Economy

IPA’s weekly links

Guest post by Jeff Mosenkis of Innovations for Poverty Action

- Two Blattman-related things, for researchers and aspiring researchers:

- IPA’s Peace and Recovery program is accepting research proposals, on topics such as war, peace, electoral violence, state-sponsored violence, terrorism, forced displacement, natural disasters, and recovery from all the above.

They fund: “full randomized trials, pilot studies, exploratory and descriptive work, travel grants, and (in rare but deserving cases) non-experimental evaluations.”

Applications from early career researchers (including Ph.D. and post-docs) are welcome, and there are small exploratory funds (under $10k) earmarked for them.

Deadline December 6th, more here, and you can see previously funded work here. - For those who want to do that work someday and want to work with Chris, a very cool Senior RA job posting, to work with Chris in Liberia following up in a landmark study (summary & ungated paper) combining cognitive behavioral therapy with cash transfers for seriously at risk youth (if I recall, interviews were sometimes interrupted so the respondent could go pickpocket someone.) Three reasons I think this follow-up project is cool:

-It’s part of a burgeoning literature on mindset/psychological interventions, and answers questions about the lasting effects. It’s also Chris’ 3rd study following up on the long-term effects of cash transfers, and the first 2 have yielded interesting findings.

-Methodologically, working in these circumstances is really interesting. The original team developed a new method to figure out if people were telling the truth in surveys on questions like how much crime they were committing.

-The original cognitive-behavioral program was developed by Johnson Borh, a Liberian conflict survivor. You can hear him and Chris talking about it on Freakonomics here.

Feel free to send the job link to anybody who might be interested (and really good)

- IPA’s Peace and Recovery program is accepting research proposals, on topics such as war, peace, electoral violence, state-sponsored violence, terrorism, forced displacement, natural disasters, and recovery from all the above.

- I asked for non-academic jobs for Ph.D.s. - here’s one doing evals w/ the American Institutes for Research in DC, and with Mercy Corps directing research on conflict, governance, and migration (being vacated by Rebecca Wolfe, who’s going to UChicago). Feel free to send me more.

- An amazing interview between Dave Evans and Nobel laureate Michael Kremer this week. I wish I could pick just one excerpt, but it was all really great (stay for the questions at the end). Video here, and audio below for those on the go:

- Also see Dave’s blog post summarizing 100+ papers by Esther Duflo

- Damon Jones shares his spreadsheet system for keeping track of travel expenses and reimbursements.

- A group of Stanford researchers, including political scientist Shelby Grossman, caught Russian-run fake Facebook accounts trying to influence public political opinion in four African countries.

- In Israel, random assignment of Jewish patients to an Arab doctor (vs a Jewish one) reduces social distance and increases perceptions of possibilities for peace among the patients (via John Holbein).

- I’m still processing this psych paper where 49 authors from 15 research teams tested 5 hypotheses with >15,000 participants (there was also a prediction component), and did both meta and Bayesian analyses on the effect sizes/replicability. As you can see from the graph above, there was a lot of variation in replication, but (if I understand), they attribute it mainly to the choices the research teams made in how to test the hypotheses (e.g. study design). I can’t decide if it’s good or bad news that researcher choices in how to answer the same question yields so much variation.

The post IPA’s weekly links appeared first on Chris Blattman.

Economy

Nominal Income Targeting and Measurement Issues

Nominal GDP targeting has been advocated in a recent Joint Economic Committee report “Stable Monetary Policy to Connect More Americans to Work”.

The best anchor for monetary policy decisions is nominal income or nominal spending—the amount of money people receive or pay out, which more or less equal out economy-wide. Under an ideal monetary regime, spending should not be too scarce (characterized by low investment and employment), but nor should it be too plentiful (characterized by high and increasing inflation). While this balance may be easier to imagine than to achieve, this report argues that stabilizing general expectations about the level of nominal income or nominal spending in the economy best allows the private sector to value individual goods and services in the context of that anchored expectation, and build long-term contracts with a reasonable degree of certainty. This target could also be understood as steady growth in the money supply, adjusted for the private sector’s ability to circulate that money supply faster or slower.

One challenge to implementation is the relatively large revisions in the growth rate of this variable (and don’t get me started on the level). Here’s an example from our last recession.

