Economy

Market Talk – June 3, 2020

ASIA:

The US government says it will block Chinese airlines from flying into the US in response to China’s decision to ban US air carriers on June 1, 2020. The Transportation Department restrictions will take effect on June 16 but could be enacted earlier if President Donald Trump decides to do so. The Transportation Department also said, “In the meantime, we will allow Chinese carriers to operate the same number of scheduled passenger flights as the Chinese government allows ours.”

HSBC has openly supported the national security law China is imposing on Hong Kong, breaking the bank’s silence on the legislation opposed by the UK government. Last week, Leung Chun-Ying, who served as the Chinese special administrative region’s third chief executive, renewed pressure when he called for the bank to declare its support for the law. The bank has released a post online and said, “We reiterate that we respect and support laws and regulations that will enable Hong Kong to recover and rebuild the economy and, at the same time, maintain the principle of ‘one country two systems.’”

India launched a USD $6.65 billion plan on Tuesday to boost electronics manufacturing, saying it would start by offering five global smartphone makers incentives to establish or expand domestic production. The government is offering a production-linked incentive (PLI) involving cash worth 4% to 6% of additional sales of goods made locally over five years, with 2019-2020 as the base year, technology minister Ravi Shankar Prasad told a news conference.

The Indian government has approved Gilead Sciences Inc’s antiviral drug Remdesivir for emergency use in treating COVID-19 patients. Remdesivir is the first drug to show improvement in COVID-19 patients in formal clinical trials. It was granted emergency use authorization by the US Food and Drug Administration last month and has received approval by Japanese health regulators.

India’s central bank has softened its stance on teaser loans, which several Indian automakers are offering this to Indian car buyers to increase the sales amid coronavirus-induced economic slump. Maruti Suzuki, Hyundai and Mercedes Benz have already launched such schemes, according to press releases over the past week. Teaser loans offer low interest rates for the first few months or years to attract customers, but rates are later rapidly increased.

The major Asian stock markets had a green day today:

- NIKKEI 225 increased 288.15 points or 1.29% to 22,613.76

- Shanghai increased 1.97 points or 0.07% to 2,923.37

- Hang Seng increased 329.68 points or 1.37% to 24,325.62

- ASX 200 increased 106.50 points or 1.83% to 5,941.60

- Kospi increased 59.81 points or 2.87% to 2,147.00

- SENSEX increased 284.01 points or 0.84% to 34,109.54

The major Asian currency markets had a green day today:

- AUDUSD increased 0.00198 or 0.29% to 0.69379

- NZDUSD increased 0.00439 or 0.69% to 0.64303

- USDJPY increased 0.12 or 0.11% to 108.91

- USDCNY increased 0.01072 or 0.15% to 7.11700

Precious Metals:

- Gold decreased 28.30 USD/t oz. or -1.64% to 1,700.30

- Silver decreased 0.33 USD/t. oz or -1.81% to 17.7260

Some economic news from last night:

China:

Caixin Services PMI (May) increased from 44.4 to 55.0

Japan:

Services PMI (May) increased from 21.5 to 26.5

South Korea:

FX Reserves - USD (May) increased from 403.98B to 407.31B

Hong kong:

Manufacturing PMI (May) increased from 36.9 to 43.9

Australia:

AIG Construction Index (May) increased from 21.6 to 24.9

Services PMI increased from 19.5 to 26.9

GDP (QoQ) (Q1) decreased from 0.5% to -0.3%

GDP (YoY) (Q1) decreased from 2.2% to 1.4%

GDP Capital Expenditure (Q1) increased from -1.0% to -0.8%

GDP Chain Price Index (Q1) increased from -1.2% to 1.1%

GDP Final Consumption (Q1) decreased from 0.5% to -0.4%

Private House Approvals (Apr) increased from -1.2% to 2.7%

Building Approvals (MoM) (Apr) increased from -2.6% to -1.8%

Indonesia:

M2 Money Supply (YoY) (Apr) decreased from 12.10% to 8.60%

Some economic news from today:

India:

Nikkei Services PMI (May) increased from 5.4 to 12.6

M3 Money Supply increased from 11.5% to 11.7%

Singapore:

Manufacturing PMI (May) increased from 44.7 to 46.8

EUROPE/EMEA:

As talks between the UK and EU continue via video conference for the remainder of the week, fresh arguments are surfacing regarding the UK access to the EU financial markets and whether they should still receive preferential treatment. The EU wants the right to shut the UK out of their financial markets with little or no prior notice, yet the UK is demanding something a little more concrete they can work with. Currently, the EU is the UK’s biggest export partner with regards to financial services. The EU currently has agreements with the US and Japan giving the EU rights to withdraw access with 30 days notice.

