Share Market

Can You Learn to Day Trade?

Learning how to trade is completely possible. It comes down to the right mix of “ingredients” that will produce a winning trader and more importantly a winning mindset.

Well in this post, I will walk you through 9 elements which have helped guide me on this journey.

#1 - Trade Less

The first thing people think of at times is that day trading comes down to placing many trades throughout the day. This couldn’t be the furthest thing from the truth. You can be a day trader and only place one trade per day.

It’s not about the amount of activity that somehow lets you in the club. This is not a knock to my scalpers out there, but the point is if you are starting out it’s not about placing 100 trades per day. It’s about knowing why you are trading, so you are not out there just swinging for the fences. [1]

If you are really new at trading, it’s probably best that you only place three trades per week. The first reason is that it limits your exposure to the market, which allows you to dissect and process your trading activity.

The second reason is that it allows you to day trade with less than $25,000 dollars which means you can only place 3 round trip trades per week anyways. [2]

Bottom line, give yourself time to learn the game before increasing the number of trades if you ever need to increase it at all.

#2 - Trade Small

The other misnomer out there is you need to have a lot of money to make money in the market. One of the biggest accomplishments of my trading career is when I took a $3,500 dollar account up to $7,500 in 5 months. You would have thought I hit the lottery of life.

If you are unable to make money trading a small account, you will not have any greater success plunging thousands of dollars in the market.

Remember, time is on your side and the only one rushing is you.

#3 - Become an Expert of One Strategy

There are traders that are able to trade 5, 7 or even 10 patterns effectively. Well, guess what? You only need one pattern to work for you to make a living trading.

For me, I really only trade two patterns. The morning breakout and the morning pullback.

Now, I don’t always get it right and sometimes make some bonehead mistakes. But focusing on these two patterns has allowed me to perfect my entry, stop and exit rules. This has resulted in me being able to turn a profit on a weekly basis regardless of how the broad market is trading.

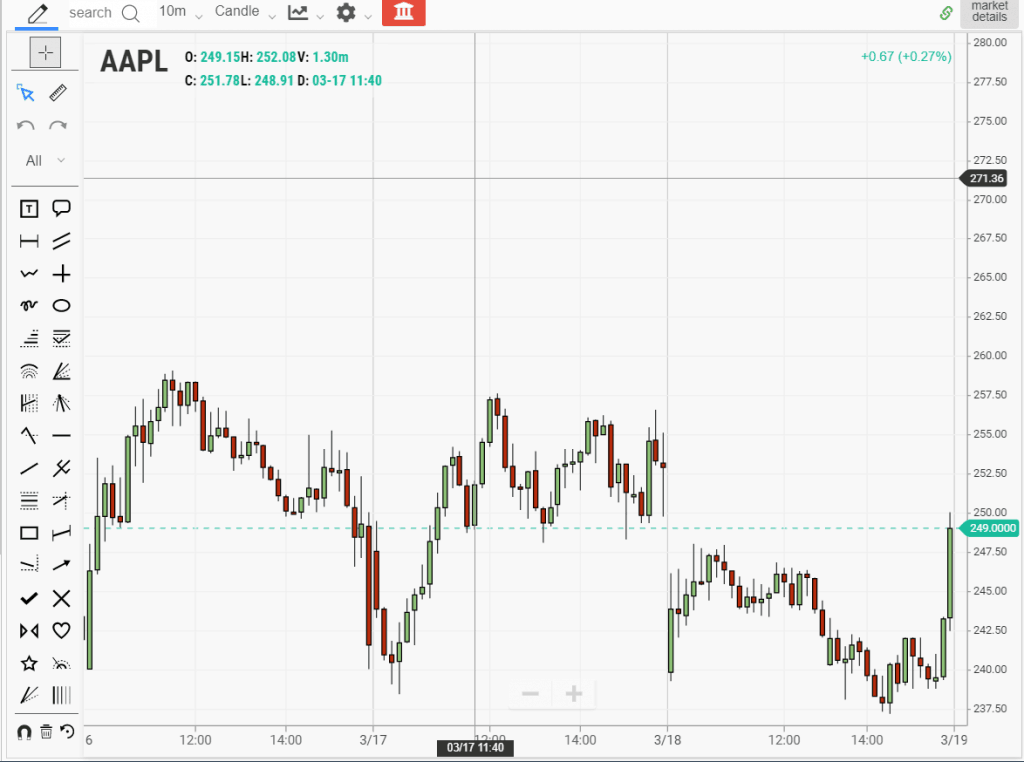

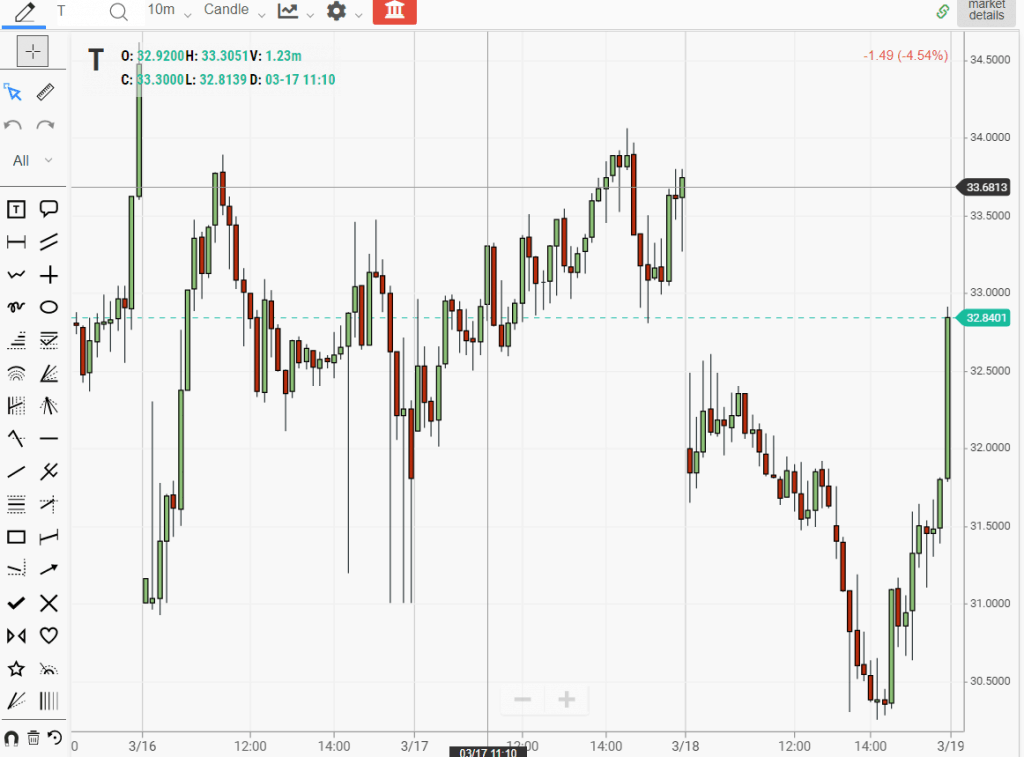

Below are examples of the trades I look for every morning.

