Finance

Selling our home was the best financial decision we have ever made

Hello! My name is Wendy Mays, and I’m super happy to share a bit of my story. In the past couple of years, my husband and I have taken several big steps to change our financial future.

From the outside looking in, it appeared we had it all: a perfect family in a beautiful, Pinterest-worthy home in sunny San Diego, California. We’d reached the pinnacle. We were living the American Dream.

The reality, however, was that we were drowning in debt, burned out, and coming to terms with the fact that if things didn’t change, we’d carry our debt to our graves. As we explored changes we could make to improve our financial situation, we realized that the biggest and best move we could make was to sell our dream home.

Turns out that selling our home was the best financial decision we have ever made.

Given the long trail of money mistakes my husband have made in the past, some who know us might be skeptical that this choice was the right one. But if you’ll indulge me for a few minutes, I hope to dispel the belief that owning your own home is always best.

The American Dream

Home ownership is part of the American Dream. It’s something most folks look forward to accomplishing. It’s a rite of passage. It’s how we show the world we’ve “made it”. We’re constantly bombarded by messages that home ownership is something successful people “should” do, the same as going to college, getting married, and having children.

Too, most people have a personal attachment to their homes. We understand this. Emotional investment was a big barrier for us too. My family had put our hearts and souls into our home. On every wall, there was something our hands had touched.

We had planned to make the place into our dream home, to stay there indefinitely. It was the first home we owned in San Diego, the first home we owned after adopting our boys. Our house meant something to us. It was sentimental.

But after attending last year’s FI Chautauqua in Greece, my husband and I agreed that becoming financially independent was an important goal for both of us. At age 46, we were late to discover the world of early retirement, but we knew if we implemented a few strategies we could change our lives — and the lives of our children.

We began to envision the legacy we could leave our children, the generational wealth we could begin to build.

The Problem with the American Dream

But there was a problem. We were broke. More than broke. We were in debt, including the house, by almost one million dollars. We didn’t discriminate when it came to debt. We had it all! We had a mortgage. We had car loans. We had credit-card debt. We had revolving debt. We had tax bills.

When we crunched the numbers, we decided we had two choices to change our money situation.

- Cut expenses, then work our way out of the mess we’d created.

- Liquidate the only asset we had access to: our home. (All of our other money was in retirement accounts.) We could use the equity to pay off a good portion of our debt.

While we recognized that we absolutely should work to cut costs and build income, the latter option made the most financial sense. Really, it was a no-brainer. But homeownership isn’t a decision we make only with our brains; our hearts have to be considered as well.

It took us about six months to arrive at a decision. For weeks, we wavered back and forth about what to do. We didn’t want to sell our house. We loved the home we had created.

Making the Decision

Ultimately, it was our children that allowed us to align our heads with our hearts. We asked ourselves, “Why do we want to achieve financial independence?” It was for our kids, to change our family tree.

We decided that “home” would be wherever we were. Home was a meal at our dinner table. It was game night. Home was watching the Littles ride their scooters in the front sidewalk and family movie night in the drive-way.

Our home wasn’t limited by four walls. It wasn’t defined by a specific house.

Once we agreed to sell our house, there was another decision to make. We would capture enough money from the sale to not only pay all of off our consumer debt, but have some left over to put into another home.

We weighed the pros and cons of renting versus purchasing another home. We ran the numbers through several different “buy vs. rent” calculators – and in each one, renting came out ahead. In fact, renting could save us anywhere between $800 and $1200 each month

Not only that, but by not buying another primary residence we’d have a significant amount of money left over that could be used for something else, such as investing in out-of-state rental properties.

We decided to rent.

Soon, we found a nice home in our current neighborhood (which was important for us). We were able to rent the place for $1100 less than our previous mortgage.

Crunching the Numbers

For my family, letting go of the attachment to our home allowed us to do some amazing things.

- We paid off all of our consumer debt. Gone are two car payments and several credit-card balances. This is a savings of about $1600 a month. ($900 in car payments and the rest in credit-card payments.)

- By renting — and downsizing slightly — we save about $1100 per month in housing payments.

- Selling our home provided seed money to begin real-estate investing, which will add $1000 of positive cash flow into our budget per month.

That’s a grand total of $3700 per month that we put back into our budget. That equates to about $44,000 each year.

Let that sink in for second. Millions of people live on less than this amount comfortably. (What could you do with an extra $44,000 per year?) It’s the equivalent of a modest income in the United States.