The EU is setting stricter rules on automakers after new reports show that newer cars are infact outputting more CO2 than previous years. The EU stated for those companies to avoid fines they must reduce emissions by 27% from 2018 levels.

The European Commission classified the new COVID-19 as a mid-level risk placing it at a level 3, with level 4 being the highest, and suggesting that the disease can cause severe human disease, but treatments are available.

The EU chief of foreign affairs has called the death of US civilian George Floyd an abuse of power on behalf of the police, and urged the public to reduce the tensions. A few cities in Europe joined in on the protests, albeit most were peaceful.

The major Europe stock markets had a green today:

- CAC 40 increased 163.41 points or 3.36% to 5,022.38

- FTSE 100 increased 162.27 points or 2.61% to 6,382.41

- DAX 30 increased 466.08 points or 3.88% to 12,487.36

The major Europe currency markets had a green day today:

- EURUSD increased 0.00513 or 0.46% to 1.12363

- GBPUSD increased 0.00028 or 0.02% to 1.25833

- USDCHF increased 0.00001 or 0.00% to 0.96170

Some economic news from Europe today:

Swiss:

GDP (QoQ) (Q1) decreased from 0.3% to -2.6%

GDP (YoY) (Q1) decreased from 1.6% to -1.3%

Norway:

Current Account (Q1) increased from 25.1B to 66.1B

Spain:

Spanish Services PMI (May) increased from 7.1 to 27.9

Italy:

Italian Composite PMI (May) increased from 10.9 to 33.9

Italian Services PMI (May) increased to 10.8 to 28.9

Italian Monthly Unemployment Rate (Apr) decreased from 8.0% to 6.3%

France:

French Markit Composite PMI (May) increased from 30.5 to 32.1

French Services PMI (May) increased from 10.2 to 31.1

Germany:

German Composite PMI (May) increased from 17.4 to 32.3

German Services PMI (May) increased from 16.2 to 32.6

German Unemployment Change (May) decreased from 372K to 238K

German Unemployment Rate (May) increased from 5.8% to 6.3%

German Unemployment (May) increased from 2,637M to 2,875M

German Unemployment n.s.a. (May) increased from 2,644M to 2,813M

Euro Zone:

Markit Composite PMI (May) increased from 13.6 to 31.9

Services PMI (May) increased from 12.0 to 30.5

PPI (YoY) (Apr) decreased from -2.8% to -4.5%

PPI (MoM) (Apr) decreased from -1.5% to -2.0%

Unemployment Rate (Apr) increased from 7.1% to 7.3%

UK:

Composite PMI (May) increased from 13.8 to 30.0

Services PMI (May) increased from 13.4 to 29.0

US/AMERICAS:

The US workforce contracted by 2.76 million positions in May, according to a report released today by ADP. Despite the contraction, the number is better than many analysts feared as a recent poll suggested May’s payroll decline could reach 8.75 million. The Labor Department will release the official unemployment figure this Friday, which many expect to be closer to 3 million.

Today the Trump administration banned Chinese passenger flights from landing in the US. The order will go into effect on June 16, and is largely in response to China’s current ban on US carriers. The US Department of Transportation’s goal of the ban is to provide “improved environment wherein the carriers of both parties will be able to exercise fully their bilateral rights.” Furthermore, the department said that they are prepared to lift the ban as soon as Bejing reopens their borders to US carriers.

The Trump administration selected five top pharmaceutical companies to develop a coronavirus vaccine: Moderna, the combination of Oxford University and AstraZeneca Plc, Johnson & Johnson, Merck & Co Inc, and Pfizer Inc, according to Reuters. The New York Times reported that the US will announce their plans for vaccine development in the coming weeks.

The Bank of Canada (BoC) voted to maintain the current benchmark rate of 0.25% this Wednesday. The central bank drastically reduced rates amid the pandemic from 1.75% in February to 0.25% in March. by Tiff Macklem was in charge of making an important decision on his first day as the central bank’s governor after Stephen Poloz resigned from his seven-year tenure. The bank issued the following statement: “The Bank’s programs to improve market function are having their intended effect. After significant strains in March, short-term funding conditions have improved. Therefore, the Bank is reducing the frequency of its term repo operations to once per week, and its program to purchase bankers’ acceptances to bi-weekly operations. The Bank stands ready to adjust these programs if market conditions warrant. Meanwhile, its other programs to purchase federal, provincial, and corporate debt are continuing at their present frequency and scope.”