#4 - Master Your Craft

Study

Please do not make the mistake of buying a trading course, looking at it once and then going out here and trading with professionals.

Trading is like any other specialized skill. It requires practice and then more practice.

You have to put in the hard work if you want to be a success.

This doesn’t mean trading only when the market is open. This also means you put in the time outside of market hours. For me, I love to review trades over the weekend.

It’s like everything slows down and I am able to process the charts in front of me with such clarity.

#5 - Journal

Journal

Show me a struggling trader and I will show you a trader that does not journal on a regular basis. As a trader, you need to be more of an analyst than a technician. This means you need to figure out not only what system works but how you are trading within that system.

Journaling allows you to not only review your trades but also your mental state when placing those trades.

Dr. Steenbarger talks about journaling not only trades but your psychology. He says traders should track their trading emotions across three areas: (1) behavioral patterns, (2) emotional patterns, and (3) cognitive patterns. [3]

For me, I have never had a losing streak when I was journaling.

It’s only when I start trading without tracking my performance do I run into problems.

#6 - Take Money Out of the Market

Cash

You need to take money out of the market, so the reality of what you are doing hits you. If you do not take the money out it will find a way to leave you.

There are those that can just compound their returns day after day. But for us mere humans, taking the money out of the market helps with the psychological barriers that prevent us from having breakthrough success.

Similar to your job or profession, you would not come to work every day and not get paid.

#7 - Focus on One Time of Day

I cannot trade the midday for my life. Those of you that follow the blog know this because I have been very transparent about my struggles.

However, put me in the morning and I can generally walk away a winner.

One of the first things you should do is focus on a specific time of the day and commit.

So, if you are going to day trade the morning, then do that and do it with conviction. If you are going to trade wedge patterns during lunc, then do that as well.

Lastly, if you want to trade end of day patterns to see if you can catch the final push higher, that’s okay as well.

But please, please do not try to trade all day when you first start. I literally could have saved thousands of dollars and countless hours of headaches if I only followed that one rule.

#8 - Be Prepared for the Long Haul

Trading Journal

If you are going to trade then that’s what you are going to do. Do not get in the game, only to quit a few months or even a year after starting.

Treat this decision like it is irreversible. Now, this does not mean go down a blind path of financial ruin. It more means you are going to take a mature and methodical approach to learn how to trade.

I still believe anyone can learn how to trade, it just takes a person sticking in the game long enough to learn what works and how to become a successful trader.

#9 - Read About Other Self-Made Traders

At times you will need to find inspiration to keep going. Now I don’t suggest you google millionaire stock trader, because this may bring out the greed which you need to keep under control.

I highly recommend you read books like Momo Traders or Zero to Hero which are more interview-style publications. This will allow you to get into the psyche of these traders to see what makes them work.

Again, I am a firm believer it’s not about the strategies, but more about learning what makes some traders tick and how they are able to win and win on a big scale.

How Can Tradingsim Help?

If you are looking to learn how to trade, you can test out your strategies in the Tradingsim market replay tool.

External References

- Dr. Steenbarger, Brett. (2010). How Do I Avoid Overtrading?. traderfeed.blogspot.com

- Pattern Day Trader. Wikipedia

- Dr. Steenbarger, Brett. ‘The Daily Trading Coach’. John Wiley & Sons. p. 43

The post Can You Learn to Day Trade? appeared first on - Tradingsim.

Share Market

Investing in Equity for Beginners and Small Investors

How should a beginner or a small investor invest in equity?

The answer widely available and promoted widely is ‘SIP karo’-invest in mutual funds through SIP.

Even if you have some lumpsum to invest chances are that you will be told “don’t take the risk of investing in one go, SIP karo”.

Some will suggest a few funds with the “best past returns”. And then quickly you will be told how simple it is to invest in MF, “App download karo aur invest karo”

For some reason, beginners and small investors are expected to be satisfied with these answers-answers that may be right if all you can invest in a few thousand every month but not if your lumpsum and monthly savings are a more than that.

Yes, it has become very easy to buy MF but it is not easy to invest in it successfully.

Challenges faces by new investors

- May want to invest in stocks but most advice is only on mutual funds.

- Need to deploy their lumpsum savings but most advice is on SIP in mutual funds.

- Everyone agrees that selecting mutual funds based on past performance is inadequate and incorrect but most advice is based on past performance.

- Market is ever-changing but most advice is one- time

- Selection and Portfolio management is not simple enough

- Don’t really learn how to invest in equity

There is a need for an investing solution beyond SIP in MF for beginners and small investors. So we decided to design a solution that addresses all the above challenges faced by them.

For whom: If your total investment i.e the lumpsum + 12 times the monthly savings you want to invest in between 1 to 5 lacs you need a better solution to investing than SIP in MF. Read on

What do you need? You need to invest your lumpsum and monthly savings in Stocks, Mutual and Index funds. You need to manage this portfolio i.e. buy, sell or hold these as the market goes through it ups and downs. And you need to do this with some understanding of the process and not just act blindly on someone’s recommendations.

Stocks, Mutual and Index Funds all have their advantages and with proper guidance, you can take advantage of all of them.

What are the benefits of investing in Stocks?

Investing in individual stocks gives you a higher level of control over your portfolio, where you can choose your allocation based on a specific industry and quickly exit once you earn a sizable profit. Since you are in control, there are no additional overheads like fund manager fees. Finally, your decisions are not impacted by external factors as is the case in a Mutual Fund, eg redemption pressure, large inflows, fund manager exit, etc.

What are the benefits of investing in mutual funds?

Mutual funds help you diversify easily with a very small investment. A typical MF holds around 50 stocks in its portfolio, thus presenting lesser risks if one stock was to perform poorly. A dedicated fund manager who understands the Indian markets actively monitors and oversees the fund so that inexperienced investors don’t have to sweat it. MFs make it easy for beginner investors in India to follow a disciplined way of investing through.