Figure 1: Q/Q nominal GDP growth, SAAR, from various vintages. NBER defined recession dates shaded gray. Source: ALFRED.

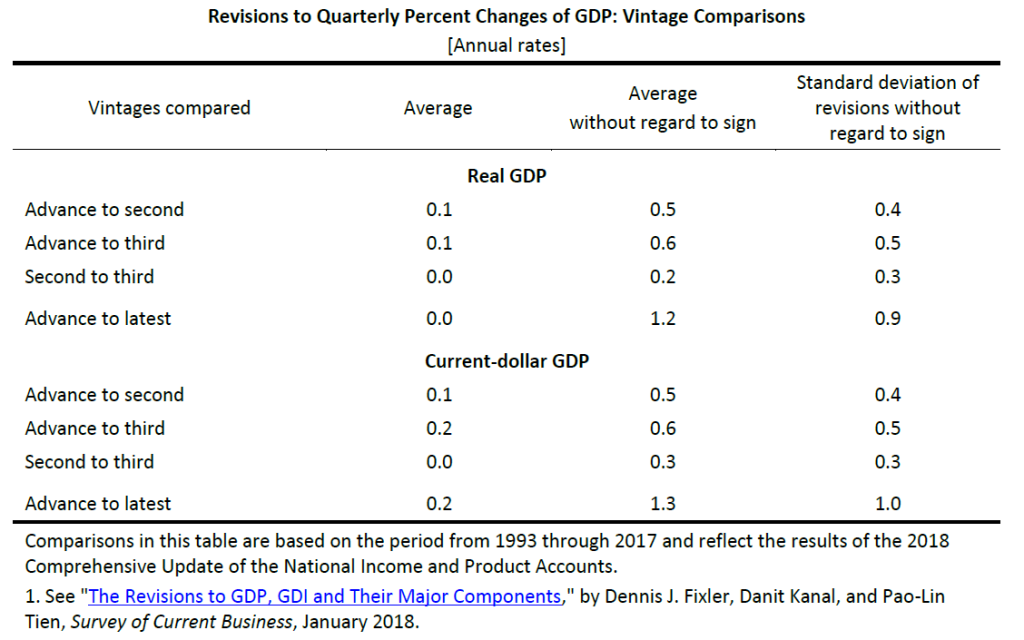

How big are the revisions? The BEA provides a detailed description. This table summarizes the results.

The standard deviation of revisions going from Advance to Latest is one percent (annualized), mean absolute revision is 1.3 percent. Now, the Latest Vintage might not be entirely relevant for policy, so lets look at Advance to Third revision standard deviation of 0.5 percent (0.6 percent mean absolute). That’s through 2017. From the advance to 2nd release, 2020Q2 GDP growth went from -42.1% to -40.5% (log terms).

Compare against the personal consumption expenditure deflator, at the monthly — not quarterly — frequency; the mean absolute revision is 0.5 percent going from Advance to Third. The corresponding figure for Core PCE is 0.35 percent. Perhaps this is why the Fed focused more on price/inflation targets, i.e.:

…variants of so-called makeup strategies, “so called” because they at times require the Committee to deliberately target rates of inflation that deviate from 2 percent on one side so as to make up for times that inflation deviated from 2 percent on the other side. Price-level targeting (PLT) is a useful benchmark among makeup policies but also represents a more significant and perhaps undesirable departure from the flexible inflation-targeting framework compared with other alternatives. “Nearer neighbors” to flexible inflation targeting are more flexible variants of PLT, which include temporary PLT—that is, use of PLT only around ELB episodes to offset persistently low inflation—and average inflation targeting (AIT), including one-sided AIT, which only restores inflation to a 2 percent average when it has been below 2 percent, and AIT that limits the degree of reversal for overshooting and undershooting the inflation target.10

Admittedly, the estimation of output gap is fraught with much larger (in my opinion) measurement challenges than the trend in nominal GDP, as it compounds the problems of real GDP measurement and potential GDP estimation; this is a point made by Beckworth and Hendrickson (JMCB, 2019). Even use of the unemployment rate, which can be substituted for the output gap in the Taylor principle by way of Okun’s Law, encounters a problem. As Aruoba (2008) notes, the unemployment rate is not subject to large and/or biased revisions; however the estimated natural rate of unemployment, on the other hand, does change over time, as estimated by CBO by Fed, and others, so there is going to be revision to the implied unemployment gap (this point occupies a substantial portion of JEC report). Partly for this reason, the recently announced modification of the Fed’s policy framework stresses shortfalls rather than deviations, discussed in this post.