US Market Closings:

- Dow advanced 527.24 points or 2.05% to 26,269.89

- S&P 500 advanced 42.05 points or 1.36% to 3,122.87

- Nasdaq advanced 74.54 points or 0.78% to 9,682.91

- Russell 2000 advanced 33.88 points or 2.39% to 1,452.09

Canada Market Closings:

- TSX Composite advanced 180.75 points or 1.17% to 15,575.11

- TSX 60 advanced 10.02 points or 1.08% to 941.72

Brazil Market Closing:

- Bovespa advanced 1,955.76 points or 2.15% to 93,002.14

ENERGY:

WTI and Brent dropped slightly at of the time of writing. However, the OPEC basket rose close to 4% of anticipation over production cuts. The next OPEC meeting is scheduled for the 9-10 of June but could be brought forward as early as the 4th.

The oil markets had a mixed day today:

- Crude Oil decreased 0.04 USD/BBL or -0.11% to 36.7700

- Brent decreased 0.15 USD/BBL or -0.38% to 39.4500

- Natural gas increased 0.027 USD/MMBtu or 1.52% to 1.8050

- Gasoline decreased 0.0014 USD/GAL or -0.13% to 1.1107

- Heating oil decreased 0.031 USD/GAL or -2.85% to 1.0575

The above data was collected around 13.47 EST on Wednesday.

- Top commodity gainers: Milk (64.39%), Cheese (61.30%), Rice (7.87%), and Sugar (3.39%)

- Top commodity losers: Heating Oil (-2.85%), Rubber (-2.55%), Lumber (-2.55%), and Lean Hogs (-7.37%)

The above data was collected around 13.52 EST on Wednesday.

BONDS:

Japan 0.02%(+2bp), US 2’s 0.20% (+3bps), US 10’s 0.76%(+8bps); US 30’s 1.56%(+8bps), Bunds -0.36% (+6bp), France 0.01% (+6bp), Italy 1.56% (+6bp), Turkey 11.41% (+6bp), Greece 1.51% (+1bp), Portugal 0.59% (+7bp); Spain 0.64% (+15bp) and UK Gilts 0.28% (+5bp).

- Germany 5-Year Bobl Auction increased from -0.740% to -0.620%

Economy

IPA’s weekly links

Guest post by Jeff Mosenkis of Innovations for Poverty Action.

Some student-created infographic examples from the Communicating Economics website.

- Communicating Economics is a site with tools, tips, and videos of in-person college level lectures on, well, pretty much what the title says. It comes from the person behind Econ Films, whom I’ve worked with before and are very good at at what they do.

- A Belgian court has cleared the way for the remains of the first Prime Minister of an independent Republic of Congo (now the DRC) to be returned to his family. In 1961 Patrice Lumumba had been in the job for three months when the Belgian government had him killed, along with two family members. And his “remains” consists of a tooth, because the Belgian authorities also ordered his body to be dissolved in acid. Longer story (for those with strong stomachs) here.

- An interesting paper by Obie Porteous, analyzing 27,000 econ papers about Africa finds:

“45% of all economics journal articles and 65% of articles in the top five economics journals are about five countries accounting for just 16% of the continent’s population. I show that 91% of the variation in the number of articles across countries can be explained by a peacefulness index, the number of international tourist arrivals, having English as an official language, and population.”

The “big five” locations that dominate Western econ are Kenya, Uganda, South Africa, Ghana, and Malawi. On Conversations with Tyler recently, Tyler Cowen asked Nathan Nunn about this (particularly as relates to RCTs). Nunn responded that it’s very difficult to set up a research infrastructure, but once it’s there, it’s hard to go somewhere new and start again, and admitted that even though he doesn’t do RCTs he’s fallen into the same pattern.

- A cool-looking paper from Agyei-Holmes, Buehren, Goldstein, Osei, Osei-Akoto, & Udry looks at a land titling program in Ghana (I know, see above, but to be fair, I know that at least Udry’s been doing research in Ghana for 30 years, and two of the authors are at Ghanaian institutions). The paper looks at how giving formal ownership to farmers increased their investments into their land and agricultural output. Except that it did the opposite - interestingly, when people got titles to the land, the value of the land increased and the owners, particularly women, shifted to other types of work, and business profits went up.