What are the benefits of investing in index funds?

An Index Fund is a mutual fund where the portfolio of stocks is not actively selected by a fund manager but is a replica of the Index eg the Nifty 50 Index Funds’ portfolio matches that of Nifty 50. Mutual funds are called actively managed funds while investing in index funds is called Passive investing. The advantage of an Index fund is that its portfolio is predictable and it comes at a lower cost. So you get the benefit of diversification at a lower cost. However, the decision to invest in Index funds is similar to any mutual fund.

How do you invest in Stocks, Mutual and Index funds?

The answer is Think Portfolio! Ensure you have a diversified portfolio of strong companies and MFs.

But how do you select the few for your portfolio from amongst a larger set of strong companies and MFs. The answer is you select the ones which have an attractive upside potential over the next 3 years.

This prevents you from buying at expensive prices-thus avoiding the risk of mediocre returns and sharp fall in case the market/stock corrects for whatever reasons.

Why 3 years? So you choose like an investor-expect growth from the company’s performance and not the market price movement (which is a trader’s mindset) which is a bonus when it happens.

How to implement this?

It is not feasible for a beginner to screen stocks and MFs and select the ones to invest in. This is the job of your advisor. However, you should not be expected to follow someone’s advice blindly. What you need is to understand the process followed in making the recommendations and enough transparency to know that due process has been followed. This will enable you to invest confidently and stay invested.

When we search for a solution based on all the above- advice to build a portfolio of stocks, mutual and index funds to invest both lumpsum and monthly savings and provided transparently; we found that there is nothing available for beginners and small investors. So we decided to build one

MoneyWorks4me PRO

With PRO you will be able to invest

- In a portfolio of strong company stocks with an attractive upside potential

- Lumpsum in a set of funds with attractive upside potential

- SIP in a set of funds with different investment styles

You have the flexibility to choose where you wish to invest and how much. We recommend investing your lumpsum equally in the stock portfolio and in MFs for better returns and a diversified portfolio.

The PRO Dashboard is designed to give you the most important decision related information right there

- For stocks, you can see how it is rated on its 10-year performance, Future Prospects, and its Upside Potential.

- For MFs you can see its Investing Style (Momentum, Quality, Value, Small Cap), Fund Quality (as compared to other funds) and it Upside Potential

An analyst note explains the rationale for the recommendation in brief. And you will be able to get further details when you click the stock or fund name.

You can also do the stock transactions from the PRO Dashboard.

If your trading account is either ICICI Direct or available on the smallcase gateway (Zerodha, HDFC Sec, IIFL, Edelweiss, 5 Paise, and Alice Blue) you can safely and conveniently complete the transaction using the APIs on the PRO Dashboard.

This convenience enables you to SIP in the stock portfolio if you do not wish to SIP in MFs.

Finally, when you transact from the PRO Dashboard your portfolio is automatically updated in the Moneyworks4me Portfolio Manager (which has many benefits).

Visit the site to understand PRO better and see a video of how simple it is to use.

Click here to view our plans and sign up.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

The post Investing in Equity for Beginners and Small Investors appeared first on Investment Shastra.

Share Market

What does a reverse stock split mean for investors?

A reverse stock split can benefit a corporation and an investor. This TradingSim article will explain what that action is. In addition, this article will also explain how reverse splits from large corporations benefit new investors. Also, this article helps investors to rebalance their portfolios in this bear market. This article can also help investors improve their trading strategies.

What is a reverse stock split?

A reverse split is a corporation’s decision to reduce the number of its existing shares. With that action, a company splits its stock into fewer shares. Because companies sell fewer shares to investors, they enable certain actions. When a corporation has reverse stock splits, companies make their shares more valuable.

Why do companies reduce shares to sell investors?

When a corporation has a reverse stock split, there are many reasons for that decision. When a corporation’s stock falls, it’s in danger of a delistment from the New York Stock Exchange. If there’s a delistment, a stock becomes a penny stock. To avoid that fate, a company makes fewer shares available to raise the share price. Stockholders vote to approve the measure.

While corporations have reverse stock splits because of negative reasons, there are positive reasons as well. If a corporation plans to have a spinoff company, a company can reverse split its shares to increase share price. Then, a corporation can spin off into another company to gain a higher share price.

What different kinds of reverse splits exist?

Just as stocks have different prices, some reverse stock splits have different ratios. For example, a company has a 100:1 reverse stock split. In that case, every 100 shares a shareholder has converted to one share.

In one example, an investor can have 100 shares of a company at $10 a share. After a reverse stock split, every 100 shares changes to one share.

With 100,000 shares before the stock split, the market capitalization is $1,000,000. With a 100:1 split, there are now 100 outstanding shares.

The calculation is as follows:

1,000,000/100-1,000.

Each share is now worth $1,000.

Does a reverse stock split affect a company’s worth?

While a reverse stock split may change an investor’s perception of a company, it doesn’t affect a company’s overall value.

Ryan Sterling is the founder of Future You Wealth in Manhattan. He noted that a company’s reverse stock split changes “are cosmetic. “They don’t say anything about the fundamentals,” added Sterling.

He also said that any psychological benefit from reverse stock splits is short-lived.

“Any enthusiasm you feel from a stock split, I would take with a whole lot of caution. When you talk about money in the stock market, the biggest eroder of wealth over time is human emotions,” said Sterling.

How is a reverse stock split different from a stock split?

While a reverse split means fewer shares for investors, a “regular” stock split does just the opposite. When a company takes that action, they make more shares available to investors. In a recent example, Apple recently announced it would have a stock split in August. Through a statement, the tech company made the decision to “make the stock more affordable to a broader base of investors”.

In Apple’s 4- for- 1 stock split, four shares sell for the price of one. As a result, if investors buy Apple stock at $ 400 a share. In this new 4-for-1 split, investors can buy one share for about $100.

Is a reverse stock split bad for investors?

When corporations have reverse stock splits, they sometimes have negative consequences. Financial expert Bill Matthews had one example of a company’s stock falling after having a reverse stock split.

“I was talking with a friend about a stock that he had bought at $1 per share. Shortly after he bought, the price fell to $0.50. A few months later, he received notice that the company was planning to implement a 1-for-10 reverse stock split. He was wondering if that reverse stock split was a good or bad thing,” said Matthews.

“According to the company’s press release, the reverse stock split of 1 for 10 would bring the stock price up to $5 per share, and that would prevent the stock from being delisted from Nasdaq. I ran into my friend a few weeks ago and asked about the stock. The stock, which was selling at $5.00 after the reverse, is now selling at $1.25 and he is down 88%,” added Matthews.