One interesting aspect of the debate over nominal GDP targeting relates to growth rates vs. levels. If it’s growth rates (as in Beckworth and Hendrickson (JMCB, 2019), there is generally a “fire and forget” approach to setting rates. An actual nominal GDP target of the level implies that past errors are not forgotten (McCallum, 2001) (this is not a distinction specific to GDP as we know from the inflation vs. price level debate). Targeting the level of nominal GDP faces another — perhaps even more problematic — challenge, as suggested by Figure 2.

Figure 2: Nominal GDP in billions of current dollars, SAAR, from various vintages. NBER defined recession dates shaded gray. Dashed red line at annual benchmark revisions. Red arrows denote implied revisions to last overlapping observation between two benchmarked series. Source: ALFRED.

Revisions can be large at benchmark revisions, shown as dashed lines in the above Figure. But even nonbenchmark revision can be large, as in 2009Q3. ( Beckworth (2019) suggests using a Survey of Professional Forecasters forecast relative to target and a level gap as means of addressing this issue — I think — insofar as the target can be moved relative to current vintage.)

None of the foregoing should be construed as a comprehensive case against some form of nominal GDP targeting — after all Frankel with Chinn (JMCB, 1995) provides some arguments in favor. But it suggests that the issue of data revisions in the conduct of monetary policy is not inconsequential.

Economy

Biden’s Big Test: Selecting a White House Chief of Staff

The American Prospect

Vice President Joe Biden was angry. It was 2013, and Ron Klain, his trusted chief of staff, was leaving for the private sector. Biden needed someone dependable to replace him during the second term. But David Plouffe, President Obama’s campaign guru and top political adviser, kept shooting down his picks. First, he vetoed Kevin Sheekey, an adviser to then–New York Mayor Michael Bloomberg, out of fear he’d be too loyal to the financier-oligarch. Biden conceded, and instead suggested Steve Ricchetti.

Ricchetti, a longtime political operative, was at the time the founder and chairman of the powerful lobbying firm Ricchetti, Inc. Though he hadn’t personally registered as a lobbyist in years, he did give the marching orders to a team of hired guns for the most powerful industries in America, including extensive ties to Big Pharma.

Plouffe didn’t budge. “The Ricchetti pick also was killed,” Glenn Thrush reported for Politico Magazine at the time, “in part because Plouffe said his background violated the president’s no-lobbyists pledge—but mostly because Ricchetti was deemed to be too chummy with the Clintons and too much of a ‘free agent’ who would look after Biden’s interests first.”

This enraged Biden. Who was Plouffe, a man 24 years his junior, to tell him what to do? “He [Biden] appealed directly to Obama, who initially deferred to Plouffe’s judgment,” Thrush reports. “Biden pressed Obama harder, arguing that he ‘needed to have his own people to do this job,’ as one aide briefed on the interaction put it. Obama finally assented—with the caveat that Biden had ‘to keep Steve from coloring outside of the lines.’”

Progressives need only to hear the name “Rahm Emanuel” to remember the stakes of this job.

That fight was over seven years ago. Ricchetti kept the job as Biden’s chief of staff throughout the second term. In 2014, Plouffe, who was so wary of bad optics on corporate power, revolved out to lobby for Uber, and now represents Mark Zuckerberg. Today, Ricchetti co-chairs Biden’s presidential campaign, and is well positioned to resume his role as Biden’s chief of staff in the White House, should his boss vanquish Donald Trump in November. If this happens, a man who has always argued against Biden’s best instincts, and a lifelong enemy of the progressive movement, will be the chief gatekeeper to the president’s desk.

The White House chief of staff is the single most powerful non-Senate-confirmed job in the federal executive branch. It typically involves managing the president’s schedule, deciding which of his advisers get face time with him, and giving marching orders for any day-to-day work that the president doesn’t personally oversee.

Progressives need only to hear the name “Rahm Emanuel” to remember the stakes of this job. As Obama’s first chief of staff, Emanuel kneecapped efforts to even propose a federal stimulus that matched the scale of the Great Recession, and constantly pushed the administration to make up the difference by hurting the most vulnerable. (Anyone remember “Fuck the UAW”?)