In fact, freeing up this money allowed me to quit my career as a lawyer and close my practice. For the first time in our lives, my husband and I can live on one income!

After the Sale

Now, several months after selling our home, we can say without hesitation that it was the best thing we’ve ever done with our money.

This one move has not only decreased our monthly expenses, but it also allowed us to pay off a lot of debt. Plus, we’ve start investing in real estate, which has also increased our monthly income.

Last year — 365 days ago — we had almost $1,000,000 in debt. Through this one unconventional move, we’ve gotten rid of almost $700,000 of that debt.

We still have about $350,000 of student loan debt to go – but we have a plan in place to attack that as well.

Once you allow yourself to think outside the box, give yourself permission to make unconventional moves with money, you can do amazing things. Housing is the biggest expense for most Americans. It almost always makes sense to seek ways to decrease that expense. Doing so can bring about all sorts of opportunities.

I encourage you to do consider the possibilities.

The post Selling our home was the best financial decision we have ever made appeared first on Get Rich Slowly.

Finance

YOUR GUIDE FOR SAVING MONEY ON PET FOOD

If you are like most people, your dog is not simply a pet. He or she is a member of your family.

You want to provide them the best of everything. From toys to treats, you love to spoil them rotten

But the costs. Oh, how they can quickly get out of control!

WHY CHEAP IS NOT BETTER

Your first thought may be to buy the cheap dog food.

Please, don’t.

The problem is that the lower quality food can lead to health problems for your pet, which could end up costing you more. It is not the answer.

Instead, focus on ways you can save while still getting your favorite canine the food and treats that are best for them.

STOCK UP WHEN ON SALE

When you find a great deal on the dog food you need, buy extra! There is no reason to pick up one bag when you can get a couple and save.

BUY IN BULK

Oftentimes, the larger bags result in greater savings. Compare the price per ounce of the smaller items to the bigger bags to find the lowest cost.

TRY THE STORE BRAND

Just as with the store brands you buy, sometimes the store brand of pet foods is the same – simply in different packaging.

Carefully review the ingredients before making the switch. After all, if they are the same, why are you paying for the label?

SIGN UP FOR THE STORE REWARDS PROGRAM

Loyalty has its perks. Many stores offer loyalty programs to members. You can get exclusive offers, discounts and coupons that are only offered to those who have signed up.

Some programs also reward for your purchase in the form of points. Once you accumulate the points you can cash them in towards savings or freebies.

GET ON THE LIST

Even if you are a member of their program, make sure you are also on the list! You will get alerts for sales and may even find some awesome coupons to make their way into your inbox as well.

Tip: Make a secondary email address to use so your inbox is not cluttered with these types of emails.

USE ONLINE SERVICES

There are online pet product providers, such as Chewy, who sell pet food and other items, often at a discount. The added perk here is that they deliver it directly to you – so no lugging home huge bags of dog food from the store.

You can use apps such as Honey or Wikibuy to compare online prices to ensure you also find the lowest possible price for the items you need.

SET UP AUTOMATED DELIVERIES

Some sites, such as Amazon, offer discounts if you sign up for automated delivery of select products. Not only will it be delivered, but you also won’t have to worry about running out.

CHECK FOR REBATE OFFERS

Sometimes, manufacturers offer product rebates. If you can find these, you’ll get money back on your purchase.

PRAISE (OR COMPLAIN)

If you have a food your pet loves, send an email letting them know. They may send you coupons or vouchers for products as a thank you.

Alternatively, if you have a problem with a product, make sure to reach out. The company may offer a refund or alternative product for your trouble.

SHOP THE WAREHOUSE

Skip the big box stores and head to your local warehouse. You may find larger bags at a lower cost sold there – saving you time and money.

BECOME A TRACKER

All stores run sales in cycles. They do this on food, clothes, and more – including pet food! Keep track of the offers at your favorite stores.

You will start to learn their cycle and can then stock up when items are on sale.

SKIP THE STORE AND MAKE HOMEMADE DOG FOOD

You can even bypass the store and make your own dog food right at home. There are countless recipes on Pinterest that you can try.

But, before you rush to start a cooking frenzy, make sure to carefully research each ingredient to make sure it is safe for your pet to consume.

PUT COUPONS TO WORK

Before you head to the store, head online, and search for coupons for your pet’s food. You may find them on the manufacturer’s website or on coupon printing sites.

Make sure to also check the product packaging as you may find them stuck to the front of that big bag of dog food.