“In this case, the stock moving from $0.50 to $5.00 overnight was just an accounting ploy. The company still had very shaky fundamentals. Savvy institutional investors won’t invest in the stock just because its price suddenly soared, and it will have a hard time raising capital if its balance sheet is poor,” said Matthews.

“Shorters, who follow reverse stock splits and target those stocks, began to put pressure on the stock price, sending it tumbling. As selling pushed the price downward, other investors panicked and sold, causing the price to plummet even lower. As my friend discovered, a reverse stock split is normally not good news for shareholders,” added Matthews.

What should investors do when a company has a reverse stock split?

When a corporation has a reverse stock split, Matthews advises investors to review a company’s balance sheet if it reduces available shares.

“If a stock in your portfolio announces a reverse stock split, take a good look,” said Matthews.

Matthews notes that if a corporation’s “fundamentals aren’t healthy, you might be better selling your shares. If you really like the stock, chances are good that you can buy back those shares at a much lower price several months down the road.”

However, if a company’s balance sheet and past earnings reports are strong, Matthews notes that investors should hold those stocks.

How does Apple stock split affect investors?

As a result of Apple’s split stock decision, many financial experts see it as a good sign. Caleb Silver is editor-in-chief of Investopedia. After Apple’s announcement, he believes that Apple’s decision will attract more investors to its stock.

“For popular stocks like Apple, the lower share price makes it attractive to investors who couldn’t afford higher share prices but want to own a piece of the company. Stock splits are seen as a sign of confidence from a company,” said Silver.

In addition, he added that Apple’s stock split is “considered a response to more demand for its shares from investors.”

Sterling doesn’t think that Apple’s stock won’t be affected by the stock split. He believes it “effectively increases demand for people who don’t understand fractional shares,” Sterling said. “If anything, it causes more volatility in the stock.”

Will Apple’s stock split impact the stock market?

While Apple’s stock split is gaining attention, financial experts say it won’t change the company’s value. Max Gokhman is head of asset allocation at Pacific Life Fund Advisors. He doesn’t think that the stock splits will affect its share price.

“To be crystal clear, however, and as proven by grade school algebra, stock splits have no impact on the value of a company,” said Gokhman.

Financial editor Ric Edelman also thinks that Apple’s value won’t be affected by the recent stock split.

“This is not a financial event and has no economy implications or bearing on the value of the investment or the outlook for Apple as a business. It’s a non-event,” said Edelman.

“This is a huge event from a psychological perspective. That’s the reason companies engage in stock splits — they know it plays on the emotions of investors,” added Edelman.

Edelman also advised investors to ignore Apple’s stock split and invest in other assets.

“You should ignore this and instead invest in diversified stock mutual funds,” said Edelman.

Rite Aid stock rises after reverse stock split

Rite Aid (NYSE:RAD) is a company that had a reverse stock split in 2019. The pharmacy chain made the decision to avoid a delisting from the New York Stock Exchange. Rite Aid’s stock was in danger of falling below $1 before the reduction of available shares.

As a result, Rite Aid had a 1-for-20 reverse stock split. Every 20 shares of Rite Aid stock is converted into one share. The share will be 20 times the original price. While the stock briefly rebounded after the split, the coronavirus crisis caused Rite Aid shares to increase.

In addition to being part of a White House COVID-19 response group, Rite Aid is expanding its services. Many pharmacy locations will also be coronavirus testing centers.

While Rite Aid will expand services, the company noted in a statement that its “current supply of generic medications is presently sufficient and the company does not anticipate any significant near-term supply chain disruptions that will affect its ability to fill prescriptions.”

Rite Aid’s Q1 2020 earnings rise above expectations after reverse stock split

Rite Aid’s Q1 2020 earnings report exceeded Wall Street expectations. In the last quarter, revenue was $6.03 billion. That’s an increase from $5.37 billion in Q1 2019. Rite-Aid’s CEO, Heyward Donigan, spoke about the positive results.

“There are certainly challenges brought about by COVID-19, including the decline in acute prescriptions and increased costs incurred to assure the safety of our associates and customers. No matter the challenge, we can execute our strategy and deliver day-to-day operational excellence in the face of a pandemic,” said Donigan.

“I am amazed by the passion and spirit of our more than 50,000 associates, who have come to work every day driven by a desire to help customers stay healthy and demonstrating the essential role of pharmacy in our communities,” added Donigan.

Donigan also spoke about the importance of Rite-Aid’s pharmacists and new initiatives during the COVID-19 era.

“Thanks to their hard work, the fundamentals of our business are strong, and we are right on track with the launch of our new RxEvolution strategy. I am excited to continue this important work as we look to become a leading mid-market PBM, unlock the value of our pharmacists and revitalize our retail and digital experiences,” said Donigan.

Rite Aid’s reverse stock split ultimately brought the corporation from the brink of bankruptcy.

Booking Holdings survives reverse stock split

Bookings Holdings(NASDAQ:BKNG) is another company that survived after a reverse stock split. When the corporation was still called Priceline, it made a decision to have a 1-for-6 split in 2003.

COVID-19 affects Booking Holdings Q1 2020 earnings

While the online trip booking company rebounded after its reverse stock split, coronavirus disrupted that growth. In its Q1 2020 earnings report, Glenn D. Fogel spoke about Booking Holdings’ disappointing results.

“Revenue declined 84% versus last year, and we recorded an adjusted EBITDA[ earnings before interest, taxes, depreciation, and amortization] loss of $376 million, the first time we have produced a quarterly EBITDA loss since 2001. We witnessed the greatest negative impact from the virus in April as newly booked room nights in that month declined over 85% year-over-year,” said Fogel.

While travel declined during the worldwide quarantine, Fogel noted that Booking Holdings’ revenue improved slightly. He noted that trip bookings rose after the economy opened up again in late spring.

“After April, room night trends have steadily improved. The improved booking trends were primarily driven by domestic travel, with international trends seeing much more limited improvement,” said Fogel.

“While almost all of our global markets showed improvement through the quarter, Europe and the United States had the highest contribution to the improved domestic booking trends,” added Fogel.

Some financial experts bullish on Booking Holdings after reverse stock split

When the U.S. State Department lifted global restrictions, Booking Holdings stock increased 1.5%. Steve Chiavarone is a portfolio manager and equity strategist and vice president at Federated Hermes. He noted that the Booking Holdings stock bump may not last because Americans are still afraid or unable to travel.