Ricchetti may be subtler and smarter than “Rahmbo,” but he would be no less of a threat if placed in charge of the Biden White House. More than just cussing out organized labor, Ricchetti’s career highlight was deliberately undermining it: He led Bill Clinton’s effort to pass permanent normal trade relations (PNTR) with China in 2000, which economists predicted at the time would cause massive blue-collar job loss. Research since has concluded that PNTR directly led to the manufacturing collapse, and that the affected (largely union) workers were unable to re-skill in the way traditional trade theory suggests they would.

At the time, only 28 percent of the public supported normalized trade with China, while a staggering 56 percent opposed it. A separate poll found 79 percent of Americans felt the country should only normalize trade with China after it improved its human rights record and labor standards. None of this dissuaded Ricchetti from pushing PNTR through Congress by any means necessary.

As Biden rightly calls out Donald Trump’s contempt for democracy on the campaign trail, he should consider what it would mean to put someone so dismissive of the popular will in charge of his own White House. Moreover, his “Build Back Better” economic agenda hinges on revitalizing American manufacturing. Why would he trust the man who helped crush manufacturing in the first place to accomplish that?

Given the clients that both Ricchettis are willing to take on, it’s perhaps unsurprising that Steve has been the Biden campaign’s ace in the hole when it comes to high-dollar fundraising.

And then there are Ricchetti’s ties to the most hated industry in America, Big Pharma. Biden has pivoted to an aggressive plan for lowering prescription drug prices, a problem on which GOP voters, Nancy Pelosi, and Alexandria Ocasio-Cortez are all united. He has vowed to repeal the law that prohibits negotiation with drug companies under Medicare, limit launch prices that set a high baseline for prescription drugs, confine price increases to the rate of inflation, and accelerate the development of generics. What message would it send about the seriousness of this plan for Biden’s right-hand man to have personally represented Novartis, Eli Lilly, and Sanofi?

Just last night, news broke that Ricchetti, Inc. has signed on to lobby on behalf of two pharmaceutical companies, Horizon Pharma and GlaxoSmithKline. This is on top of the firm’s longstanding relationship with Japanese pharmaceutical giant Eisai, whom Steve Ricchetti’s brother Jeff, co-founder of the lobbying firm, personally represents. Big Pharma clearly knows that their route into sabotaging Biden’s prescription-drug agenda runs through Steve Ricchetti. The right’s propaganda machine would have a field day with such a glaring conflict of interest. If Biden grants Ricchetti a senior job, he’d give Tucker Carlson a free attack line grounded in actually legitimate complaints.

Given the clients that both Ricchettis are willing to take on, it’s perhaps unsurprising that Steve has been the Biden campaign’s ace in the hole when it comes to high-dollar fundraising. Early on, he sold private conversations with himself as an incentive to wealthy donors, and has given backroom pitches to Wall Street executives. When Biden’s campaign was flailing in January, Ricchetti was personally “imploring bundlers to gather as much money as possible,” according to The New York Times.

Cleverly, Ricchetti has pushed Biden toward opposing support from super PACs, even as he cozies up to the wealthy donors who make super PACs so odious and gets them to donate to Biden directly. By spurning the best-known means of big-money corruption, but not big-money corruption per se, Ricchetti can create an appearance of concern for the public interest without meaningfully changing his tactics.

Ricchetti’s comfort around the ultra-wealthy is probably one of his biggest assets to the Biden campaign. Journalist George Packer writes that Biden used to denigrate his fundraising aide Jeff Connaughton because “Biden hated fund-raising, the drudgery and compromises it entailed. He resented any demands placed on him by the people who helped him raise money and the people who wrote checks, as if he couldn’t stand owing them.” (For his part, Connaughton went on to author the angry confessional The Payoff: Why Wall Street Always Wins, where he writes, “I came to D.C. a Democrat and left a plutocrat.”)

Biden bragged for decades about being one of the poorest men in Congress. His disdain for D.C. glad-handing meant that from day one, onlookers predicted Biden would struggle with funding a national presidential campaign—and sure enough, Biden for President, Inc., was running on fumes in January when Ricchetti told bundlers to dig deep.