GET FREE SAMPLES FROM YOUR VET

Vets get free samples of the products they sell – so ask for one! The freebies do not cost them anything, so they should be more than happy to give you one if you inquire.

The post YOUR GUIDE FOR SAVING MONEY ON PET FOOD appeared first on Penny Pinchin' Mom.

Finance

A Peek Into the Last Few Weeks (and our family vacation!)

How to get a shower and get ready for the day when you’re taking care of two babies! 🙂

People ask me all the time how I’m doing with having two babies and I think this early morning picture says it all. Life is full, my hands are full, and my heart is so full! (By the way, I’m actually putting this post together while trying to bounce Kierstyn to sleep in the Baby K’tan… it’s rare that I don’t have at least one baby in my arms these days!)

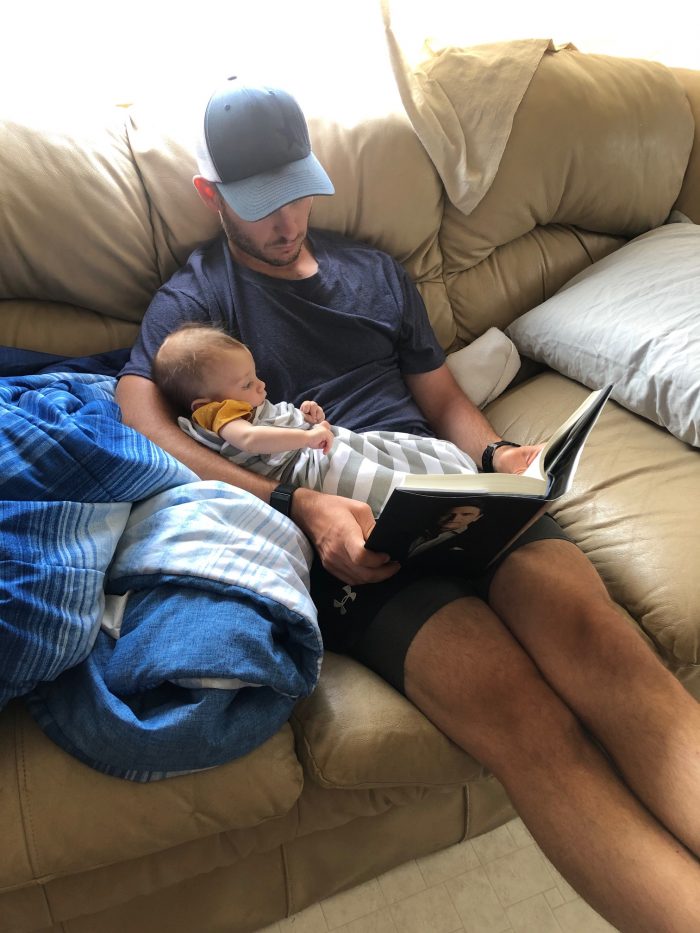

How could my heart not be full when this is an almost daily site at our house!

Silas had another weekend baseball tournament at a town about an hour away (Murfreesboro). We had fans set up with a generator, tents, lots of cold drinks in coolers, and these cold wraps to keep everyone cooled down

Champ has been learning how to hold his head up and roll over!

The babies have started to love having books read to them. Goodnight Moon was Silas’ favorite book when he was little, so it’s been so fun to introduce the babies to this book!

We packed for our family trip in tubs — each person got a tub for the week. This saved so much space in our vehicle and made things much more organized!

Our one out of state trip this summer was to go meet up with my family at Bull Shoals Lake in Arkansas. We weren’t sure if the trip was going to happen due to COVID-19, but because of a number of safety measures we put into place, DCS gave us special permission to be able to go and take Champ with us.

