The Stretch IRA (individual retirement account) was a popular tax strategy. The strategy benefitted wealthy people who wanted to leave their robust retirement accounts to their heirs. However, there are alternatives to the retirement account that can benefit investors.

In this TradingSim article, I’ll explain what a stretch IRA is. I’ll also detail how people benefitted it from it before 2020. Then, I will explain how recent legislation essentially ended the stretch IRA. This article will also explain what alternatives exist to help taxpayers rebalance their portfolios to pass their retirement accounts down to their loved ones.

What is a stretch IRA?

A stretch IRA is a strategy that taxpayers used to pass a 401k or IRA down to a family member. When a person uses that strategy, they don’t have to pay taxes on the IRA after it’s passed down to their heirs.

The term stretch IRA comes from the ability to pass the account down from generation to generation and “stretch” the account for many years. If a taxpayer is investing on their own, they were able to to use stretch IRA’s to benefit their investment strategies.

Brian Graff is the president and CEO of the American Retirement Association. He wrote about the details of IRAs as estate planning for taxpayers.

“An IRA is an estate planning technique used to effectively spread the taxation of an inherited IRA by choosing a grandchild as a designated beneficiary,” wrote Graff.

“Under current rules, when an IRA account holder dies, the inherited IRA is generally required to be distributed over the life expectancy of the beneficiary. That would obviously be a long time — or ‘stretched’ — in the case of a grandchild beneficiary,” added Graff.

Financial experts explain the benefits of stretch IRAs

Financial Expert

Jeffrey Levine is a tax expert and a CPA and CEO of BluePrint Wealth Alliance. He noted that many wealthy taxpayers have used the strategy to benefit their surviving family members after they pass away.

“It makes sense: Once you’re dead, you don’t need a retirement account,” said Levine.

Financial expert Ric Edelman is co-founder of Edelman Financial Engines. He said that stretch IRA’s were a source of income.

“The Stretch IRA was a loophole. IRAs are designed to be lifetime income for you,” said Edelman.

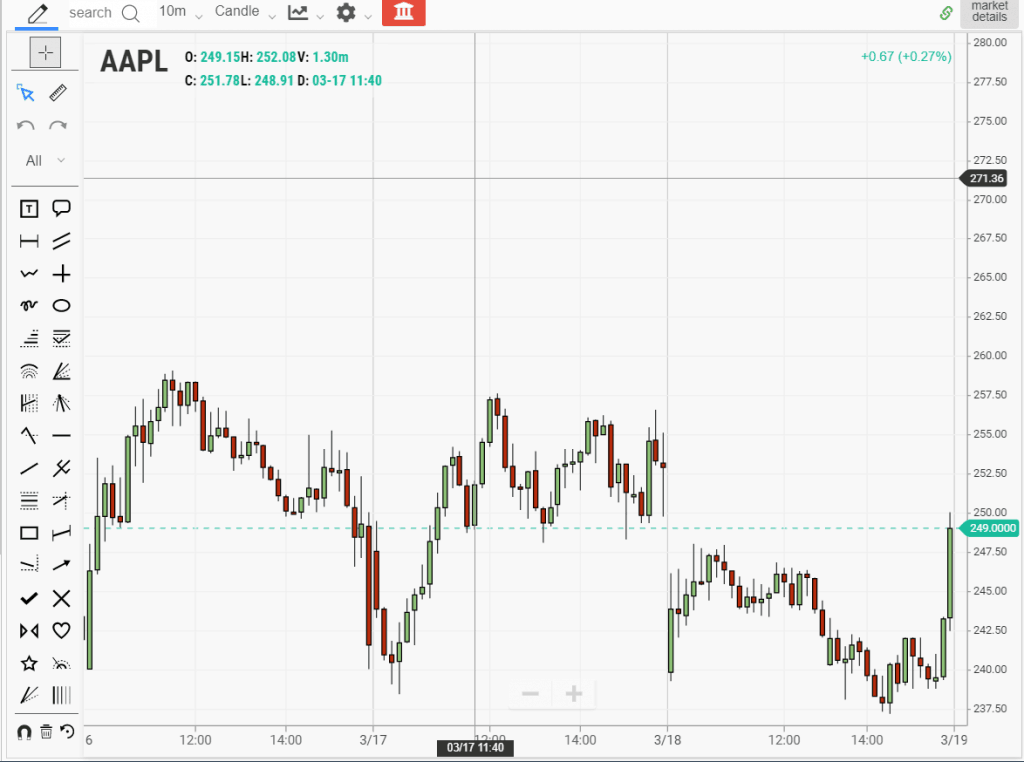

Apple stock is a popular stock for investors who have stretch IRAs

How is a stretch IRA different from a traditional IRA?