The post IPA’s weekly links appeared first on Chris Blattman.

Economy

6 Crucial Races That Will Flip the SenateThis November, we have…

6 Crucial Races That Will Flip the Senate

This November, we have an opportunity to harness your energy and momentum into political power and not just defeat Trump, but also flip the Senate. Here are six key races you should be paying attention to.

1. The first is North Carolina Republican senator Thom Tillis, notable for his “olympic gold” flip-flops. He voted to repeal the Affordable Care Act, then offered a loophole-filled replacement that excluded many with preexisting conditions. In 2014 Tillis took the position that climate change was “not a fact” and later urged Trump to withdraw from the Paris Climate Accord, before begrudgingly acknowledging the realities of climate change in 2018. And in 2019, although briefly opposing Trump’s emergency border wall declaration, he almost immediately caved to pressure.

But Tillis’ real legacy is the restrictive 2013 voter suppression law he helped pass as Speaker of the North Carolina House. The federal judge who struck down the egregious law said its provisions “targeted African Americans with almost surgical precision.”

Enter Democrat Cal Cunningham, who unlike his opponent, is taking no money from corporate PACs. Cunningham is a veteran who supports overturning the Supreme Court’s disastrous Citizens United decision, restoring the Voting Rights Act, and advancing other policies that would expand access to the ballot box.

2. Maine Senator Susan Collins, a self-proclaimed moderate whose unpopularity has made her especially vulnerable, once said that Trump was unworthy of the presidency. Unfortunately, she spent the last four years enabling his worst behavior. Collins voted to confirm Trump’s judges, including Brett Kavanaugh, and voted to acquit Trump in the impeachment trial, saying he had “learned his lesson” through the process alone. Rubbish.

Collins’ opponent is Sara Gideon, speaker of the House in Maine. As Speaker, Gideon pushed Maine to adopt ambitious climate legislation, anti-poverty initiatives, and ranked choice voting. And unlike Collins, Gideon supports comprehensive democracy reforms to ensure politicians are accountable to the people, not billionaire donors.

Another Collins term would be six more years of cowardly appeasement, no matter the cost to our democracy.

3. Down in South Carolina, Republican Senator Lindsey Graham is also vulnerable. Graham once said he’d “rather lose without Donald Trump than try to win with him.” But after refusing to vote for him in 2016, Graham spent the last four years becoming one of Trump’s most reliable enablers. Graham also introduced legislation to end birthright citizenship, lobbied for heavy restrictions on reproductive rights, and vigorously defended Brett Kavanaugh. Earlier this year, he said that pandemic relief benefits would only be renewed over his dead body.

His opponent, Democrat Jaime Harrison, has brought the race into a dead heat with his bold vision for a “New South.” Harrison’s platform centers on expanding access to healthcare, enacting paid family and sick leave, and investing in climate resistant infrastructure.

Graham once said that if the Republicans nominated Trump the party would “get destroyed,” and “deserve it.” We should heed his words, and help Jaime Harrison replace him in the Senate.

4. Let’s turn to Montana’s Senate race. The incumbent, Republican Steve Daines, has defended Trump’s racist tweets, thanked him for tear-gassing peaceful protestors, and parroted his push to reopen the country during the pandemic as early as May.

Daine’s challenger is former Democratic Governor Steve Bullock. Bullock is proof that Democratic policies can actually gain support in supposedly red states because they benefit people, not the wealthy and corporations. During his two terms, he oversaw the expansion of Medicaid, prevented the passage of union-busting laws, and vetoed two extreme bills that restricted access to abortions.The choice here, once again, is a no-brainer.

5. In Iowa, like Montana, is a state full of surprises. After the state voted for Obama twice, Republican Joni Ernst won her Senate seat in 2014. Her win was a boon for her corporate backers, but has been a disaster for everyone else.

Ernst, a staunch Trump ally, holds a slew of fringe opinions. She pushed anti-abortion laws that would have outlawed most contraception, shared her belief that states can nullify federal laws, and has hinted that she wants to privatize or fundamentally alter social security “behind closed doors.”

