosenkis of Innovations for Poverty Action.

Some student-created infographic examples from the Communicating Economics website.

- Communicating Economics is a site with tools, tips, and videos of in-person college level lectures on, well, pretty much what the title says. It comes from the person behind Econ Films, whom I’ve worked with before and are very good at at what they do.

- A Belgian court has cleared the way for the remains of the first Prime Minister of an independent Republic of Congo (now the DRC) to be returned to his family. In 1961 Patrice Lumumba had been in the job for three months when the Belgian government had him killed, along with two family members. And his “remains” consists of a tooth, because the Belgian authorities also ordered his body to be dissolved in acid. Longer story (for those with strong stomachs) here.

- An interesting paper by Obie Porteous, analyzing 27,000 econ papers about Africa finds:

“45% of all economics journal articles and 65% of articles in the top five economics journals are about five countries accounting for just 16% of the continent’s population. I show that 91% of the variation in the number of articles across countries can be explained by a peacefulness index, the number of international tourist arrivals, having English as an official language, and population.”

The “big five” locations that dominate Western econ are Kenya, Uganda, South Africa, Ghana, and Malawi. On Conversations with Tyler recently, Tyler Cowen asked Nathan Nunn about this (particularly as relates to RCTs). Nunn responded that it’s very difficult to set up a research infrastructure, but once it’s there, it’s hard to go somewhere new and start again, and admitted that even though he doesn’t do RCTs he’s fallen into the same pattern.

- A cool-looking paper from Agyei-Holmes, Buehren, Goldstein, Osei, Osei-Akoto, & Udry looks at a land titling program in Ghana (I know, see above, but to be fair, I know that at least Udry’s been doing research in Ghana for 30 years, and two of the authors are at Ghanaian institutions). The paper looks at how giving formal ownership to farmers increased their investments into their land and agricultural output. Except that it did the opposite - interestingly, when people got titles to the land, the value of the land increased and the owners, particularly women, shifted to other types of work, and business profits went up.

The post IPA’s weekly links appeared first on Chris Blattman.

Economy

6 Crucial Races That Will Flip the SenateThis November, we have…

6 Crucial Races That Will Flip the Senate

This November, we have an opportunity to harness your energy and momentum into political power and not just defeat Trump, but also flip the Senate. Here are six key races you should be paying attention to.

1. The first is North Carolina Republican senator Thom Tillis, notable for his “olympic gold” flip-flops. He voted to repeal the Affordable Care Act, then offered a loophole-filled replacement that excluded many with preexisting conditions. In 2014 Tillis took the position that climate change was “not a fact” and later urged Trump to withdraw from the Paris Climate Accord, before begrudgingly acknowledging the realities of climate change in 2018. And in 2019, although briefly opposing Trump’s emergency border wall declaration, he almost immediately caved to pressure.

But Tillis’ real legacy is the restrictive 2013 voter suppression law he helped pass as Speaker of the North Carolina House. The federal judge who struck down the egregious law said its provisions “targeted African Americans with almost surgical precision.”

Enter Democrat Cal Cunningham, who unlike his opponent, is taking no money from corporate PACs. Cunningham is a veteran who supports overturning the Supreme Court’s disastrous Citizens United decision, restoring the Voting Rights Act, and advancing other policies that would expand access to the ballot box.

2. Maine Senator Susan Collins, a self-proclaimed moderate whose unpopularity has made her especially vulnerable, once said that Trump was unworthy of the presidency. Unfortunately, she spent the last four years enabling his worst behavior. Collins voted to confirm Trump’s judges, including Brett Kavanaugh, and voted to acquit Trump in the impeachment trial, saying he had “learned his lesson” through the process alone. Rubbish.

Collins’ opponent is Sara Gideon, speaker of the House in Maine. As Speaker, Gideon pushed Maine to adopt ambitious climate legislation, anti-poverty initiatives, and ranked choice voting. And unlike Collins, Gideon supports comprehensive democracy reforms to ensure politicians are accountable to the people, not billionaire donors.

Another Collins term would be six more years of cowardly appeasement, no matter the cost to our democracy.

3. Down in South Carolina, Republican Senator Lindsey Graham is also vulnerable. Graham once said he’d “rather lose without Donald Trump than try to win with him.” But after refusing to vote for him in 2016, Graham spent the last four years becoming one of Trump’s most reliable enablers. Graham also introduced legislation to end birthright citizenship, lobbied for heavy restrictions on reproductive rights, and vigorously defended Brett Kavanaugh. Earlier this year, he said that pandemic relief benefits would only be renewed over his dead body.

His opponent, Democrat Jaime Harrison, has brought the race into a dead heat with his bold vision for a “New South.” Harrison’s platform centers on expanding access to healthcare, enacting paid family and sick leave, and investing in climate resistant infrastructure.

Graham once said that if the Republicans nominated Trump the party would “get destroyed,” and “deserve it.” We should heed his words, and help Jaime Harrison replace him in the Senate.