In a traditional IRA, a person takes the required minimum distribution after turning 72 by April 1. The IRS determines the required minimum distribution by taking the account balance on December 31 of the previous year.

After that, the IRS calculates the number of years left in an account holder’s life expectancy. The IRS “Uniform Lifetime” table makes that determination. The account holders and spouse beneficiaries withdrew their funds at a certain age. They withdrew funds by the age of 72 as well.

In contrast, in a stretch IRA, an account holder names their youngest relatives as beneficiaries instead of their spouses. The account gains value because it can take longer to cash out the IRA with a younger beneficiary.

The required minimum distributions are small enough to warrant smaller taxes. If an account holder’s spouse is named as a beneficiary, they roll the IRA over in their name. After that, they name a younger family member as a beneficiary to stretch the IRA without paying taxes.

Why are people against the stretch IRA?

While many wealthy people saw the stretch IRA as a way to expand wealth, many critics say it’s a way for the well-off to dodge paying taxes on their wealth. Former President Obama proposed a budget in 2016. In that proposed budget, non-spouse beneficiaries spend their IRA funds within five years. Tax expert Jeffrey Levine noted in 2019 that the limit would end the stretch IRA.

“In contrast, today such beneficiaries are generally able to extend distributions from their inherited retirement accounts over their life expectancy,” wrote Levine.

“To be very clear, this provision would effectively mark the death of the ‘stretch IRA,’ and all the tax benefits that come along with it,” added Levine.

Obama’s proposal in 2016 laid the groundwork for the SECURE Act.

Why is the stretch IRA “dead”?

Zombies

The Setting Every Community Up for Retirement Enhancement ( SECURE) Act in 2020 marked the end of the stretch IRA in its current incarnation. In that legislation, there were a variety of changes to retirement account rules. As a result of the changes, an account holder’s beneficiaries have to withdraw from an inherited IRA within 10 years.

Because of that change, beneficiaries can’t stretch the IRA tax-free for generations. Bill Van Sant is the senior vice president and managing director at Girard. He commented on how the end of stretch IRA’s affect inherited accounts.

“The result will most likely be a quicker depletion of the inherited IRA but also more of the inherited IRA going to taxes, especially if the beneficiary is working during the time in which they have to spend down this IRA,” said Van Sant.

“For a lot of people, the bulk of their wealth has been established in their IRAs,” said Michael Repak, vice president and senior estate planner with Janney Montgomery Scott.

“This law, even though it didn’t get the publicity of the Tax Cuts and Jobs Act, will have an equal impact on estate planning,” he added.

Michael Repak is a vice president and senior estate planner. He notes that

“For a lot of people, the bulk of their wealth has been established in their

IRAs,” said Repak.

“Any time a change like this comes along it forces the profession to revisit the arithmetic of their planning techniques,” said Repak. “Truth be told, we’re all in the same boat and trying to evaluate it all.”

What are the exceptions to the end of the stretch IRA?

Graff noted that there were exceptions to the end of the stretch IRA. He said the legislation “would change the rules so that it generally would require inherited IRAs to be distributed — and taxed — within 10 years. However, in the case of beneficiaries who are children, the 10-year period would not run until the child turns 18.

“So theoretically you could still ‘stretch’ the distribution for 28 years if the grandchild is a newborn, which admittedly is much less than the child’s life expectancy. It is important to note there are broad exceptions to this rule for IRA beneficiaries who are disabled and for surviving spouses,” added Graff.

While the stretch IRA is mostly ineffective, there are exceptions to the rule.

- Minors are exempt from the 10-year rule until they reach the age of 18.

- Beneficiaries are exempt if they’re no more than 10 years younger than the account holder. The law suspends the 10-year rule unto the death of the beneficiary.

- Disabled or chronically ill people are exempt from the law until the disabled beneficiary’s death. Then, the funds are spent within 10 years.

- A surviving spouse can roll over inherited assets into their own IRA’s to bypass the stretch IRA. The remaining assets are distributed within 10 years of the surviving spouse’s death.

What does the SECURE Act mean for taxpayers and their IRAs?

As a result, many IRA holders have to make changes to their accounts. Rhian Horgan is the founder of Kindur, a retirement financial technology company. He advocates that people make their spouses beneficiaries of their accounts. With that action, they can spend the IRA within the 10-year window.

“Check your IRA beneficiaries. It may be more beneficial to name your spouse, rather than children, as the beneficiary as they are not subject to the 10-year distribution rules,” said Horgan.

In addition, the required minimum distribution age to make withdrawals changed. Before the SECURE ACT, the age was 70 1/2. Now that age is 72. Tony Drake, a certified financial planner, explained the details of the age changes.