“But you still have restrictions on Americans coming in, and I think ultimately, people aren’t just staying home because of mandates. They’re staying home because they’re worried about their health,” said Chiavarone.

“I think for a lot of reasons, you’re still going to see travel levels down. I think you’re still going to see a preference for domestic travel. But, hey, incrementally, the idea that there are parts of the world that have gotten coronavirus under control enough that we can start to lift restrictions, that’s a good thing,” added Chiavarone.

Some financial experts are bearish on Booking Hearings stock

While some analysts are bearish on Booking Holdings’ stock, Broyhill Asset Management is bullish on the company’s stock. In a letter to clients, Broyhill Asset Management thinks that Booking Holdings will survive the coronavirus-caused decline in trip bookings.

“During the quarter, we also built a position in Bookings (BKNG), which we had been watching long before the crisis began. For the past three years, the stock has been under pressure due increasing concerns about the company’s competitive positioning—in relation to both hotel loyalty programs and Google’s search engine,” said Broyhill.

“And although Bookings will likely suffer in the short term, its more entrenched European business, combined with its strong balance sheet, should make it among the best-positioned companies throughout the travel sector,” added Broyhill.

While Booking Holdings has difficulty now, the reverse stock split ultimately benefited the company.

Grow Capital reduces available shares

Grow Capital(OTCQB:GRWC) is a corporation that incubates fintech companies. The company recently announced that it’s implementing a 1-for-20 reverse stock split.

The company is implementing the reverse stock split to increase its trading price to $4.00. Once the stock price reaches that threshold, it will meet NASDAQ’s required bid price. Grow’s interim CEO Terry Kennedy spoke about the changes in a statement.

“This reverse split will help GRWC normalize trading and better align with our business activity. Our subsidiary is growing and we have new acquisitions on the horizon. Issuing this reverse-split is expected to raise our per-share price and allow for better long-term planning,” said Kennedy.

Grow’s board president James Olson also spoke about the reverse stock split.

“The Board believes it is in the best interests of GRWC and the stockholders to implement the Reverse Stock Split to reduce the number of our issued and outstanding shares of common stock”, said Olson.

Olson spoke about the reverse stock split “thereby increasing the number of shares of common stock available for issuance. We believe it is likely to increase the market price as fewer shares will be outstanding.”

He also noted that “the expected increased market price will encourage interest in the common stock.”

Grow Capital is another company hoping to increase its share price by reducing available shares to investors.

Xerox has reverse stock split

In addition to small companies like Grow Capital, established corporations like Xerox(NYSE:XRX) had a reverse stock split in 2017. Xerox spoke about the 1-for-4 stock split in a statement.

“As a result of the reverse stock split, every four shares of Xerox common stock issued and outstanding or held as treasury shares were automatically combined and reclassified into one share of Xerox common stock. The reverse stock split also affected all outstanding Xerox equity awards and outstanding convertible securities,” said Xerox.

What did financial experts say about Xerox’s stock split?

When Xerox announced its reverse stock split, Ian Wyatt, editor of High Yield Wealth, spoke about the decision.

“So why did Xerox bother with a reverse stock split if investor wealth remains unchanged? Visibility is the answer. Many institutional investors—mutual funds in particular—ignore stocks priced in single digits. Many investment firms ignore these stocks as well. Xerox is trying to raise its profile with its reverse-stock split,” said Wyatt.

Wyatt noted that he and other experts were unsure if the decision would impact Xerox stock.

“We’re agnostic on the reverse stock split. It could raise Xerox’s standing among institutional investors and research analysts. It could also lower Xerox’s standing among other investors. Some investors are repelled by reverse stock split. They view a reverse stock split as an insincere strategy for raising the share price. Financial performance ultimately determines value and price in the long run.”

Xerox revenue falls during COVID-19

While Xerox stock rebounded after the stock split initially, shares tumbled during the coronavirus crisis. The corporation’s Q2 2020 revenue fell to $1.465 billion from $2.263 billion.

“The global COVID-19 pandemic crisis significantly impacted our second quarter 2020 revenues due to business closures and office building capacity restrictions that impacted our customers’ purchasing decisions and caused lower printing volumes on our devices,” said Xerox in a statement.

Xerox is still a viable company after its stock split, but has suffered like man companies in this current economy.

AIG rebounds after reverse stock split

AIG( NYSE:AIG) stock rebounded after collapsing during the 2008 financial crisis. The insurance company tried to recover by having a 1-for-20 reverse stock split.

Cathy Seifert is an insurance analyst with Standard & Poor’s Equity Research. She noted that AIG’s stock split was more about easing investors’ worries than about its bottom line.

“Market psychology probably has something to do with this. The underlying fundamentals haven’t changed but the mechanics have,” said Seifert.

AIG another victim of COVID-19 crisis

Just as with Xerox, AIG’s revenue dropped during the coronavirus crisis.

AIG spoke about the results in a statement.

“Overall, AIG reported adjusted pre-tax income of $803 million and adjusted after-tax income of $571 million or $0.66 per diluted share, compared to $1 — compared to $1.3 billion or $1.43 per share in the second quarter of 2019. The key drivers of the year-over-year reduction were higher catastrophe losses from COVID and civil unrest, along with lower net investment income,” said AIG.

While AIG persevered after 2009, the company’s still struggling during the current volatile economy.

E-trade thrives after reverse stock split

E-Trade( NASDAQ:ETFC) approved a 1-for-10 reverse stock split in 2010. Since then, Etrade stock soared as the trading firm added customers during the COVID-19-caused shutdown. E-Trade’s CEO, Chad Turner, spoke about the company’s positive results.

“We delivered strong financial results on top of continued record-setting operating metrics,” said Chad Turner, Chief Financial Officer. “We generated our highest period ever of revenue from trading-related activity, which more than offset the quarter-over-quarter pressure on net interest income, given the Fed’s recent rate cuts to near zero.

“While we remain prudent on managing expenses as we navigate this low interest rate environment, we continue to opportunistically invest in sales and marketing to maintain the tremendous momentum in growth of accounts, assets, and deposits amid an environment that is particularly ripe for franchise growth,” said Turner.

Turner also spoke about how the increase in traders caused a growth in assets.

“Furthermore, the blistering pace of account and asset growth continued in the second quarter, with $13.6 billion in net new retail assets, and 327,000 net new retail accounts, bringing our year-to-date retail asset flows to $31.9 billion and account growth to 656,000,” added Turner.