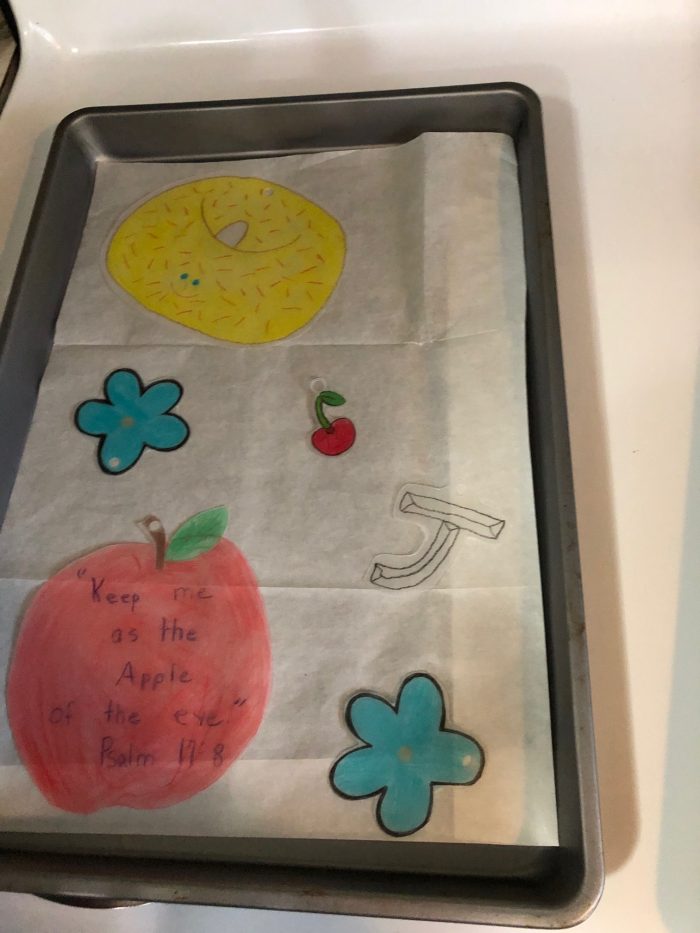

Every afternoon during our annual extended family lake vacation, my mom has “Grandma Time” with her grandkids. She teaches them a Bible lesson, they do a craft, have a snack, and do a game together.

Over the past two years, the older grand kids have started helping out. This year, each of the older ones signed up to help out with a craft and/or a snack and then Kathrynne is in charge of games (complete with an elaborate ticketing system and prizes they can turn their tickets in for at the end of the week ala Chuckie Cheese style!)

As many of you know, my mom had some serious health issues last year, including multiple extensive surgeries and skin grafts for skin cancer. She also got really sick with pneumonia in the middle of all that.

She almost didn’t get to come on the annual lake vacation last year. She did come, but she was so weak and sickly that I wondered if she’d make it another year.

This year, at 66 years old, she’s stronger than ever — not only leading Grandma Time, but also skiing and helping with the babies and cooking and looking for ways to reach out and serve all day long.

I know many of you prayed for her last year and I just wanted to tell you thank you, again! I look at this photo I snapped earlier this week and it just reminds me to be grateful for the many gifts it represents.

Her first time in a pool!

They had this sign at the pool! 😉

For details on how we all pitch in on meals and clean up, check out this post.

One of my favorite parts of our extended family vacations: the daily salad bars we have.

On our way home, we stopped by Ozark, MO so the girls and I could go in to the discount store there. (More details on what we bought coming this weekend!)

Jesse’s parents and his sister, Lisa, drove from Kansas to meet up with us so they could meet the babies, too.

I’m so grateful we got to spend time with extended family. This year certainly has made us so much more grateful for this!

A year ago, we were in the middle of our foster care home study and praying for who God would bring into our home for us to love on.

We were at peace about pursuing this path, but we were still apprehensive and wondering what it might mean for our future. There were so many unknowns, so many what if’s, and so many things outside our control.

I look back on this last year and the 5 children we’ve had the privilege to have in our home — 4 for just a very short-term stint and sweet little Champ who has been with us for almost 4 months.

There are still just as many unknowns, what if’s, and things outside our comfort zone. My heart has been broken in a hundred little pieces over the things we’ve seen and witnessed firsthand and the many kids and their stories whom we weren’t able to say yes to. I’ve cried more tears in the last 10 months than I’ve cried in the last 10 years (okay, pregnancy and postpartum probably played a part in that!).

And yet, my heart is fuller and happier than I can ever remember. The opportunity to love, pour into, and nurture has filled me up in the deepest of places. Seeing my husband and kids sacrifice and serve and love so well has been one of the most amazing experiences.

I don’t know what the future holds. I can imagine it will be full of heartbreak and beauty, tears and love, a roller coaster of emotions, and many things I can’t even imagine.

There are many unknowns, but this one thing I know: I don’t regret for one second saying “yes” to foster care. I look at these pictures and think, “We could have missed this.”

Finance

What Are Payroll Taxes? 8 FAQs About How a Tax Cut Would Work

Millions of people are on edge about their expired unemployment benefits and whether a second round of stimulus checks is coming.

But there’s another issue that keeps resurfacing as lawmakers wrangle over the next stimulus bill: payroll taxes.