“If you hit age 70 1/2 in 2019, you will need to take RMDs for 2019 and 2020 even though you don’t turn 72 until 2021. Those who turn age 70 1/2 in 2020 do not have to take their RMDs until age 72,” said Drake.

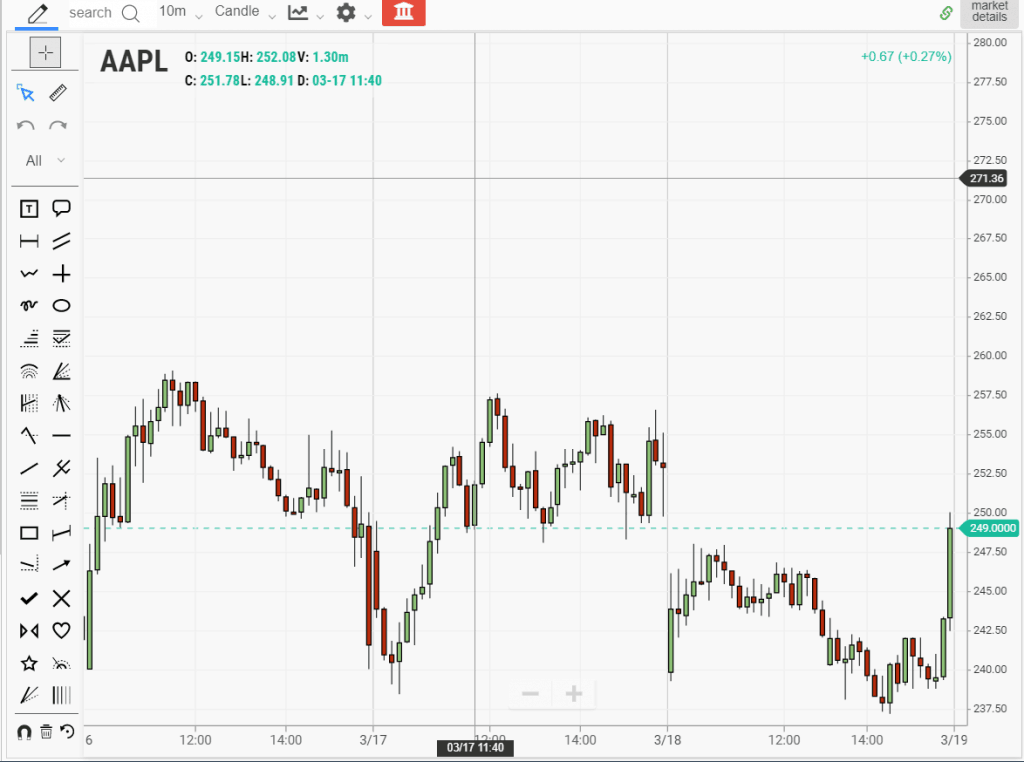

The SECURE Act impacts retirement accounts like stretch IRA’s

How does the SECURE ACT impact workers?

“The SECURE Act pushed that limit to age 72, allowing for IRA owners to defer paying tax on those funds while they, hopefully, keep growing,” added Drake.

Drake also noted that the SECURE Act helps IRA holders who are still working.

“The SECURE Act allows you to continue contributing to your IRA at any age as long as you are still working. This gives you a valuable tax deduction and helps you save more for retirement,” said Drake.

Drake also noted that small business owners can benefit from the SECURE Act.

“It encourages more small businesses to offer employees a 401(k) by utilizing tax credits to cover some of the cost,” said Drake.

“The SECURE Act allows plan providers to include more guaranteed lifetime income options, or annuities, in employer-sponsored 401(k)s,” added Drake.

How does the loss of stretch IRAs impact overall IRAs and estate planning?

Leon LaBrecque, chief growth officer of Sequoia Financial Group, noted that the new legislation will “open the whole door to a lot of financial planning.”

LaBreque also said that the SECURE Act impacts wealthy taxpayers. In addition, the legislation will impact middle-class IRA holders that are diligent savers.

“It really changes planning for anyone with an IRA bigger than about $400,000,” said LaBrecque. “And it wouldn’t just impact those with an IRA today,” said LaBrecque.

He noted it will impact “anyone with a large 401(k), 403(b), a pension plan, or any other retirement asset that will eventually get rolled into an IRA. This affects regular folks.”

“This law, even though it didn’t get the publicity of the Tax Cuts and Jobs Act, will have an equal impact on estate planning,” he added.

What are the tax implications for IRA holders after the SECURE Act?

As a result of the SECURE Act, there are many implications for taxpayers. Jamie Hopkins is the director of retirement research and vice president of private client services at the financial advisory firm Carson Group. He notes that assets in an IRA would have less time to grow under the new legislation.