E-Trade stock soared after its successful reverse stock split.

Motorola struggles after reverse stock split

Motorola( NYSE:MSI) had a 1-for-7 reverse stock split in 2010 before split into two corporations: Motorola Solutions and Motorola Mobility. The company spoke about the split in a statement.

“Today’s announcement marks another important milestone toward the upcoming separation that is expected to benefit Motorola, its stockholders, as well as each company’s respective customers and employees. We look forward to taking advantage of the opportunities before us as we begin the new year as two independent, publicly traded companies,” said Motorola.

Motorola suffers during global pandemic

Even though the split helped the company after the decline of its Razr phones, the COVID-19 crisis hurt Motorola as well. In its latest Q2 2020 report, the company spoke about its worse-than-expected earnings.

“Q2 results included revenue of $1.6 billion, down 13% from a year ago, including $40 million of revenue from acquisitions and $30 million of currency headwinds. GAAP operating earnings of $218 million and operating margins of 13.5% compared to 18.8% in the year-ago quarter,” said Motorola in a statement.

Despite its reverse stock split, Motorola’s stock stumbled during the COVID-19 crisis.

AT&T profits rise after reverse stock split

AT&T (NYSE:T) stock remained stable after its reverse stock split in 2002. In that split, the corporation had a massive 24,875 for 50,000 stock split.

Since that stock split, AT&T stock rose and still had a positive Q2 2020 earnings report. CEO John Stankey spoke about the results.

“Our core subscription businesses proved to be resilient in the face of the economic downturn. Our mobility and business wire line segments performed well, and we grew EBITDA[ earnings before interest, taxation, depreciation, and amortization] margins in both areas. EBITDA of $7.8 billion was up year-over-year with both EBITDA margins and service margins expanding, and that’s inclusive of COVID impacts,” said Stankey.

He added that AT&T’s cash flow grew despite the pandemic.

“Cash flow was impressive even during the pandemic. Cash from operations came in at more than $12 billion and free cash flow came in at $7.6 billion,” said Stankey.

Stankey also noted that the quarantine helped AT&T’s cable and HBO Max streaming service grow as well.

“Our software-based entertainment businesses performed well. ATT TV subscriber growth in its first full quarter was better than we expected and it’s our highest performing video product with customer satisfaction, double the level of our legacy TV services,” added Stankey.

AT&T stock and business division rebounded and increased after its reverse stock split almost 20 years ago.

Citigroup

Citigroup (NYSE:C) had a 10-for-1 reverse stock split in 2013. During the split, some shareholders disapproved of the split. One shareholder commented on the split at the time.

“You guys know what the price of the stock is. It is the same price when we did the reverse split. This stock has to reach $600 for me to break even. Bring it down to $4.65 and then maybe it can climb back up to $60,” said the shareholder.

CEO Michael Corbat spoke about the stockholders’ concerns.

“This reverse stock split wasn’t done to engineer the stock price. It was done to reduce volatility and to get shareholders out of the stock who were using it as a trading vehicle, ” said Corbat.

Citigroup has better-than-expected earnings after reverse stock split

Despite the coronavirus crisis, Citigroup exceeded Wall Street expectations. Corbat spoke about the Q2 2020 results.

“While credit costs weighed down our net income, our overall business performance was strong during the quarter, and we have been able to navigate the COVID-19 pandemic reasonably well. The Institutional Clients Group had an exceptional quarter, marked by an increase in Fixed Income of 68%. Global Consumer Banking revenues were down as spending slowed significantly due to the pandemic,” said Corbat.

“We entered this crisis from a position of strength. During the quarter, our regulatory capital increased and our CET1 [common equity tier one capital] ratio improved to 11.5%, comfortably above our new regulatory minimum of 10%. We continued to add to our substantial levels of liquidity and our balance sheet has plenty of capacity to serve our clients,” added Corbat.

Corbat also spoke about how Citigroup was prepared for more volatility in the future.

“With a sharp emphasis on risk management, we are prepared for a variety of scenarios and will continue to operate our institution prudently given this unprecedented situation,” said Corbat.

Citigroup stock flourished after its reverse stock split and help from the Federal Reserve.

Aurora Cannabis latest company to have reverse stock split

In a more current example of a stock split, Aurora Cannabis (NYSE:ACB) is implementing a 1-for-12 reverse stock split. The corporation will reduce its available shares to investors from 1.3 billion to roughly 110 million.

Despite the boom in pot sales during the worldwide quarantine, the marijuana company’s shares have plummeted. Aurora explained its decision in a statement.

“The company intends to use a portion of this available capacity to provide further balance sheet strength and preserve flexibility given macroeconomic uncertainty caused by COVID-19,” said Aurora in a statement.

What do financial experts say about Aurora Cannabis’ reverse stock split?

In response to the announcement, Innovation Shares managing director Matt Markiewicz said that Aurora had no choice but to implement the reverse stock split. Aurora stock plunged to 69 cents a share. With that disappointing share price, the stock’s in danger of being delisted from the New York Stock Exchange (NYSE).

“They had to do this to stay compliant with NYSE rules. They can’t jeopardize the U.S. because of the large shareholder base here. There’s no way the company would risk cutting that conduit,” said Markiewicz.

Jefferies analyst Owen Bennett believes that the reverse stock split will hurt investors’ confidence in the cannabis company’s stock.

“Today’s announcement of a further [at-the-market program], alongside language that suggests [how] this will be used, will be a blow to sentiment,” wrote Bennett in a note to clients.

In contrast, Cowen analyst Vivien Azer notes that Aurora Cannabis’ positive cash flow can help its reverse stock split. However, she said that she had concerns about its overall balance sheet.

She noted that the cash flow is “a positive (particularly in the current environment), but we[Cowen] continue to have concerns on the balance sheet.”

Aurora has positive Q3 2020 earnings

Despite the concerns about Aurora’s reverse stock split, the company had a positive and negative Q3 2020 earnings report. While Aurora still hasn’t turned a profit, the company had an 18% increase in revenue to $78.4 million. CEO Michael Singer spoke about the corporation’s results.

“I am incredibly proud of the Aurora team for working through these challenging times in order to maintain uninterrupted operations at all of our production facilities and ensure we continue to meet the needs of our patients and consumers,” said Singer.

“I am also pleased that our third quarter 2020 financial results were in-line with our expectations, and that we remain firmly on track with the cost-savings and capex[capital expenditure] goals we detailed during our business transformation plan in February 2020,” added Singer.