The Republican-proposed HEALS Act didn’t include a payroll tax cut. Democrats are widely opposed to the idea. But President Trump continues to push for one and has said he could suspend payroll taxes without waiting on Congress.

So what exactly are payroll taxes, and who would benefit from reducing them or temporarily eliminating them altogether?

8 FAQs: What Are Payroll Taxes and How Would Cutting Them Work?

1. What are payroll taxes?

Payroll taxes are the taxes that are deducted from your paycheck for Social Security and Medicare. Sometimes they’re referred to as Federal Insurance Contribution Act (FICA) taxes.

For most employees, payroll taxes amount to 7.65% of earnings. You pay 6.2% of the first $137,700 of your salary for Social Security and nothing on earnings above that amount.

The remaining 1.45% goes toward Medicare. You’ll pay the full 1.45% no matter how much you earn. Unlike Social Security taxes, Medicare taxes don’t have a salary cap. Single filers earning above $200,000 and married couples filing joint returns earning over $250,000 pay an additional 0.9% Medicare tax.

Your employer matches the 6.2% you pay on your Social Security wages and the 1.45% you contribute to Medicare. However, they aren’t required to pay the additional 0.9% Medicare tax if your income exceeds the above thresholds.

The money that’s withheld is credited to your future retirement benefits.

2. How much do self-employed people pay?

Self-employed people are on the hook for both the employee and employer contributions, so they typically pay 15.3%, rather than 7.65%, into Social Security and Medicare.

3. Are 401(k) contributions subject to payroll taxes?

Yes. While you don’t pay income taxes on contributions to a traditional 401(k), Social Security and Medicare taxes are deducted upfront.

4. How much would a payroll tax cut save me?

The answer depends on how much you earn and how much the tax is reduced by. As of July 23, Republicans hadn’t yet released their proposal, so we don’t know whether we’re talking about a reduction or temporarily eliminating it.

Suppose the payroll tax was completely eliminated for a year and you earn $40,000. You’d save $3,060 a year, which would put an extra $59 or so in your pocket each week.

5. How would a payroll tax cut help me if I’m unemployed?

It wouldn’t, at least not directly. A payroll tax cut goes to people earning a paycheck and probably the businesses that employ them, as well.

Of course, supporters argue that people will spend the extra money and create jobs. Those in favor also say that businesses will be able to keep more workers on the payroll and even hire more workers if they’re spending less on taxes.

6. Are payroll taxes taken out of unemployment benefits?

No. While unemployment is taxed as ordinary income, you won’t pay payroll taxes on it.

7. Have payroll taxes ever been cut before?

Yes. The Obama administration temporarily cut employee payroll taxes (but not employer payroll taxes) by 2 percentage points in 2011 in the aftermath of the financial crisis. The tax cut only reduced Social Security taxes. Medicare taxes weren’t affected.

8. Would a payroll tax cut put my future Social Security and Medicare at risk?

Probably not. For the 2011 payroll tax cut, Congress used general revenues to make up the shortfall in the Social Security trust.

Can Trump Really Pass a Payroll Tax Cut on His Own?

The president has the authority to delay the due date for taxes during a declared disaster, but he can’t change the tax law.

So while Trump could order the IRS to suspend payroll tax collection by delaying the due date, he’d still need Congress to actually forgive the taxes. Otherwise, the tax bill will eventually come due.

Unless the cut is passed into law, tax experts say employers would likely err on the safe side and continue to withhold payroll taxes from employee paychecks.

Robin Hartill is a certified financial planner and a senior editor at The Penny Hoarder. She writes the Dear Penny personal finance advice column. Send your tricky money questions to [email protected].

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

-

Business2 weeks ago

Business2 weeks agoBernice King, Ava DuVernay reflect on the legacy of John Lewis

-

World News2 weeks ago

Heavy rain threatens flood-weary Japan, Korean Peninsula

-

Technology2 weeks ago

Technology2 weeks agoEverything New On Netflix This Weekend: July 25, 2020

-

Finance3 months ago

Will Equal Weighted Index Funds Outperform Their Benchmark Indexes?

-

Marketing Strategies7 months ago

Top 20 Workers’ Compensation Law Blogs & Websites To Follow in 2020

-

World News7 months ago

World News7 months agoThe West Blames the Wuhan Coronavirus on China’s Love of Eating Wild Animals. The Truth Is More Complex

-

Economy9 months ago

Newsletter: Jobs, Consumers and Wages

-

Finance8 months ago

Finance8 months ago$95 Grocery Budget + Weekly Menu Plan for 8