When a beneficiary withdraws from the IRA, they have to withdraw a greater amount of money that will push them into a higher tax bracket.

“For most people, that would push them into a higher tax rate,” said Hopkins.

That child is getting that money at a point in time when he or she is probably in their highest earning years,” say

David Levine is a tax attorney at Groom Law Group. He joked that it would be better for IRA holders to pass away in 2019. Taxpayers could have still benefited from the stretch IRA last year.

“In some cases, it may be better to die on Dec. 31, 2019 than Jan. 1, 2020,” said Levine.

How does the end of stretch IRAs affect trusts?

Living Trust

In this bear market, IRA beneficiaries have to spend the money quicker than before. Ed Slott, a financial expert noted that IRA beneficiaries have to spend money quickly from any conduit trust that helped heirs inherit money.

Conduit trusts were similar to stretch IRAs. Trusts are a form of estate planning that gives the trust holders more control over their retirement accounts. Because of that leeway, they can let young beneficiaries extend IRA benefits. However, Slott noted that with the SECURE Act, the money must be withdrawn within a decade.

“Money is out [from the trust] after 10 years, and may get paid out to the very beneficiaries you used the trust to protect it from,” said Slott.

“Your trust won’t work anymore the way you thought it did. This is an emergency planning situation,” added Slott.

What do financial advisors advise about the end of the stretch IRA?

Many financial experts have different kinds of advice about how to handle the changes to the stretch IRA. Melissa Kahn is an advisor for State Street Global Advisors. She wants investors to talk to their financial advisors to change their estate planning.

“Advisors will want to talk to their individual clients as well as their small plan employers who may have used the ‘Stretch’ IRA tax rules for estate planning purposes. They will need to be aware of the changes and perhaps pivot to other estate planning strategies,” said Kahn.

Frederick Brackin is an associate in Gunster Law Firm’s Tax Law and Private Wealth Services. He advised IRA holders to have conduit trusts as alternatives to stretch IRA’s.

“For instance, if the client has named a conduit trust as a beneficiary, then that should immediately be discussed because under the new rule the payments to a conduit trust would flow through to the beneficiary of that trust over the 10-year period instead of over the beneficiary’s life expectancy under the prior rule,” said Brackin.

“The client may not want the beneficiary of that trust to receive such a substantial amount outright and therefore it may be necessary to amend the trust to provide for an accumulation trust instead of a conduit trust,” added Brackin.

What do financial advisors says about inherited IRAs?

Brackin adds that financial advisors should help IRA holders and advise them on how to work around the end of stretch IRAs.

“Therefore, advisors should work with clients to determine if a full or partial Roth conversion may make sense in that client’s specific situation. A Roth conversion will not be recommended under all circumstances, but where the correct circumstances exist,” said Brackin.

“For instance, if the account owner can pay the income tax on the conversion with funds that are outside of the retirement account, then the Roth conversion may be a way to work around some of the income tax issues created by the new 10-year rule,” added Brackin.

Steve Parrish is co-director of the Retirement Income Center at The American College of Financial Services. He noted that inherited IRAs will have to be reexamined.

“Inherited IRA trusts will have to be completely redrafted. Some new planning may come where the inherited IRA is deferred for 10 years after death and then paid out as a lump sum.” said Parrish.

If IRA holders still want to stretch their retirement account benefits to their loved ones, here are the top five alternatives.

1. Accumulation trusts can be better alternative to stretch IRA

If IRA holders still want to extend their IRAs, they can put their funds in accumulation trusts. Accumulation trusts are exempt from the SECURE Act if account holders take action.

While the SECURE Act requires IRA beneficiaries to withdraw their funds within 10 years, accumulation trusts can be an exception. If an IRA holder chooses, the trustee can decide to stretch the withdrawals out for several years.

Accumulation trusts can have tax liabilities

Charlie Douglas, president of HH Legacy Investments, advises IRA holders to choose accumulation trusts. In that case, trustees have more control over how they give their heirs benefits.

“If you want the stretch benefit, you have to get rid of that [see-through] trust and go to an [accumulation] trust,” said Douglas.

While the trust may be beneficial to IRA holders, there is a tax burden. If they don’t choose traditional IRAs, there can be a hidden additional tax. With a traditional IRA, the trusts are taxed at a higher rate.

2.Roth IRAs a top alternative to stretch IRAs

In addition to accumulation trusts, Roth IRAs are another good alternative to stretch IRAs. Financial advisor Michael Repak noted that the change to stretch IRAs may make investors look closer at Roth IRA’s.

“This will force people to take a hard look at Roth conversions,” said Repak.

An IRA conversion to a Roth IRA would mean a reduced tax bill for the account holders. In contrast, the IRS taxes withdrawals from traditional IRAs at a higher rate.