“As outlined in our press release on Friday, revenue for Q1 2020 was $58.7 million with gross profit at $10.6 million. Both of these metrics are in line with the numbers previously estimated on the year-end call,” concluded Singer.

When Aurora Cannabis has a reverse stock split, it remains to be seen how it will impact investors.

Staffing 360 solutions has reverse stock split

Staffing 360 Solutions is another corporation that had a reverse stock split. The corporation’s stock will be sold in a 1-for-5 split. CEO Brendan Flood spoke about the shareholders’ decision in 2018.

“At a Special Meeting of Stockholders today, the stockholders of Staffing 360 Solutions voted by a large margin (over 74% of outstanding shares) to provide the Board with the authority to effect a reverse stock split at a ratio in the range of 1-for-2 to 1-for-10, such ratio to be determined by the Company’s Board of Directors. After careful consideration, the Board determined the appropriate reverse stock split to be a ratio of 1-for-5,” said Flood.

Staffing 360 Solutions Q1 2020 results mixed

After its reverse stock split, Staffing 360 Solutions had a mixed Q1 2020 revenue report.

While the corporation’s revenue was down, it was still in line with Wall Street expectations. Flood spoke about the Q1 2020 results.

As outlined in our press release on Friday, revenue for Q1 2020 was $58.7 million with gross profit at $10.6 million. Both of these metrics are in line with the numbers previously estimated on the year-end call.

Principal accounting officer Sharnika Viswakula spoke about the results as well.

“For the first quarter of 2020, revenue of $58.7 million reflects a decrease of 20.5% over the prior year of $73.8 million,” said Viswakula.

Staffing 360 Solutions has had mixed results since its reverse stock split.

Reverse stock splits affect investors in may different ways

In reverse stock splits, many corporations have been impacted in many ways. For investors, there are different results that can affect their ability to buy shares of a company’s stock and profit after the stock splits.

If investors want more information about reverse stock splits and how they affect their portfolios, they can practice trading on TradingSim. With research and simulated trades, investors can find the best stocks that can persevere after reverse stock splits.

The post What does a reverse stock split mean for investors? appeared first on - Tradingsim.

Share Market

How the Athlete Mindset Can Help You Trade Smarter

When my student Roland Wolf passed $1 million in trading profits, it got me thinking.* Can athletes — or anyone with the athlete mindset — make for better traders?

Roland was a professional soccer player before an ankle injury ended his career. When he started trading, his work ethic was incredible.

Now he’s turned $4,000 into $1 million in four years.*

Weekend motivation to study hard, read https://t.co/44AfbpKZry & see https://t.co/EcfUM6l2S3 to follow in Roland’s footsteps of turning $4k into $1 million in 4 years…ask yourself how hard you’re willing to study & work to give your family a better life! How bad do you want it? pic.twitter.com/wVbuA955hn

— Timothy Sykes (@timothysykes) July 18, 2020

I learned the athlete mindset from personal experience. From a very young age, I was obsessed with tennis…

My goal was to become a professional tennis player. My obsession drove me to wake up at 5 a.m. to practice before school. It drove me to practice for hours after school. All that practice made me better, but it also took its toll. Tommy John surgery brought my career to an end.

But I applied the same focus and determination I developed through tennis to trading. And that paid off.

It’s not just me and Roland, though. There are others. To respect their privacy, I won’t name them in this post. But I’ll shed some light on why former athletes can go on to be great traders.

(*Please note that these kinds of trading results are not typical. Most traders lose money. It takes years of dedication, hard work, and discipline to learn how to trade, and individual results will vary. Trading is inherently risky. Before making any trades, remember to do your due diligence and never risk more than you can afford to lose.)

The Athlete Mindset Applied to Trading

First, I’m not saying you have to be an elite athlete to be a great trader. You don’t even need to have an athletic background. But anyone with the athlete mindset already has a deep understanding of how to work on a process.

It’s like a leg-up to the ultimate goal: becoming a consistent, self-sufficient trader.

So, if you are an athlete or former athlete, keep reading to see how you can apply your mindset to trading. If you’re not an athlete, keep reading to discover how the athlete mindset can help you become a better trader. The parallels are eerie.

Athlete Mindset: Better Today than Yesterday

Elite athletes know that not every day will be their best. At the same time, they work every day to raise their performance level. They show up every day and put in the work. Every day is a chance to get better. It doesn’t matter whether it’s game day, a practice day, or film day.

Over time — even on bad days — they’re far better than average.

Trading is similar. Even the best traders have bad days. Traders with a growth mindset work to get better every day. When they lose, they learn from it. When they win … they learn from it. They show up every day ready to put in the work. And they learn from it.

Reviewing personal and team performance is common to top-level athletes in all sports. It can give anyone with an athlete’s mindset an advantage in trading. (The best way to review your trading performance is to keep a trading journal.)

Athlete Mindset: Never Give Up

Anyone who’s ever been an athlete knows you don’t give up until the final whistle blows or the match is over. You play every point, play, or down like it matters. You keep fighting — even if losing seems inevitable.

Why not give up? Again, it’s the mind of an athlete. It’s striving to be your best and give 100%. It’s working toward perfection — even while knowing perfection is near impossible.

And it’s knowing that things can change fast. Comebacks happen. One or two big mistakes can cost you the win. Or help you snatch victory from the jaws of defeat.

It’s all built in from endless hours of dedication, discipline, and hard work. And it doesn’t matter if your focus is individual competition or team competition. Elite athletes all know of big comebacks and underdogs defeating heavily favored opponents.

Trading is similar in that top traders all go through adversity. We all lose. Sometimes we take trading losses that seem unfair or beyond our control. Don’t take this to mean you shouldn’t cut losses quickly. I’m not talking about hold and hope. I’m talking about not giving up on the process of becoming a better trader.

Think of it this way … how often do top baseball players get a hit? If you get a hit one-third of the time, you’re one of the best.

Athlete Mindset: Train Every Day

Part of the athlete mindset is to train every day. That doesn’t always mean physical training. Elite athletes do have days of rest. But they use those days to review film, work on strategy, or dissect their opponents.

Traders with the athlete mindset have the same kind of work ethic. I’m known for using #NoDaysOff on social media. That comes from my days as a tennis player.

Students like Roland with the athlete mindset apply it to trading. His dedication to studying his first six months in the Trading Challenge was crazy. He studied seventeen hours per day, every day. He studied when the market was closed. It paid off for him.

Roland’s playing soccer again, by the way. Check this out.

That’s the athlete mindset in action.