Left to his own instincts, Biden seems likelier to chat with the shrimp cocktail waiter than the banker at a fancy fundraising event. Biden may have been a centrist standard-bearer over the decades, but he was never an ideological one—he just knows which way the wind is blowing.

That’s why the minders who shape the president’s thinking—and most especially, the chief of staff who controls their access to him—are so immensely powerful. They literally control which policies and ideas the president gets to see. Imagine how differently history might have gone if Obama had known Christina Romer’s estimate that the country needed $1.8 trillion of stimulus in 2009, information which his future chief of staff Rahm Emanuel pushed to restrict from his ears?

We now face an economic downturn that dwarfs the Great Recession, and it’s just one of a dozen interlinked crises. True, the Biden campaign is claiming that they’ve learned the lessons of history about a too-small stimulus. But it’s terrifying to think that a man who has spun through the revolving door between the White House and K Street three separate times might guide Biden through fights with his former benefactors in Big Pharma over a coronavirus vaccine, with Big Oil over a climate plan, and with corporate boardrooms around the world over rebuilding domestic industry.

Progressives may be able to persuade a President Biden on many issues if they can just sit down to talk with him, but they’ll need to get through the door first. That won’t be doable if Ricchetti is the doorman. Biden should do himself a favor and keep him out of the loop.

The post Biden’s Big Test: Selecting a White House Chief of Staff appeared first on Center for Economic and Policy Research.

Economy

IPA’s weekly links

Guest post by Jeff Mosenkis of Innovations for Poverty Action.

Some student-created infographic examples from the Communicating Economics website.

- Communicating Economics is a site with tools, tips, and videos of in-person college level lectures on, well, pretty much what the title says. It comes from the person behind Econ Films, whom I’ve worked with before and are very good at at what they do.

- A Belgian court has cleared the way for the remains of the first Prime Minister of an independent Republic of Congo (now the DRC) to be returned to his family. In 1961 Patrice Lumumba had been in the job for three months when the Belgian government had him killed, along with two family members. And his “remains” consists of a tooth, because the Belgian authorities also ordered his body to be dissolved in acid. Longer story (for those with strong stomachs) here.

- An interesting paper by Obie Porteous, analyzing 27,000 econ papers about Africa finds:

“45% of all economics journal articles and 65% of articles in the top five economics journals are about five countries accounting for just 16% of the continent’s population. I show that 91% of the variation in the number of articles across countries can be explained by a peacefulness index, the number of international tourist arrivals, having English as an official language, and population.”

The “big five” locations that dominate Western econ are Kenya, Uganda, South Africa, Ghana, and Malawi. On Conversations with Tyler recently, Tyler Cowen asked Nathan Nunn about this (particularly as relates to RCTs). Nunn responded that it’s very difficult to set up a research infrastructure, but once it’s there, it’s hard to go somewhere new and start again, and admitted that even though he doesn’t do RCTs he’s fallen into the same pattern.

- A cool-looking paper from Agyei-Holmes, Buehren, Goldstein, Osei, Osei-Akoto, & Udry looks at a land titling program in Ghana (I know, see above, but to be fair, I know that at least Udry’s been doing research in Ghana for 30 years, and two of the authors are at Ghanaian institutions). The paper looks at how giving formal ownership to farmers increased their investments into their land and agricultural output. Except that it did the opposite - interestingly, when people got titles to the land, the value of the land increased and the owners, particularly women, shifted to other types of work, and business profits went up.

The post IPA’s weekly links appeared first on Chris Blattman.

-

Business2 months ago

Business2 months agoBernice King, Ava DuVernay reflect on the legacy of John Lewis

-

World News2 months ago

Heavy rain threatens flood-weary Japan, Korean Peninsula

-

Technology2 months ago

Technology2 months agoEverything New On Netflix This Weekend: July 25, 2020

-

Finance4 months ago

Will Equal Weighted Index Funds Outperform Their Benchmark Indexes?

-

Marketing Strategies9 months ago

Top 20 Workers’ Compensation Law Blogs & Websites To Follow in 2020

-

World News8 months ago

World News8 months agoThe West Blames the Wuhan Coronavirus on China’s Love of Eating Wild Animals. The Truth Is More Complex

-

Economy11 months ago

Newsletter: Jobs, Consumers and Wages

-

Finance9 months ago

Finance9 months ago$95 Grocery Budget + Weekly Menu Plan for 8