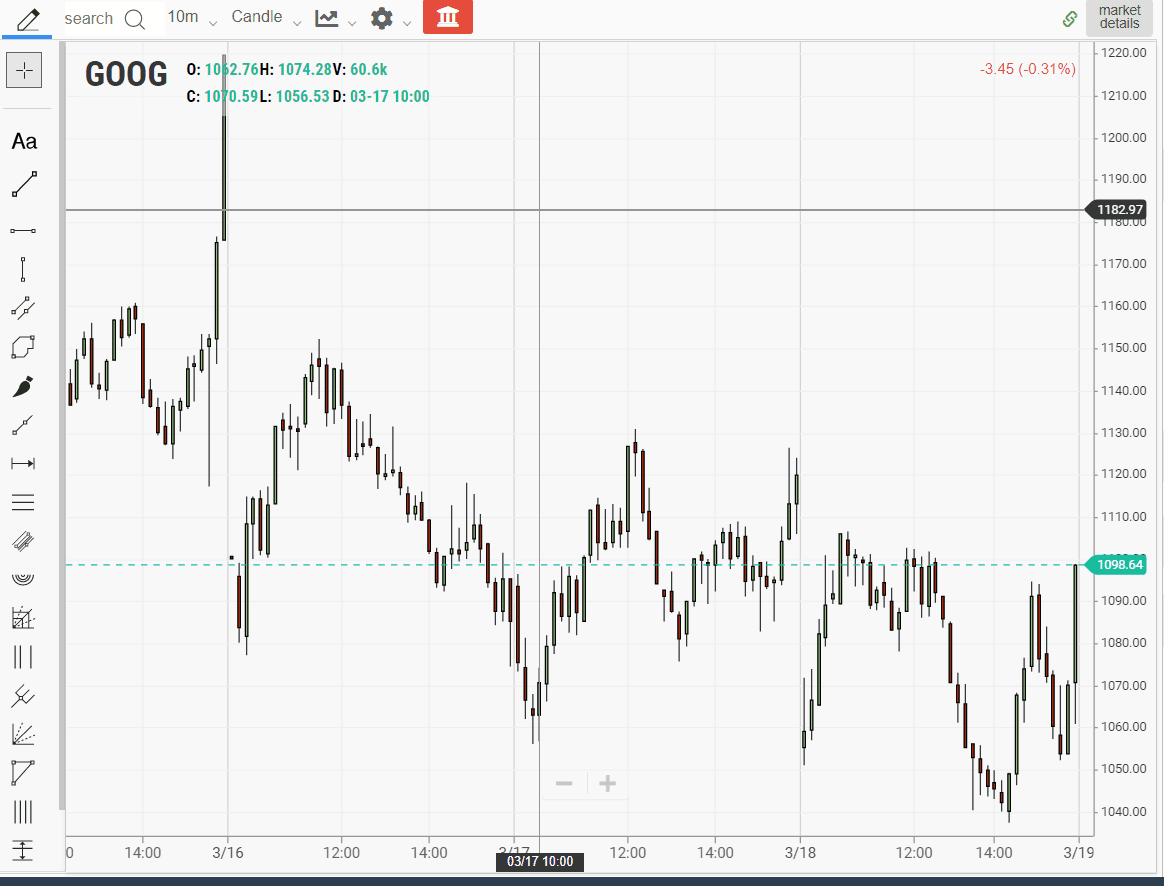

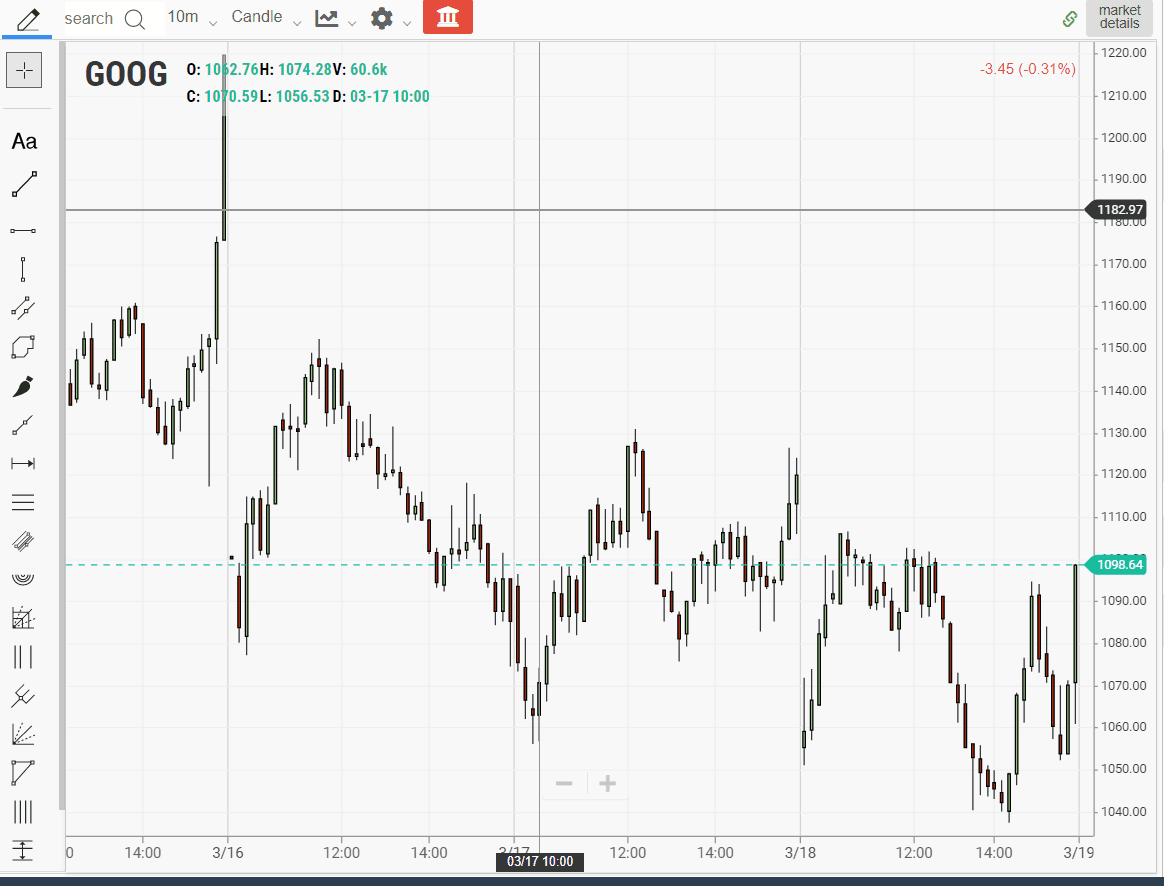

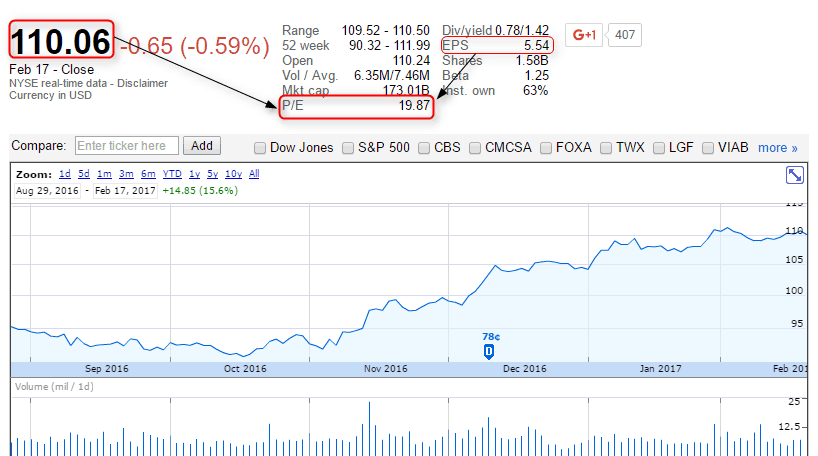

Google stock is a common holding in Roth IRAs

IRA expert Ed Slott noted that the Roth IRA’s can be a better alternative to a stretch IRA. It can also be better than a traditional IRA.

“That strategy was not workable once you turned 70 1/2 because the process starts by being eligible to make a contribution to a traditional IRA. Now, they can do the backdoor Roth even after 70 1/2,” said Slott.

When the IRA holder first converts their traditional account to a Roth IRA, there is a tax penalty in the year of the conversion. The original account holder pays income tax on the money that’s converted into a Roth IRA. Because the original money was never taxed, it has to be taxed as income.

Many taxpayers may see this conversion as costly. However, Rehak notes that the extra cost will have long-term benefits.

“Just about every planning technique involves some trade-offs. But the trade-offs can be worth it, said Repak.

How can heirs benefit from Roth IRAs?

Non-spouse beneficiaries of IRA holders withdraw benefits tax-free if the money was contributed using after-tax income. That’s possible if the account was five years old when the IRA holder passed away.

Rob Greenman is a financial adviser and partner of Vista Capital Partners. He commented that the tax liability for heirs can be lower. That’s possible if they’re in the same tax bracket as the original IRA holder.

“Chipping away at the future tax liability due on withdrawals at low-income bracket levels over a number of years could be a favorable move,” said Greenman.