Her opponent, Democrat Theresa Greenfield, is a firm supporter of a strong social safety net because she knows its importance firsthand. Union and Social Security survivor benefits helped her rebuild her life after the tragic death of her spouse. With the crippling impact of coronavirus at the forefront of Americans’ minds, Greenfield would be a much needed advocate in the Senate.

6. In Arizona, incumbent Senate Republican Martha McSally is facing Democrat Mark Kelly. Two months after being defeated by Democrat Kyrsten SINema for Arizona’s other Senate seat, McSally was appointed to fill John McCain’s seat following his death. Since then, she’s used that seat to praise Trump and confirm industry lobbyists to agencies like the EPA, and keep cities from receiving additional funds to fight COVID-19. As she voted to block coronavirus relief funds, McSally even had the audacity to ask supporters to “fast a meal” to help support her campaign.

Mark Kelly, a former astronaut and husband of Congresswoman Gabby Giffords, became a gun-control activist following the attempt on her life in 2011. His support of universal background checks and crucial policies on the climate crisis, reproductive health, and wealth inequality make him the clear choice.

These are just a few of the important Senate races happening this year.

In addition, the entire House of Representatives will be on the ballot, along with 86 state legislative chambers and thousands of local seats.

Winning the White House is absolutely crucial, but it’s just one piece of the fight to save our democracy and push a people’s agenda. Securing victories in state legislatures is essential to stopping the GOP’s plans to entrench minority rule through gerrymandered congressional districts and restrictive voting laws — and it’s often state-level policies that have the biggest impact on our everyday lives. Even small changes to the makeup of a body like the Texas Board of Education, which determines textbook content for much of the country, will make a huge difference.

Plus, every school board member, state representative, and congressperson you elect can be pushed to enact policies that benefit the people, not just corporate donors.

This is how you build a movement that lasts.

Economy

Fear & Data

Fear.

It is a key driver of behavior, whether in markets (Fear & Greed), politics (Tribalism), Health care (Anti-Vaxxers) or whatever (FOMO).

Fear is a great memory aid. For most of human history, people communicated not via the written word, but by oral storytelling. Hence, we are primed for emotional, memorable narratives. Looking at data and performing cold, calculated analyses is a learned, not innate, skill.

Social media understands this. Is it any surprise the algorithms of Facebook surfaces the most extreme views and claims? Look at what plays directly into that evolutionary trait, via clickbait and manufactured outrage. With our perfect hindsight bias, isn’t it obvious how inevitable this was?

Irrational fear is a driver of much of what we think and do. Often reflexively, frequently without thought. Contemplate what this means as you process new pandemic information, relying on mental models, performing data analysis.

How often do we react to a headline we disagree with, but after diving into the data underneath, it changes our mind? Not often enough, but on those rare occasions when that happens, it is a sign that you are doing this correctly. Our first reaction is the thoughtless programmed emotional response; the second is the more complex analytical result. It is your lizard brain (basal ganglia and brainstem) versus developed frontal lobe (neocortex).

Which brings us back to Covid-19. The probability of anyone of person getting this disease and then suffering a fatality is exceedingly low. I don’t want to suggest things are statistically normal, and you should definitely do things to stay safe: wear masks, socially distance, wash your hands frequently, and not touch your face. You can be (relatively) safe by doing these simple things.

But excess fear is driving all sorts of negative consequences, including stress, psychoses, economic damage, relationship issues, and health problems. This is counter-productive.