4. Let’s turn to Montana’s Senate race. The incumbent, Republican Steve Daines, has defended Trump’s racist tweets, thanked him for tear-gassing peaceful protestors, and parroted his push to reopen the country during the pandemic as early as May.

Daine’s challenger is former Democratic Governor Steve Bullock. Bullock is proof that Democratic policies can actually gain support in supposedly red states because they benefit people, not the wealthy and corporations. During his two terms, he oversaw the expansion of Medicaid, prevented the passage of union-busting laws, and vetoed two extreme bills that restricted access to abortions.The choice here, once again, is a no-brainer.

5. In Iowa, like Montana, is a state full of surprises. After the state voted for Obama twice, Republican Joni Ernst won her Senate seat in 2014. Her win was a boon for her corporate backers, but has been a disaster for everyone else.

Ernst, a staunch Trump ally, holds a slew of fringe opinions. She pushed anti-abortion laws that would have outlawed most contraception, shared her belief that states can nullify federal laws, and has hinted that she wants to privatize or fundamentally alter social security “behind closed doors.”

Her opponent, Democrat Theresa Greenfield, is a firm supporter of a strong social safety net because she knows its importance firsthand. Union and Social Security survivor benefits helped her rebuild her life after the tragic death of her spouse. With the crippling impact of coronavirus at the forefront of Americans’ minds, Greenfield would be a much needed advocate in the Senate.

6. In Arizona, incumbent Senate Republican Martha McSally is facing Democrat Mark Kelly. Two months after being defeated by Democrat Kyrsten SINema for Arizona’s other Senate seat, McSally was appointed to fill John McCain’s seat following his death. Since then, she’s used that seat to praise Trump and confirm industry lobbyists to agencies like the EPA, and keep cities from receiving additional funds to fight COVID-19. As she voted to block coronavirus relief funds, McSally even had the audacity to ask supporters to “fast a meal” to help support her campaign.

Mark Kelly, a former astronaut and husband of Congresswoman Gabby Giffords, became a gun-control activist following the attempt on her life in 2011. His support of universal background checks and crucial policies on the climate crisis, reproductive health, and wealth inequality make him the clear choice.

These are just a few of the important Senate races happening this year.

In addition, the entire House of Representatives will be on the ballot, along with 86 state legislative chambers and thousands of local seats.

Winning the White House is absolutely crucial, but it’s just one piece of the fight to save our democracy and push a people’s agenda. Securing victories in state legislatures is essential to stopping the GOP’s plans to entrench minority rule through gerrymandered congressional districts and restrictive voting laws — and it’s often state-level policies that have the biggest impact on our everyday lives. Even small changes to the makeup of a body like the Texas Board of Education, which determines textbook content for much of the country, will make a huge difference.

Plus, every school board member, state representative, and congressperson you elect can be pushed to enact policies that benefit the people, not just corporate donors.

This is how you build a movement that lasts.

Economy

Fear & Data

Fear.

It is a key driver of behavior, whether in markets (Fear & Greed), politics (Tribalism), Health care (Anti-Vaxxers) or whatever (FOMO).

Fear is a great memory aid. For most of human history, people communicated not via the written word, but by oral storytelling. Hence, we are primed for emotional, memorable narratives. Looking at data and performing cold, calculated analyses is a learned, not innate, skill.

Social media understands this. Is it any surprise the algorithms of Facebook surfaces the most extreme views and claims? Look at what plays directly into that evolutionary trait, via clickbait and manufactured outrage. With our perfect hindsight bias, isn’t it obvious how inevitable this was?

Irrational fear is a driver of much of what we think and do. Often reflexively, frequently without thought. Contemplate what this means as you process new pandemic information, relying on mental models, performing data analysis.

How often do we react to a headline we disagree with, but after diving into the data underneath, it changes our mind? Not often enough, but on those rare occasions when that happens, it is a sign that you are doing this correctly. Our first reaction is the thoughtless programmed emotional response; the second is the more complex analytical result. It is your lizard brain (basal ganglia and brainstem) versus developed frontal lobe (neocortex).

Which brings us back to Covid-19. The probability of anyone of person getting this disease and then suffering a fatality is exceedingly low. I don’t want to suggest things are statistically normal, and you should definitely do things to stay safe: wear masks, socially distance, wash your hands frequently, and not touch your face. You can be (relatively) safe by doing these simple things.

But excess fear is driving all sorts of negative consequences, including stress, psychoses, economic damage, relationship issues, and health problems. This is counter-productive.