Christine Russell is a senior manager of retirement and annuities at TD Ameritrade. She recommends that IRA holders have different accounts for heirs that have different incomes.

“A solid strategy now is to have multiple primary beneficiaries,” says Russell.

“You could leave a bigger traditional IRA to a low earner, and a smaller Roth IRA to a high earner,” added Russell.

New Roth IRAs can help sidestep stretch IRAs

LaBrecque advised IRA holders could fund a completely new Roth IRA to leave inheritances to their heirs. The contribution limit is $6,000 if an account holder is under 50. If the account holder is 50 and older, the limit is $7,000. The income limit is $137,000 for single taxpayers and $203,000 for married couples.

LaBrecque noted that Roth IRAs can be part of an inheritance to bypass stretch IRAs. He also commented that Roth IRA’s can be used to sidestep the stretch IRA instead of leaving liquid cash.

“Instead of trying to leave them money when you die, you can use a Roth as part of their inheritance,” said LaBrecque.

Slott noted that wealthy IRA holders want to make sure the funds are not squandered or lost.

“Clients [with the largest IRA balances] are naturally concerned about post-death control. They built large IRAs and want to make sure that these funds are not misused, lost or squandered,” said Slott.

He notes that that IRAs are misused “by beneficiaries due to mismanagement, lawsuits, divorce, bankruptcy or by falling prey to financial scams or predators.”

“In order to keep your client’s IRA estate plan intact, the IRA portion will probably have to be replaced with either a Roth IRA (via lifetime Roth conversions) or with life insurance, which offers better leverage and flexibility since it won’t be subject to any post-death Secure Act limitations,” said Slott.

What do financial advisors say about Roth IRA taxes to bypass stretch IRAs?

Financial experts have tax advice about Roth IRA conversions. Jeffrey Corliss is managing director and partner at RDM Financial Group. He advises IRA holders to pay taxes on Roth conversions from outside assets.

“You want to pay the taxes due on the conversion from outside assets and not from the converted IRA assets. Due to penalty issues, it is never better to pay with funds from the IRA being converted, especially if you are under [age] 59 ½,” said Corliss.

Corliss also believes that a Roth IRA would be a good alternative to a stretch IRA.

“Given the change to the stretch IRA provision in the SECURE Act, doing a Roth IRA conversion may make sense and is at least worth looking into with your tax adviser,” says Corliss. “It may save you or your heirs many dollars in income taxes.”

Van Sant spoke about how IRA beneficiaries can have tax benefits from Roth IRA’s.

“The original IRA owner will begin converting all or part of their IRA into a Roth IRA during their lifetime,” says Van Sant. “Although upon the original owner’s passing, the beneficiaries will still have to deplete the Roth IRA within 10 years, there will be no tax consequences [for the inheritors] as distributions from Roth IRAs are not subject to federal taxes.”

3. Life Insurance

In addition to Roth IRA’s, life insurance is an option for people who want to bypass the stretch IRA’s.

Financial expert Ric Edelman noted that life insurance can be an asset to taxpayers. They can benefit from having a life insurance policy to pass down to heirs.

“Parents can spend all of their assets and the kids still get an inheritance,” said Edelman.

What are the tax benefits of using life insurance to bypass the stretch IRA?

Greg Hammond is a financial professional with Hammond Iles Wealth Advisors. He noted that life insurance policies can reduce the taxes heirs have to pay.

“This strategy can be used by individuals of any age to increase the impact of their retirement funds. ” It can also “reduce the tax burden on their future heirs while paying less in income and estate taxes,” said Hammond.

Hammond noted that a life insurance policy can help limit tax liabilities for IRA holders.

“This ‘double impact’ retirement account strategy uses distributions from a retirement account to pay for a life insurance policy owned outside of the individual’s taxable state,” said Hammond.

It would “thereby leave an income and estate tax-free inheritance to their future heirs,” noted Hammond.

“Both the heirs and the charities receive the benefit of the planning, while potentially avoiding taxes,” added Hammond.