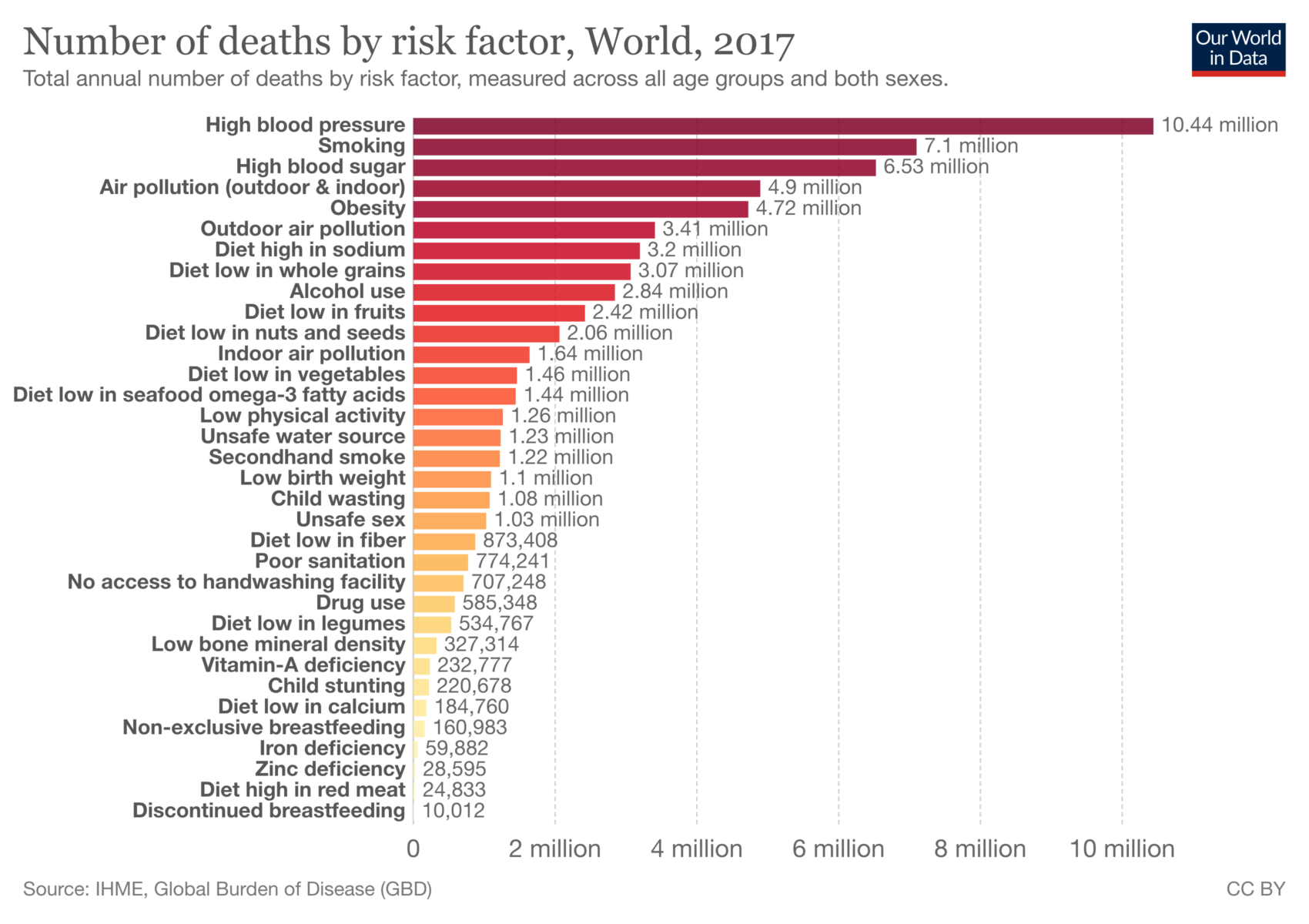

One day, this pandemic will end. Then we can all go back to worrying about cholesterol, high blood pressure and sugar.

Previously:

Over/Under Represented: Causes of Death in the Media (June 13, 2020)

Fearing the Dramatic, Complacent for the Mundane (April 29, 2020)

Denominator Blindness, Shark Attack edition (February 5, 2020)

Shark Attacks Illustrate an Investing Problem (February 4, 2020)

MiB: Danny Kahneman (February 11, 2020)

Crashes & Terrorists & Sharks – Oh, My! (November 9, 2020)

How’s Your MetaCognition? (August 16, 2020)

Source: Our World In Data

The post Fear & Data appeared first on The Big Picture.

-

Business2 months ago

Business2 months agoBernice King, Ava DuVernay reflect on the legacy of John Lewis

-

World News2 months ago

Heavy rain threatens flood-weary Japan, Korean Peninsula

-

Technology2 months ago

Technology2 months agoEverything New On Netflix This Weekend: July 25, 2020

-

Finance4 months ago

Will Equal Weighted Index Funds Outperform Their Benchmark Indexes?

-

Marketing Strategies9 months ago

Top 20 Workers’ Compensation Law Blogs & Websites To Follow in 2020

-

World News8 months ago

World News8 months agoThe West Blames the Wuhan Coronavirus on China’s Love of Eating Wild Animals. The Truth Is More Complex

-

Economy11 months ago

Newsletter: Jobs, Consumers and Wages

-

Finance10 months ago

Finance10 months ago$95 Grocery Budget + Weekly Menu Plan for 8