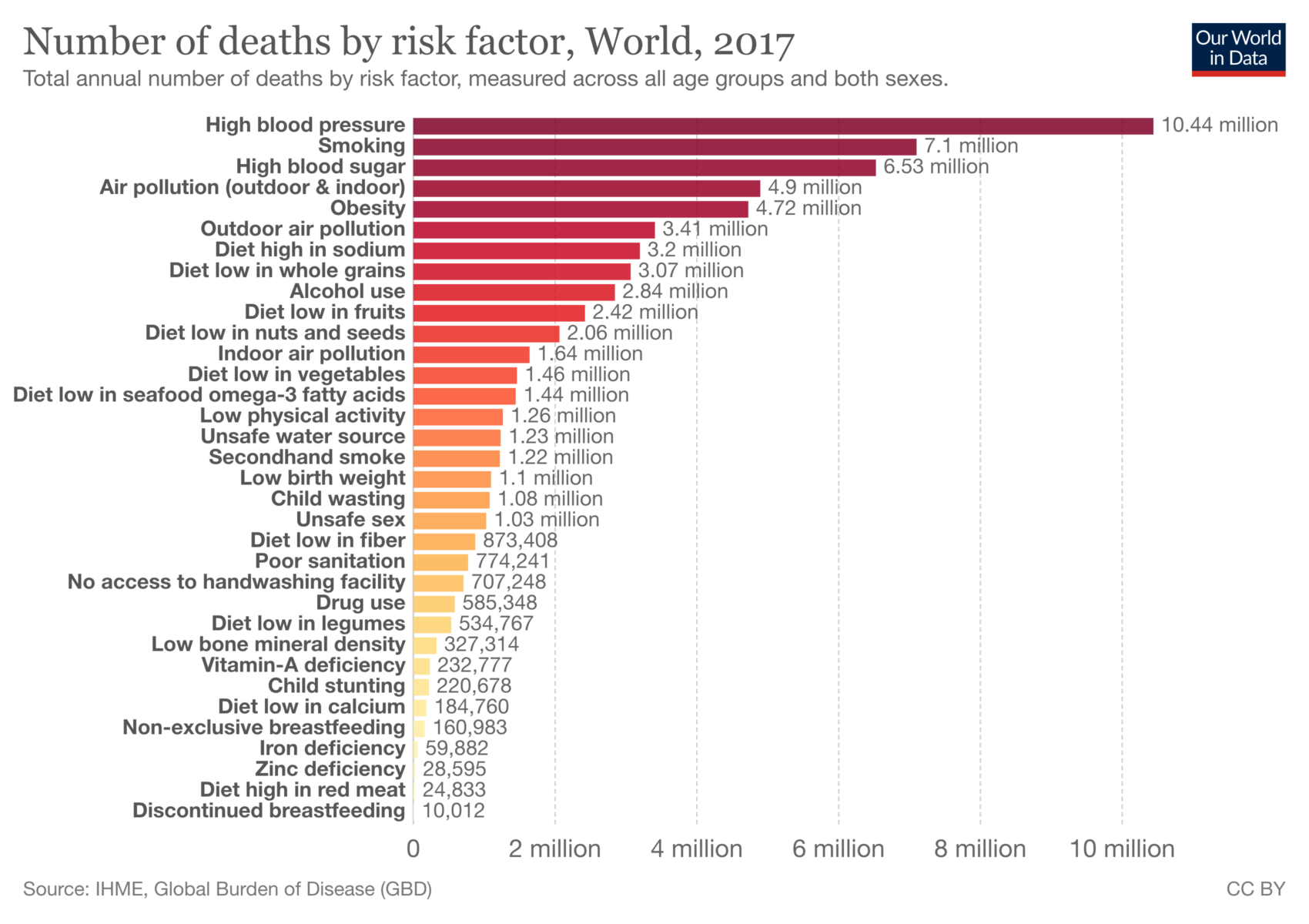

One day, this pandemic will end. Then we can all go back to worrying about cholesterol, high blood pressure and sugar.

Previously:

Over/Under Represented: Causes of Death in the Media (June 13, 2020)

Fearing the Dramatic, Complacent for the Mundane (April 29, 2020)

Denominator Blindness, Shark Attack edition (February 5, 2020)

Shark Attacks Illustrate an Investing Problem (February 4, 2020)

MiB: Danny Kahneman (February 11, 2020)

Crashes & Terrorists & Sharks – Oh, My! (November 9, 2020)

How’s Your MetaCognition? (August 16, 2020)

Source: Our World In Data

The post Fear & Data appeared first on The Big Picture.

-

Business2 months ago

Business2 months agoBernice King, Ava DuVernay reflect on the legacy of John Lewis

-

World News2 months ago

Heavy rain threatens flood-weary Japan, Korean Peninsula

-

Technology2 months ago

Technology2 months agoEverything New On Netflix This Weekend: July 25, 2020

-

Finance4 months ago

Will Equal Weighted Index Funds Outperform Their Benchmark Indexes?

-

Marketing Strategies9 months ago

Top 20 Workers’ Compensation Law Blogs & Websites To Follow in 2020

-

World News8 months ago

World News8 months agoThe West Blames the Wuhan Coronavirus on China’s Love of Eating Wild Animals. The Truth Is More Complex

-

Economy11 months ago

Newsletter: Jobs, Consumers and Wages

-

Finance10 months ago

Finance10 months ago$95 Grocery Budget + Weekly Menu Plan for 8