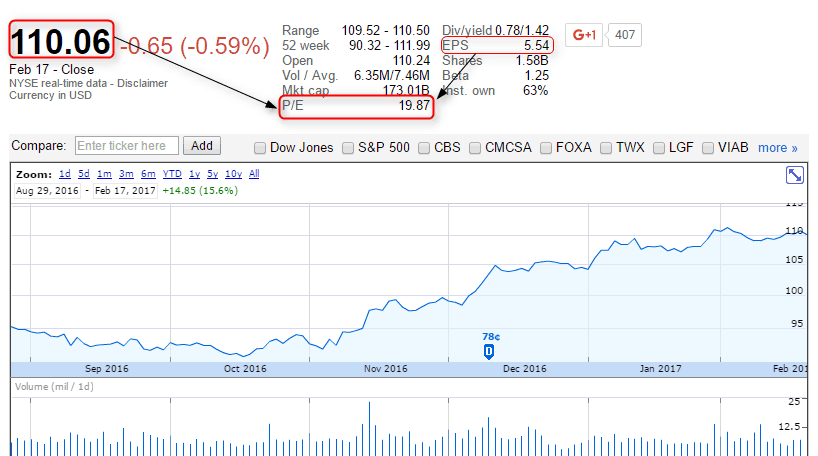

Disney stock is a common stock that’s passed down through stretch IRAs

While using life insurance as an alternative to stretch IRAs is a good strategy, it isn’t always affordable. If an IRA holder lists an heir as a beneficiary on a life insurance policy late in life, it may cost more. Michael Roberts is president of Arden Trust Company. He warns policy holders to add their beneficiaries as soon as possible.

“That premium wouldn’t be cheap, and you would need to be insurable,” said Roberts.

If IRA holders want to find an alternative to stretch IRAs, a generous life insurance policy is always a good option.

4. Donating to Charity

Another way to bypass stretch IRAs is to donate IRA funds to charities. Keith Bernhardt is vice president of retirement income for Fidelity Investments. He noted that charitable contributions can help an IRA holder’s heirs.

“You might also want to do charitable giving from an IRA now and leave more money in other assets to heirs”, said Bernhardt.

How does charitable giving have an effect on taxes without a stretch IRA?

Craig Wild is a CPA and senior partner at Wild, Maney, & Resnick, LLP. He noted that taxpayers that take the standard deduction could lose a tax benefit.

“People that make charitable donations are losing the tax benefit if they’re taking the standard deduction,” said Wild.

If taxpayers over 70 want to make a direct donation from their IRA’s to charity, it can help heirs- and reap tax benefits. Wild noted that a qualified charitable contribution can meet the requirement to take minimum deductions.

“That’s an indirect way to get a tax benefit,” said Wild.

In addition, there are ways to help the beneficiaries as well.

Tim Steffen is a CPA and wealth management consultant with PIMCO. He echoes Wild’s assertion that the trust payment can copy the required minimum distribution to a beneficiary.

“In these cases, the payment you get off the trust can replicate the required minimum distribution the beneficiary would have taken from an IRA,” said Steffen.

“You get a payment from the charitable remainder trust instead of the IRA each year,” added Steffen.

While there is a tax deduction, the amount may be less because of the IRS. Thomas Neuhoff is a CPA with Henry & Peters in Tyler, Texas. He noted that the charitable deduction may be less than expected.

“The charitable deduction up front is so much smaller because of the rate set by the IRS,” said Neuhoff.

5. Create a charitable trust to bypass stretch IRA

In addition to giving money to a charity, IRA holders can create charitable trusts as an alternative to stretch IRAs. While it is possible, the amount in the IRA that a holder needs could be hefty. Robert S. Keebler is a CPA and partner with Keebler & Associates LLP. He noted that a great amount is needed in an IRA to create a charitable trust.

“Realistically, you’ll need at least $500,000 in the IRA to make it worthwhile,” said Keebler.

If there is a tragedy involving an heir, Keebler notes that the money in the trust still goes to a charity.

“If you do it for the life of your child, and the child dies a month after you do”, there is a consequence. “Then that money goes to charity,” said Keebler.

What are the tax implications of a charitable trust to bypass stretch IRAs?

Scott Bishop is vice president of financial planning with STA Wealth Management. He explained how charitable trusts are created.

“The asset owner could create and fund the trust with IRA assets at death, and beneficiaries would get a regular income stream from the trust,” said Bishop.

He also added that “similar to the required minimum distributions from an inherited IRA, which could be distributed over a certain amount of time or the beneficiary’s lifetime.”The assets are only taxed when they leave the trust.”

Repak noted that the longer that a person should carefully plan their charitable trust.

“The longer the period for the stream of payments, the less the tax deduction, so the term of the trust should be considered and coordinated with the IRA owner’s family goals and objectives,” said Repak.

“I think this is one of the most interesting options, but it’s important to bear in mind that this works best for a family that already has philanthropic intentions,” said Repak.

While giving to charity is something people should do anyway, creating a charitable trust can offer a way for IRA holders to help their heirs as well.

Alternatives to stretch IRA can help account holders and their heirs

While the stretch IRA is effectively over, there are still options for account holders. These alternatives can help account holders pass down their hard-earned assets to their loved ones. With TradingSim’s informative articles, people can find the best information to have the best financial futures.

The post Top 5 Alternatives to the Stretch IRA appeared first on - Tradingsim.

Source link

قالب وردپرس