Athlete Mindset: Determination, Dedication, and Work Ethic

Every elite athlete I’ve met and worked with has it. Some people say, “Oh, that athlete has a gift, freakish natural ability.” The road to elite status is littered with gifted athletes who never made it. Why? For too many, it’s because they never developed the mindset of a successful athlete.

The other side of that is powerful. Many top-level athletes overcome crazy disadvantages. They have an intense work ethic and determination.

Likewise, a lot of people who play sports develop the athlete mindset. Even if they don’t play beyond high school or college.

Pay attention, this is important: Maybe they weren’t good enough to reach the next level as an athlete. But they use the athlete mindset to excel in other areas of life. The business world is full of former athletes who brought that mindset into their careers.

You Don’t Have to Be a Nerd (You Have to Put in the Time)

You don’t have to be a nerd. And you don’t have to be good at math to be a winning and consistent trader. But you MUST have a strong work ethic.

The reason so many former top-level athletes make great traders is because of their work ethic. They flat out know how to put in the effort. Also, their self-talk is better. They know how to overcome the inner voice that tries to talk them out of being productive.

Math and Science: Not Required

I’m not knocking math and science. I’m just saying that success as a penny stock trader doesn’t require you to be good at math or science. Trading penny stocks requires you to learn a unique but finite set of skills. That happens by creating good habits. Then applying those good habits to trading.

Brand new to penny stocks? Start here with my FREE penny stock guide.

Shout Out to Athletes

Again, it’s not just Roland. I’ve worked with several former athletes. Here’s a picture of me and former New York Giants wide receiver Plaxico Burress. We appeared together on Maria Bartiromo’s show on Fox.

And these four videos show me teaching former NBA players about penny stocks.

Teaching NBA Players About Penny Stocks Parts 1-4

There are others. Again, to respect their privacy I won’t name them. But I have more than one former top-level athlete in the Trading Challenge. They’re amazing to work with because…

Elite Athletes Know What It Takes

One of the reasons I wanted to write this blog post is because I’m so impressed by my former athlete students. They just seem to know what it takes.

They’ve been humbled and made to work harder. They’ve all been at the top of their game only to have their world turned upside down. Each has had a bad loss, been the newbie at the next level, or struggled through injury.

They’ve all had to overcome adversity.

And because of that, they’re prepared to put in the time and effort. Even when it seems lonely, they’re ready to work to get to the next level.

The work ethic I developed from tennis changed my life. And even though my elbow injury was devastating, my dad calls it the million-dollar injury.

Could I have reached that elite level as a tennis player? I’ll never know. What I do know is this: the athlete mindset I developed in pursuit of my dream is still there. It’s still part of me. It drives me to be a better teacher every single day. Just like it drove me to be a better trader when I started two decades ago.

So if you’re an athlete — or someone with an athlete mindset — this is a shout out to you. Join my Trading Challenge. I believe you already have an edge.

This video shows some of the parallels between top-level athletes and traders.

Stock Trading Lessons From An NBA Great

It’s Lonely to Be an Elite Athlete

One of the reasons I teach is because trading can be a lonely profession. Sometimes ignorant haters accuse me of not being able to trade, saying that’s why I teach. Most of them are too lazy to do a little homework.

I start each year with a small account and donate my trading profits to charity. Why? Because most of my students start with small accounts. It helps students more than if I traded with a huge account every year.

But the other reason I focus on teaching is because I don’t want to sit in a room watching stocks all day long. It’s a very lonely life. I’ve been there.

As a teacher, I work on behalf of students. And it frees up time for working on charity projects.

But as a shout out to athletes…

I know that loneliness you’ve felt while honing your skills. I remember those days as a tennis player and as a trader. What I say right now is … use it. You know from experience that if you keep working at it, you can develop the skills it takes to succeed. You already have the athlete mindset which makes you uniquely qualified.

Why? Because…

Passion Drives the Athlete Mindset

It’s that feeling of waking up every morning hungry to get better. Practice becomes a part of you. It’s no longer something you do … it’s who you are. You practice the same move over and over again. You do it until it becomes a habit.

It’s very similar to how…

Passion Drives Profitable Traders

Trading isn’t about making more money. The trading mindset is also about practice. It’s about getting better every day. Traders who focus only on the money blow up accounts. Traders who focus on the process become better traders.

Next Steps for Trading With the Athlete Mindset

If you’re an athlete, congratulations. Tap into the athlete mindset and your crazy work ethic. Apply it to trading. You already have what it takes to succeed. Apply to the Trading Challenge today

If you’re not an athlete…

Share This Post With Athletes

Share this blog post with anyone you know who is (or was) an athlete. It doesn’t matter which sport. If they got injured or they’re career is over, I want to teach them. I KNOW they have the right mindset for success.

Even if you were an athlete 10 or 20 years ago. Once you understand that work ethic, it’s part of you. You can tap into it. It’s not just about the money. It’s about passion.

I get the chance to talk with students who are former athletes. It’s beautiful to see them passionate about something again. And it’s beautiful to see they understand it’s all about the process, dedication, and work ethic.

Develop the Athlete Mindset for Trading

Study the athlete mindset. Elite athletes get that way through hard work and determination. The process they use is the process of success. It applies directly to trading.

Trading Challenge

Finally, when you join the Trading Challenge, get ready. Coach Sykes will nearly break you. I will break all the assumptions you make. I will get you out of your bad habits because I’m a tough coach. Got what it takes?

What do you think about applying the athlete mindset to trading? Comment below, I love to hear from all my readers!

The post How the Athlete Mindset Can Help You Trade Smarter appeared first on Timothy Sykes.

-

Business3 weeks ago

Business3 weeks agoBernice King, Ava DuVernay reflect on the legacy of John Lewis

-

World News3 weeks ago

Heavy rain threatens flood-weary Japan, Korean Peninsula

-

Technology2 weeks ago

Technology2 weeks agoEverything New On Netflix This Weekend: July 25, 2020

-

Finance3 months ago

Will Equal Weighted Index Funds Outperform Their Benchmark Indexes?

-

Marketing Strategies7 months ago

Top 20 Workers’ Compensation Law Blogs & Websites To Follow in 2020

-

World News7 months ago

World News7 months agoThe West Blames the Wuhan Coronavirus on China’s Love of Eating Wild Animals. The Truth Is More Complex

-

Economy9 months ago

Newsletter: Jobs, Consumers and Wages

-

Finance8 months ago

Finance8 months ago$95 Grocery Budget + Weekly Menu Plan for 8